The Climate Bonds Initiative has recently partnered with South Pole Group, Climate Policy Initiative (CPI) and ICLEI – Local Governments for Sustainability to support cities in emerging and developing countries to gain access to the green bond market.

The Green Bonds for Cities project, led by South Pole Group and CPI, and part of Climate-KIC’s Low Carbon City Lab, will provide guidelines, toolkits and training sessions for city administrators wishing to tap into the green bond market to finance their low-carbon and climate-resilient urban infrastructure.

As a first milestone of the project, a 2-page fact sheet is available online outlining the first findings and scope of the project.

Roundtables will be held with cities in Mexico, Latin America and South East Asia to engage with stakeholders and support capacity building around the green bond opportunity.

Cities at the centre of climate change action

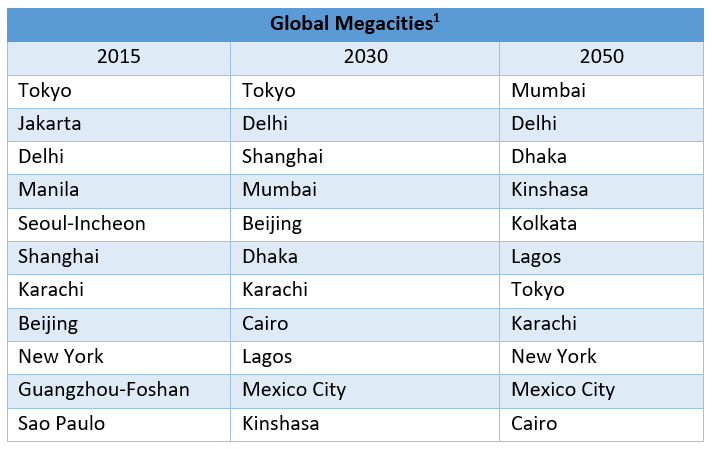

The world’s cities host 50% of the global population and account for 70% of global greenhouse gas emissions. The share of urban population is expected to rise to 60% by 2030, with the bulk of this growth to take place in emerging markets and developing countries. By this time, almost all of the world’s megacities (cities with a population of 10 million or more) will be located in Asia and Africa. Behind them, large cities of between 5 million and 10 million people have already doubled in number over the past twenty years and are again concentrated in Asia, Latin America and Africa.

An estimated USD 50 trillion will need to be spent over the next 15 years in basic urban infrastructure such as transport, building energy efficiency, telecommunications, water and waste infrastructure.

Limited Access to capital

Many cities in emerging economies have limited access to capital markets and conventional means of financing (such as bank loans) often offer inadequate terms to finance new infrastructure. The green bond market offers municipal governments access to low-cost capital to meet their infrastructure and climate investment needs,

At present, only 20% of cities in developing and emerging economies are creditworthy enough to raise capital in local debt markets. Legal frameworks may also restrict the ability of municipalities to issue their own debt.

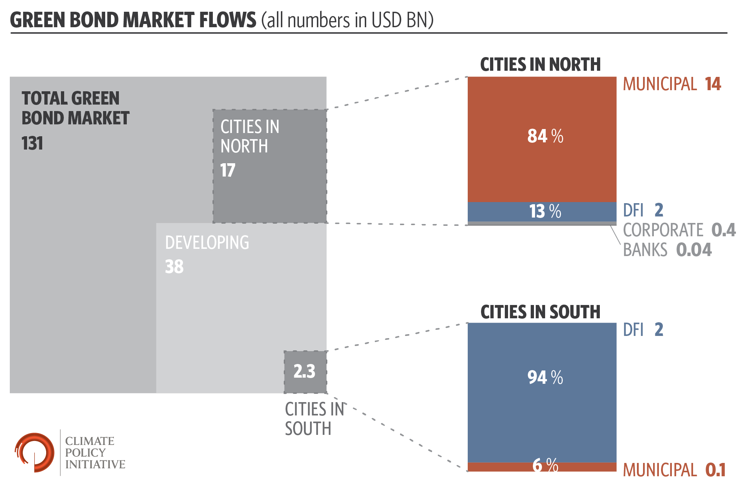

Looking at the green bond labelled universe, analysis from Climate Policy Initiative found that only 1.7% of proceeds flow to cities and city-based infrastructure in the Global South, with Johannesburg (South Africa) being the only city in a developing market to issue a green bond; the remainder coming from bonds issued by development finance institutions.

Source: September CPI Blog

Green Bond Potential

The dramatic growth of the green bond market (see our latest report for the most up-to-date figures) shows that there is strong investor appetite for stable, long-term investments that deliver environmental benefits.

The city, or ‘muni’, labelled green bonds universe totalled USD 17 billion of outstanding issuances as of August 30th 2016. In the US, municipalities raising funds via bond issuance is an established financing method. Green muni bonds are primarily used to finance transport and water infrastructure, with smaller shares going to energy, buildings and waste.

Despite the difficulties some cites may have for direct capital raising (see above) there is still scope for growing the green city bond market: local utilities, transport authorities and waste management companies may be better suited for bond issuance. Established assistance measure such as credit enhancements, third-party guarantees, or on-lending by more creditworthy entities could also be utilised to support issuances from non-creditworthy local governments.

The Green Bonds for Cities project will explore the alternative pathways for cities to access the green bond market, depending on the legal frameworks in place and their fiscal conditions.

Identifying assets that qualify for green bond financing has also proven to be a challenge for some municipalities. Tools such as the Green Bond Principles and The Climate Bonds Standard can help address this challenge.

Best Practice and Building Capability

The US Green City Bonds Coalition, another project supported by the Climate Bonds Initiative, is an example of an initiative that builds cities’ capacity through an education programme, support tools and sharing of best practices.

The Green Bonds for Cities project focuses on cities in emerging and developing countries, and works to develop Green Bond Strategy Guidelines, Green Bond Toolkits and Training Sessions to support cities’ ability to access capital markets and tap into the green bond opportunity.

Mexico City – Watch this Space

As part of the project, Climate Bonds Initiative will be working directly with the City of Mexico Climate Change department to develop a green financing strategy for the city. It will support the issuance of a green bond once the City gains state-like powers in January 2017, allowing it to issue its own debt.

Watch this space for updates on the Green Bonds for Cities project and new issuances from local governments.

The Last Word

"Climate action can’t be separated from green city financing. Today’s cities and the megacities of 2030 and 2050 need green, resilient, low carbon development. City authorities, national governments and the providers of water transport and energy all have a role in harnessing green bond finance models for urban infrastructure."

"Climate action can’t be separated from green city financing. Today’s cities and the megacities of 2030 and 2050 need green, resilient, low carbon development. City authorities, national governments and the providers of water transport and energy all have a role in harnessing green bond finance models for urban infrastructure."

Sean Kidney, CEO Climate Bonds Initiative

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.

[1] Allianz Risk Pulse. (2015). “The megacity state: The world’s biggest cities shaping our future.”; Demographia. (2016). “Demographia World Urban Areas 12th Annual Edition.”; Hoornweg, Daniel and Kevin Pope. (2014). “Socioeconomic Pathways and Regional Distribution of the World’s 101 Largest Cities.” University of Toronto Global Cities Institute.