The Climate Bonds Initiative has released its COP22 Green Bond Directions paper, outlining growing awareness green bonds as NDC financing tools.

Growth, new markets and NDCs

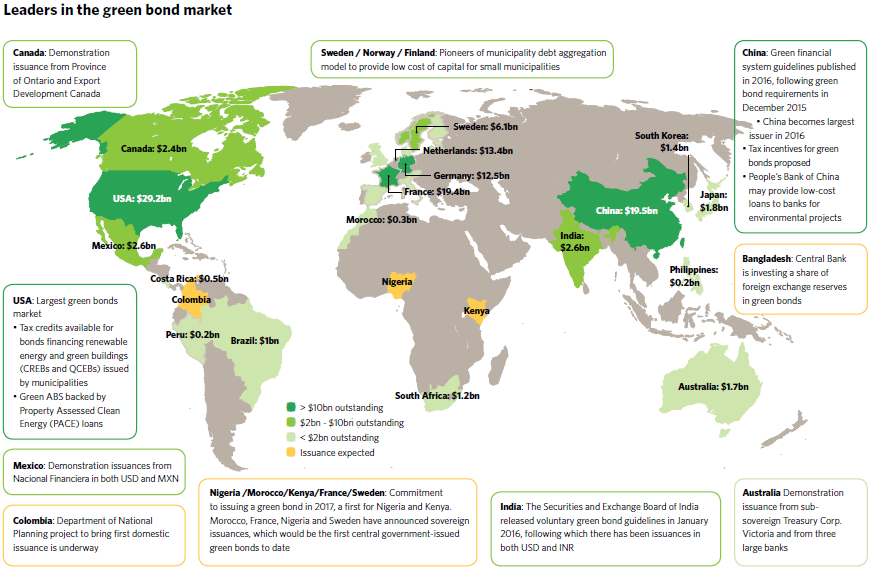

- Climate finance through the green bond market has grown substantially in 2016, funding both climate mitigation and adaptation efforts. Issuance in 2016 is on track to be more than double that of 2015.

- Growth in 2016 has been driven by government action and demonstration issuance in China - soon to be the world’s largest green bond market - with other emerging markets growing, including India, Brazil and Mexico.

- Green bonds are now being seen as a capital raising tool to meet mitigation and adaptation targets set out in the Nationally Determined Contributions (NDCs).

Sovereign issuance in the pipeline

France, Nigeria and Sweden have foreshadowed sovereign green bond issuance for 2017, with several other countries investigating various options.

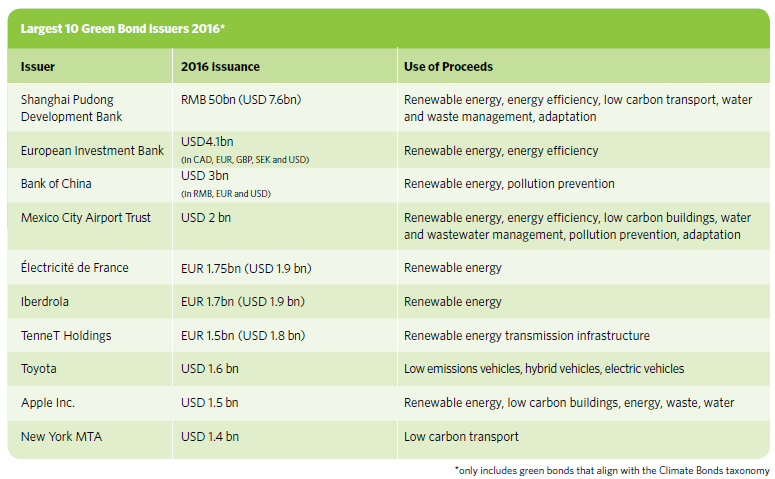

The big green bonds in 2016 – Use of proceeds, what are they funding?

Post Paris: National capital raising plans to meet NDCs

As the Paris Agreement enters into force, countries now face the challenge of implementing the commitments set out in NDCs. National capital raising plans to meet the targets’ financing need to be developed.

With public budgets under strain and banks having restricted lending capabilities, private sector sources of capital need to be engaged.

Tapping green bond markets will be an important strategy to raise capital for low carbon and climate resilient infrastructure that can support meeting NDC targets.

The world has deep capital resources, much of which is sitting in near-zero interest bonds in developed economies.

The challenge is the lack of investible opportunities that address climate change priorities.

Green bonds are a tool to help meet climate targets by closing the gap between funding needs and investor demand; they are a ‘friction reduction’ instrument.

Green finance, green infrastructure and new growth

Governments need to develop ambitious green investment pipelines that will meet the objectives of their climate change plans; green infrastructure will play a pivotal role in these.

Low carbon transport plans – rail and bus rapid transport systems – need to be brought forward; waste and wastewater treatment (with methane capture) developed; and clean energy generation and smart grids prioritised.

With cities accounting for 80% of energy emissions, the rapid rates of urbanization we can expect to see in the coming 15 years, particularly in the developing world, require planning and infrastructure to be directed towards low carbon and resilient forms.

Incentives and support tools will also be necessary to achieve the scale of investments required.

The G20 Green Finance Study Group (GFSG) Synthesis Report recommends actions governments can take to promote the development of green finance and green bonds to help nations with national capital raising and green investment plans.

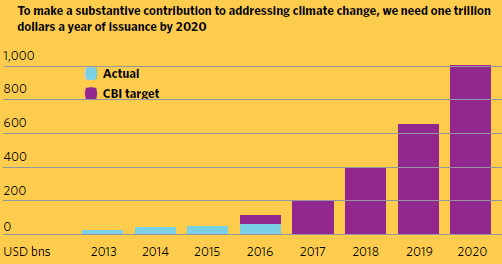

Green Bonds Target: USD 1 trillion by 2020

The Paris Agreement marked the first step towards achieving a 2-degree global warming target by the end of the century.

After a global stocktake of the aggregate impact of NDCs in 2018, nations will need to update their NDCs or submit new ones by COP 2020; these will need greater ambition if we are to meet the agreed goals of holding emissions to no more than 2°C, and ideally 1.5°C.

Action needs to focus on shifting investments towards green solutions and facilitating large-scale project pipelines to ensure capital is reallocated and committed to sustainable growth based on NDC targets.

A large and liquid green bonds market will help.

Our view is that green bonds will be playing a pivotal role in shifting capital when the market reaches USD 1trn of issuance per year by 2020 – given the rapid rate of growth to date, this is possible.

The Last Word

We think this quote says it all:

“The development of this new global asset class is an opportunity to advance a low carbon future while raising global investment and spurring growth.

For investors, green bond markets offer a stable, rated and liquid investment with long duration. For issuers, green bonds are a way to tap the huge (USD) 100 trillion pool of patient private capital managed by global institutional fixed-income investors.

The shift to the capital markets from banks will also free up limited bank balance sheet capacity for early-stage project financing and other important infrastructure lending.”

Mark Carney, Governor of the Bank of England and FSB Chair “Resolving the Climate Paradox” September 2016.

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.