Climate Bonds Initiative releases inaugural report focused on Latin America and Caribbean (LAC) market

LAC’s green bond market heating up in 2019 with exciting opportunities

in the green infrastructure sector, new study reveals.

NEW YORK, 23/09/2019, 8AM: Climate Bonds Initiative launches the Latin America and Caribbean: Green Finance State of the Market 2019 (SoTM) at Climate Week today, the first detailed analysis of green finance in LAC since the region entered the market in 2014. The SOTM report is sponsored by United Nations Development Programme (UNDP) through the Partnership for Action on Green Economy (PAGE) and by the Inter-American Development Bank (IDB) and IDB Invest.

According to the report, LAC’s green bond market has been picking up strongly in 2019, with LAC countries contributing to 2% of global green bond issuance volume (1% of bonds and 5% of issuers) through H1 2019. Brazil leads the market with 41% of green issuance.

Key findings:

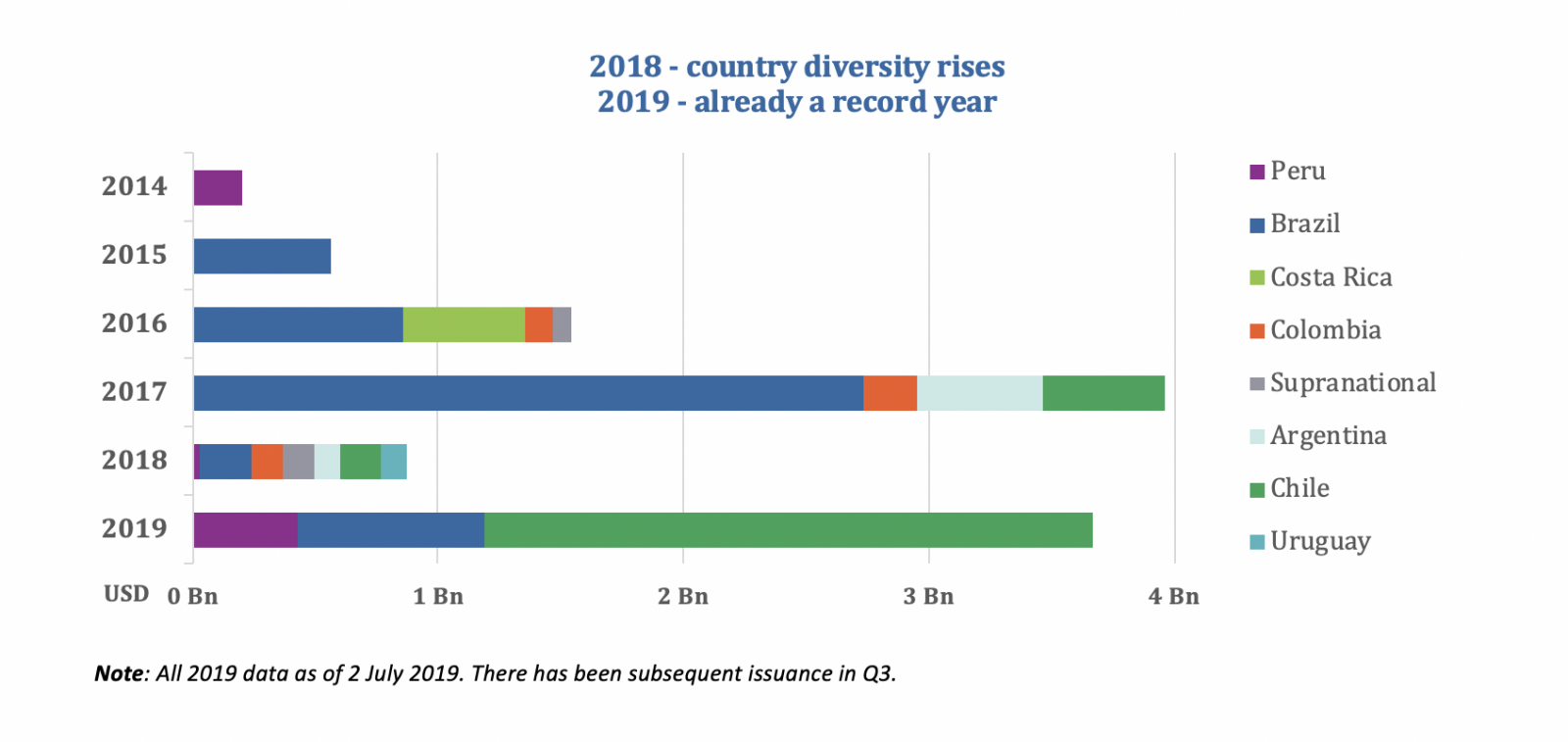

- As of 2 July 2019 (the report's cut-off date), issuance at USD3.7bn was three times higher than H1 2018 and 40% higher than H1 2017. This has been driven by Chile’s two sovereign green bonds;

- New deals have closed since then, already making 2019 a record year with USD4.6bn, bringing total LAC issuance to date to USD13.6bn;

- Still, 8 of LAC’s 33 countries have issued green bonds (9 if we include the recently Certified Climate Bond from the first green bond issuer from Barbados);

- Brazil is the largest market for labelled green bonds, followed by Chile and Mexico;

- There are significant differences in issuer types between countries: Brazil is dominated by non-financial corporates, Chile by the sovereign deals, Mexico by development banks, and Argentina by local governments;

- Peru and Colombia have indicated potential future sovereign green issuance;

- Allocations to Land Use and Industry are more common in LAC than elsewhere in the world. These two sectors represent almost a quarter of LAC issuance;

- Similar to other markets, Energy allocations are high, while Buildings and Water have a lower share. However, there are considerable differences by country;

- Over 80% of issuance is in hard currency, mainly USD, but this varies by country. In some markets local currencies dominate, e.g. all deals from Colombian issuers are denominated in COP;

- There is a high share of private placements compared to other regions. Many have been issued by local financial institutions and/or are supported by development banks;

- The vast majority of volumes benefit from an external review: Primarily Second Party Opinions (SPOs) but also Certified Climate Bonds, including the two Chilean Sovereign green bonds. The first deal from Barbados, the most recent addition to the regional country list, is also a Certified Climate Bond;

- Driven by Brazilian and Chilean issuers, Water is the largest sector financed by unlabelled climate-aligned issuance, ahead of Energy. In terms of public sector issuers, we identified the highest potential for green bond issuance among Mexican entities.

- Sustainable agriculture and the blue economy offer future opportunities in the region. The latter include blue economy projects that could be financed by bonds, which if labelled, could be included in Climate Bonds’ green bond database.

Juan Antonio Ketterer, Chief of the Connectivity, Markets and Finance Division; Inter-American Development Bank (IDB)

“This report provides a very useful description of what has been achieved, along with an assessment of the potential for growth. The IDB supports governments and financial institutions in Latin America and the Caribbean to develop green bond markets with both technical assistance and credit enhancement instruments. To be able to scale up fully, green bond markets need to provide investors with the highest level of standards and transparency. We, at the IDB, are committed to the development of green bond markets in Latin America and the Caribbean to ensure a highest level of transparency and compliance.”

Gema Sacristán, Chief Investment Officer, IDB Invest

“IDB Invest is contributing to the creation of this asset class by subscribing green bonds. Along with innovative instruments that mitigate risks for investors, we're building a roadmap for private investment in this area, fostering the growth of this market.”

Justine Leigh-Bell, Deputy-CEO, Climate Bonds Initiative:

“The development of LAC’s capital markets presents substantial opportunities to scale up investment in green projects. This is urgently needed, especially in the context of sustainable infrastructure and agriculture development.”

“Chile has taken the lead and shown remarkable leadership, with concrete actions to tackle climate change. We expect to see more and more Sovereigns and corporate green bonds coming from LAC countries.”

Gonzalo Pizarro, Regional Policy Adviser on Poverty, SDGs and Human Development for UNDP in Latin America and the Caribbean

“The growth of bond markets in Latin America and the Caribbean provides increasing opportunities to finance the implementation of the SDGs and green economy projects in the region. Green Bonds can also to promote environmental and social governance in the financial sector, they can stimulate financial, regulatory, and economic policy reforms to boost green growth and can help countries make the transition towards becoming low carbon economies. ”

<Ends>

Contact:

|

LAC Communications and Media Manager, Climate Bonds Initiative +55 (61) 98135 1800 |

Head of Communications & Media, Climate Bonds Initiative (London) +44 (0) 7914 159 838 Andrew.whiley@climatebonds.net

|

Notes for Journalists:

About the Climate Bonds Initiative: Climate Bonds Initiative is an international investor-focused not-for-profit organisation working to mobilise the USD100tn bond market for climate change solutions. The Climate Bonds Initiative carries out market analysis, policy research, market development; advises governments and regulators; and administers a global green bond Certification Scheme. For more information, please visit http://www.climatebonds.net.

About the IDB

The Inter-American Development Bank is devoted to improving lives. Established in 1959, the IDB is a leading source of long-term financing for economic, social and institutional development in Latin America and the Caribbean. The IDB also conducts cutting-edge research and provides policy advice, technical assistance and training to public and private sector clients throughout the region.

About IDB Invest

IDB Invest, a member of the Inter-American Development Bank (IDB) Group, is a multilateral development bank committed to the economic development of its member countries in Latin America and the Caribbean through the private sector. IDB Invest finances sustainable companies and projects so they can achieve financial results and maximize the region’s economic, social, and environmental development. With a portfolio of $12.4 billion in assets under administration and 342 clients in 24 countries, IDB Invest provides innovative financial solutions, knowledge and advisory services in response to its clients’ needs in a variety of sectors.

About the Partnership for Action on Green Economy (PAGE)

The Partnership for Action on Green Economy (PAGE) seeks to put sustainability at the heart of economic policymaking. PAGE supports nations and regions in reframing economic policies and practices around sustainability to foster economic growth, create income and jobs, reduce poverty and inequality, and strengthen the ecological foundations of their economies. Bringing together the expertise of five UN agencies – UNEP, ILO, UNIDO, UNDP and UNITAR – and working closely with national governments, PAGE offers a comprehensive and coordinated package of technical assistance and capacity building services to countries in their just transition to more inclusive, greener economies.

About UNDP

UNDP partners with people at all levels of society to help build nations that can withstand crisis, and drive and sustain the kind of growth that improves the quality of life for everyone. On the ground in nearly 170 countries and territories, we offer global perspective and local insight to help empower lives and build resilient nations. www.undp.org.

Images:

Note: All 2019 data as of 2 July 2019. There has been subsequent issuance in Q3.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.