Record year for Green, Social and Sustainability Debt Issuance in ASEAN: Climate Bonds Initiative Report

Green issuance continues to dominate. Significant increase in issuance of sustainability bonds

London/Singapore: 29/04/2021 02:00 BST / 09:00 SGT: Climate Bonds Initiative, supported by HSBC, launched the ASEAN Sustainable Finance State of the Market 2020 report[1]. The report outlines regional and national developments covering three overarching debt themes based on the projects, assets and activities financed: Green, Social, and Sustainability (GSS).[2] The report also highlights key policy developments that are anticipated to drive ASEAN’s sustainable finance market.

Key highlights

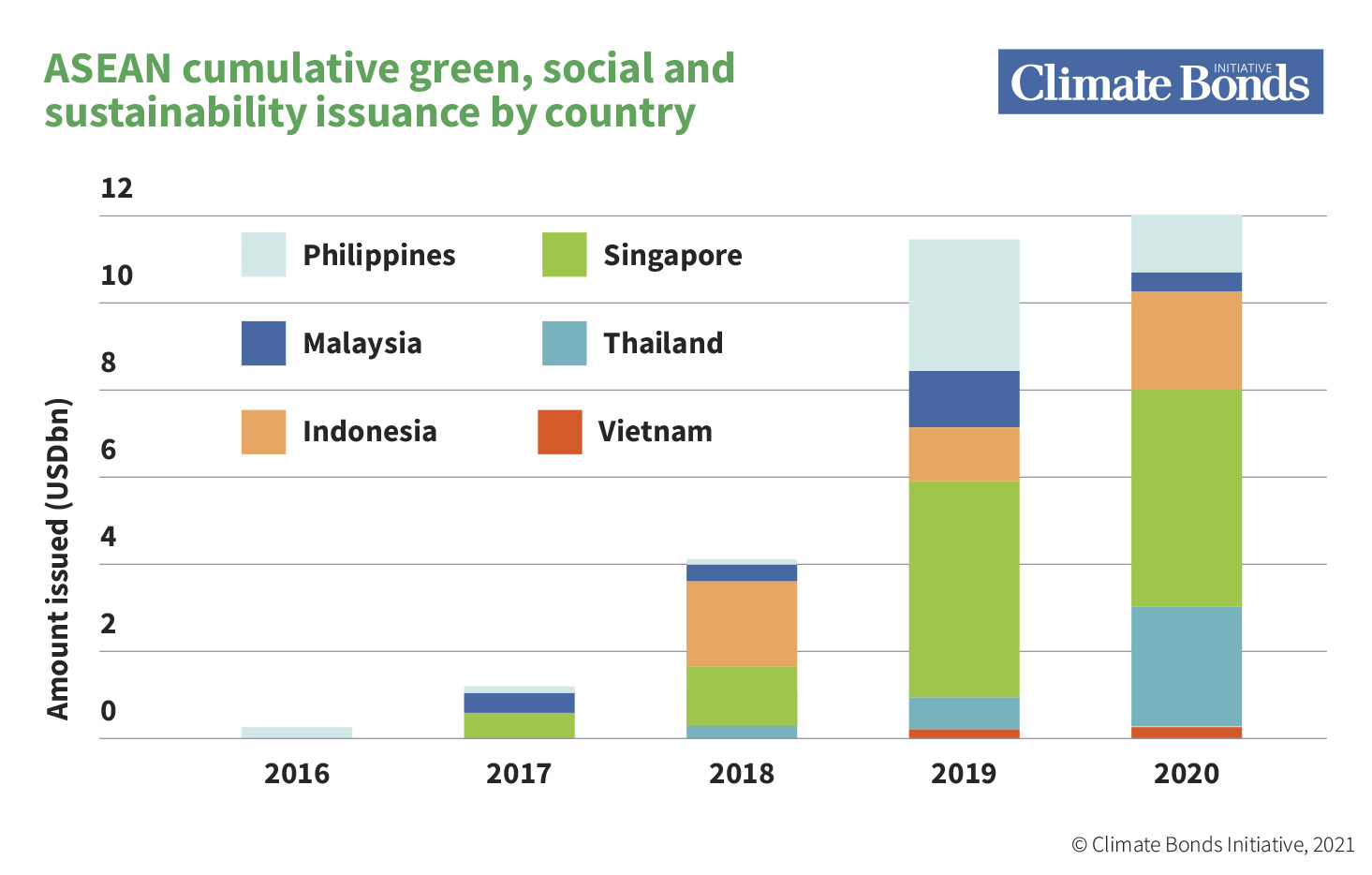

- ASEAN GSS issuance reached a record high of USD12.1bn in 2020, a 5.2% Y-o-Y increase from USD11.5bn issued in 2019.

- Cumulative GSS issuance in ASEAN since 2016 now stands at USD29.1bn.

- The GSS market composition showed a marked difference from previous years; whilst green labelled debt continues to dominate, sustainability bonds rose in prominence.

- Singapore remained the leader of GSS issuance in 2020, representing 53% of the region’s issuance. Thailand and Indonesia also experienced significant growth.

- Certification under the Climate Bonds Standard – representing international best practice - was obtained by four issuers.[3]

(See Chart 1, Map 1)

Green-labelled debt [4]

Green-labelled debt, referring to green bonds, green loans and green sukuk, continued to account for the majority of GSS issuance, with regional issuance of USD9.3bn, a 5.6% Y-o-Y increase from USD8bn issued in 2019.

2020 saw a consistent increase of both instrument size and number of issuers:

- 40 green products (21 bonds, 19 loans) issued in 2020, up from 32 in 2019.

- Green bond and loan issuers increased to 30 (15 bonds, 15 loans), up from 20 in 2019.

- 2020 saw 26 debut issuers, with the majority from Singapore; and four repeat issuers.

The largest Southeast Asian issuer was MS Commercial Pte Ltd of Singapore with its USD1.44bn green loan followed by Indonesia-headquartered Star Energy Geothermal (Dajarat II) Ltd, which issued a USD790m green bond.

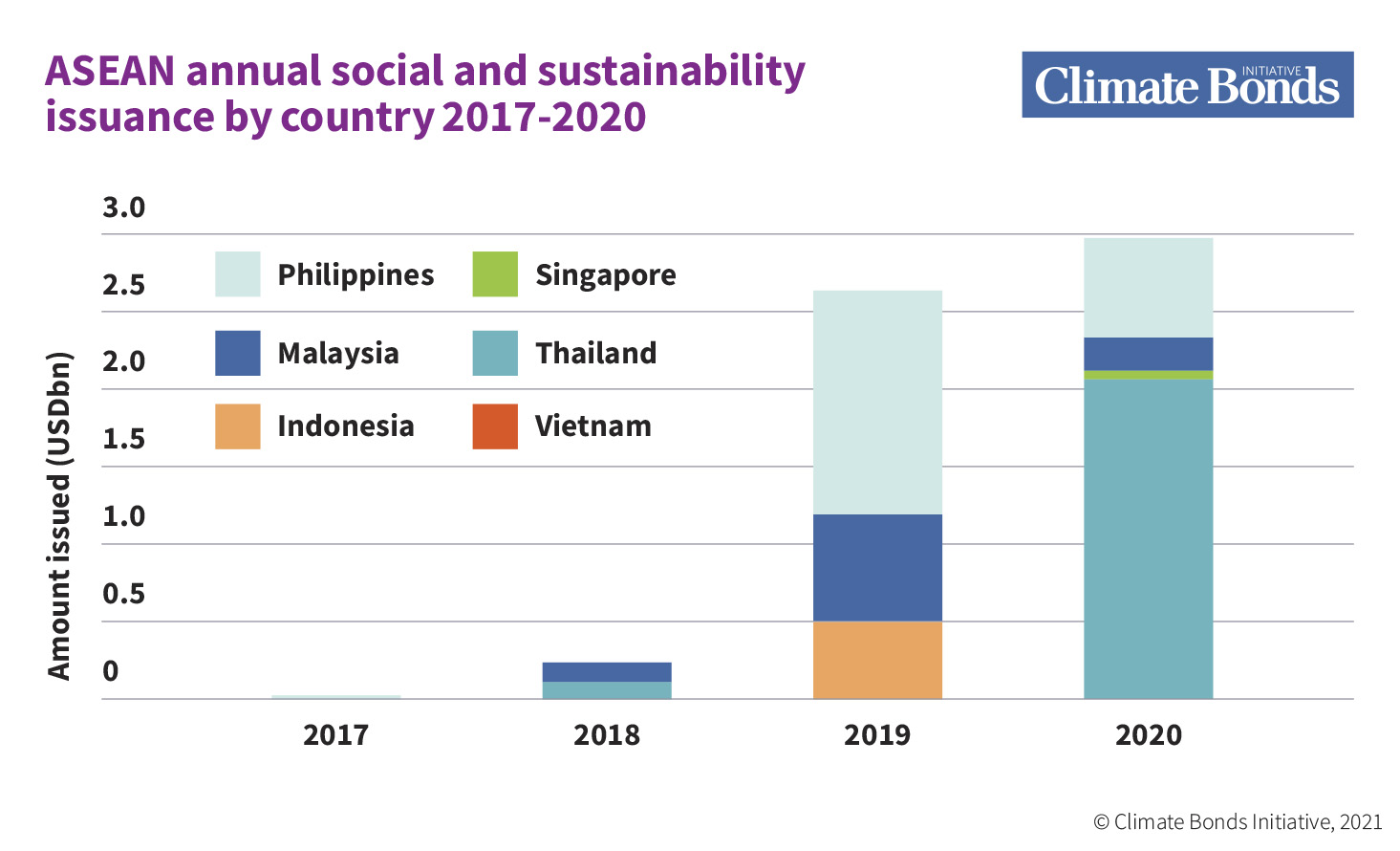

Social and sustainability bonds[5]

Sustainability bond issuance reached an all-time high of USD2.9bn in 2020, with six new deals coming to market driven by the demand for health services financing, as well as increasing efforts to meet the United Nations Sustainable Development Goals (UN SDGs) and poverty alleviation projects. (See Chart 2)

Social bond issuance decreased 10% Y-o-Y to USD48.7m in 2020 from three deals. Despite overall growth, the ASEAN social and sustainability bond markets are still at an early stage compared to other regions, constituting 5% of Asia-Pacific and 1% of the global markets.

Key market highlights

- Singapore remained the regional leader with total issuance of around USD5bn dominated by green loans in the real estate sector.

- Thailand and Indonesia saw strong growth:

- Indonesia’s growth was driven by sovereign and government-backed entities’ issuance.

- Thailand’s private sector saw activity with multiple ‘Climate Bonds Certified’ issuances.

- Malaysia and Singapore intensified longer term positioning as regional hubs for green and sustainable finance.

- Vietnam continued its momentum from 2019 and saw the signing of two green loans in 2020 with a total size of USD257m.

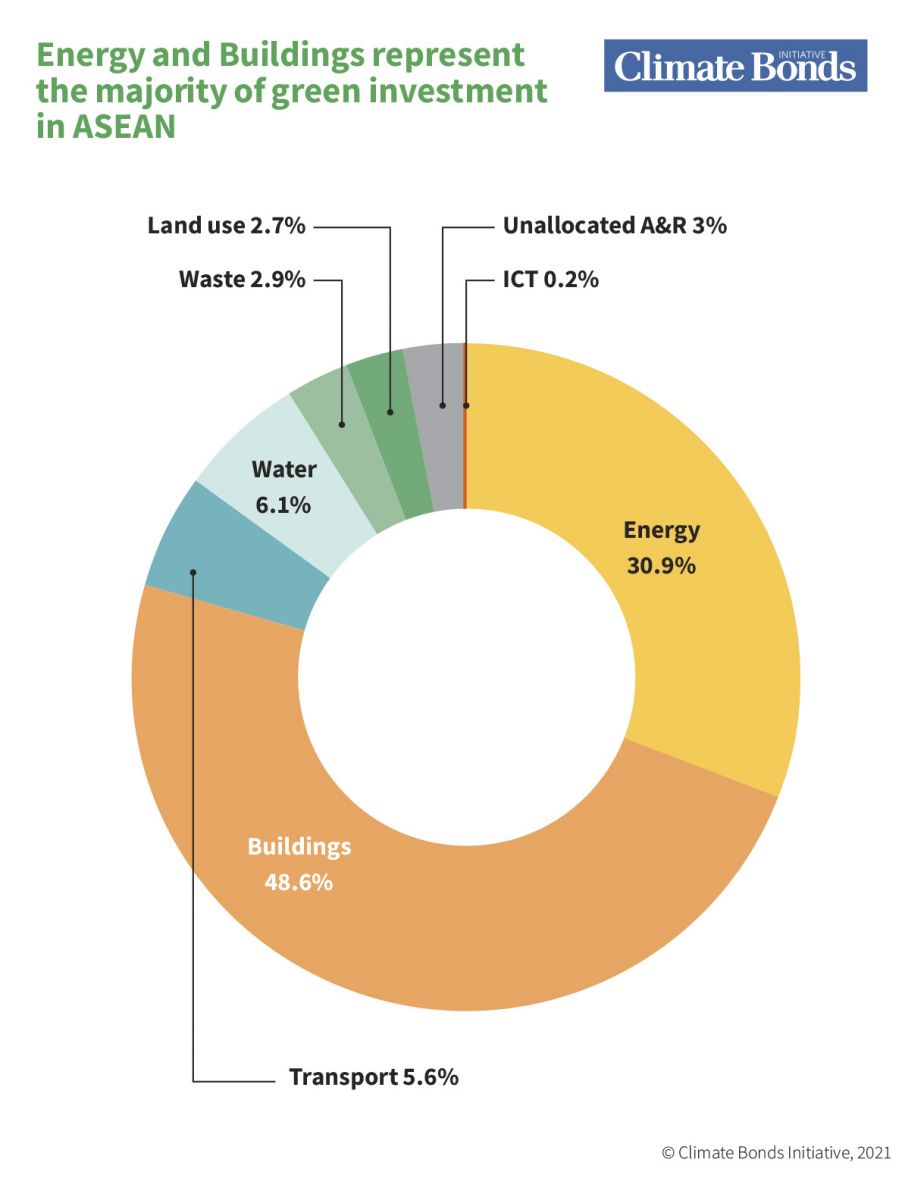

- Energy, buildings and transport filled the top 3 Use of Proceeds (UoP) in 2020.

Sean Kidney, Chief Executive Officer, Climate Bonds Initiative:

"ASEAN’s growth prospects are uncontested and despite the unprecedented circumstances in 2020, the market proved its strength and durability, a positive signal for future opportunities.”

“Government and regulatory policy shifts have had an impact and are vital to building regional capacity to meet the climate crisis and sustainable development goals. Institutional investors continue to seek quality green and sustainability-based investments. This demand will grow throughout the 2020s.”

“The green and sustainable bonds, loans and sukuk from the region reflect the role green finance is playing in supporting national infrastructure development while addressing adaptation and resilience. There is tremendous potential for more!”

Jonathan Drew, Managing Director, ESG Solutions, Global Banking, HSBC:

“The manifestation of sustainability risk arising from COVID-19 has led many Southeast Asian nations to accelerate their sustainability and climate ambitions.”

“Whilst we saw an uptick in the use of green and sustainable finance last year, the region’s sustainable finance market remains at a relatively nascent stage. Headway is being made and is likely to continue at pace as economies regenerate. Increasing sovereign GSS issuance representing best-in-class leadership is already attracting strong investor interest and demand, and the further development of regulations, standards and frameworks will be critical in providing consistency and clarity for market participants.”

“Through continued collaboration amongst the public and private sector, Southeast Asia will be able to channel the huge amount of capital needed to support sustainable growth.”

Outlook

The Report suggests that sustainable finance is set to further underpin national recovery and stimulus plans to ‘build back better’. Public sector issuance remains a driver to encourage private sector issuers to participate in the market, and ASEAN’s sovereign issuers club is set to expand with planned sovereign green bond issuance already announced by Singapore and Vietnam.

In addition, ASEAN markets are collectively developing a taxonomy to bring greater clarity for market participants and deepening efforts to improve definitions for sustainable investments. The development of other instruments, such as sustainability-linked bonds and loans or transition bonds, are also needed to meet the larger financing needs of ASEAN’s low-carbon transition.

<Ends>

Full Report: ASEAN Sustainable Finance: State of the Market Report 2020

HSBC Centre of Sustainable Finance Website

Media contacts:

Lucy Stewart

Senior Communications Manager

HSBC Singapore

+65 9658 3405

Andrew Whiley

Head of Communications & Media

Climate Bonds Initiative (London)

+44 (0) 7506 270943

Andrew.whiley@climatebonds.net

Leena Fatin

Senior Communications & Digital Manager

Climate Bonds Initiative (London)

+44 (0)759 332 0198

Launch Webinar: Thursday April 29th

09:00 London / 15:00 Hanoi, Bangkok, Jakarta / 16:00 Singapore, Hong Kong / 18:00 Sydney

Notes to Editors:

About the Climate Bonds Initiative

The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website www.climatebonds.net

About Certification

The Climate Bonds Standard and Certification Scheme is a labelling scheme for bonds, loans & other debt instruments. Rigorous scientific criteria ensure that it is consistent with the goals of the Paris Climate Agreement to limit warming to under 2 degrees. The Scheme is used globally by bond issuers, governments, investors and the financial markets to prioritise investments that genuinely contribute to addressing climate change.

The Hongkong and Shanghai Banking Corporation Limited

The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. HSBC serves customers worldwide from offices in 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of $2,959bn at 31 March 2021, HSBC is one of the world’s largest banking and financial services organisations.

ends/more

Chart 1: ASEAN cumulative GSS issuance 2016 - 2020

Chart 2: ASEAN social and sustainability issuance 2017 – 2020

Chart 3: ASEAN Use of Proceeds 2020

Map 1: ASEAN cumulative GSS to end 2020

Ends/Final

[2] The report focuses on: Green Loans and Bonds, Sustainability Bonds and Social Bonds. Climate Bonds does not yet track or assess the global market of Sustainability-Linked Bonds (SLBs) or Sustainability-Linked Loans (SLLs), preventing inclusion of these debt categories in this analysis.

[3] Comprising one green loan from Phu Yen TTP (USD186m) in Vietnam, and three green bonds from Thailand, including the Thai Sovereign Sustainable & Green bond (THB30bn) with proceeds financing Bangkok urban metro upgrades

[4] Refer to page 5 of Report

[5] Refer to page 11 of Report