Public support for green bonds continues in the first half of 2018, with more sovereign green bonds, new national guidelines and incentives, green finance strategies under development and action from central banks.

Download our summary of the first half of 2018’s top 5 green bond policy developments and what to expect for the rest of the year.

Sovereign Green Bond Growth

Sovereign issuance continues to gain momentum this year with Indonesia, Belgium and Lithuania entering the market.

Poland and France also continue their engagement in sovereign green bond issuance with a second green bond of EUR1.2bn from Poland and France tapping its green OAT again in June, totalling EUR14.8bn issued.

Hong Kong and Kenya have both made commitments to join the list of sovereign issuers soon.

More national guidelines for green bonds

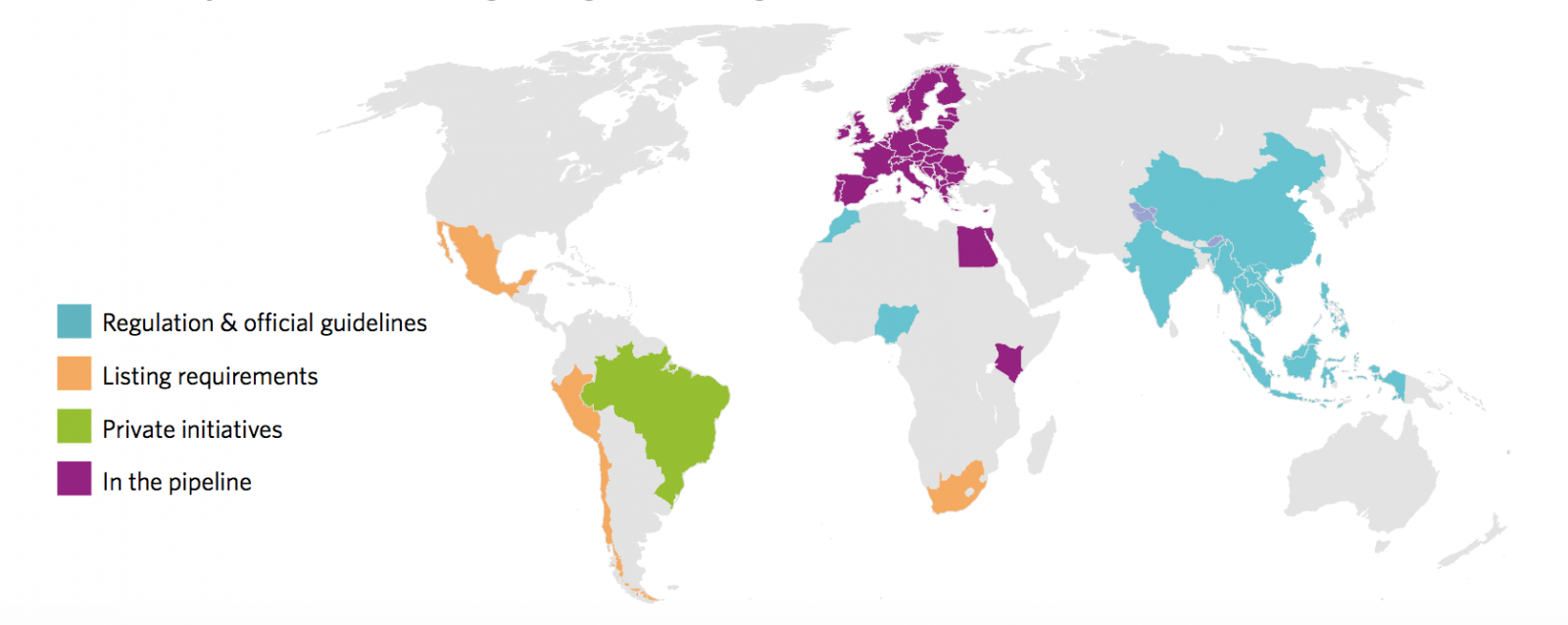

More countries are developing green bond guidelines in line with international best practices.

This year, Latin America has been leading progress on this front, with Peru’s Green Bonds Guide and Chile’s guidelines that were published along with the launch of a “Green and Social Bond Segment” on the Santiago Exchange.

The NSE in Kenya has been working on national guidelines as part of the Kenya Green Bond Programme. The SEC in Nigeria is also expected to finalise its regulation on green bonds by the end of the year, where the Climate Bonds Initiative has recently launched the Nigeria Green Bond Market Development Programme in partnership with FMDQ and FSD Africa.

Map of green bond guidance

The EU Taxonomy on Sustainable Finance and Green Bond Label

The EU is also working on developing a Taxonomy and a label for green bonds. The European Commission launched a Technical Expert Group (TEG) to follow up on its Action Plan on sustainable finance announced in March, and the three legislative proposals that followed.

We will keep you posted on progress as Sean Kidney, CEO of Climate Bonds, attends the TEG’s monthly meetings.

Targeted green bond incentives

So far this year, we have seen the launch of a three-year “Green Bond Grant Scheme” from Hong Kong, which will provide up to HKD800,000 (USD102,000) in subsidies for issuers.

Kenya might be next, where the Capital Markets Authority (CMA) put forward a policy proposal to the national Treasury to extend the current tax exemption for green bonds.

Governments consults private sector on green finance strategies

Governments are initiating conversations with the private sector to set green finance agendas, often led by finance ministries. Experts have been brought together to advise on the development of green finance agendas in Sweden, UK and Canada.

Central banks action

The People’s Bank of China has explicitly introduced green bonds in its collateral and macro-prudential policies, with a view to incentivise banks’ green lending.

At the international level, central banks have decided to coordinate action on managing climate-related risks through the Network for Greening the Financial System (NGFS). The network of central banks and supervisors, which currently counts 16 members from Europe, Asia and Africa, held its inaugural meeting in January, and set up a governance structure and work plan focused on 3 work streams: Supervision, Macrofinancial and Mainstreaming green finance.

The Last Word

The first half of 2018 has seen green bond issuance of USD74.6bn, a 4% increase from H1 2017. The green bonds market is growing, but it needs to grow much faster to meet the 1trillion by 2020 target.

Public sector action will be key to achieve this kind of scale in the short timeframe. During the course of the year we expect to see more sovereign issuance, subnational commitments through the Green Bond Pledge, and progress towards an international taxonomy. Committed governments will follow with targeted incentives and support schemes to accelerate the pace of growth of green finance.

We’ll be reporting again at the end of the year.

Download the H1 update here.

‘Till next time,

Climate Bonds