Climate Bonds State of the Market 2017 Report

Climate Week New York City Launch with HSBC

Green & ‘Climate-Aligned’ Bond Universe now stands at $895bn outstanding issuance

London/New York 18/09/2017 18:30 BST/13:00 EDT: HSBC and the Climate Bonds Initiative have launched the 6th annual‘Bonds and Climate Change: the State of the Market in 2017’ report at the HSBC Sustainable Finance and Investing Responsibly Briefing in New York, on the first day of Climate Week NYC.

Commissioned by HSBC and produced by the Climate Bonds Initiative, the State of the Market report has become the authoritative international analysis of both the labelled green bond and ‘climate-aligned’ bond universe**. This year’s datasetincludes all Climate-Aligned and Green Bonds issued after 1st January 2005 and before 30th June 2017.

‘Bonds and Climate Change: State of the Market in 2017’ quantifies all bonds where proceeds are being used to finance low carbon and climate resilient infrastructure. In this report, we uncover bonds that finance investments compatible with a 2- degree transition path rather than investments that are marginally environmentally beneficial. This takes a cue from the Paris COP21 Agreement that all investments should be in line with the steep emission reduction trajectory needed to achieve a rapid transition to a sub-2-degree Celsius world.

The 2017 report has a particular focus on cities, with ten case studies identifying existing best practice green city bonds and also opportunities for new city based green bond issuance.

Key findings: Overall Universe

-

The climate-aligned bond universe now stands at $895bn outstanding - A jump of $201bn from the 2016 figure. This total is comprised of unlabelled climate-aligned bonds at $674bn and labelled green bonds at $221bn.

-

The $201bn increase on 2016 includes $138bn in new bonds from existing issuers, plus $144bn from new issuers minus $81bn of matured bonds and issuers that no longer meet our climate-aligned criteria.

