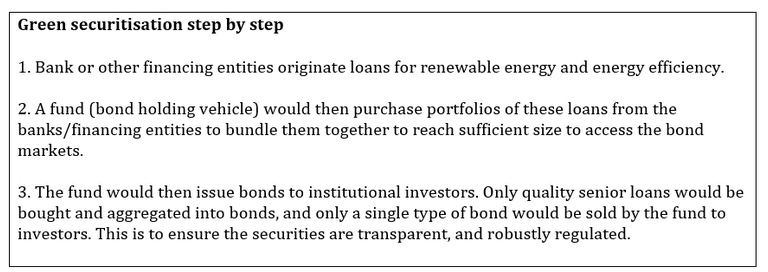

To tap bond markets, smaller loans and assets need to be aggregated and packaged in to reach the size institutional investors are demanding. Aggregation is necessary for many renewable energy and energy efficiency projects, as they are often smaller scale.

Aggregated assets can be sold onto institutional investors through the issuance of asset-backed securities. Securitisation allows the transfer from banks and other loan originators to long-term investors of the lowest risk part of the capital structure of renewable energy assets, once the projects are past the development phase, and enter the less risky operational phase. Renewable energy projects lend themselves to securitisation due to their stable income profile and low operational risks. Energy efficiency savings also provide stable revenue streams to back bond issuance.

As banks get these assets off their balance sheet, they can recycle their capital and lend to new projects in the riskier development phase to facilitate the building of new renewable energy assets. Getting assets off the balance sheets of banks is particularly attractive in the current economic climate, as banks are restricting their lending due to stricter regulation.

Policy actions

- Standards for loan contracts, installation processes, operations and management: Standards for loan contracts, installation processes, operations and management procedures creates consistency, which improves the ability of packaging loans into securities. As with standards for what is green, government can endorse and fund work on the development of principles and standards for green bonds by market actors, rather than develop them directly, to ensure that they will fit the needs of the market.

- Green warehousing: Public sector finance institutions can be sponsors of, or investors in, aggregation facilities (warehouses/conduit entities) that packages assets, and provides standards around contracts and loans accepted for packaging. Such aggregation facilities can play an important role in driving standardization of contracts and features of loans by setting out minimum requirements for green securitization.

- Green covered bonds provide an opportunity to increase transparency to underlying green assets, and provide a bridge between bonds with entity recourse and pure asset-backed securities, where bondholders are reliant solely on the performance of a defined pool of assets. In most countries where covered bonds are issued, legislation has been created to define stringent requirements that a bank needs to meet in order to be licensed to issue covered bonds, as well as the core concepts applied in structuring covered bonds. Including green assets, e.g. renewable energy and low-carbon transport assets, as eligible assets in covered bond legislation would boost green bond issuance.