The Climate Aligned Bond Universe

Investment Opportunities Outside the Labelled Green Market

Asia-Pacific and Europe Lead Regions, Transport Lead Sector

LONDON: 08/07/2021 09:00 BST: Climate Bonds has released the latest in its periodic reporting series on identifying climate-aligned issuers and investments. Supported by DBS Bank, the Climate Investment Opportunities: Climate-Aligned Bonds & Issuers 2020 reportprovides a comprehensive analysis of the global unlabelled climate-aligned bond market, which consists of investment opportunities that extend beyond the thematic bond market. These instruments are identified via a proprietary methodology developed by Climate Bonds.

The Climate-Aligned Bonds & Issuers 2020 includes a market analysis of developed (DM) and emerging markets (EM), as well as a standalone section on China. Spotlights on low-carbon transport, green hydrogen, and real estate companies are also included. The latter is based on a framework developed by Climate Bonds which identifies the top performing property companies from a disclosure and transparency perspective.

Major findings

The report identifies a universe of over USD913bn from 420 climate-aligned issuers based in 45 countries. The size of the climate-aligned universe is equivalent to approximately half of the labelled Green, Social and Sustainability (GSS) bond market, which has reached cumulative USD1.7tn in 2020.

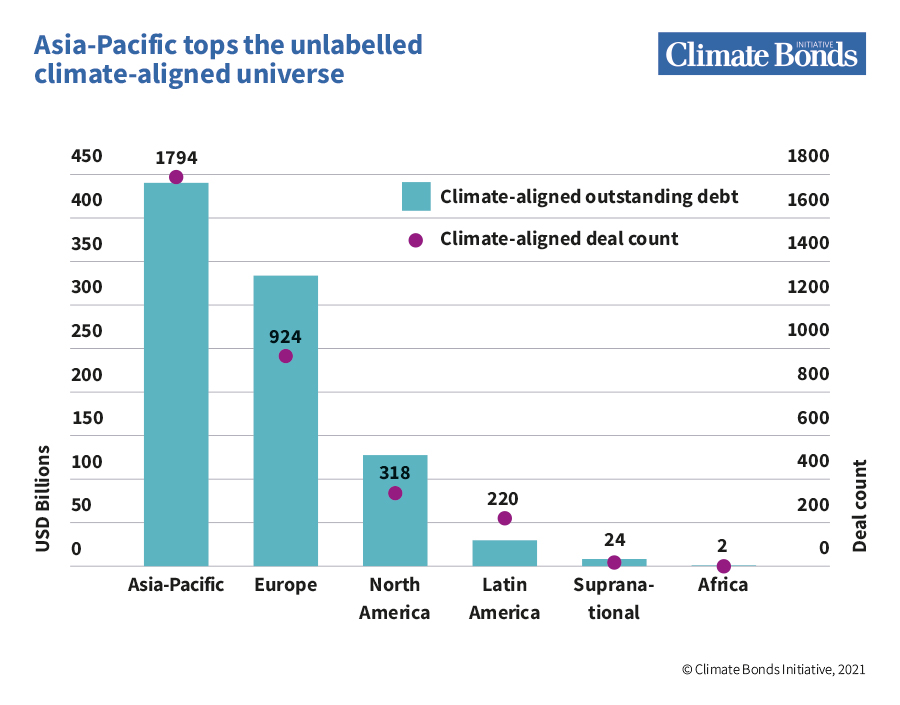

The climate-aligned bond universe is almost equally split between DM and EM, with 1% of volume coming from supranational institutions. Asia-Pacific is the top region, accounting for USD436.6bn (48%) brought to market by 183 climate-aligned issuers. Bonds from China represent the vast majority of issuance from Asia-Pacific (74%), and 36% of the global total. Europe ranks second in regions, accounting for USD321.3bn (35%) and 121 issuers.

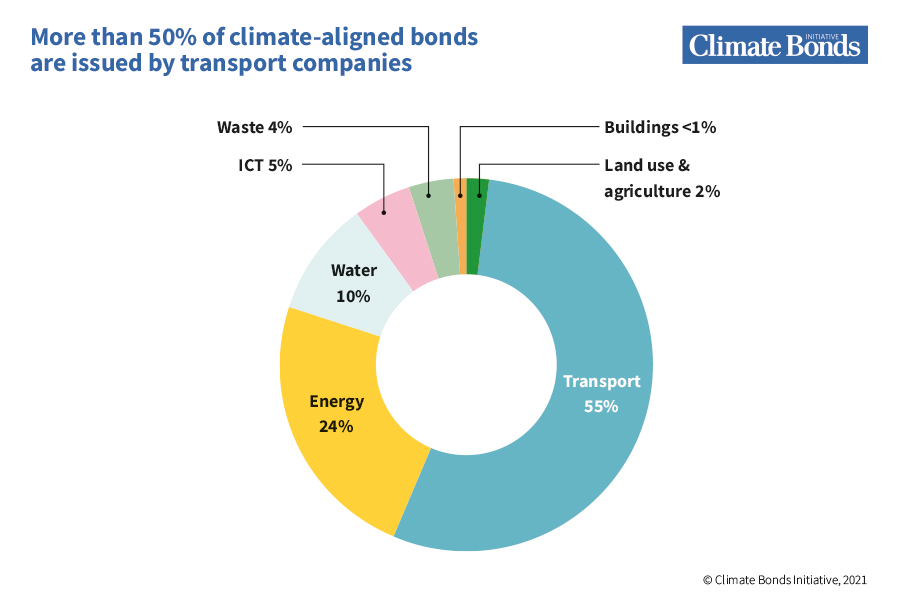

The Transport climate theme dominates the climate-aligned universe, followed by Energy and Water. Railway companies are the most widespread, accounting for almost all the Transport related climate-aligned volume.

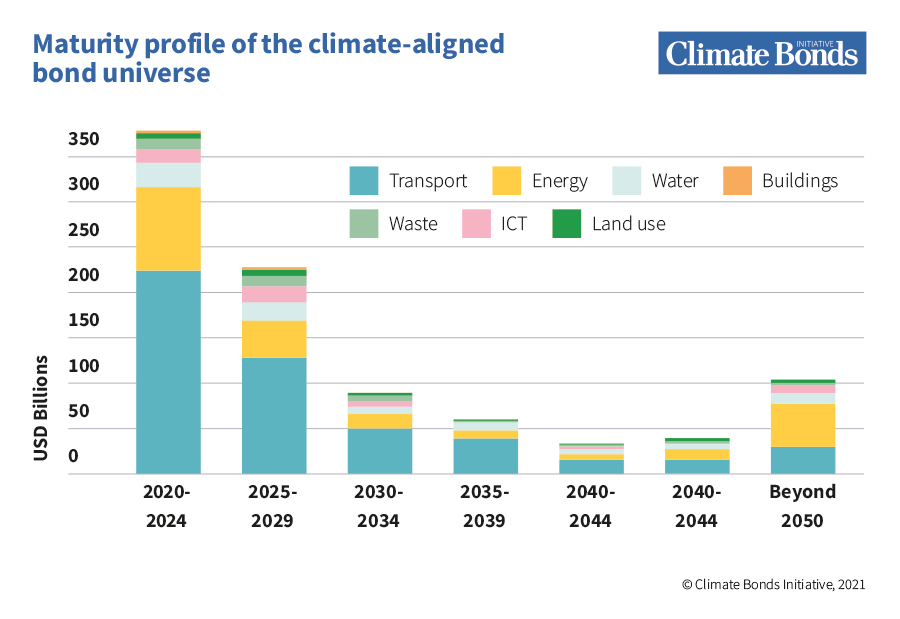

Over 40% of the climate-aligned volume will mature in the short term, which raises opportunities for refinancing climate-aligned business operations in the GSS bond market. As many climate-aligned companies identified in the report have already issued labelled bonds, refinancing opportunities can contribute towards the expansion of the labelled bond universe.

At a Glance

Developed Markets:

- DM account for USD464.8bn from 203 climate-aligned issuers spread across 21 countries. EUROFIMA is the only supranational institution, which accounts for approximately 1% of the universe.

- Europe is the largest source of climate-aligned volumes with USD319bn from 112 issuers domiciled across 14 countries.

- Transport leads climate-aligned issuance, followed by Energy and Water.

- France is the largest source of DM climate-aligned bonds; SNCF, EDF, Orange SA are the top issuers.

- More than half of the volume will mature within eight years, which shows huge potential for scaling up the labelled green bond market.

China and Emerging Markets:

- Asia-Pacific dominates EM issuance with 73% of volume, followed by Latin America at 24%

- Energy is the top climate theme, followed by Transport and Water

- China is the largest source of climate-aligned bonds, with USD325bn from 96 climate-aligned issuers

- EM (excluding China) account for 14% of the global climate-aligned universe, with USD123.3bn issued by 121 climate-aligned issuers domiciled across 23 countries

- South Korea is the largest source of EM climate-aligned bonds; Korea Electric Power Corporation, Indian Railway Finance Corporation and Korea Rail Network Authority are the top issuers

- Almost half of the climate-aligned outstanding debt will mature in the short term, offering opportunities to scale up the EM GSS market. with an additional USD40bn (33%) maturing by 2029

General Findings

- Climate-aligned investment opportunities extend well beyond the GSS bond market, offering a more varied risk and maturity profile

- Unlabelled instruments are difficult to identify, and labelling is an important signposting tool for investors

- Harmonised green definitions and disclosure practice can facilitate the identification of and growth of climate-aligned investment opportunities

- Climate-aligned issuers could refinance their business operations in the GSS bond market, and benefit from a broader investor base as well as the extra visibility offered by the green label

Hydrogen

If the production of hydrogen molecules can be decarbonised cost-effectively, hydrogen can play a substantial role across the energy system. To reach widespread adoption of green/low-carbon hydrogen, public sector investment is required to provide the necessary infrastructure to attract private investment and drive down costs.

Climate-aligned companies, especially those operating in the Energy climate theme, are well positioned to raise finance for the development of green hydrogen activities and maintain business relevant in light of the global transition towards carbon neutrality.

Real estate companies are challenging to classify

Identifying the share of revenue streams associated with highly energy efficient green buildings is tricky. Industry certification schemes and metrics to quantify energy efficiency and/or improvements vary substantially across building types and across countries, which makes it difficult to compare and evaluate the climate-alignment of these companies.

Better and more standardised disclosure will help pinpoint climate-aligned investment opportunities to investors There is also considerable scope for real estate companies to use green finance tools to fund low-carbon real estate projects. Green bonds can demonstrate that an entity is developing a green building portfolio to limit its environmental footprint.

Climate-aligned companies can help direct increased funding towards low-carbon vehicles

Despite the growth of investments in low-carbon mobility in recent years, substantial emissions reductions in the transport sector are still necessary to meet the 1.5°C climate ambition. There is urgent need to scale up investment in low-carbon technologies and infrastructure, transitioning away from fossil fuels. Increased investments from and into climate-aligned entities can help bridge the funding gap at the scale and pace required to meet stringent climate targets.

Clifford Lee, Global Head of Fixed Income, DBS Bank:

“The ESG-themed bond market continues to evolve, develop and grow rapidly across the world and more recently in Asia. Assessing bonds and issuers along climate-aligned business activities and assets can serve to further this growth and DBS is very focused on working with our issuers and investors to expand the market further and bring about real change in promoting climate and societal well-being.”

Yulanda Chung, Head of Sustainability Financing, Institutional Banking, DBS Bank:

“DBS operates in markets across Asia’s fastest growing economies, home to a sizeable portion of climate-based solutions. To achieve a low-carbon transition, we need to see a significant shift of mindsets and behaviour from issuers. Being climate-aligned is more than a “relabelling”, it is to communicate to your investors how you are positioned in addressing climate risks and in finetuning business strategies to capture the opportunities.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The climate aligned universe represents a further opportunity for investors seeking to re-weight their portfolios to meet ESG objectives and reduce their carbon exposure. Simultaneously the opportunity exists for climate aligned companies to enter the GSS labelled bond market via refinancing and benefit from the extra visibility offered by such instruments. Expanding green and sustainable debt markets, increasing the depth and diversity of offerings has a positive impact that benefits all stakeholders.”

<Ends>

Climate-Aligned Bonds & Issuers 2020 can be downloaded here.

For more information:

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Acknowledgements: Climate Bonds Initiative thanks DBS Bank for its sponsorship and support in the production of this report.

Methodology: Full methodology can be found page 3 of the Report.

Launch Webinar: Two Report Launch Webinars will be held on:

Figure 1:

Figure 2:

Figure 3: