New US Green Finance Record

LONDON: 30/11/2017 13:00 GMT: Latest Climate Bonds Initiative analysis of US municipal green bond issuance shows California has just topped $5bn, the first state to reach the milestone and setting a new US record.

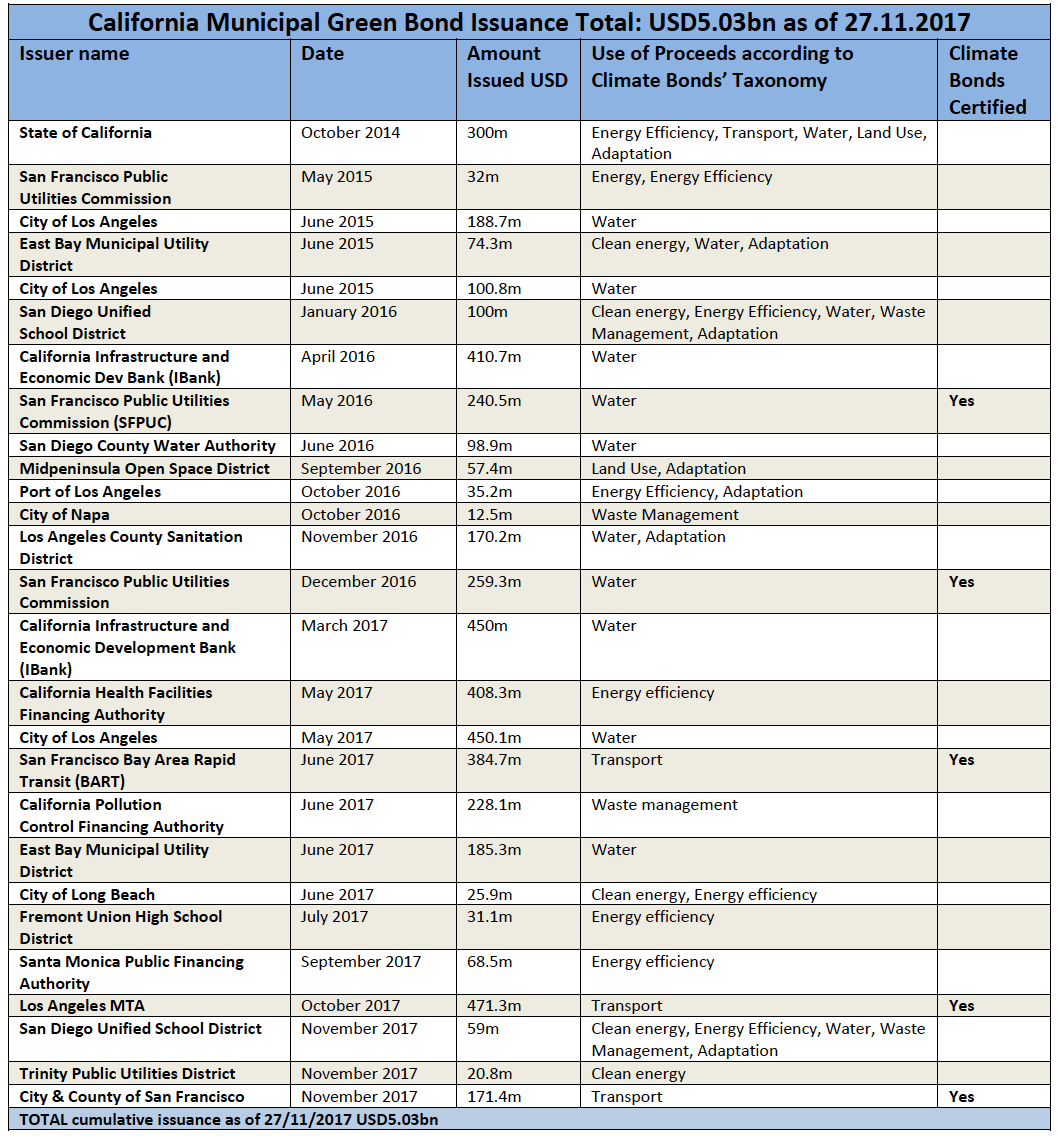

Issuance reached $5.03bn following the close of the $171.4mn Climate Bonds Certified Transbay Transit Centre bond for the City and County of San Francisco.

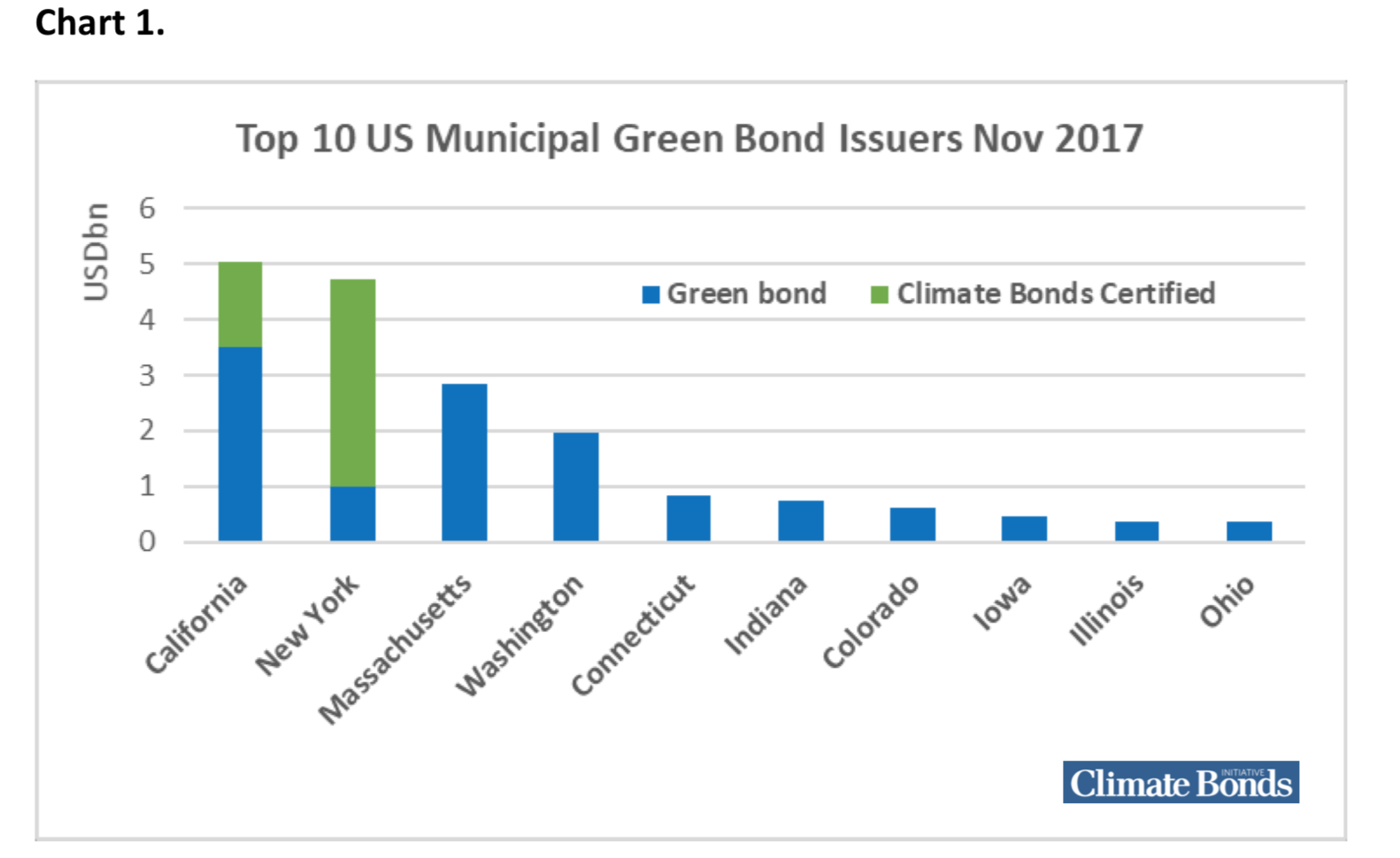

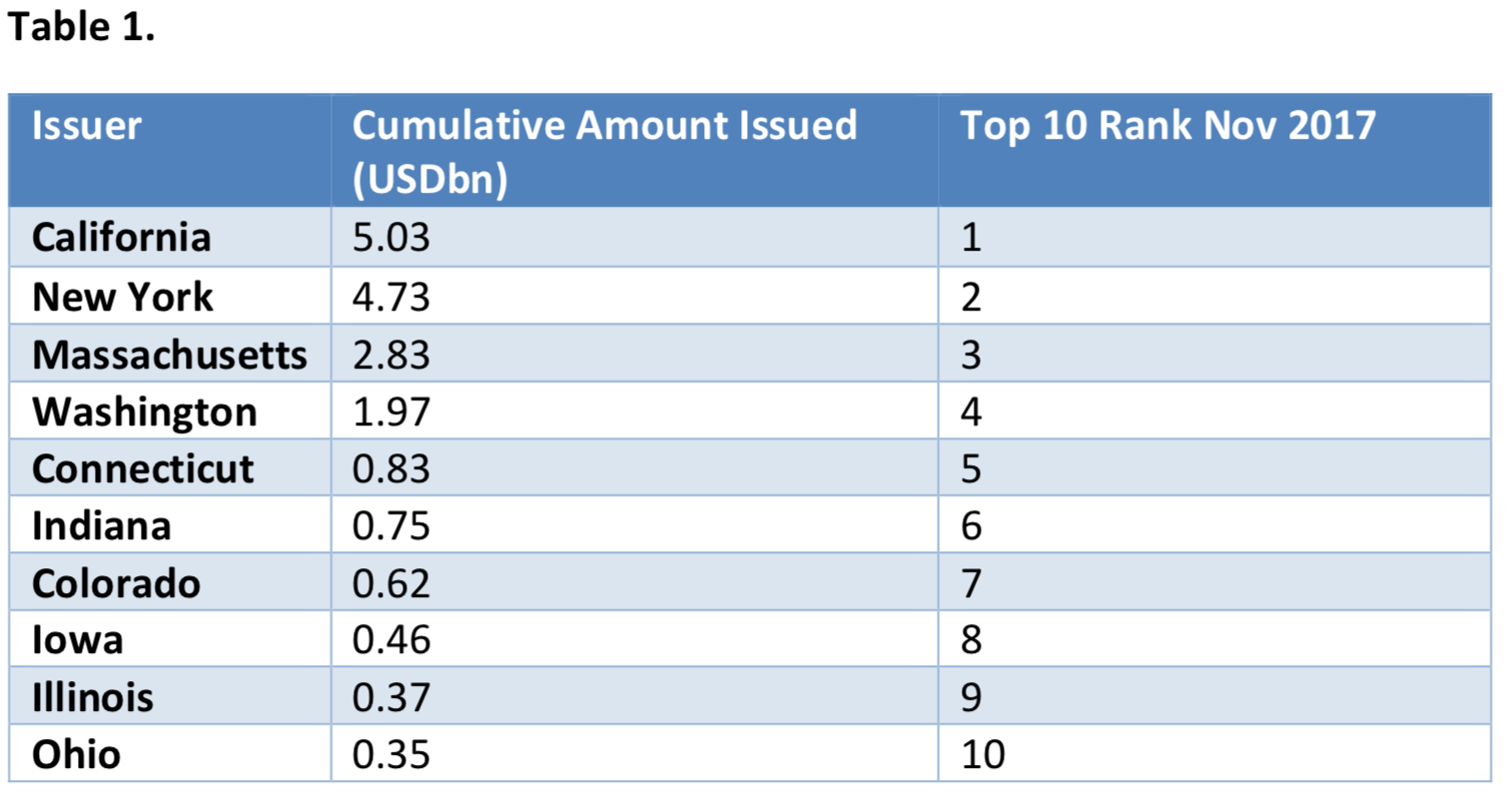

California currently leads US Municipal green issuance on bonds that have closed, followed closely by New York State on $4.73bn, Massachusetts on $2.83bn, Washington State at $1.9bn, with Connecticut, Indiana, Colorado, Iowa, Illinois & Ohio all under $1bn (Top 10 ranking below).

Green issuers have ranged from large institutions including IBank to smaller issuers such as the Trinity Public Utilities District and Midpeninsula Open Space District (Full list below).

A growing number of California issuers have also followed international best practice in gaining Climate Bonds Certification for their green issuance, including Bay Area Rapid Transit (BART), SFPUC and Los Angeles MTA.

State Treasurer John Chiang:

“California has long been a national standard bearer in areas ranging from advancing civilrights to protecting our natural resources. In that same vein, the State of California and its municipalities lead the U.S. in the use of green bonds, raising more than $5 billion in affordable capital to both curb climate change and build critical infrastructure.”

“The achievement is laudable but not enough considering how the United States still lagsbehind Europe, Asia, and South America in taking advantage of climate-friendly green bonds to finance the conversion of a fossil-fuel based economy to a carbon-free alternative.”

“I am working to change that equation by hosting a major green bonds symposium in February. I am assembling the nation’s foremost experts to come up with ways toturbocharge this innovative, new market, with an eye toward unlocking its latent potentialto pay for billions of dollars in investments to protect our planet from global warming.”

Justine Leigh-Bell, Director of Market Development Climate Bonds Initiative:

“Capital flows are moving in the right direction from diverse municipal issuers of every size across the state. The focus on water, energy and waste is very encouraging. The challenge now is to increase the number of green issuers across the state and encourage repeat issuance.”

“Our previous data at the end of Quarter 3 had New York State in front, but California has just nudged ahead to reach the landmark $5bn figure for municipal green bonds. The foundation is there to lead US states again and be first to reach $10bn.

“We expect the State Treasurer’s February 2018 Green Bonds Symposium and Governor Brown’s Global Climate Action Summit later in 2018 will both provide sub national, national and international momentum around green investment to address climate change.”

<Ends>

Andrew Whiley

Head of Communications and Media,

Climate Bonds Initiative, London

+44 (0) 7914 159 838

andrew.whiley@climatebonds.net

Notes for Journalists

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not- for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Green Bond Figures: All figures quoted are for labelled municipal green bonds that have closed and are accurate as of 30/11/2017.

California Municipal Green Bond Issuers: California Health Facilities Financing Authority California Infrastructure and Economic Development Bank (IBank), California Pollution Control Financing Authority, State of California, City and County of San Francisco, City of Long Beach, City of Los Angeles, East Bay Municipal Utility District, Fremont Union High School District, Port of Los Angeles, Los Angeles County MTA, Midpeninsula Regional Open Space District, City of Napa, San Diego Unified School District, San Diego County Water Authority, San Francisco Bay Area Rapid Transit, San Francisco Public Utilities Commission, Los Angeles County Sanitation District, Santa Monica Public Financing Authority and Trinity Public Utilities District.

California Green Finance Symposium 2018: California State Treasurer John Chiang is convening a two day Green Bond Symposium on Feb 27-28, 2018 in partnership with the Milken Institute and Environmental Finance, in Santa Monica.

Climate Action Summit 2018: Governor Gerry Brown will hold a Global Climate Action Summit in conjunction with the UNFCCC & other climate action leaders from September 12- 14, 2018 in San Francisco.

Tables and Charts: