Latest Q4 2017 report completes two years of data observations examining green bond behaviour in primary markets

Privacy laws are changing. We want to stay in touch. Do you?

Please reconfirm your Blog Subscription here: A couple of clicks is all it takes.

What’s it all about?

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually allowing a more longtitudinal analysis as the market expands.

The Q4 2017 report covers USD15.1bn or almost 40% of the face value of labelled green bonds issued in Q4. 15 EUR and 8 USD labelled green bonds are analysed in the report.

The detailed methodology is outlined below.

Highlights from Q4 2017:

- 14 out of 22 issuers are first time green bond issuers

- USD green bonds again had larger oversubscriptions and achieved larger spread tightening during book building than vanilla equivalents. EUR green bonds are similar to the market

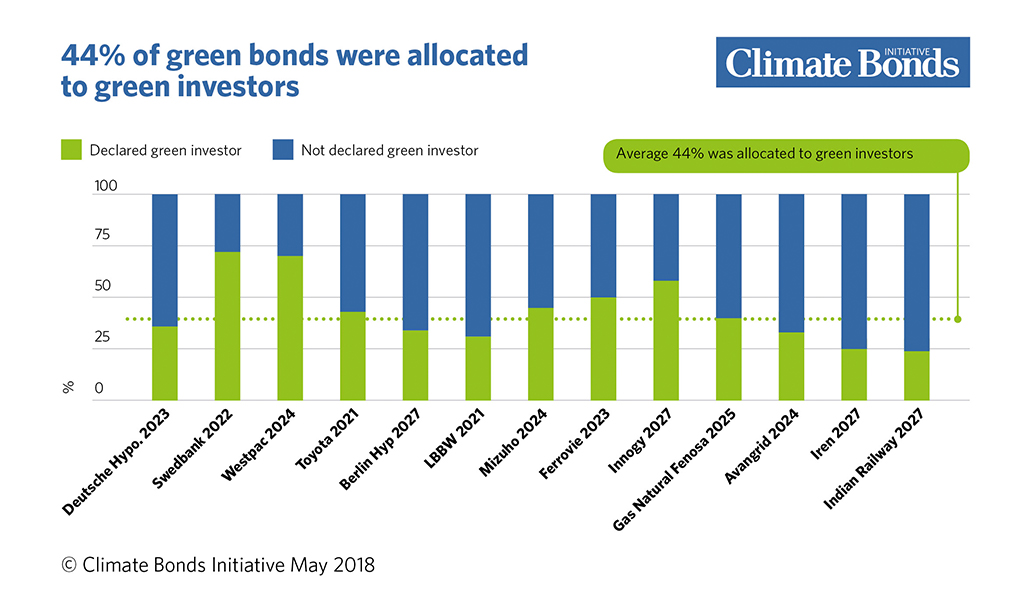

- 44% of green bonds were allocated to green investors. Non-mandated investors continue to support the market

- The greenium: new issue premiums are not a given for buyers of green bonds

Detailed Findings:

With a full two-year period of data observations, we have seen evidence of green bonds benefiting both issuers and investors.

Diversity within the pool of qualifying bonds remains limited, with corporate bond issuance coming from utility, real estate, and financial sectors. However, with market growth projections for 2018 set at USD250-300bn, we hope to start capturing sector diversification in our future reports.

In Q4 2017 we observed the following:

- USD green bonds were more oversubscribed than vanilla equivalents. EUR green bonds achieved similar book cover to vanilla equivalents. In both cases, this observation has held true for the last three quarterly reports, for which we have used comparable data.

- USD green bonds tightened, on average, more during the book building process than vanilla equivalents. Again, this has remained consistent for the last three quarters. Results for EUR green bonds have shown more variation.

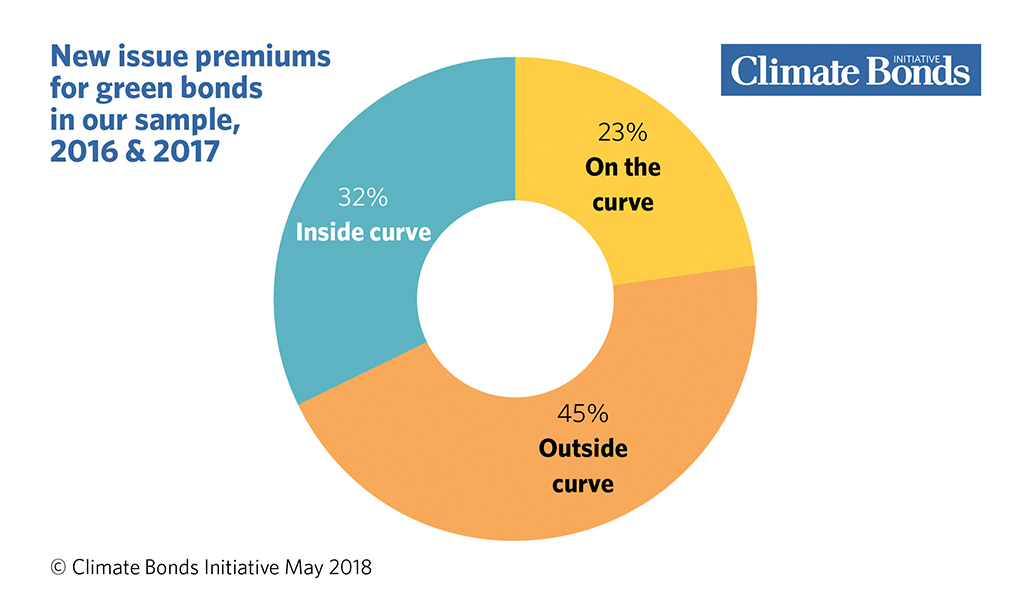

- Half of the green bonds in our, albeit limited, sample did not exhibit a new issue premium. We have built yield curves for 42 green bonds issued during the last 24 months. More do not exhibit a new issue premium, than do. Evidence of a greenium is mounting.

- 44% of green bonds were allocated to green bond investors, a slight decline on the prior quarter (47%). Green bonds continue to attract a broad range of investors.

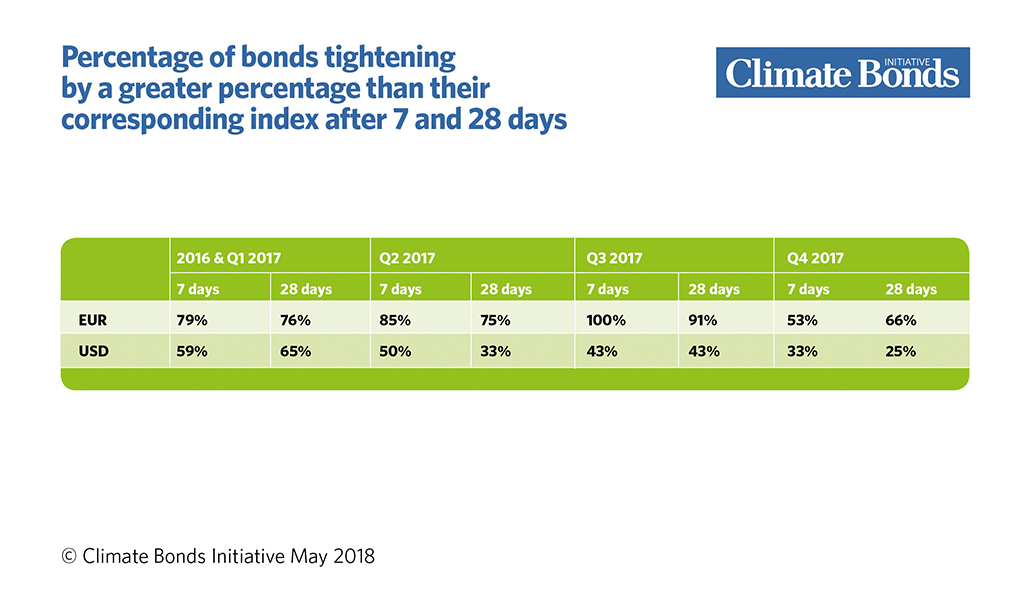

- Just over half of the EUR green bonds in our sample tightened by a larger percentage than the corresponding index after 7 and 28 days. These numbers are lower than in prior quarters. USD green bonds continue to lag in the immediate secondary market.

Report methodology

105 green bonds were issued during Q4 and their combined face value totals USD39.7bn. The report covers 23 labelled green bonds, with a total volume of USD15.1bn, or around 40% of the quarterly total.

The sample is restricted is restricted by currency, not domicile of issuer, and includes green bonds from developed, emerging and frontier market countries. We have included all labelled green bonds which meet a set of parameters designed to capture the most liquid portion of the market, while trying not to limit diversity of issuer type.

Who’s saying what?

Peer Stein, Global Head of Climate Finance, Financial Institutions Group IFC:

“IFC sees green bonds as critical to filling the financing gap for climate mitigation and adaptation in emerging markets. The most recent findings of our joint pricing publications for green bonds continue to add hard evidence to the discussion about issuer and investor benefits for green bonds.”

Tony Trzcinka, CFA. SVP and Portfolio Manager, Impax Investment Management LLC:

“The latest Greenium report confirms the pricing and demand dynamics that we see every day. There is continued strong demand for green bonds. It is also reassuring to see that Treasurers are “consistently happy with how green bonds place”. We hope this analysis encourages potential issuers of green bonds.”

Max Bronzwaer, Treasurer, Obvion NV:

“The continuing increase in the number of new entrants and returning issuers to the green bond market, shows that the green bond market keeps growing and is getting more mature. In following studies, it would be interesting to see whether green bonds behave differently than vanilla bonds in times when market volatility increases.”

Sean Kidney, CEO of Climate Bonds Initiative:

“Climate Bonds tracking and analysing of the performance of green bonds against vanilla bonds extends for more than one year now as we continue to gather market data, examining the benefits of green bonds for both issuers and investors.

Our ongoing research will benefit from growing market diversity. After this initial year of quarterly reporting we are moving to a semi-annual reporting cycle to provide a longer-term perspective in what is a rapidly developing market.”

What’s the back story?

The report is a continuation of our ongoing assessment of green bonds pricing. A preliminary Snapshot briefing paper examining Q4 of 2016 was produced for the 2017 Climate Bonds Annual Conference.

The first Green Bond Pricing Report examining eligible green bonds from 2016 and Q1 of 2017 was released in August. In November 2017, we published a report covering Q2 2017, and in February 2018, the report for Q3 2017.

The Last Word

Downward pressure on yields in the past two years have made it challenging to identify to what degree bond performance is linked to it being green or otherwise. As economic measures begin to improve, we expect to see investor preferences becoming more starkly observable, with potential for green bonds to bifurcate from vanilla counterparts.

Download the full report here.

‘Till next time,

Climate Bonds

Partner Disclosure: Several organisations named in this communication are Climate Bonds Partners. A full list of Partners can be found here.