Three-Quarters of Green Bond Volume Raised in China Offers Reporting on Project Expenditure

First-of-a kind research shows strong accountability record in China’s huge green market but highlights room for improvement

London/Beijing: 18/05/2022: 15:00 (GMT+8): The Climate Bonds Initiative and SynTao Green Finance Co., Ltd., sponsored by UKPACT, today launch the Post-Issuance Reporting in China’s Green Bond Market 2022 report. The trailblazing report covers 627 bonds from 382 issuers, worth USD163.2bn, and it is the first study of post-issuance disclosure practices of green bonds in China.

Post-issuance reporting adds credibility to an instrument (and issuer), confirming that green projects were financed in line with commitments in the prospectus, ensuring accountability and reducing the risk of greenwashing, and enhancing investor confidence, all of which are conducive to healthy market development.

China has made great strides in the development of green finance in recent years, driven by a strong green finance policy agenda. Market transparency is key to enable sustainable finance to continue to deliver its intended benefits, and to contribute towards China’s 30-60 climate goals in the most effective way.

The new report builds on the series of global studies on this topic that Climate Bonds has conducted over the last few years. By shedding more light on reporting practices, the aim is to understand the availability and attributes of disclosure on the use of proceeds (UoP) and environmental impacts of the projects, assets and activities financed by green bonds. This can identify avenues for improvement and spur more informed discussions among various market participants.

Said Raymong Zhang, CEO of SynTao Green Finance:

“Post issuance information disclosure, especially on the environmental impact generated from green bond's use of proceeds, is of great significance to the dynamic growth of China's green bond market. A joint endeavor of issuers, regulators and investors is needed to further improve the quality of post issuance information disclosure.”

Said Sean Kidney, CEO, Climate Bonds Initiative:

“Post-issuance reporting has been identified as among the most crucial elements to increase the appeal of Chinese green bond market. It adds transparency and credibility to an instrument (and its issuer), confirming that the underlying projects were financed in line with commitments, ensuring accountability, reducing the risk of greenwashing, and enhancing investor confidence, all of which are conducive to healthy market development.”

Key Findings

Availability and quality of reporting are good, but can improve

Overall, the research finds that post-issuance reporting practices in China are generally good but still have room for improvement, both in terms of the availability and quality of reporting.

This may be related to the stringency yet complexity of the regulatory framework (see below), as well as other issues discussed in the paper.

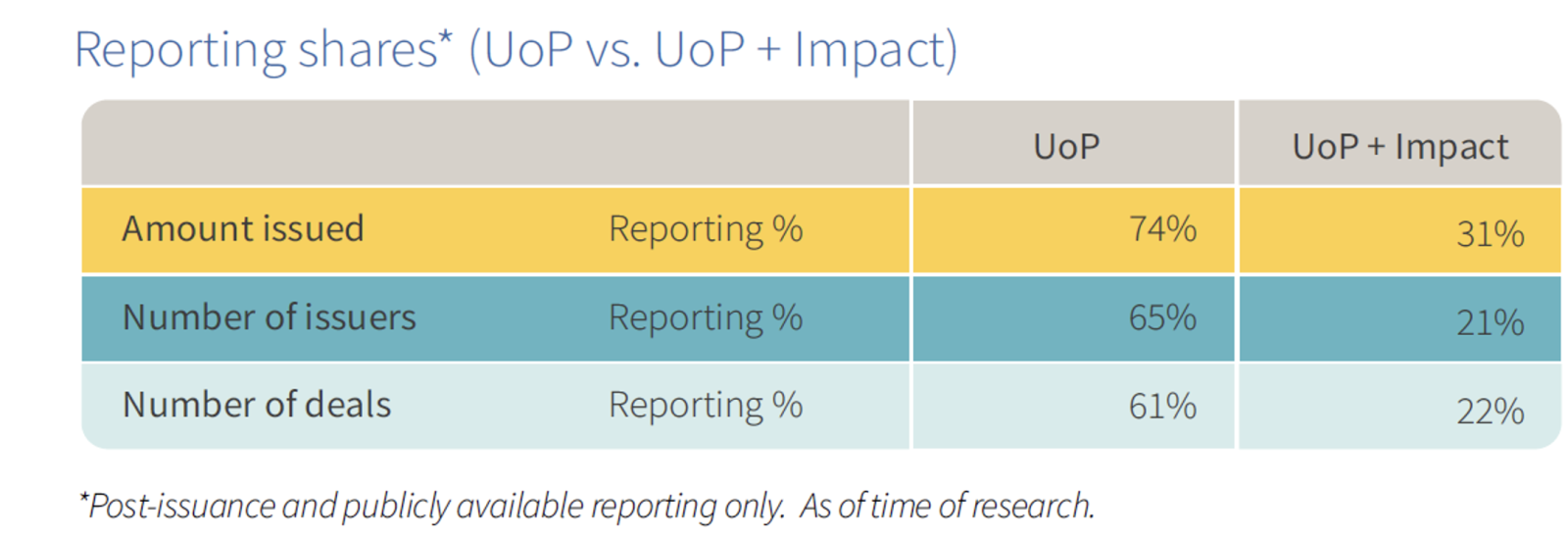

Despite regulatory requirements, the share of post-issuance reporting is lower than globally, especially in terms of impact. It is much more common for issuers to report UoP than impact (larger difference than in the rest of the world), and no issuers were found to report impact without UoP. The reporting shares are higher by amount issued than number of issuers and number of deals, reflecting the fact that larger issuers/deals are more likely to report.

