Climate-aligned universe indicates huge potential for the green bond market

Sean Kidney launches major CBI report at the HSBC Finance for Global Change Forum in New York

Annual global analysis of climate finance and green investment

Climate Bonds Initiative’s flagship ‘Bonds and Climate Change State of the Market 2018' report will be launched today at HSBC’s Finance for Global Change Forum, one of the first events to kick off Climate Week NYC.

The State of the Market (SOTM) report provides an analysis of the labelled green bond climate-aligned and universe, highlighting investment opportunities to finance climate-aligned assets within the following climate themes: clean energy, low carbon transport, water management, low carbon buildings, waste management and sustainable land use.

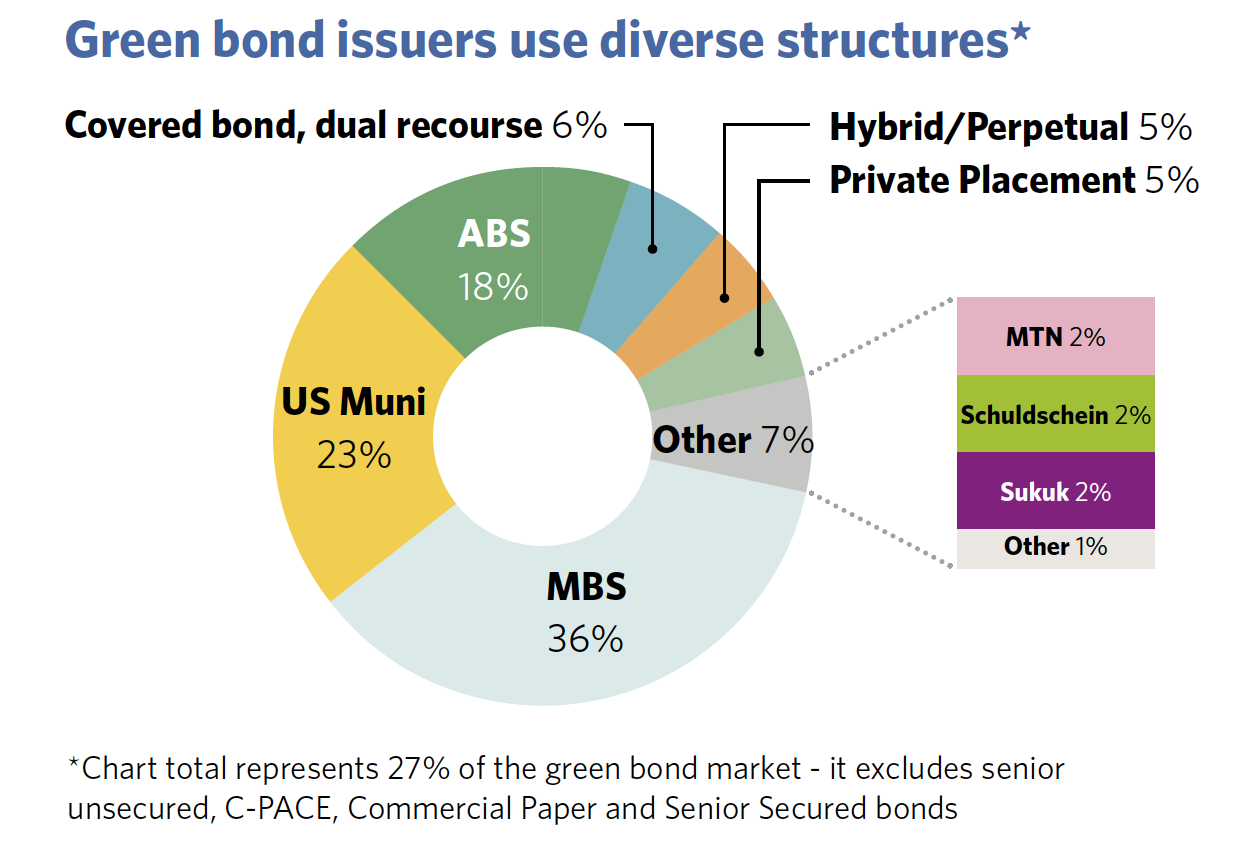

This year’s report also provides an in-depth analysis of the diverse bond structures that have been used in the green bond market, as well as an update on the latest policy developments.

The headline numbers

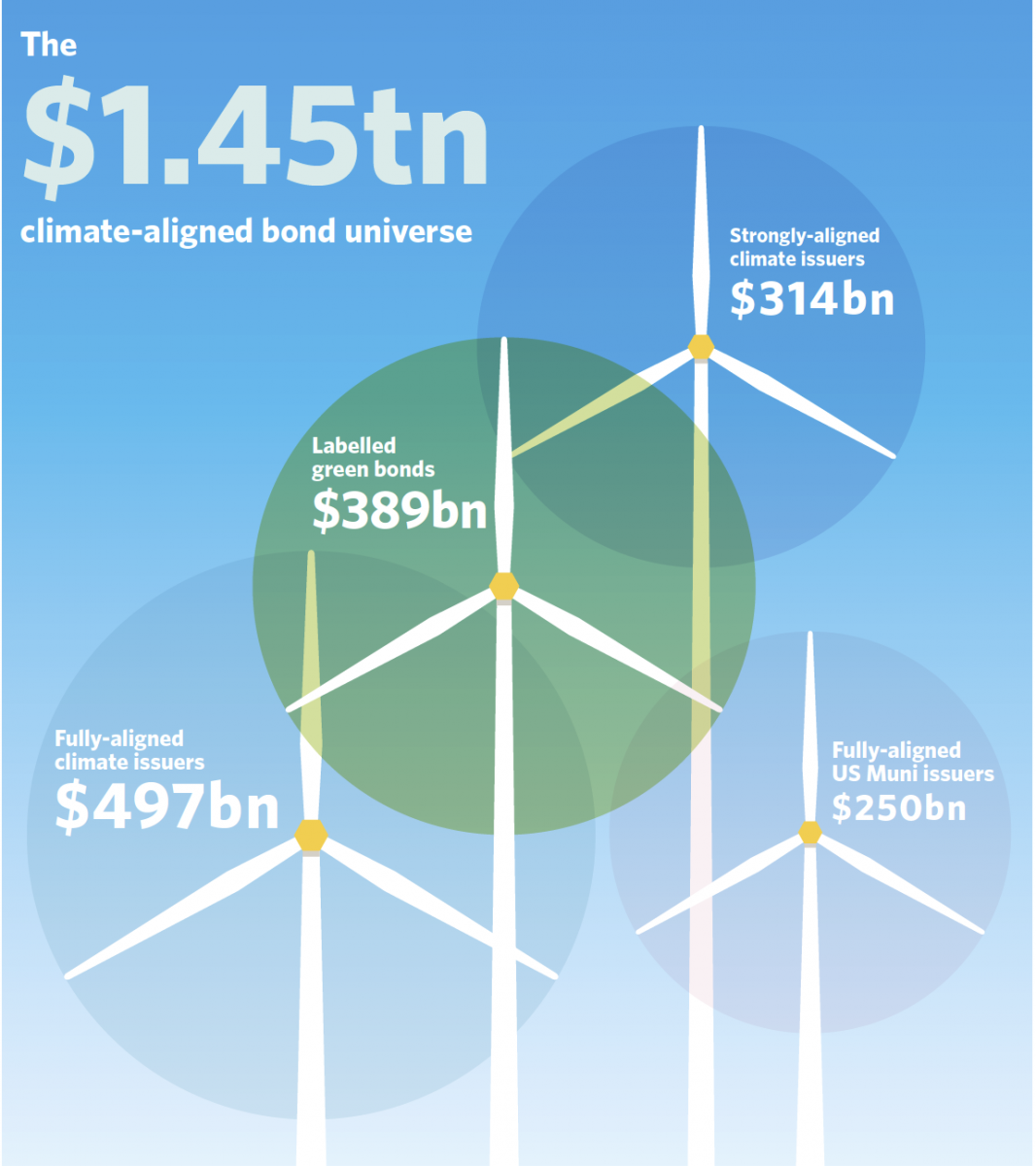

While previous SOTM reports focused on identifying fully-aligned issuers that derive >95% of revenues from ‘green’ business lines, this year we expanded the scope to include strongly-aligned issuers that derive 75-95% of revenue from green business lines.

Separate research was conducted on fully-aligned US Muni agencies to identify their total outstanding unlabelled bonds.

This year’s dataset includes climate-aligned and green bonds issued after 1st January 2005 and before 30th June 2018*.

*more information on the research’s methodology can be found on page 2 of the report.

Green bonds: Key findings

- USA, China and France are top three countries for labelled green bond issuance, followed by Supranationals, Germany, Netherlands, Sweden, Spain, Canada and Mexico

- Fannie Mae is by far the largest green bond issuer with USD37.7bn of outstanding aligned volume, followed by the EIB – USD26bn and Kreditanstalt fuer Wiederaufbau (KfW) – USD15.2bn

- If we exclude development banks, the French Republic Government Bond OAT takes the second place in the larget issuer league table at USD12.2bn, followed by Engie SA (USD7.8bn)

- Top sectors for green bond issuance are: Multi-sector (USD179bn), Energy (USD90bn) and Buildings (USD70bn)

- 498 green bond issuers with USD389bn of outstanding bond volume accounts for 32% of the climate-aligned universe

The green label is an important tool to finance climate-aligned assets and projects

The green bond label is and will remain an essential tool within the fixed income space for both investors and issuers. For issuers, it can provide much-needed finance for low carbon assets while also signalling sustainability aspirations and enabling access to a wider investor base. For investors, the label enables easy identification of green fixed income products as well as enhanced transparency of the projects being financed and their impact.

The universe of bonds from ‘pure-play’ issuers highlighted throughout this report indicates that there is huge potential for the growth of the labelled green bond market.

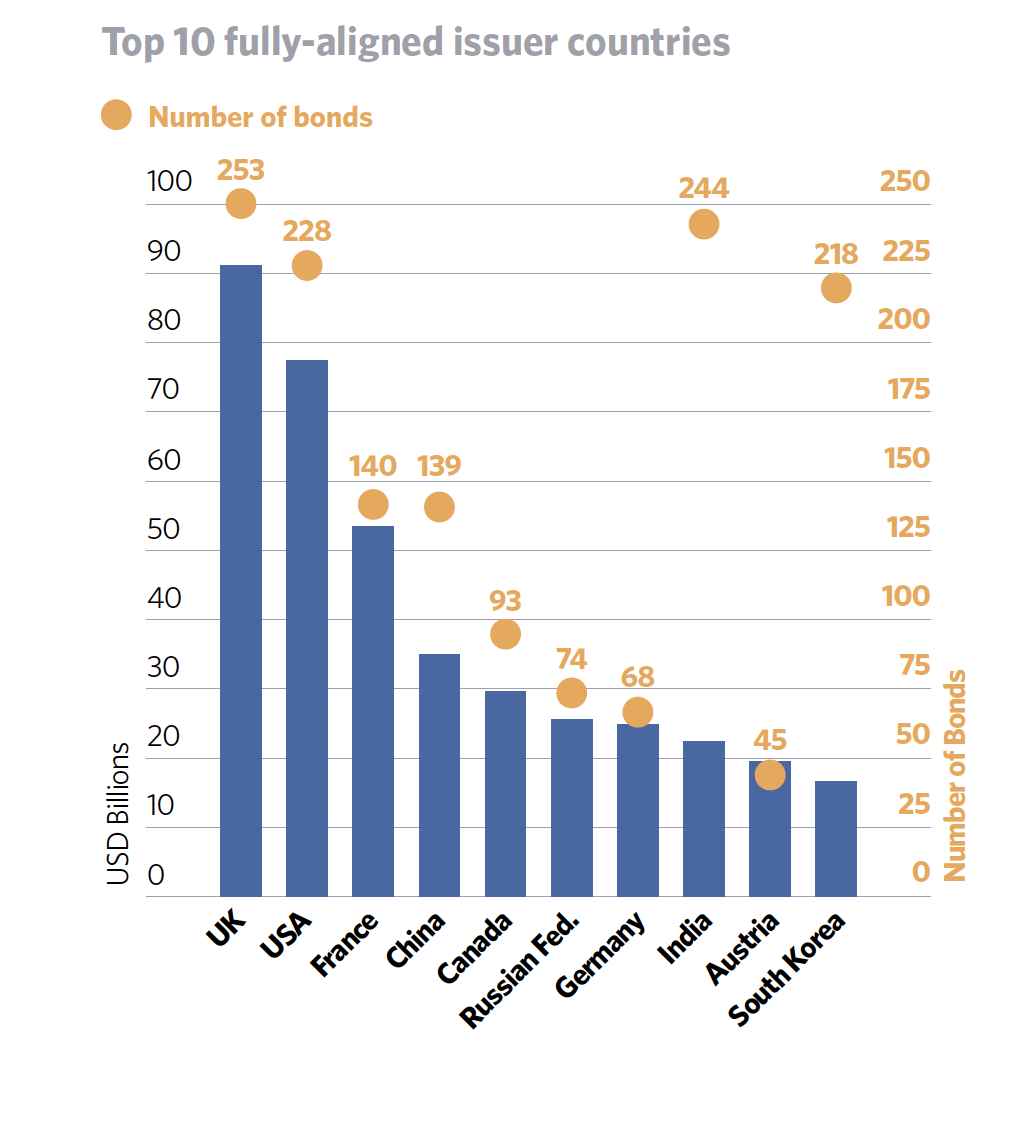

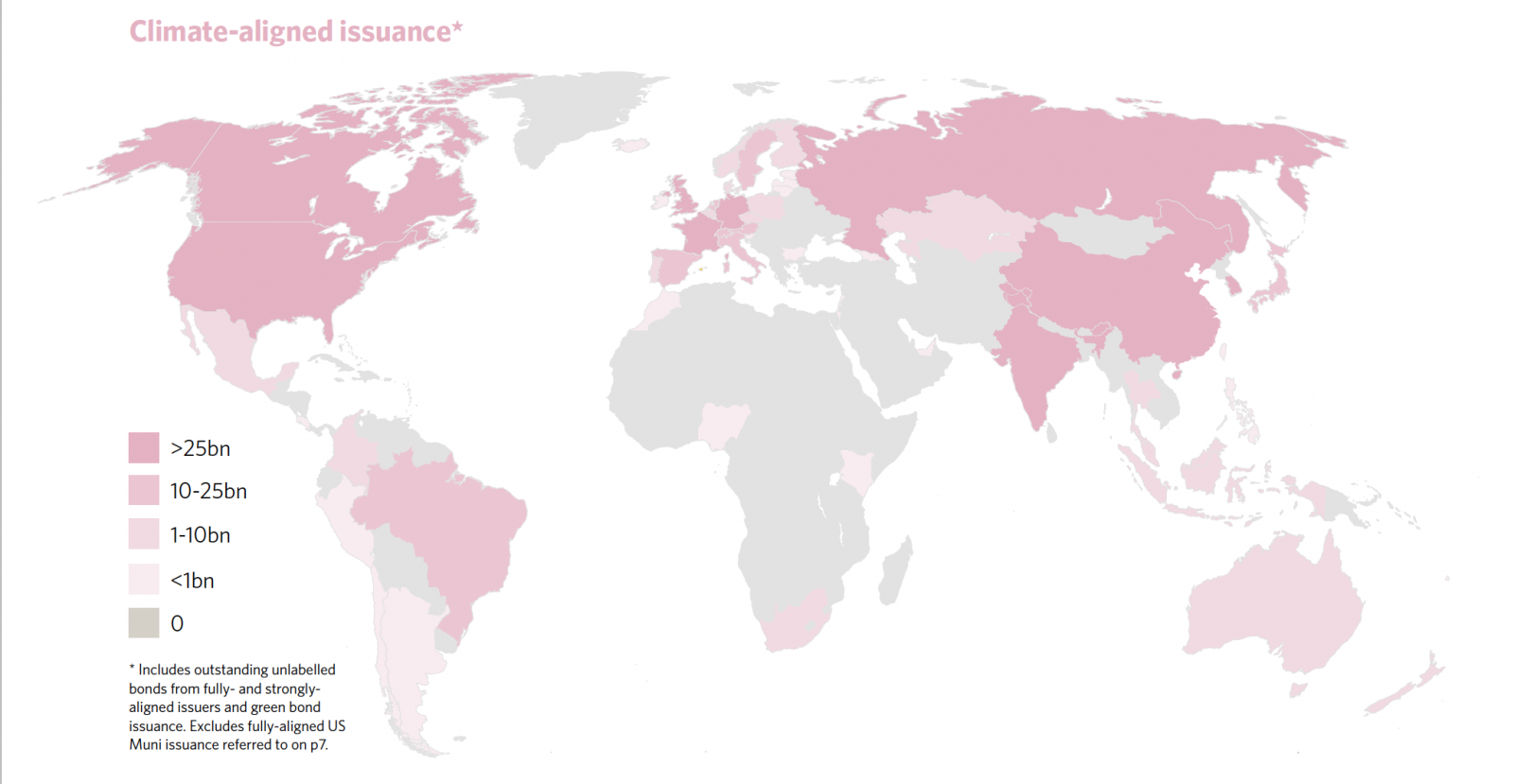

Opportunities for fully-aligned entities to issue green bonds exist all across the world

Focus on green bond’s diversity of deal structures

The introduction of solar ABS and PACE ABS as new funding instruments designed specifically to refinance large pools of small green loans and leases initiated a green securitisation market, which has gained prominence with Fannie Mae Green MBS.

Private placements have accompanied public bond issuance since 2010 and have been instrumental in supporting the introduction of green bonds in emerging markets or to tap into foreign investors.

Green Schuldschein, sukuk, covered bonds, hybrids and MTN programmes all play a role in developing green finance against unique national or regional market backdrops. (Read more on green bond structure diversity on pages 22-27 of the report.)

Key findings: Overall universe

- Climate-aligned bond universe: 869 issuers with USD1.2tn outstanding, plus USD250bn outstanding bonds from US Muni fully-aligned issuers

- EUR denominated bonds account for 26% of the overall universe, with USD316bn outstanding and are closely followed by USD denominated bonds – USD314bn

- Almost a quarter of the universe is AAA-rated by international and/or local credit rating agencies and 84% of the USD1.2tn universe is investment grade

- 5 to 10-year tenors are most common

Key findings: Sectoral overview

- At USD532bn outstanding, transport is the largest theme in the climate-aligned universe at 44%, followed by energy at 23% and multi-sector at 15%

- Energy has the highest number of climate-aligned issuers (292) while the buildings sector has the largest number of bonds outstanding (1,843)

The last word

The report identifies a universe of USD1.45tn climate-aligned bonds, made up of USD389bn in green bonds.

This points to a large universe of unlabelled bonds financing green infrastructure, implying a huge potential for a larger and even more diverse green bond market.

However, there is still a long way to go. Global emissions remain on track to exceed 2 degrees of warming and USD90tn of investment in climate projects is needed by 2030.

If we are to successfully combat climate change, global green finance needs to reach USD1tn by end 2020 and grow each year of the new decade.

'Till next time,

Climate Bonds