Behind the high profile green bond offerings of 2016, policy initiatives gathered pace.

Download our analysis of the last year and some pointers for 2017.

Green bonds grow as a mainstream tool to help implement NDCs

Post Paris and Marrakesh climate negotiations, green bonds have gained traction as a part of country capital raising plans for financing their Nationally Determined Contributions (NDCs).

2016 saw the link between global climate finance and green bonds highlighted again and again.

Sovereign green bond programmes

Poland won the race in 2016 and France was second to issue in January this year. Sweden and Kenya launched inquiries to develop local markets, Nigeria has committed to green bonds in 2017 and several other nations began quiet preparations.

Sovereign issuance is an important policy measure that complements other public sector issuance, particularly from development banks and municipalities.

Country level action taking off

China & France have led in issuing official green finance guidelines.

We now have high-level committees up and running in several countries including India, Mexico and Brazil, to support respective domestic policy and market development. A full summary of national actions is here.

The Big Three Policy Developments for 2017

The year of the sovereign?

The first sovereign green bond of 2017 is out. Nigeria is coming, Bangladesh and Morocco have also made statements of intent and we expect to see more sovereign green bonds to follow throughout the year.

Our Climate Bonds tip is that 2017 will close with ten separate sovereigns having raised the green bonds flag.

Capital-raising plans for NDCs

In 2017, we expect to see specific capital-raising plans in place for NDCs from several countries. As initial NDC implementation plans become more widespread, expect to see green bonds added to the climate finance mix.

International cooperation on green finance and green bonds:

Via the G20 Green Finance Study Group (GFSB), the FSB’s Task Force on Climate-related Financial Disclosures, the Bank of England and the European Commission’s High Level Expert Group on sustainable finance, green bonds moved up the global financial agenda in 2017.

Regardless of the disquiet over US climate policy intentions, we expect to see further mainstreaming of green finance in 2017, with German leadership at the G20 and the freshly minted European Commission Expert Group maintaining momentum in the run up to COP23 in Bonn.

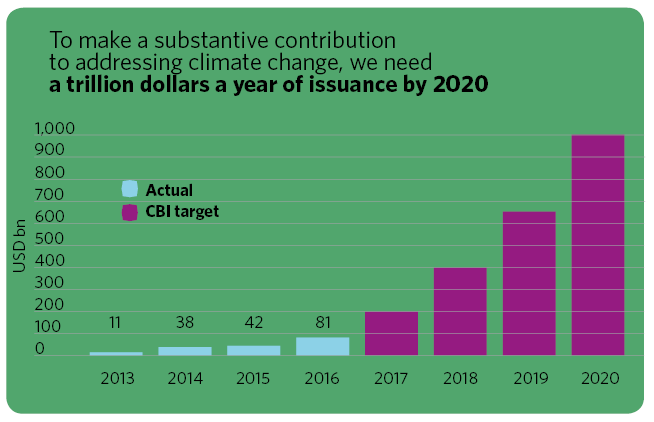

The Last Word - We need to see USD 1 trillion of annual issuance by 2020

The green bond market has grown at record levels in 2016, but to meet global needs for climate-aligned infrastructure it needs to grow much faster.

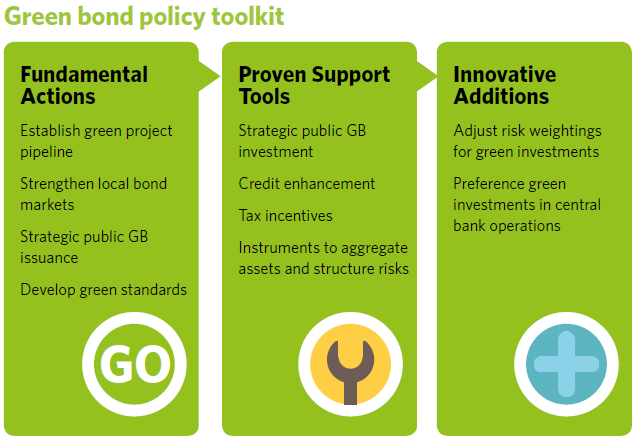

Public sector policy is central to enabling and scaling up private capital flows into green bond issuance and investment at a rapid rate. USD1 trillion by 2020 is the target.

Existing and well-proven tools that governments have used in the past to successfully steer private capital towards policy priority areas can now be applied to channel capital to climate investments, through green bonds.

Doing this will make the target far easier to achieve.

‘Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.