The world’s second largest and fastest growing source of green bonds, China may reach its carbon peaking goal before 2030.

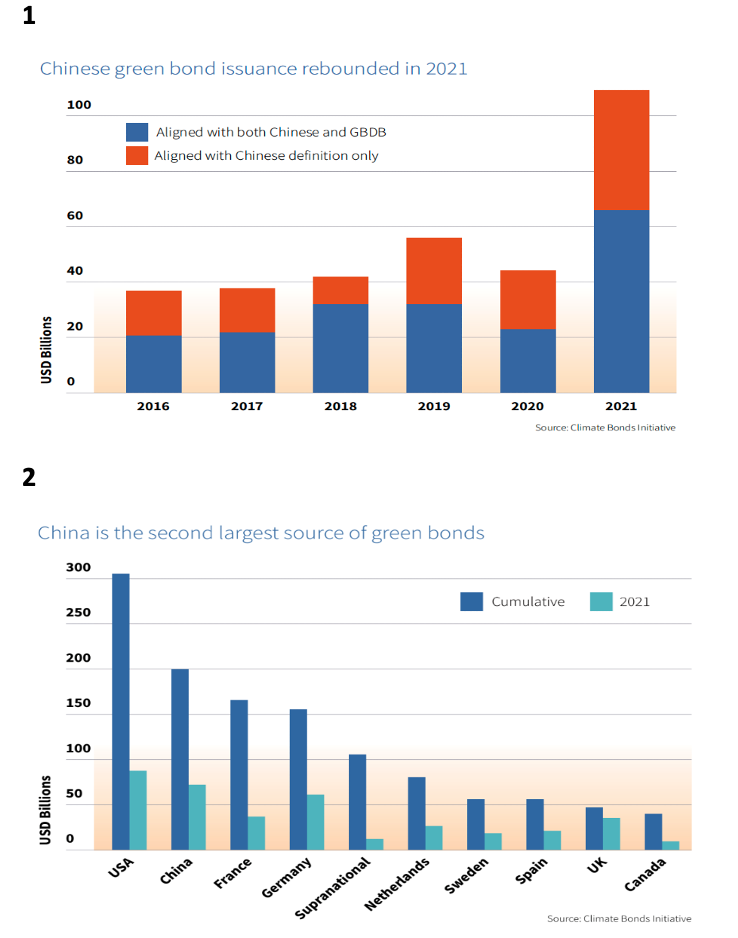

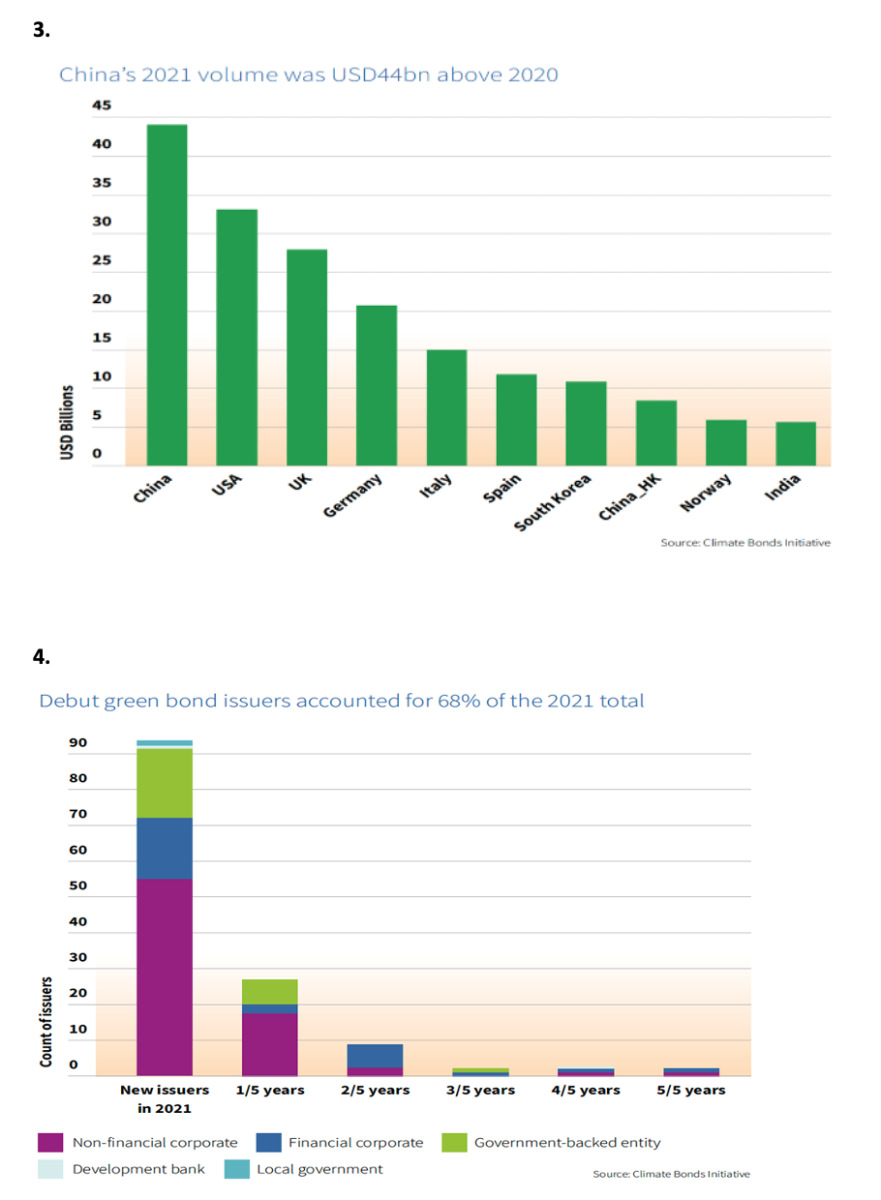

London/Beijing: 04/06/2022: 09:00 (GMT+8): Latest market intel reveals cumulative issuance of green bonds by Climate Bonds’ definitions reached nearly USD200bn (RMB1.3tn) at the end of 2021. Annual issuance in 2021 reached a record high of USD68.2bn (RMB440.1bn), up 186% year-on-year (See figure 1). China ranked as the second largest green bond market in the world on both accounts (See figure 2).

The news comes as Climate Bonds Initiative (Climate Bonds) and China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC, publish the China Green Bond Market Report 2021.

According to the report, China is very likely to reach its carbon peaking goal before 2030. The momentum seen in 2021 will continue to support that. However, green and sustainable financing in China needs to further accelerate on a larger scale to provide the funding required to reach the 30·60 targets. This will be done through all five pillars, covering standards, disclosure, incentives, products, and international cooperation, to improve the financial policy framework that supports orderly, credible development in the market.

Sean Kidney, CEO, Climate Bonds Initiative:

“It is with great encouragement we see China embrace green bond markets as it sets sights on rejuvenated climate ambitions. Last year saw a big bounce in China’s green issuance suggesting the nation is moving forward with well-placed belief in the transformative power labelled debt markets.”

China’s new climate targets fire up green markets

2021 marked the first year after China announced the country’s targets for carbon dioxide to peak by 2030 and achieve carbon neutrality by 2060 (30·60 targets). It was also the first year of the nation’s fourteenth Five-Year Plan period (2021-2025). The country’s action to expedite carbon emission reduction was reflected in the vast expansion of its green bond market during the year.

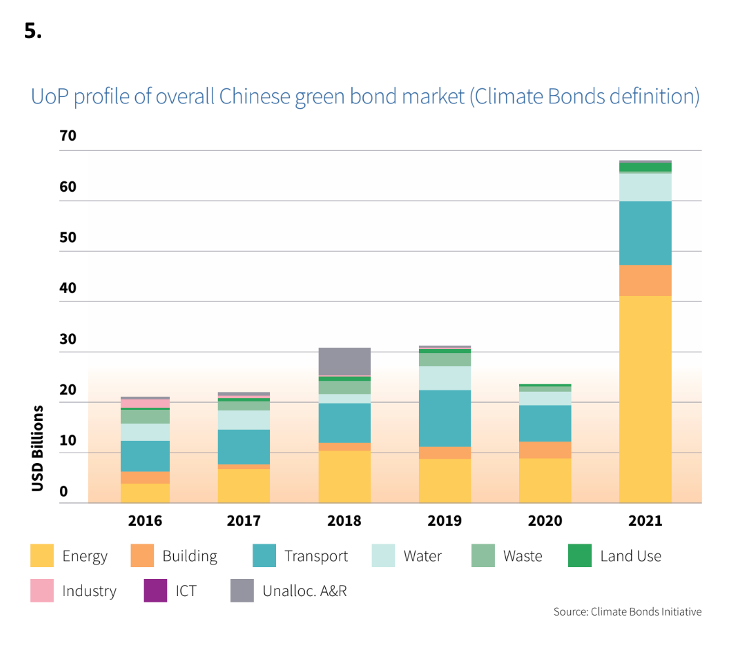

In 2021, green bonds originating from China was USD44bn higher than the prior year (2020), making it the fastest growing market globally (See figure 3). Climate Bonds expects the momentum to continue, backed by further reform in green financial policy and surging investor demand.

2021 China Green Bond Market Highlights:

- 2021 saw increased diversity of supply, as more new issuers entered the market. The 2021 pool of green bonds came from 138 entities, 94 of whom were debut issuers (See figure 4).

- Most of the growth came from the onshore market. The onshore market constituted 81.4% of 2021 green bond issuance originating from China and 87% of the overall growth.

- Financial and non-financial corporates drove the overall market expansion in 2021. Issuance growth from the non-financial and financial corporates accounted for 58% and 38% of the total volume growth in Chinese green bonds, respectively.

- Most of the Use of Proceeds (UoP) was earmarked for Renewable Energy, Low Carbon Transport, and Low Carbon Building. UoP earmarked for Renewable Energy grew 3.6-fold year-on-year to USD41.3bn (RMB266.4bn). It was the largest Chinese UoP category in 2021 at 60.6% (see figure 5).

- Second party opinions (SPOs) remained the most popular external review type.

- By the end of 2021, the total outstanding amount of green bonds originating from China and aligned with both Chinese and Climate Bonds green definitions was USD145.3bn (RMB937.8bn). About 92% of these bonds will mature by 2026, reflecting a huge potential for refinancing during the coming four years.

- China’s labelled green bond market experienced the highest growth rate since the introduction of the green financial policy framework in 2016. About 62% of China’s labelled green bonds were included in Climate Bonds Green Bond Database (GBDB) in 2021, representing a 10-percentage point improvement in the inclusion rate from 2020.

Fan Liu, Deputy General Manager, China Central Depository & Clearing CO.LTD:

“2021 saw substantial development in the Chinese green bond market with leading increase in issuance globally. The issuance and trading of green bonds increased significantly throughout the year, and the funds raised were directly channeled to support the real economy. Following the national action to achieve carbon dioxide peaking by 2030 and carbon neutrality by 2060, CCDC continuously strives to improve its green financial services, covering green bonds, green bond indexes, and ESG evaluation system. CCDC promotes high-quality development of China’s green bond market through further enhancement of its ChinaBond Green Bond Environmental Benefit Disclosure Indicator System and the ChinaBond Green Bond Environmental Benefit Database.”

Eddie Ching, Senior Executive Vice President and Deputy Chief Executive Officer, HSBC Bank (China) Company Limited:

“The financial sector plays a key role in facilitating China’s transition towards a low-carbon and climate resilient economy. While China has set its carbon peak and carbon neutrality goals, significantly more financing needs to be deployed to mitigate and adapt to climate change. We expect China’s green bond market to further expand as demand continues to grow among both issuers and investors. At HSBC, we are dedicated to mobilizing finance to support our clients with their low-carbon transition.”

To download the report, click here.

For more information, please contact:

Mariana Caminha

Head of Regional Communications

+55 (61) 98135 1800 (We Chat)

mariana.caminha@climatebonds.net

Notes for journalists:

About the Climate Bonds Initiative: Climate Bonds Initiative is an international not-for-profit working to mobilise global capital for climate action. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit www.climatebonds.net.

Figures: