New! China Green Finance Policy Analysis Report 2021

All you need to know about the developments in China's green finance policies and green bond market

London/Beijing: 19/05/2022: 14:00 (GMT+8): The Climate Bonds Initiative (Climate Bonds) and SynTao Green Finance today published the China Green Finance Policy Analysis Report 2021 supported by UK PACT (Partnering for Accelerated Climate Transition). The report assesses China's latest green finance policies and provides an overview of green bond market developments in the region.

According to the report, the country's financial regulators and stock exchanges have played a key role in preparing China’s financial markets to achieve the country’s ambitious 30·60 decarbonisation targets.

Starting with Central government and filtering down to the local level, state departments in China have implemented and deployed various policy measures to support the growth of the market. Amongst these are policies put in place to deepen the markets and provide a broader range of instruments through which issuers can finance their climate friendly liabilities.

Report highlights include:

- The latest developments in China's green finance policies contributing to the achievement of its 30·60 decarbonisation targets;

- An overview of the shape and size of the Chinese green bond market as of 31 December 2021;

- A summary of local policy incentives and an assessment of their efficacy;

- An evidence based analysis, demonstrating a positive relationship between regional green finance policy implementation and an increase in green bond issuance.

The report also presents market stakeholders' recommendations for policy development and expectations for the future growth of China's green finance market. Enhanced transparency and standardisation were identified as critical to encouraging more issuers to come to the market. Investors wanted bonds from issuers with strong fundamentals and robust green financing frameworks.

Green bonds are the most established of the thematic labels with a recorded cumulative issuance of USD1.6tn across global markets by the end of 2021, according to the Climate Bonds Green Bond Database. In 2021, China was the second largest country source of green bonds after the USA.

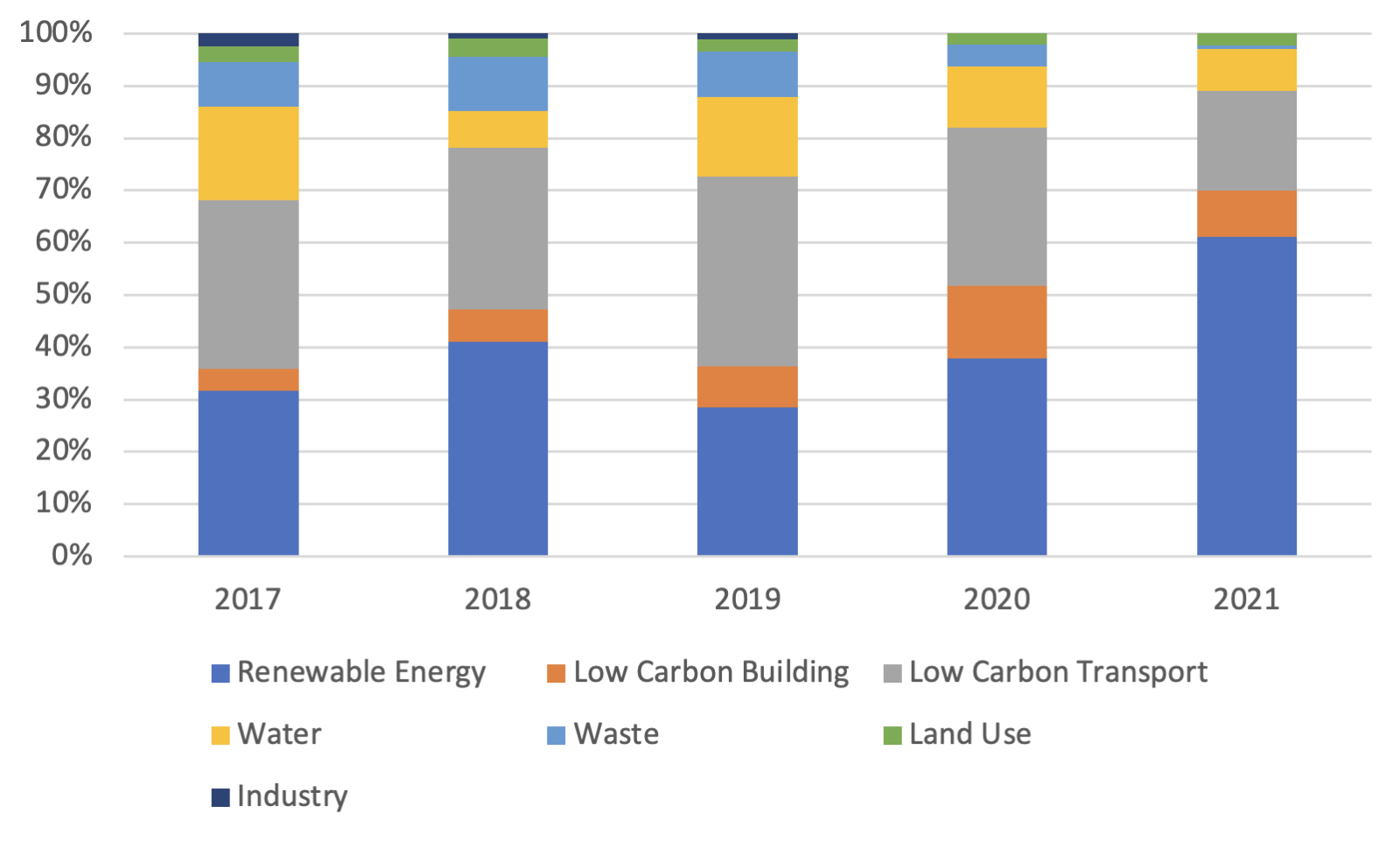

Chinese green bond issuance slowed down in 2020 as COVID-19, and its ramifications took centre stage (USD23.8bn). However, the market rebounded sharply during 2021. The volume of green bonds originating in China that both met the Climate Bonds green definitions and was recorded in the Climate Bonds Green Bonds Database amounted to USD68bn. This accounted for 62% of total issuance from the region. Renewable Energy was the most popular Use-of-Proceeds, consistent with 30·60 decarbonisation goals.

UoP of green bonds originating in China: Renewable Energy UoP overtook Low Carbon Transport in 2021.

Sean Kidney, CEO, Climate Bonds Initiative:

"Effective policies at the central and local level are key to driving China's green finance market development and low-carbon transition. It is encouraging to see that government departments have proactively responded to the country’s ambitious climate goals. We look forward to seeing more investors and issuers join the carbon neutrality journey in China."

GUO Peiyuan, Chairman of SynTao Green Finance:

"Government policy in China plays a critical role in driving green bond market growth to new heights in 2021. It is expected the trend of rapid growth in China's green bond market will continue in 2022 to effectively support China's carbon neutrality target, with more sophisticated incentive mechanisms rather general policies."

The Final Word

China has released a series of policies to stimulate its green finance market and contribute to the low-carbon transition and the green bond market in China experienced strong growth in 2021. China's green finance market must attract more issuers and investors to address severe and increasing climate risks and accelerate the transformation to a green economy.

For more information, please contact:

Head of Regional Communications

+55 (61) 98135 1800 (We Chat)

Notes for journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit http://www.climatebonds.net/.