Media Release

India Sustainable Debt Market hits USD 19.5 Billion in cumulative issuance

Cumulative GSS volume almost doubled in the last two years. Public policy emerges to support the growth of sustainable debt market.

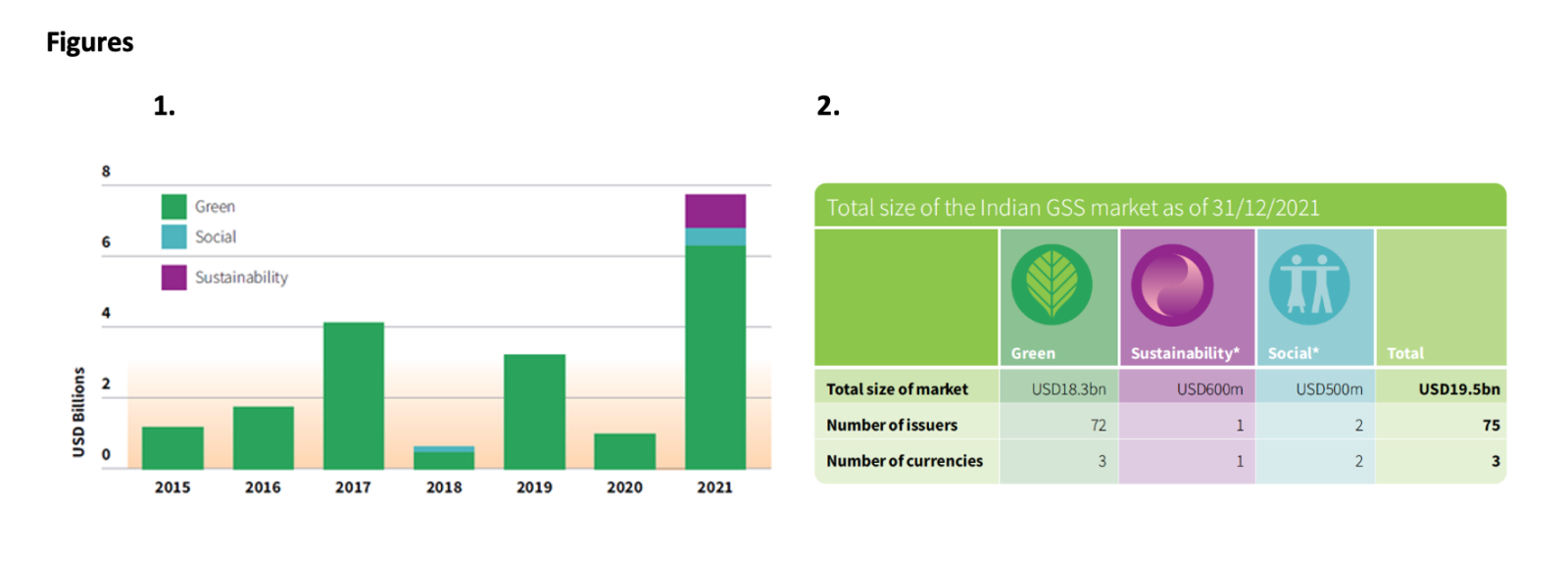

London/Mumbai: 26/05/2022: 18:00 (GMT+8): The India sustainable debt market continued to grow in 2021 with issuance of green, social, and sustainability (GSS) debt totaling USD7.5bn, a six-fold (+585%) increase compared to 2020 figures.

These and other findings are brought by the India Sustainable Debt Market State of the Market 2021 report, launched today by the Climate Bonds Initiative. The Report was produced with the support of the FCDO/UK Government, and in collaboration with the Climate Policy Initiative, Fichtner India, Green Tree Global, NABCONS, Nishith Desai Associates and SustainMantra.

Key findings: over USD 19.5 Billion Market

The report shows that Indian cumulative GSS volume almost doubled in the last two years to represent USD19.5bn in value. The green label remains the most popular theme among Indian issuers. Of the 29 issuers reviewed, 26 have issued at least one green debt instrument since 2015.

However, financial institutions and others are increasingly exploring the social and sustainability (S&S) labels which resulted in a total raised to date of USD2.2bn. A key development has seen sustainability linked bonds by issuers from hard to abate sectors like cement and steel starting to take off.

A diverse labelled market begins to blossom

Sustainability linked bonds (SLB) from large players in the “hard to abate sectors” like cement, steel, etc. have made their mark and these instruments, issued by players from other segments like metals, etc., are likely. In addition, it is expected that FIs may also start issuing SLB. There was also a “Skill Development Bond” which could possibly be a global first. (See figure 1 & 2)

Utility scale solar leads sector issuances

The utility-scale renewable energy sector is the main reason for the success of green finance in India, as evidenced in the rapid scale-up of grid-connected renewable. Deals with a diverse use of proceeds (UoP) are expected to increase in both number and scale. There are signs that green bonds are in the pipeline for solar rooftop assets; waste management operations; agriculture; real estate; and electric vehicle (EV) ecosystems.

Impact investment industry is supporting budding players

The impact investing space is increasingly active and investing in early-stage companies and preparing to support the large, labelled issuers of the future. Among other sectors, impact investment is active in early-stage players in waste management, EV ecosystem, distributed renewable energy and more.

Landmark sovereign issuance likely to make an impact

It is anticipated that an Indian sovereign green bond will be issued in the domestic market in 2022. India plans to quadruple its renewable power generation capacity by 2030 and recently announced plans to issue an INR green sovereign bond of up to USD3.3bn in 2022. This landmark transaction is likely to draw on best practices and will significantly boost the domestic market.

Policy Support is underway

Supportive public policy has begun to emerge with the Indian Ministry of Finance (MoF) setting up a Sustainable Finance Task Force (SFTF) to:

a) develop a taxonomy of sustainable activities;

b) recommend reporting and disclosure policies;

c) determine appropriate financial policy and regulations, and

d) devise relevant measures for the financial ecosystem.

The work of the SFTF and resulting policy support is likely to give the market additional momentum in the medium to long term.

Sean Kidney, CEO of the Climate Bonds Initiative:

“India has been presenting exciting numbers in the sustainable debt market. We believe that policy development will bring transparency and alignment between international and domestic best practices. The present heat wave in the Indian sub-continent and the human suffering that comes with it is a painful reminder of the accelerated need to fight the climate crisis”.

Eyes on 2022: What’s next?

The Indian GSS debt market is gathering momentum. Here’s the five key themes influencing the market development in 2022:

• The Union Budget of 2022 included the announcement of a domestically issued sovereign green bond using conventional mechanisms. The sovereign green bond will likely encourage more issuance from public and private sector entities in the domestic green bond markets with an almost immediate impact.

• Most GSS deals originating from India have been in the offshore market. The actions of the MOF’s Sustainable Finance Task Force will likely strengthen the domestic market further; however, the effects may only materialise in the medium- to long-term.

• Utility-scale renewable energy is expected to continue its dominance among UoP categories based on robust auction mechanisms for assets and support from the banking community.

• Solar rooftop and EVs will remain the next best development prospects in the Indian market and are expected to benefit from future green bonds.

• In the past, interest rate movements have affected GSS issuance volumes. The expectation of higher rates could lead to lower volumes in the near term across not only thematic but overall debt issuance.

- To download the report, click here.

- Launch Webinar: Join us on 30th May for a comprehensive look into green, sustainability and other labelled debt in India. Our expert panel will discuss the regions progress to date and where its heading. Register now: http://ow.ly/JwGv50JaUYu

For more information, please contact:

Head of Regional Communications

+55 (61) 98135 1800 (Whatsapp)

Notes for journalists:

Global green and other labelled Market At the end of 2021, Climate Bonds had recorded more than 16,000 GSS+ debt instruments with a cumulative volume of USD2.8tn. In 2021, Climate Bonds captured USD1.1tn of new GSS+ volumes, 46% more than the USD730.5bn in 2020. The green theme is still the largest source of debt, with 49% of the total, (USD523bn), and SLBs demonstrated the fastest growth, expanding by ten times year-on-year (YOY). Our latest market update takes us to the end of Q1 2022 and shows GSS+ volumes have passed USD3trn.

About the Climate Bonds Initiative: Climate Bonds Initiative (Climate Bonds) is an international organisation working to mobilise global capital for climate action. It promotes investment in projects and assets needed for a rapid transition to a low-carbon, climate resilient, and fair economy. The mission focus is to help drive down the cost of capital for large-scale climate and infrastructure projects and to support governments seeking increased capital markets investment to meet climate and greenhouse gas (GHG) emission reduction goals. Climate Bonds conducts market analysis and policy research; undertakes market development activities; advises governments and regulators; and administers a global green bond Standard and Certification scheme. Climate Bonds screens green finance instruments against its global Taxonomy to determine alignment, and shares information about the composition of this market with partners. The aim is to help build investment products that enable shifting capital allocations towards low-carbon assets and projects.

About the India State of the Market Report: This is Climate Bonds Initiative’s (Climate Bonds) first India State of the Market Report, building on an inaugural country briefing published in 2018. The scope of this report includes green, social, and sustainability (GSS) debt and sustainability-linked bonds (SLBs) originating from India and priced on or before 31 December 2021.