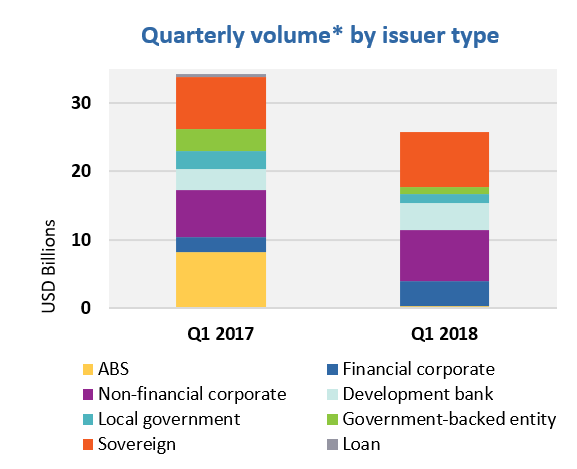

Q1 reflects growth in sovereign and emerging market issuance

Quarterly Highlights:

- USD25.8bn of issuance*

- 71 green bond issues with 11 from Sweden, 10 from China and 9 from the USA

- 52 issuers from 21 countries

- 25 market entrants from 12 countries bring the total number of green bond issuers to 440

- 2 new countries – Iceland and Indonesia – bring the number of “green bond” countries to 47

- 2 new issuers – Indonesia and Belgium – bring the number of sovereign green bond issuers to 6

- March issuance was strong with 27 deals in 10 countries and 17 new issuers (7 from China)

What’s it all about?

Green bond issuance kept a good pace in 2018’s first quarter with 71 green bonds coming from 52 issuers, with preliminary figures reaching USD25.8bn.

USD17.4bn were issued in developed markets, with a third of the volume coming from two Belgian deals: Belgium’s sovereign Green OLO and logistics company WDP’s green bond.

Issuance from emerging markets (including supra-nationals) is increasing, representing 32% of quarterly issuance compared to just 15% in Q1 2017.

Sovereigns played a central role this quarter, accounting for approximately a third of issuance in both developed and emerging markets. This trend is set to continue in the coming quarters.

Download the full report here.

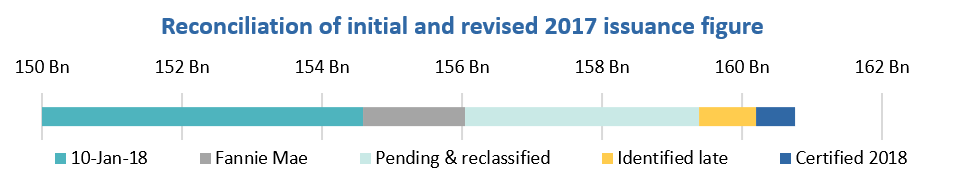

2017 green bond issue volume revised to USD160.8bn

Our annual numbers for green bond issuance in 2017 have been revised from USD155.5bn to USD160.8bn. The main reasons for the adjustment are summarised by the chart below (see page 2 of the report for more details).

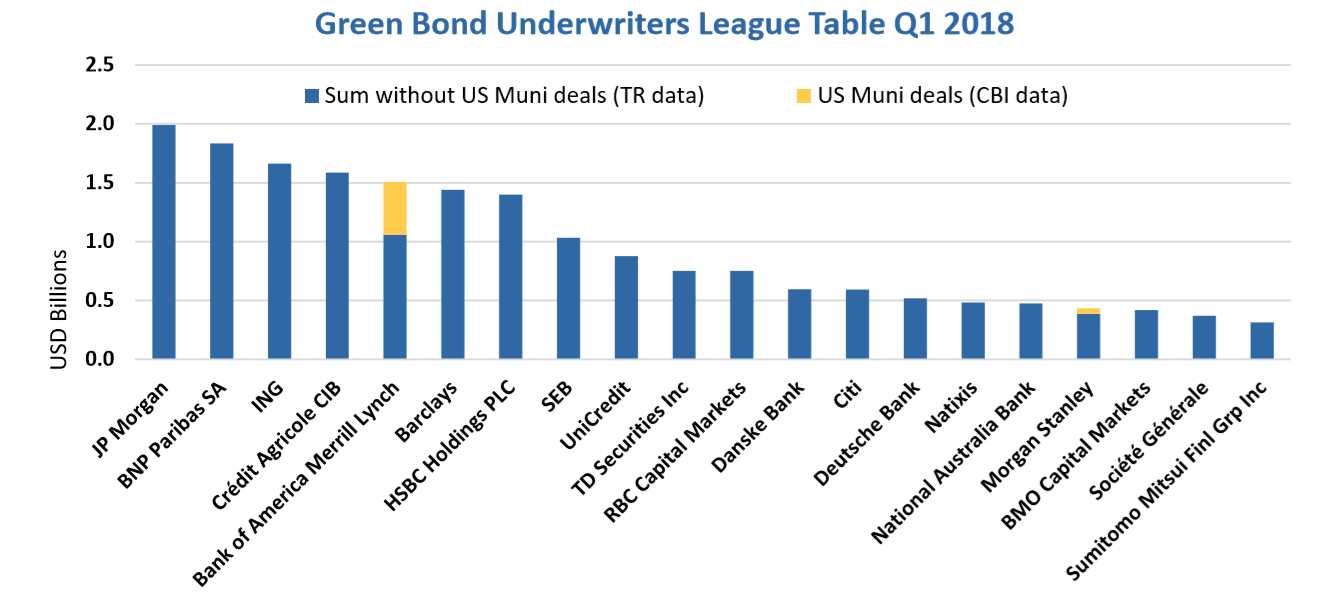

Underwriters League Table

Q1 league table shows JP Morgan, BNP Paribas and ING in the top three spots, with ING appearing on the podium for the first time!

The Last Word

Q1 has shown that 2018 is off to a good start. With big green finance events in the pipeline and the launch of the Green Bond Pledge, there is plenty of opportunity to double the market yearly and meet the imperative USD1tn by 2020 milestone.

The enthusiasm and appetite witnessed at our 2018 Annual Conference last month, along with the increase of sovereign issuance from both developed and emerging economies, make the USD300bn target seem well within our reach.

Download the full report here.

‘Till next time,

Climate Bonds

* All charts and analysis are based on preliminary figures for Q1 2018 issuance volume and number of deals, pending the inclusion of Q1 Fannie Mae Green MBS deals and six deals still under assessment for inclusion in the CBI green bond database (see p.4 of the summary for more details on the database inclusion methodology).