Forestry joins expanding suite of sectors available for green bond certification under

Climate Bonds Standard

The new Forestry Criteria of the Climate Bonds Standard has been formally launched today, marking a major turning point in best practice for low carbon and climate resilient investment in forestry industries.

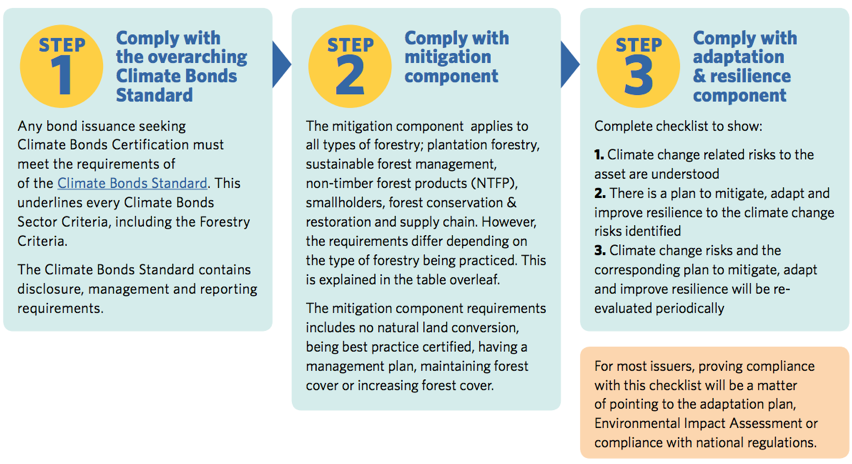

Developed for potential green bond issuers and investors, the new Forestry Criteria defines and evaluates low carbon and climate resilient forestry projects by encompassing two broad components:

- Climate mitigation

- Climate resilience

Prospective assets and projects

The three broad categories that the Forestry Criteria includes in its scope are:

- Assets and projects related to commercial forestry;

- Conservation and restoration forestry;

- Necessary supporting infrastructure for each.

Within each of these categories, the assets and projects seeking Certification may include:

- Plantation forests

- Sustainably managed natural forests

- Conservation forests

- Land under reforestation or restoration

- Protected lands

- Equipment for the management, maintenance and harvesting of forests

- Timber storage facilities

- Supply chain facilities, such as nurseries, panel production and pulp, and paper production

- Monitoring facilities, such as weather stations and warning systems for fire, illegal incursion, epidemics and floods or droughts

Why Forestry?

An integral industry for many developed and developing countries, forestry-related investments form a substantial part of the capital assets in some countries. The UNFCCC has estimated that, globally, an additional USD14 billion in financial flows will be required to address climate impacts in agriculture, forestry, and fisheries in 2030, and specifically for forestry, UNEP estimates that USD17-33 billion per year is required to achieve a 50% reduction in deforestation by 2030.

Our State of the Market Report 2018 analyses the green and climate aligned bond universe for sustainable land use (see page 29), including forestry. Overall, Land Use accounts for only USD37.3bn or 3% of the climate aligned universe, but there is strong indication that there is untapped potential for this to grow with the provision of Criteria.

Climate Bonds has also identified Life on Land (SDG15) which includes sustainable forest management, as one of the six specific SDGs where increased green investment would provide a benefit, particularly in emerging economies. Targets 15.1, 15.2, 15A & 15B of SDG 15 are particularly relevant.

The Forestry Criteria will assist in creating new capital flows into the sector with a new science-based framework that includes definitions and a screening mechanism for projects, assets, and activities against which both issuers and investors can assess green bonds. The qualifying projects and assets will be eligible for Climate Bonds Certification.

Bonds seeking Certification must also meet the reporting and transparency requirements of the overarching Climate Bonds Standard.

Why seek Certification?

Climate Bonds Certification allows issuers to demonstrate to the market that their bond meets industry best practice for climate change mitigation and resilience, as well as for management of proceeds and transparency.

Forestry has not yet become a significant share of the green bond market, and while best practice standards do exist in the sector, they do not necessarily focus on strong climate measures.

Certification indicates to investors that proper climate due diligence has been carried out on the assets that they are investing in – a robust and credible way for this new asset type to enter the green bond market.

Benefits of issuing a Certified Climate Bond include:

- Investor diversification (forestry issuers should find they attract new investors by certifying)

- Greater investor engagement

- Investor stickiness (investors buying Certified Climate Bonds tend to buy and hold)

- Strengthened reputation (certifying shows commitment to delivering low carbon infrastructure)

- Freeing up of balance sheets

Criteria Development

Development of the Forestry Criteria began in 2014 with the convening of an Agriculture, Forestry and Other Land Use (AFOLU) TWG to work on the Land Use Criteria. The development of the Land Use Criteria set principles that were then refined into specific Forestry Criteria.

A Forestry TWG was then convened on the basis of the work done by Land Use TWG. A second group, the Industry Working Group (IWG), was responsible for checking the Forestry Criteria are practical for use.

Across the two groups there was representation from leaders and subject matter experts drawn from academia, NGOs, issuers, investors and verifiers.

The Criteria underwent public consultation in June 2018.

Climate Bonds extends its thanks to the dedicated TWG and IWG members for their instrumental role in developing the Criteria.

|

Forestry Criteria Technical Working Group Members Lead Specialist: Christine Negra (Versant Vision) Paul Chatterton (World Wildlife Fund (WWF) Stuart Clenaghan (Eco System Service Limited) Petri Lehtonen (Indufor) Michele Laird (Abt Associates) Rupert Edwards (Forest Trends) Sergio Collaço de Carvalho (University of Oxford) Torsten Boettcher (Agrobanco) David Ganz (The Center for People and Forests (RECOFTC))

|

Forestry Criteria Industry Working Group Members Lars Mac Key (DanskeBank) Michael Anderson (ERM) Eliza Mathews (ANZ) Beth Nelson & Pip Best (EY) Jacob Michaelsen (Nordea) Mark Robinson (DNV.GL) Sophie Beckham (International Paper) Sami Lundgren & Timo Lehesvirta (UPM) Esben Brandi (APG Asset Management) Brian Kernohan (Hancock Natural Resources Group) Rama Chandra Reddy & Jean-Dominique Bescond (World Bank) |

|

Land Use Criteria Technical Working Group Members Lead Specialist:Christine Negra (Versant Vision LLC) Lead Specialist:Tanja Havemann (Clarmondial AG) Keith Alverson (UNEP) Geoff Blate (USDA Forest Service) Rupert Edwards (Forest Trends) Martial Bernoux (French Research Institute for Development (IRD) Adam Chambers (USDA NRCS-National Air Quality and Atmospheric Change Team) Paul Chatterton (WWF International) Jane Feehan (European Investment Bank) David Ganz (RECOFTC) Mark Holderness (Global Forum on Agricultural Research)

|

Land Use Criteria Technical Working Group Members David Howlett (Global Resilience Partnership) Frank Hicks (Independent advisor) Henry Neufeldt (Formerly, World Agroforestry Center (ICRAF)) Mark New (African Climate and Development Initiative, University of Cape Town) Simon Petley (EnviroMarket Ltd.) Roseline Remans (Bioversity International, CGIAR) Lamon Rutten (Independent Consultant) Brett Shields (Spatial Informatics Group (SIG) and Asia LEDS Global Partnership) Naomi Swickard and Jerry Seager (Verified Carbon Standard (VCS)) Annette Thiele (University Greifswald, Partner in the Greifswald Mire Centre) Raylene Watson (Independent Consultant) |

Expert Comments

Christine Negra, Versant Vision and Technical Working Group (TWG) Lead shared her views about the launch:

“To tackle climate change, the forestry sector needs to function as a net carbon sink rather than as a GHG emitter. In the recent IPCC report, land-based mitigation – including afforestation and reforestation – is an essential component of all four model pathways to a 1.5-degree world.”

“The new Forestry Criteria of the Climate Bonds Standard provides necessary guidance for defining investable forestry assets that are aligned with global mitigation goals.”

Dr. David Ganz, Executive Director, The Centre for People and Forests (RECOFTC) and a TWG member:

"The CBI Forestry Criteria can help to ensure that forestry infrastructure assets or projects meet a certain standard for climate-friendly investment. People should be able to live equitably and sustainably in and alongside thriving forests and healthy, resilient landscapes."

"Involvement of the private sector and government is imperative and good governance is the bedrock for the development and implementation of ‘community friendly’ national forest policies, programmes, and regulatory frameworks."

Petri Lehtonen, former senior partner at Indufor & now Forest Finance Expert at FAO and TWG member:

"Forests, as major renewable resources, will have an increasingly important role in finding sustainable solutions for global problems such as population growth, increasing competition for land, climate change and declining natural capital.”

“A swift transition towards a green economy and bio-based production is needed and providing this, CBI standard for investment in such a crucial natural resource as forests, is a step in the right direction."

Sean Kidney, CEO, Climate Bonds Initiative:

“Low carbon and climate resilient forestry management is an essential factor for carbon sequestration and protection of natural capital in a carbon constrained world experiencing increased climate impacts.”

“The Forestry Criteria is a significant step in expanding the reach of the Climate Bonds Standard to a new sector. Issuers, asset managers and institutional investors now have a new, robust, science-based process for delineating forestry investments compatible with addressing climate change and achieving the Paris Agreement goals.”

The last word

Definitions and disclosure mechanisms have been an emerging issue in the field of green finance as market growth has accelerated during 2016-2017.

Climate Bonds has been expanding the scope of its sector based Criteria throughout 2018 and will continue this program next year, providing issuers and investors with the additional investment assurance around climate credentials of green bonds in additional industry sectors.

Meanwhile, further details on the Forestry Criteria can be found in three supporting documents:

The Forestry Background Document

Keep an eye out for announcements including the release of Bioenergy, Protected Agriculture and Hydropower Criteria in the coming months.

The new Climate Bonds Standard Version 3.0 is also on the way, so stay tuned!

‘Till next time,

Climate Bonds