Expert groups to commence development of science-based low carbon and climate resilient screening tool for agriculture investments

Agri TWG & IWG start the Process

Climate Bonds has convened an Agriculture Technical Working Group (TWG) aiming to develop a verifiable and science-based Criteria for Certifying agriculture-related climate or green bond issuances. The ultimate objective is to catalyse increased public and private investment, in agriculture-based climate mitigation, adaptation and resilience interventions.

Formation of the new Expert Groups for Agriculture is part of the accelerated development programme around the Climate Bonds Standard which saw new Criteria development programmes launched in 2018, including an umbrella Adaptation and Resilience Group. More details are in our latest newsletter here.

The Agriculture TWG held its inaugural meeting at the end of February 2019; the accompanying Industry Working Group (IWG) will be launched in April 2019.

Criteria Working Group Composition

Both groups gather representatives from investors, academia, public entities, environmental and agricultural NGOs and international policy bodies from around the world. Both groups will convene on a regular basis to develop Criteria that low carbon agriculture-related investments must meet if they are to be Certified under the Climate Bonds Standard.

|

TWG Lead Specialist Lini Wollenberg - CGIAR |

|

|

TWG |

IWG |

|

Amy Dickie - California Environmental Associates |

Aarti Ramachandran/Iman Effendi - FAIRR Initiative |

|

Anna Lorant - Institute for European Environmental Policy |

Andrew Gazal - ESG Responsible Investments |

|

Bob Scholes, Wits University Johannesburg |

Ankita Shukla - Sustainanalytics |

|

Gerard Rijk - Profundo |

Aurélie Choiral Gupta - Credit Suisse |

|

Gillian Galford - Gund Institute for Environment |

Brian Kernohan - Hancock Natural Resource Group |

|

Greg Fishbein - The Nature Conservancy |

Chang He - CECEP |

|

Jeroen Dijkman - FAO |

Francisco Avendano - Climate Policy IFC |

|

Jonathan Hillier - University of Edinburgh |

Guo Peiyuan - Syntao |

|

Kim Schumacher - University of Oxford |

Hamish McDonald - NaturesCoin. |

|

Mukiri wa Githendu, Kenyatta University |

Jacob Michaelsen - Nordea |

|

Ngonidzashe Chirinda - CGIAR |

Maarten Biermans - Rabobank |

|

Pablo Fernandez - BVRio |

Mareike Hussels - SAIL Ventures |

|

Pedro Machado - Brazilian Agriculture Research Corporation (Embrapa) |

Morgan Jones/John Kazer - Carbon Trust |

|

Raylene Watson - ebsadvisory |

Pedro Moura Costa - SIM/Facility |

|

Sam Schiller - Kellogg School of Management |

Pip Best - E&Y |

|

Stephen Donofrio - Forest Trends |

Roberto Strumpf, Pangea Capital |

|

Soora Naresh Kumar - ICAR-Indian Agricultural Research Institute |

|

|

Tanja Havemann - Clarmondial AG |

|

|

Timm Tennigkeit - UNIQUE |

|

|

Christine Negra - Versant Vision |

|

The Criteria will be available for public comment towards the end of 2019. Once completed and released, the Agriculture Criteria will provide for Certification of agriculture-related investments under the Climate Bonds Standard.

Visit this page for ongoing Agriculture Criteria developments.

Developing the new Sector Criteria

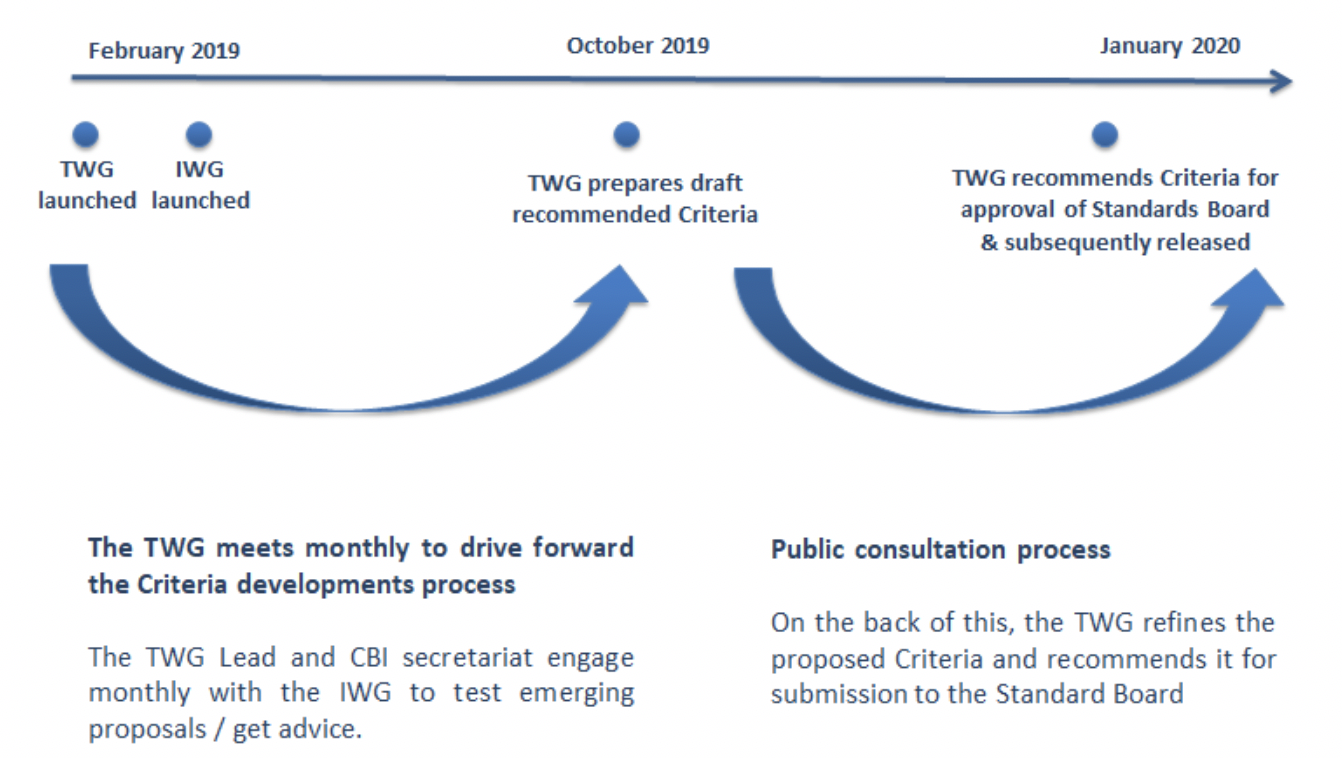

The Agri TWG and IWG undertake the following process when developing sector-specific criteria:

Criteria Development and the EU TEG

The European Commission’s Technical Expert Group (TEG) on Sustainable Finance is also developing guidance for sustainable finance in agriculture.

Sean Kidney, CEO and several of our TWG and IWG members are also contributing to the TEG. As both pieces of work develop, efforts will be made to ensure they complement one another wherever possible.

Agriculture’s Role in Climate Change

The food supply chain contributes 19-29% of global GHG emissions of which majority of food system emissions occur at the farm level (80%–86%); the remainder comes from pre-farmgate production and post-farmgate activities such as processing, packaging, refrigeration, transport, retail, catering, domestic food management and waste disposal.

Climate change also poses significant risks to agriculture ecosystems, potentially affecting productive uses of agriculture resources and related socio-economic systems.

The Green Finance Opportunity

The Criteria will help unlock opportunities for green finance, aiming to mobilise capital towards climate-aligned agricultural projects and assets. Governments can also use the Criteria as guidance assisting in setting regulation/recommendations towards decarbonising the sector.

In 2017, agriculture and forestry made up a small proportion of the overall climate-aligned bond universe, accounting for just 1% of climate bond value. By 2018, despite the need for more finance to address climate change in these sectors, investment remained small.

The Last Word

There is enormous potential for green bonds and climate finance to tap into agriculture investments. Climate Bonds Standard Agriculture Criteria will provide guidelines to issuers defining low carbon and climate resilient pipelines.

This will be a new initiative aimed at market development and tackling one of the heavy emitting sectors of global economic activity and aligning investment towards sustainable practices and outcomes that contribute towards achieving the goals of Paris Climate Agreement.

A big thank you goes to our dedicated TWG and IWG, without whom we cannot develop this multi-stakeholder, science-based Criteria!

‘Till next time,

Climate Bonds

Background Notes

The Agriculture Criteria

Development of the Agriculture Criteria originally began through development of Land Use Criteria back in 2014. The remit of the original Land Use Criteria was to develop Criteria that would work for forestry, agriculture and other land use.

However, to improve the low carbon ambition of each sub-sector it was decided that the land sector should be tackled by several separate Criteria.

Forestry Criteria were developed first, and the Agriculture Criteria now follow. In both cases (Forestry & Agriculture), the Criteria build on the principles established by the original Land Use Criteria work.

The scope of the Agriculture Criteria includes cropland, grassland, livestock and controlled environment agriculture, such as vertical farming or hydroponics.

The Climate Bonds Standard

The Climate Bonds Standard provides green definitions that issuers can Certify their bonds against. It is not a financial standard; rather it assesses the low carbon credentials of a bond. It is a science-backed screening tool that investors, issuers and intermediaries can use to evaluate the environmental integrity of green and Climate Bonds.

The Climate Bonds Standard allows easy prioritisation of climate and green bonds with confidence that the funds are being used to deliver climate change solutions. It consists of the overarching Climate Bonds Standard and a suite of sector-specific Criteria.

Sector Criteria are currently available for Solar, Wind, Geothermal, Forestry, Low Carbon Buildings and Low Carbon Transport. Bonds are Certified under the Climate Bonds Standard; assets funded must meet the requirements of the relevant Criteria. Soon to be available are Criteria for Bioenergy, Hydropower and Waste Management.

The Climate Bonds Standard Board* reviews all Criteria and documentation prior to final release. Decision-making is implemented through consensus.

*Disclosure: The Climate Bonds Standard Board is an Advisory Committee to the Climate Bonds Board.