September was one of the biggest months ever for green finance. We blogged here and here and here to keep you updated on all the developments.

Here’s our pick of the top green bond stories from the last days in September which you may have missed.

“Go Long on Green Bonds” Carney Tells World

BoE chief and FSB Chair Mark Carney didn’t hold back during his 22nd Sept Arthur Burns Memorial Lecture in Berlin

In “Resolving the climate paradox” the central banker was determined to keep the G20 momentum going on green finance; leaving the financial world in no doubt on which direction global capital should go. We particularly like his description of green bonds:

“One proposal is international collaboration to facilitate cross-border investment in green bonds.”

“The development of this new global asset class is an opportunity to advance a low carbon future while raising global investment and spurring growth.”

“By managing what gets measured, and building a mainstream green bond market, we can help resolve the Tragedy of the Horizon.”

Carney finished with a reminder to the G20 and a call to Germany.

“The G20 – whose members account for around 85% of global emissions – has a unique responsibility. The German Presidency could be decisive.”

The full speech and slides are available here.

If you haven’t already:

- Download a copy of the full address

- Read it through, a couple of times, then

- Send it on to your CIO, investment committee, pension fund board or favourite fund manager

Please do, it comes with our highest recommendation.

Mexican Green Bond Committee takes off as Grupo Aeroportuario lands a record $2bn for airport green bond

Foreshadowed in May this year by Bolsa Mexico with the support of Climate Bonds and Mexico2, the new Green Bond Committee has settled on Joint Presidents and a cross-section of representation from banking, finance, insurance, MDBs, pension funds and credit rating agencies.

As a reminder of how big the LATAM green bond market could grow, Grupo Aeroportuario de la Ciudad de México just issued a record USD 2bn in green bonds to fund a the new Mexico City airport, set to begin operating in late 2020.

You can find all the details here. Proceeds will go to energy efficiency improvements for airport buildings, as well as an improved waste management system.

Some eyebrows were also raised earlier this year when, during a wide ranging interview with El Economista, Climate Bonds chief Sean Kidney forecast Mexico could have a green bond market worth USD 2bn within three years.

With this Grupo Aeroportuario bond and now NAFIN issuing their second certified green bond, our boss’s forecast has been met two and a half years early!

With the new green bonds committee having the backing of key national stakeholders, we feel confident that during 2017 issuance in Mexico will really take off.

In amongst the many announcements during New York Climate Week, this one from Nigerian President Buhari caught our eye

Speaking at a Taking Climate Action for Sustainable Development meeting on the sidelines of the 71st Session of the United Nations General Assembly, President Buhari was clear.

“We are set to launch our first ever Green Bonds in the first quarter of 2017 to fund a pipeline of projects all targeted at reducing emissions towards a greener economy”

The Nigerian President said his country’s commitment to the Paris Agreement is articulated through its Nationally Determined Contributions (NDCs) “ensuring a strong cross-sectoral approach, coherence and synergy for Climate Action.”

We’re particularly interested in Nigeria, with Lagos set to be one of the world's mega-cities by 2030.

Nigerian Environment Minister Opens Green Bond Consultation

Climate Bonds Director Justine Leigh-Bell recently visited to support a UNEP backed green finance consultation coordinated by the Ministry of Environment & Ministry of Finance. The consultation was opened by Environment Minister Hajiya Amina Mohammed.

Along with positive developments in Nigeria and now Kenya (more to come on Kenya in a future blog), and our Green Bonds for Cities project focussed on emerging economies, developing green bond markets to help finance green infrastructure and sustainable cities is high on our agenda.

Boost for Green Buildings in Big US Cities - Zero Carbon by 2050 Ambition

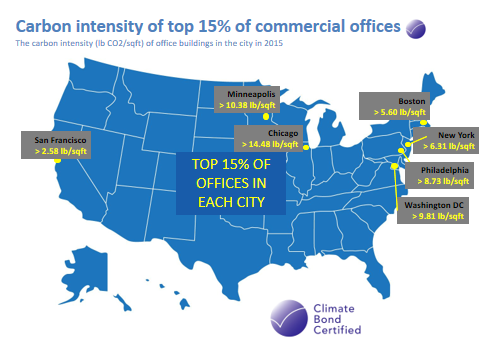

You may have missed the release of new Climate Bonds baselines and emission performance trajectories for commercial property in seven major US cities.

It’s a boost for institutional investors seeking greener property investments. They now have a straightforward, transparent approach to assess the ongoing environmental performance of office buildings and new developments in some the US’s biggest commercial property markets.

Emissions performance trajectories have been set by examining the emissions performance of the top 15% of office buildings in:

- Boston

- Chicago

- Minneapolis

- New York City

- Philadelphia

- San Francisco

- Washington D.C.

The individual emissions performance trajectories for each city are then calibrated to reach zero emissions by 2050. This forms the basis of assessing certification against the Low Carbon Buildings Criteria of the Climate Bonds Standard, a simple formula based on:

- Existing top 15% performance baseline

- Bond start date and term

- Zero emissions by 2050 objective

This gives an emissions performance target specific to each bond (expressed in pounds (lbs) of CO2 per square foot) that gradually requires improvements in building performance over time.

Singapore and Australia

New baselines and performance criteria have also been released for Singapore and Australia’s six biggest cities, including Sydney and Melbourne and more are in the pipeline for the US.

Spur for Greener Cities

By linking investment to certification and ongoing improvement in building performance we’re hoping to spur both investors and property bond issuers to look towards smarter greener cities and the 2050 zero emissions goal.

Greener buildings help make greener cities.

In major urban centres across three countries Climate Bonds just made it easier for institutional investors to find, assess and back the best performers in city office design and operation.

Till next time,

Climate Bonds Communications

Disclaimer: The information contained in this media release does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.