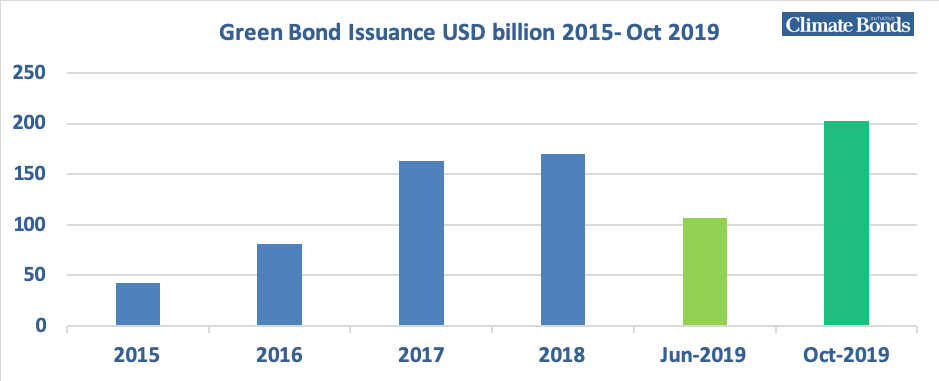

LONDON: 23/10/2019 14:00 BST: Progressive green bond and loan issuance for 2019 has just passed USD200bn, marking an all-time high for the green market and setting the stage for annual issuance post December to meet Climate Bonds Initiative forecast range for the year of between $230-250bn.

Climate Bonds analysis sets the global figure at USD202.2bn as at 22/10/19. Green bonds closing from Terna Energy*, EUR150m (USD167m), (the first green bond issued from Greece), and a mix of green bonds and loans from Singapore, Japan, Sweden and China, were among the deals pushing the total past the USD200bn mark. Progressive issuance for 2019 reached USD100bn in late June. (See Figure 1)

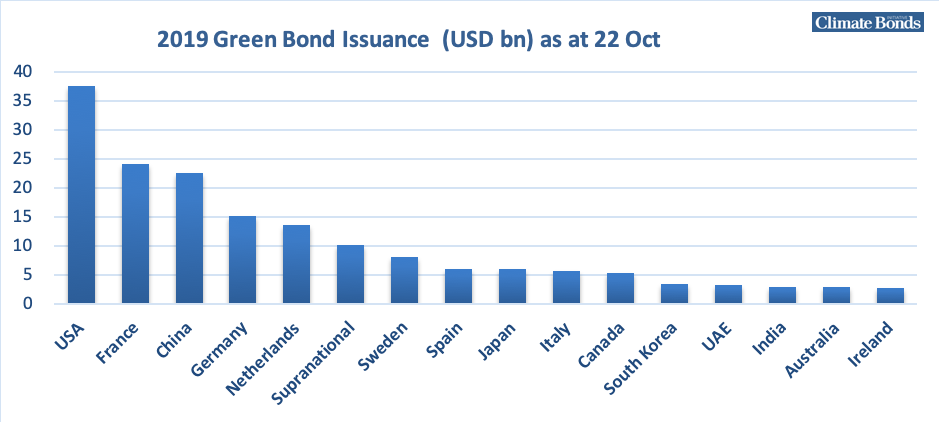

The USA leads national rankings to date in 2019 followed by France, China, Germany, Netherlands, Sweden, Spain, Japan, Italy and Canada. Supranationals rank between Netherlands and Sweden. (See Figure 2)

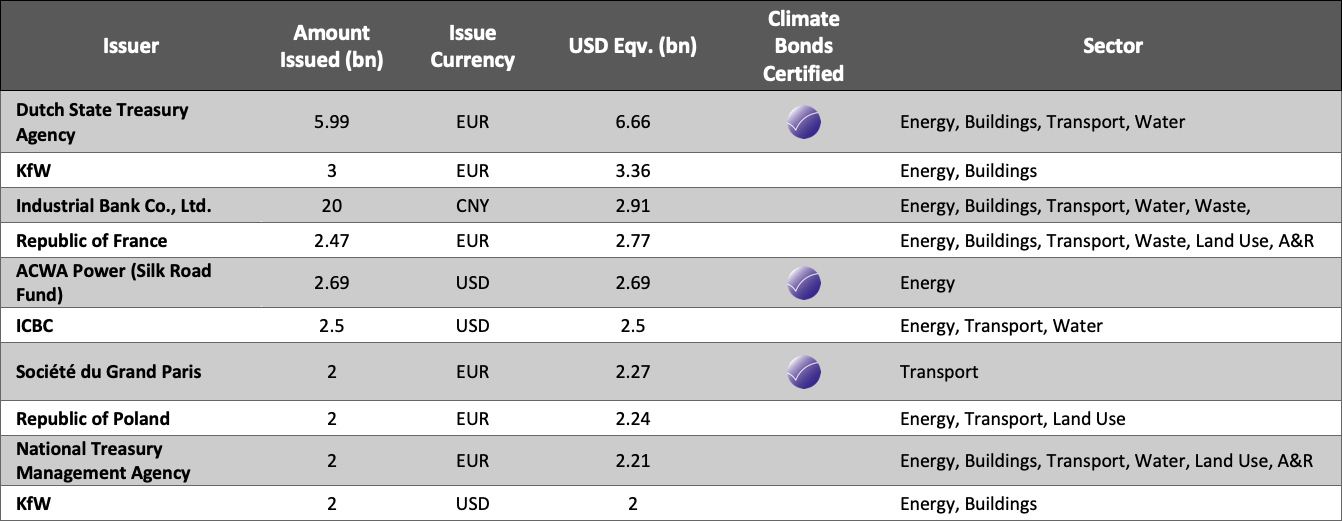

The five largest green bonds/loans issued in 2019 so far are from Dutch State Treasury Agency* EUR5.99bn (USD6.66bn), KfW EUR3bn (USD 3.36bn), Industrial Bank Co., Ltd. CNY20.0bn (USD2.91bn), Republic of France EUR2.47bn (USD2.77bn) and the Noor Energy 1(ACWA Power, Silk Road Fund)* USD2.69bn green loan, funding single largest Concentrated Solar Power (CSP) site in the world. (See Table 1)

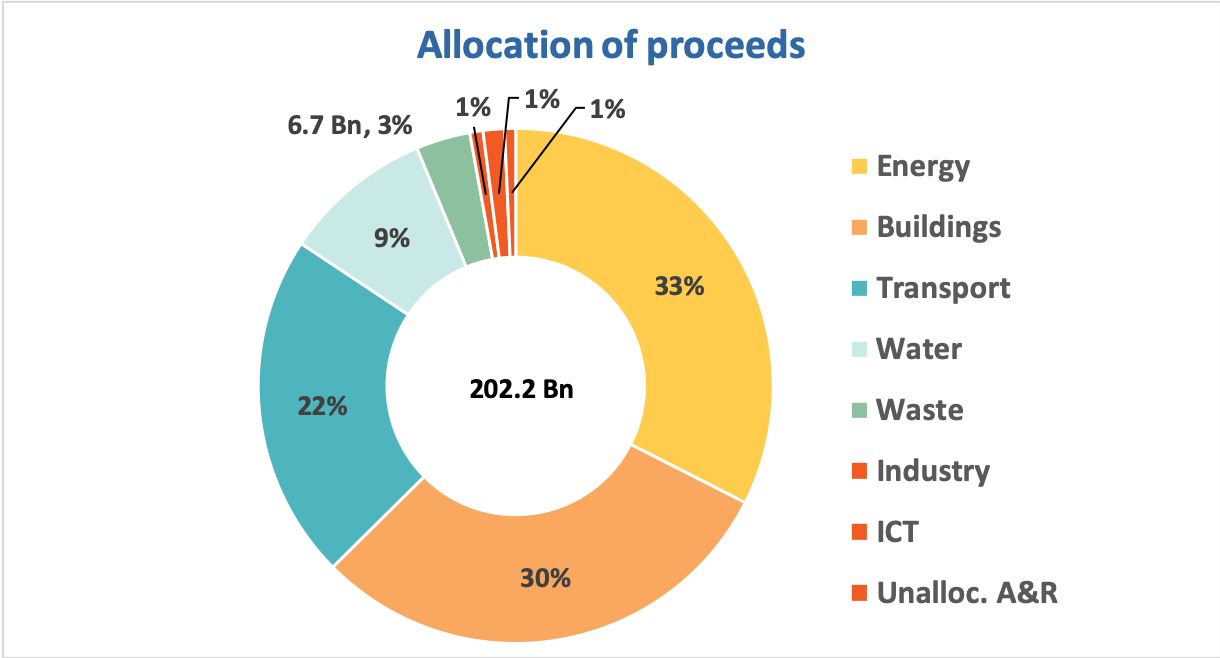

Energy dominates overall Use of Proceeds at 33%, followed by low carbon buildings on 29%, low carbon transport 20%, water 9%, with waste and land use each at 3%. (See Figure 3)

Nine nations have issued sovereign green bonds in 2019 at USD25.8b (approx. 13%) of total issuance for the year to date. France, Belgium, Poland, Ireland, Indonesia, Chile and Nigeria are now repeat sovereign issuers.

Climate Bonds Certified bonds/loans for the year is almost a fifth of the market, at approx 19% (USD37.5bn) of volume via issuers demonstrating international market best practice.

Climate Bonds Initiative forecasts USD350-400bn in global annual green bond/loan issuance for CY2020.

Sean Kidney, CEO, Climate Bonds Initiative:

“Based on these figures, 2019 will be another record year for green finance. New sovereigns are entering the market and pioneers like France, Poland and Nigeria are now repeat green issuers. Bond size and diversity of issuers is increasing, and noteworthy is the presence of leading European and Chinese banks amongst the largest issuers. All positive signs of market maturation.”

“But $200bn or $400bn a year is not enough to address the climate emergency and provide the capital at the scale urgently required for large scale transition, adaptation and resilience.”

“From here on, every year in the 2020s must be a record year for green finance. The climate challenge for global finance – regulators, banks, insurers and institutional investors – remains. Generating that first $1 trillion in annual green investment by 2021/22 is now critical. It’s the benchmark from which to measure year on year growth in climate based investment towards 2030.”

*Climate Bond Certified

<Ends>

For more information:

Head of Communications and Media,

Climate Bonds Initiative

+44 (0) 7914 159 838

andrew.whiley@climatebonds.net

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Figure 1: Global Annual Green Bond Issuance 2015-22 Oct 2019

Figure 2: Top 15 2019 Green Bond Issuance by country at 22 October 2019

Figure 3: Use of Proceeds Breakdown for USD202.2bn at 22 Oct 2019

Table 1: Ten Largest 2019 Green Bond/Loans at 22 October 2019

<Ends>