Deals aligned with international (i.e., Climate Bonds’) green definitions are more likely to report impact, but the difference in UoP disclosure is not substantial. Offshore deals are less likely to report UoP, but report impact more often.

Financial corporates report UoP more than other groups. They also report impact more often looking at amount issued, but less in terms of issuer count.

Most, but not all, issuers meet regulatory requirements

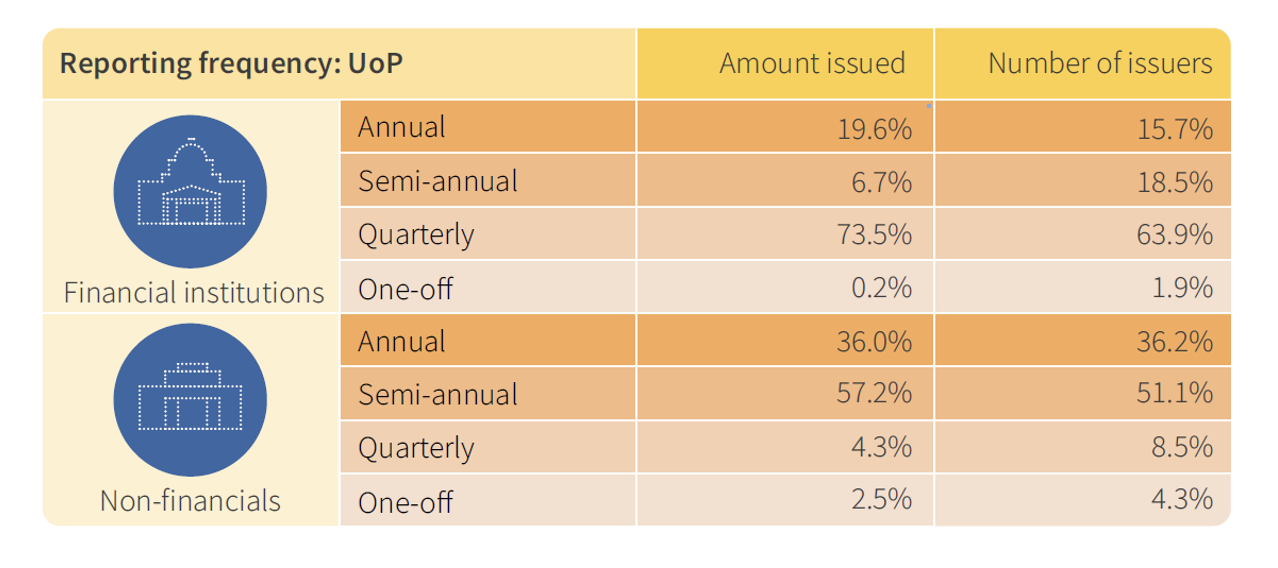

Most issuers report at least as frequently as regulation requires them to do. Reporting in China is more frequent than in the rest of the world, where annual disclosure dominates heavily across all issuer types.

Financial institutions are more distributed than non-financials in terms of project-level granularity. Almost half of non-financials disclose each individual project while 37% do not break down projects nor project categories. To some extent this is due to the nature and size of many non-financial issuers, which often finance just one project and one category/sub-category.

Combining multiple types of external review is more common in China than in the rest of the world and extends to post-issuance reviews. 25% of reporting issuers and almost 40% of the amount issued were covered by assurance and/or Climate Bonds Certification, which are considered the two most stringent forms of review – larger issuers are more likely to opt for these. 38% of the amount issued and 53% of issuers had no post-issuance review, which is broadly in line with our global study – smaller issuers are more likely to fall in this group.

Impact disclosure is generally good

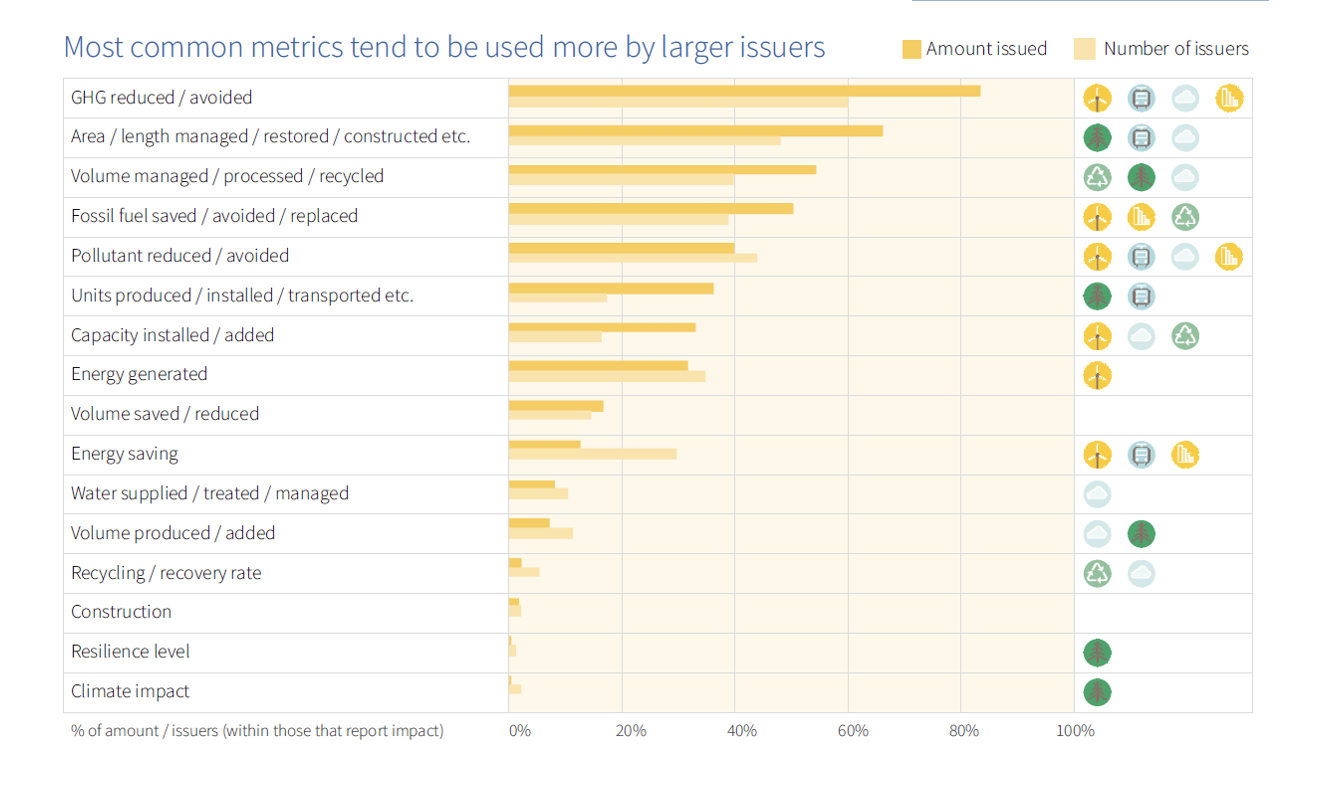

Among issuers that report impact, the quality of disclosure tends to be quite good. The level of project detail, number, and granularity of metrics/KPIs reported, and reference to relevant external data sources are among the features that stand out the most. Another positive is that most issuers provide cumulative impacts in each green bond report – this is rare in the rest of the world, being more common for UoP data.

The analysis of metrics/KPIs suggests Chinese issuers are more likely to focus on core metrics, while reporting them with greater granularity. Reflecting the importance of pollution in the country, GHGs and other pollutants are disaggregated into individual substances much more often than in the rest of the world.

Stringent but complex regulatory framework

China’s regulatory disclosure framework is more stringent and advanced than in other regions, especially for issuers of financial bonds. Despite this, the framework faces some challenges, which are closely linked to the complexity of the Chinese bond market and the multiplicity of bodies that regulate the space:

• Inconsistency of regulatory requirements

• Incompleteness of regulatory framework

• Inconsistency of information disclosure channels

Addressing these issues is important to ensure high reporting standards and comparability of disclosure as the market grows further, which are also key for investors and other data users (including policymakers). The unification of the Green Bond Endorsed Project Catalogue between different regulatory agencies in 2021 is a positive precedent and may pave the way for further consolidation of regulatory requirements.

Regulatory consolidation and consistency can unlock more potential

The fact that China’s regulatory disclosure framework is more stringent and advanced than in other regions demonstrates a strong willingness to ensure best practices and transparency in the market. From this solid base, regulatory bodies can now look to address the challenges that the existing framework faces, especially the inconsistency of regulatory requirements between different bond/issuer types.

As highlighted in our global study, creating a common reporting framework is the best way to increase the availability, quality and (crucially) consistency of disclosure. Efforts to achieve this globally are ongoing, through initiatives like the Harmonized Framework, ICMA Impact Reporting Working Group, and EU Green Bond Standard.

China will gain from pursuing a similar objective, and its sustainable finance future will look even brighter than it already does if so. In this context, regulators, issuers, and all other market participants can contribute to better disclosure practices by being aware of best practice guidelines and promoting and implementing them across their work. Effective guidelines and regulation are one side of the coin; their consistent use by market participants is the other side.

To download the report, click here.

For more information, please contact:

Head of Regional Communications

+55 (61) 98135 1800 (We Chat)

Notes for journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit http://www.climatebonds.net/.