-

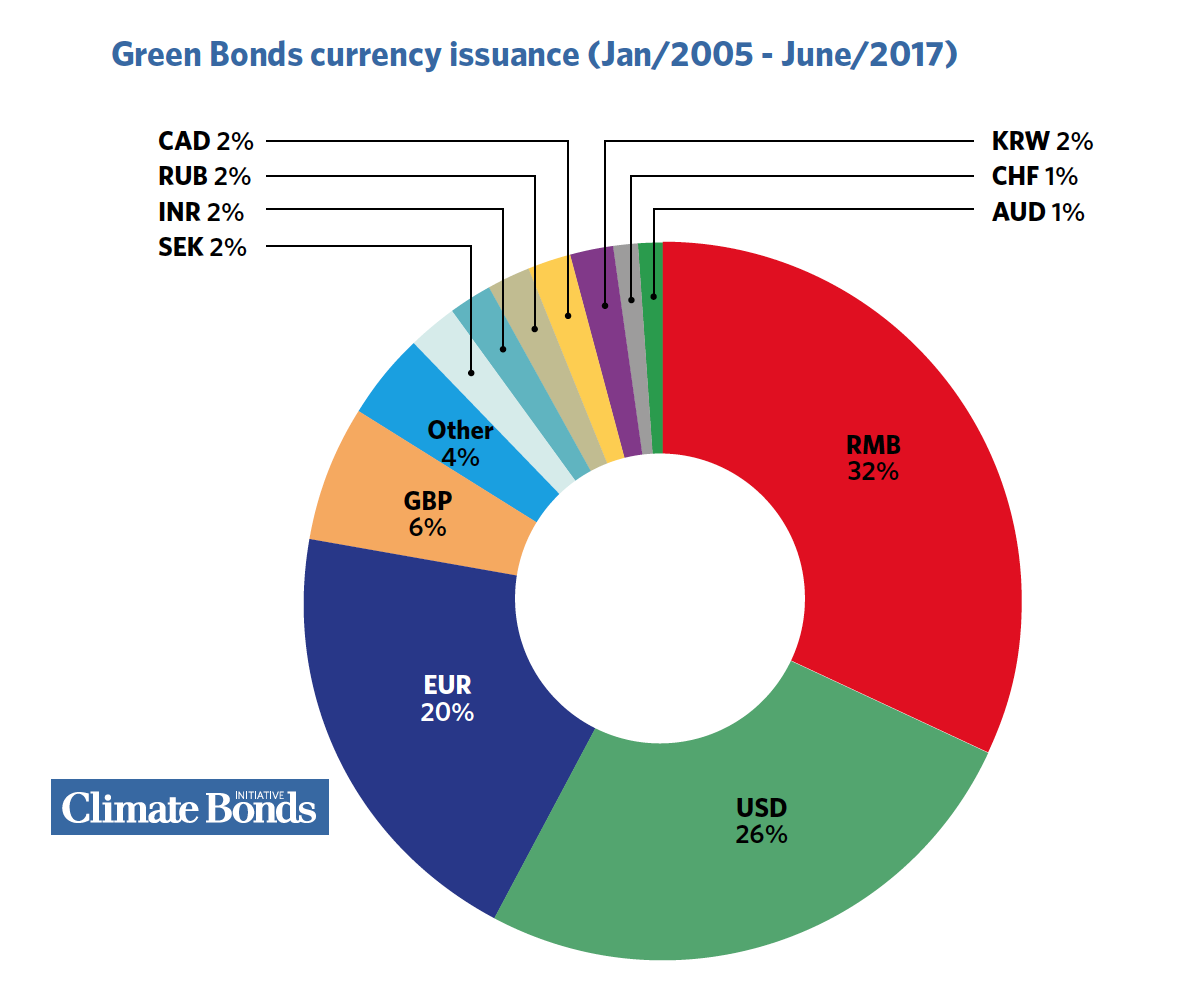

In the climate-aligned bond universe, the Chinese RMB is the dominant currency (with 32% of the total amount outstanding), followed by the U.S. dollar (26%) and the Euro (20%).

-

43% of the universe meets basic investment parameters. The majority of bonds have tenors of 10 years or more; the majority are also government-backed.

-

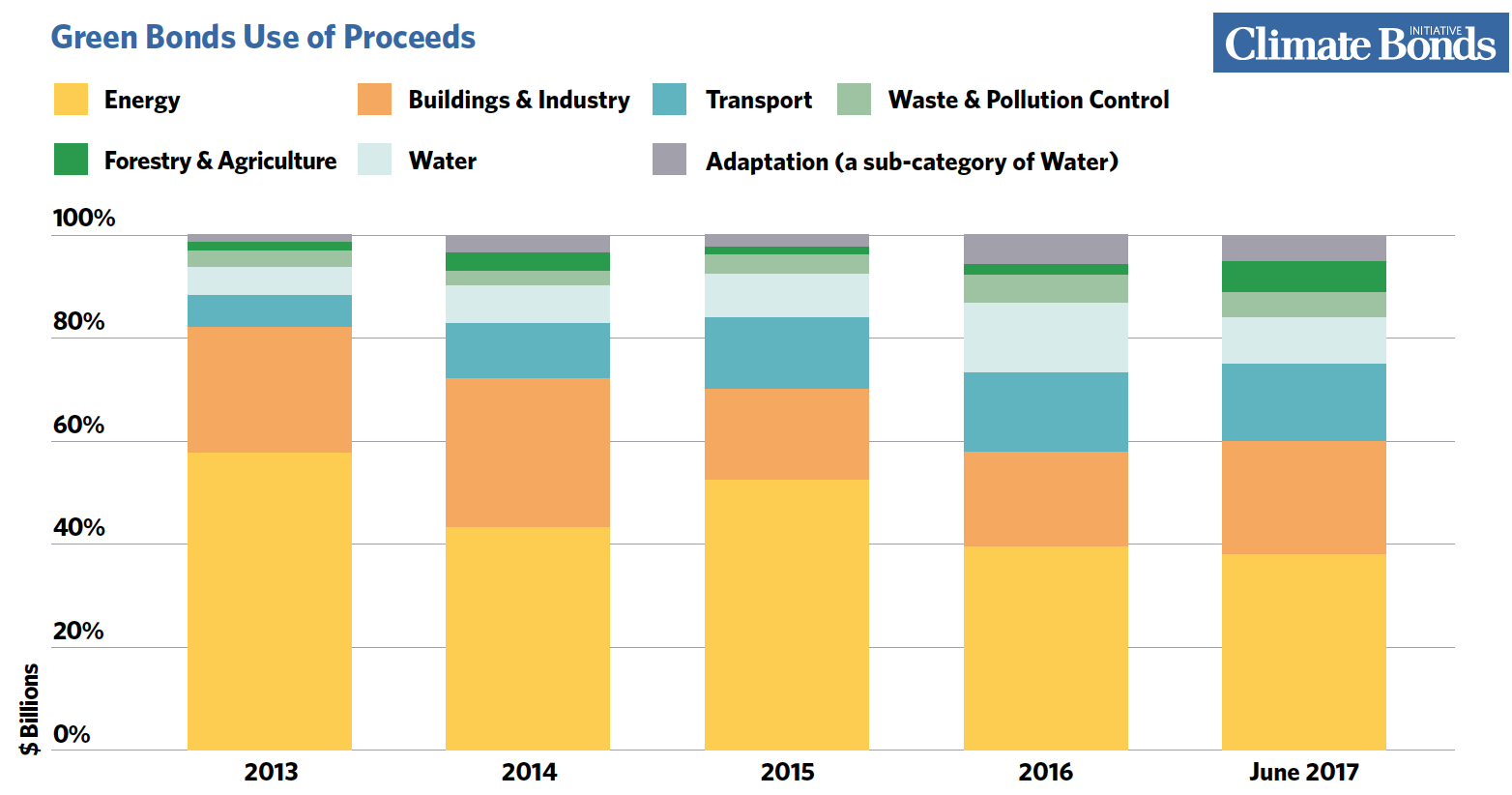

Low Carbon Transport was the largest single sector, accounting for $544bn (61%) of the total $895bn climate aligned universe, followed by clean energy at $173.4bn (19%).

-

Building and Industry, Agriculture and Forestry, Waste and Pollution, Water comprise 7% and Multi-Sector bonds are at 13% up from the 2016 figure of 8.2%, a small but welcome pointer towards more diversity in issuance.

Key Findings: Green Bonds

-

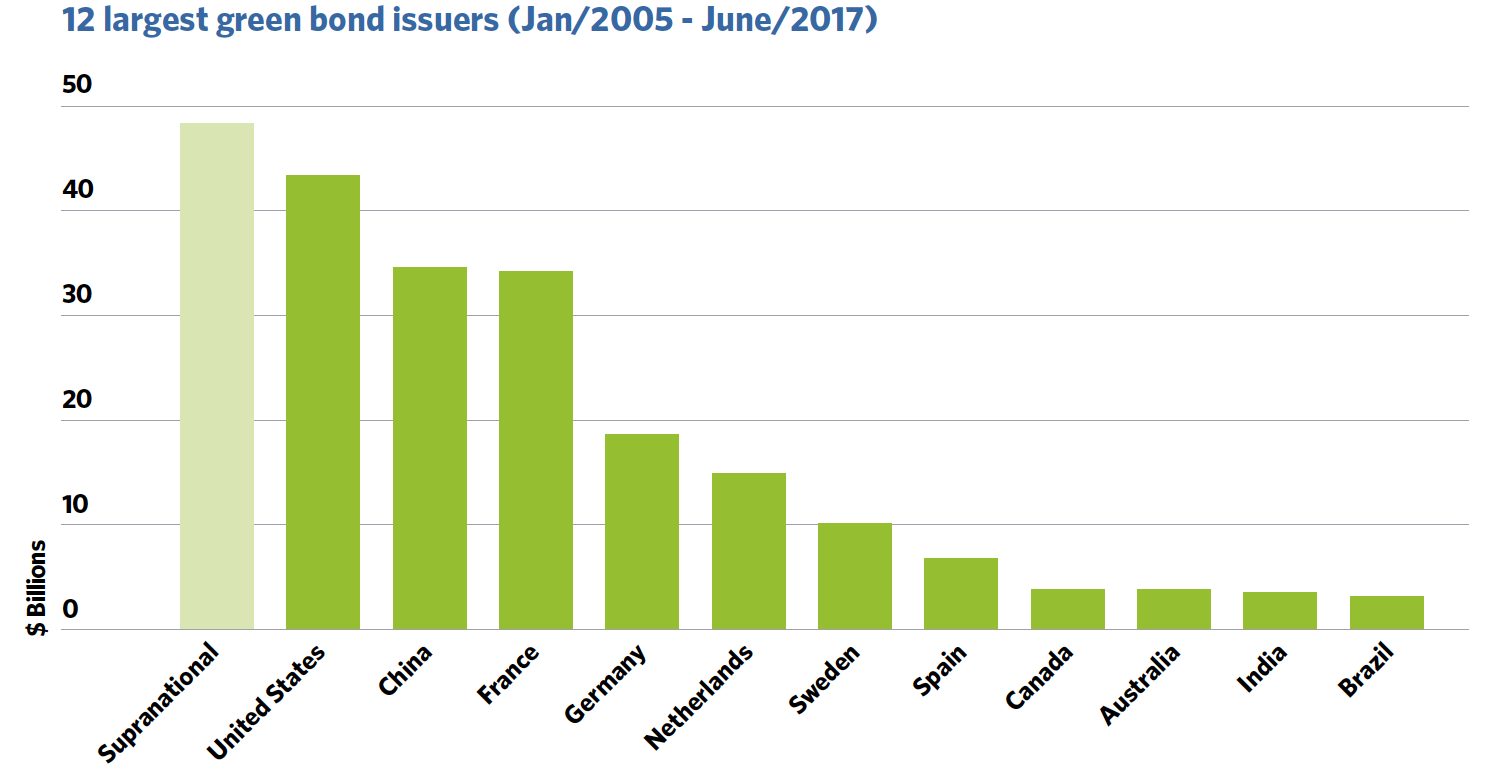

The largest labelled green bond issuers in descending order are Supranationals, USA, China, France, Germany, Netherlands, Sweden, Spain, Canada, Australia, India and Brazil.

-

New York City is amongst the largest sub-sovereign bond issuers in the U.S. The city has shown leadership in supporting best practice with both the Metropolitan Transportation Authority (MTA) and NYC Housing Development Corporation issuing Climate Bonds Certified green bonds.

-

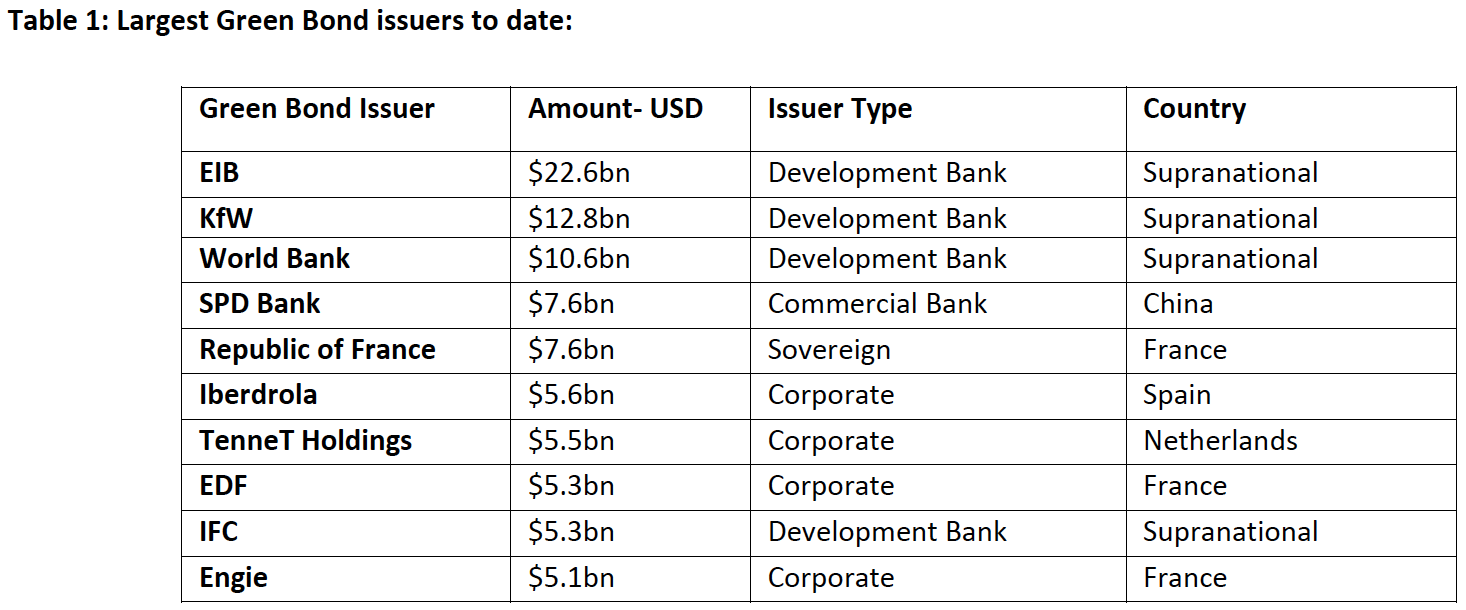

Globally, development banks are the largest green issuers with EIB, KfW and World Bank in the top three positions.

-

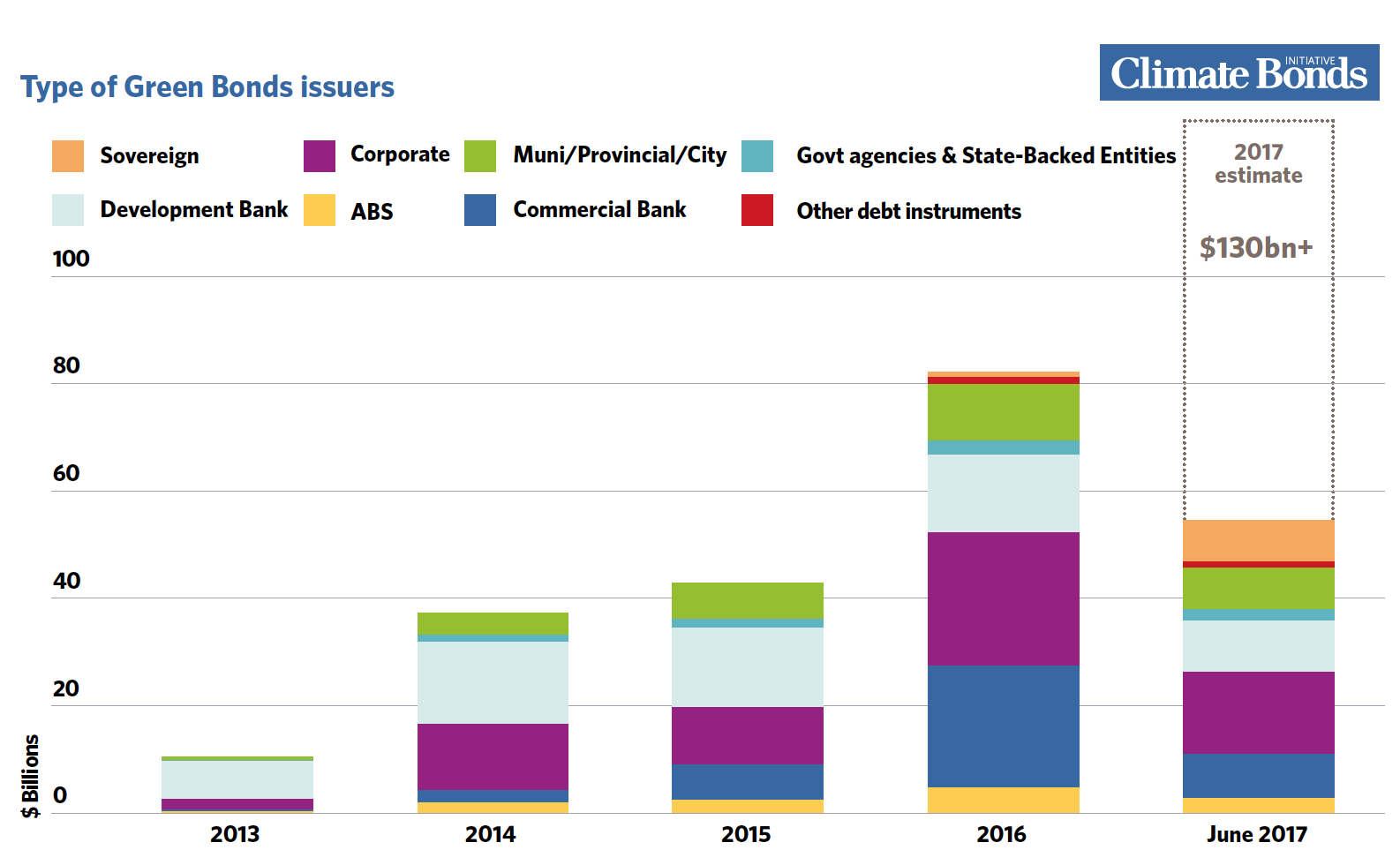

Issuance from corporates and commercial banks has grown, but demand from institutional investors continues to outstrip supply.

-

There is significant headroom for more quality green issuance, particularly from banks and corporates. Increasing bank based and corporate issuance is now a vital component in meeting climate finance targets & country climate plans.

Zoe Knight Managing Director, Group Head, HSBC Centre of Sustainable Finance:

“The report demonstrates the increasing role of sub sovereigns, and cities in the financing of climate and emissions goals. We need to accelerate sustainable opportunities for long term investment to help meet these goals. More green and climate-aligned bond issuance will improve capital allocation, create market depth and help drive the climate outcomes we are all looking for.”

Sean Kidney, Climate Bonds CEO:

“We’re making a start on green finance. But banks, corporates and governments have to be working much more closely with cities to fund climate resilient infrastructure. They must increasingly align their investments with country climate plans and build economic resilience to deal with the climate impacts to come. This also means increasing linkages with the UN’s SDGs as a vital part of the transition we face.”

Cities and Climate Change

70% of global greenhouse gas emissions come from cities, and many of the world’s most populated cities sit on coastlines, rivers and flood plains. For this reason, they are particularly vulnerable to negative impacts from a changing climate. Bonds are a key tool to finance climate resilient infrastructure in cities.

City Specific Findings

The report includes 10 city-based case studies analysing 5 that have successfully issued green bonds: New York, Gothenburg, Wuhan, Hong Kong and Cape Town; and 5 potential green issuers: Amsterdam, Mumbai, Tokyo, Lagos and Medellín.

Green Issuer: New York City

The city has shown leadership in supporting best practice and potential for future issuance is substantial. New York is a frequent issuer with total issuance since 2012 exceeding $10bn. The planned and current climate infrastructure projects include $1.7bn for subway expansion and $315m for wastewater adaptation.

Green Issuer: Cape Town

Cape Town issued its first green bond in July 2017, a ZAR1bn ($76m) a Certified Climate Bond; the first Certified green bond for South Africa, and the second South African city green bond after Johannesburg, in 2014. Proceeds are supporting transportation, energy efficiency, wastewater, and coastal resilience projects.

Potential Green Issuer: Lagos

Lagos is one of the world’s fastest growing megacities, and an economic powerhouse in West Africa. As a waterfront city with aunique set of planning and adaptation challenges, Lagos could benefit significantly from city green bond issuance across a number of sectors, which have been identified as priority areas in the Lagos State Development Plan.

Potential Green Issuer: Tokyo

Japan is home to the world’s second largest bond market. In February 2017, the Tokyo Metropolitan Government (TMG) published a ‘Green Bonds Issuance Policy’ as part of a larger constellation of environmental goal setting, establishing a path to a greener city as Tokyo revamps its infrastructure for the 2020 Olympics.

<Ends>

For more information, please contact:

Andrew Whiley

Head of Communications and Media, Climate Bonds Initiative

+44 (0) 7914 159 838

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy.

The State of the Market Report is commissioned by the HSBC and is produced on an annual basis by the Climate Bonds Initiative. This is the 6th annual report, and can be downloaded here. Previous reports can be found here.

The dataset of this year’s report is comprised of a universe of $895bn climate-aligned bonds outstanding, made up of 3,493 bonds from 1,128 issuers across seven climate themes: transport, energy, multi-sector, water, buildings and industry, waste and pollution, agriculture and forestry. The dataset includes all climate-aligned and green bonds issued after 1st January 2005 and before 30th June 2017.

**Labelled green bonds: Bonds labelled as ‘green’ by the issuer and are financing green assets and projects and form the basis of green indices.

**Climate-aligned bonds: This label is increasingly used to refer to bonds that are financing green/climate assets that help enable a low carbon economy but have not been labelled as ‘green’ by the issuing entity.

Visuals for promotional use and download