Updated Methodology released outlining the classification and screening process to identify green debt instruments eligible for inclusion in the CBI Green Bond Database

Another stage in Q3 & 4 reviews and updates of Climate Bonds frameworks. New umbrella Standard V3 due out in Q4.

The Climate Bonds Initiative uses a clear set of criteria to define which green bonds are eligible to enter the CBI Green Bond Database, which is used by a wide range of stakeholders including green bond index providers and green bond ETFs.

The Climate Bonds Initiative has now updated its CBI Green Bond Database Methodology. This change ensures our green bond database is in alignment with the recently released Climate Bonds Taxonomy 2018: A Guide to Climate Aligned Assets and Projects and the expansion in the scope of the Climate Bonds Standard Sector Criteria.

What’s new?

The updated Methodology includes more detailed classification criteria and screening process for labelled green bonds allocating proceeds to financing assets/projects in the following sectors:

- Energy

- Buildings

- Transport

- Water

- Waste

- Natured Based Assets

- Industry

- ICT

The full list of classification criteria is available in the Methodology’s Appendix (p4-8).

To reflect the Taxonomy’s latest format, the Methodology includes a traffic light system providing a clearer distinction between included assets (green), assets needing further review (orange) and ineligible assets (red).

Download the English version here.

How does it work?

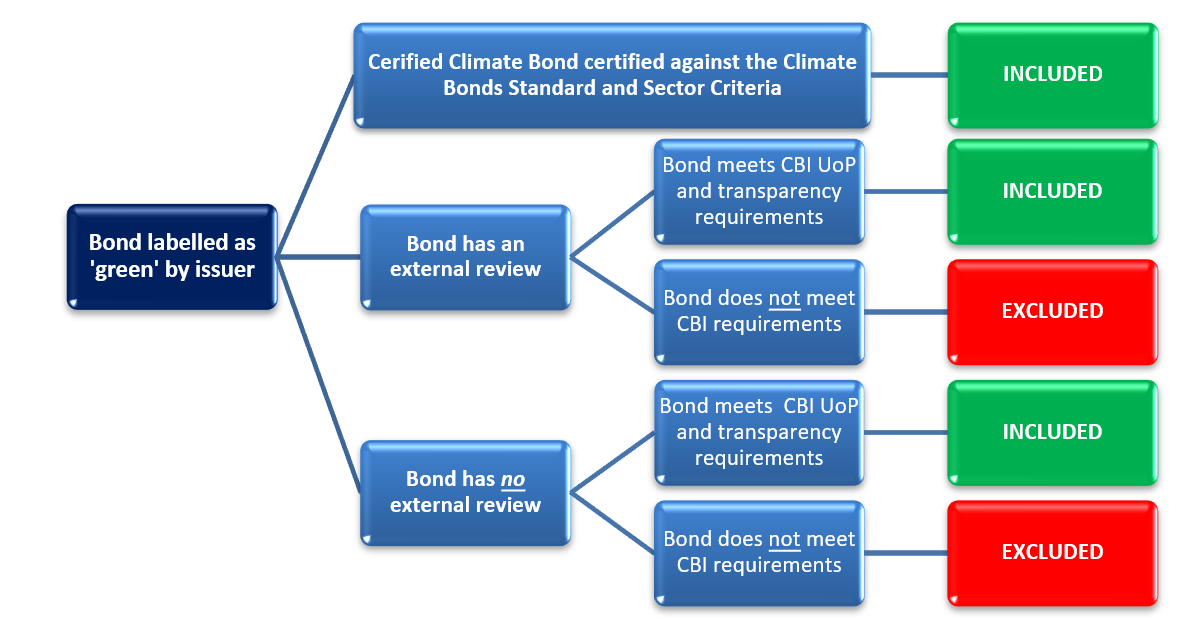

The Climate Bonds Initiative screens labelled green debt instruments by reference to the Climate Bonds Taxonomy to identify green bonds and loans as eligible for inclusion in the CBI Green Bond Database.

While we commonly refer to debt instruments included in the CBI Green Bond Database as “green bonds”, any debt format is acceptable, including but not limited to:

- Schuldschein,

- sukuk,

- green loans,

- medium term notes,

- debentures,

- retail bonds,

- securitisations and tranches in wider deals (ABS, MTN programs, loan).

In short, any debt structure or instrument which is asset-linked or asset-backed is eligible.

The Eligibility Process

The three-step process to classify a green bond as eligible is as follows:

- Identify green-themed, labelled bonds

- Screen the projects or assets for alignment with the Climate Bonds Taxonomy

- Evaluate the allocation of proceeds to aligned projects and assets

Climate Bonds’ assessment is based on information available from the issuer’s green bond framework, external reviews or certification-related verification, as well as other sources such as bond prospectus, issuer website, corporate reporting, rating agencies and media coverage.

The methodology for inclusion in the CBI Green Bond Database is somewhat less stringent than the Certification Criteria, but is still aligned to the Green Bond Principles and the Climate Bonds Taxonomy. The methodology uses a simplified version of the Climate Bonds Taxonomy as reflected in the Appendix (p4-8).

For borderline and/or complicated cases, input from the Climate Bonds Standards team, and on occasion, external technical experts, is sought.

Green bond status

Pending

In some cases, the information available on the deal’s use of proceeds (UoP) is insufficient for an immediate decision as to whether the bond should be included or excluded.

Such bonds are marked as ‘Pending’ and further work is undertaken to obtain or clarify information. If no further information is made available or the information obtained does not show alignment with the Taxonomy, the bond is added to the ‘Excluded Bonds’ list.

Exclusions

If the bond’s use of proceeds is not aligned to the Climate Bonds Taxonomy, the bond is added to the CBI Excluded Bonds list.

The same applies if more than 5% of bond proceeds are used or expected to be used for ‘general corporate purposes’, working capital, social assets / projects or assets that do not align to the Climate Bonds Taxonomy. Lack of sufficient information to determine the alignment of UoP also results in exclusion.

Excluded bonds are announced in the Climate Bonds Market Blog, together with the rationales for exclusion.

Reclassifications

If a green bond is included but the issuer cannot fulfil the criteria at a later date or the proceeds are applied to “non-green” assets, it may be removed from the CBI Green Bond Database. Conversely, excluded bonds may be re-classified if satisfactory information is provided or obtained at a later date and this new information confirms alignment to the Taxonomy.

A change from excluded to included may also occur if we change the methodology to expand the list of acceptable approaches to labelling or if the scientific thinking and internal guidance on asset categories evolves.

However, deals will not be excluded simply because Climate Bonds tightens the screening criteria levels used in this Methodology. Any changes to the screening criteria will be pre-announced in the Climate Bonds Market Blog.

Read the full Methodology now (English version).

Want to know more?

Subscribe to our Blog to stay updated on the latest green finance developments and receive our well regarded Market Blog directly into your inbox every month.

The full list of deals included in the CBI Green Bond Database is available here.

For further queries on our Green Bond Database, please visit our Data Requests page and complete the relevant form.

Follow our Twitter @climatebonds for the very latest.

The Last Word

To date in 2018 we've announced our enlarged Water Criteria, proposed new Criteria for Forestry, Bioenergy and Protected Agriculture and have started the development process on Electrical Grids. We've just launched our Climate Bonds Taxonomy 2018 last week and now this roll out of our latest Green Bond Database Methodology.

Green finance in 2018 has been marked by new players, new products and increasing institutional investor interest. These trends will continue between now and 2020.

Stay tuned as we take another big step: the release of the new umbrella Climate Bonds Standard V3 is due in Q4.

‘Till next time,

Climate Bonds