Investing for Zero Carbon Emissions from Commercial Property by 2050

Institutional investors seeking greener property opportunities now have a straightforward approach to assess the ongoing environmental performance of office building investments in some of the US’s biggest commercial property markets.

We are always looking for ways to make it easier to certify under our Climate Bonds Standard and as part of this, we have released emission performance trajectories for commercial offices in seven US cities. These trajectories will enable property bond issuers in these markets to gain certification against the Climate Bonds Low Carbon Buildings Criteria.

These emissions performance trajectories are calibrated to reach zero emissions by 2050, so bond issuers will be required to satisfy emissions criteria (expressed in pounds (lbs) of CO2 per square foot) that become stricter over time.

Cities Covered

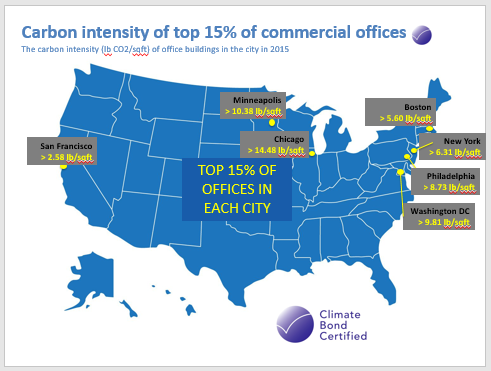

Emissions performance trajectories have been set by examining the emissions performance of the top 15 per cent of office buildings in:

- Boston

- Chicago

- Minneapolis

- New York City

- Philadelphia

- San Francisco

- Washington D.C.

We’ve established these emissions performance trajectories where jurisdictions have enacted mandatory building energy benchmarking and disclosure policies; these give us the data we need to assess the emissions performance of buildings in each city.

As of June 2015, 14 jurisdictions in the US have enacted such policies, with more to follow in due course. As further jurisdictions enact mandatory disclosure policies (and existing ones mature), we’ll continue to add to our list of cities covered, enabling Climate Bond Certification in even more US markets.

How does it all work?

The emissions performance of the top 15 per cent of buildings in each city forms the starting point for the trajectory, which then takes a linear pathway to zero emissions by 2050.

The city trajectories are used to derive emissions performance targets specific to each bond, varying according to when the bond is issued and the term of the bond. It’s these targets that bond issuers have to satisfy to gain Climate Bonds Certification.

There’s an easy-to-use CO2 Target Calculator on our website that enables issuers to ascertain the emissions performance targets that they must satisfy to gain Climate Bonds Certification.

Certification against emissions performance targets complements the certification pathway available to issuers through significant office upgrades and retrofits.

Further information on the Climate Bonds Low Carbon Buildings Criteria is available here.

Who’s saying what?

John Dulac, Buildings Sector Lead - Energy Technology and Policy, International Energy Agency (IEA):

John Dulac, Buildings Sector Lead - Energy Technology and Policy, International Energy Agency (IEA):

“The global buildings sector accounts for more than a third of final energy consumption and ultimately, one-third of global energy-related CO2 emissions.”

“A concerted global effort towards energy efficiency in buildings is critical. Straightforward building energy and emissions performance targets are an important step toward limiting average global temperature rise to 2°C or below.”

Sean Kidney, CEO, Climate Bonds Initiative:

Sean Kidney, CEO, Climate Bonds Initiative:

“These new emissions performance trajectories mean property bond issuers have a simplified, straightforward means to assess the performance of buildings and portfolios against current and future expectations.”

“Asset managers and institutional investors will now have an evidence-based screening tool and green assurance mechanism to help guide property investment decisions. Release of these emissions performance trajectories should spur green property development in the commercial heart of major US cities.”

Building energy efficiency is crucial to lowering US energy consumption

Catalysing green investment in the US building stock is a vital component in the transition to the low-carbon economy, given estimates that the building sector accounts for more than 40% of US energy consumption and calculations that 30% of energy use in buildings is wasted.

There is a huge opportunity for relatively easy financial gain, with widespread adoption of existing energy efficiency technologies and introduction/use of new technologies estimated to achieve savings of more than $200bn annually.

Have any US green property bonds been issued already?

2016 has already seen US green property bonds from the Dormitory Authority of the State of New York Colombia University, Renovate America/Hero Funding Trust and University of Texas, amongst others.

Where can I find out more?

The Climate Bonds website has detailed information on the Low Carbon Buildings Criteria.

Or simply contact our Head of Certification Rob Fowler.

The Last Word

Linking more commercial property investment with improving energy and emissions standards in major US cities is a match made in climate heaven.

Improving emission performance in our big cities is already a part of today’s urban agenda. Outside of the US, there are now trajectories available for commercial properties for six major Australian cities and Singapore.

Having an international certification and standards scheme gives additional certainty and helps build innovation and market confidence amongst global issuers and investors.

Climate Bonds will be releasing trajectories for more US cities in the future.

These first seven are just the start.

Disclaimer: The information contained in this media release does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation