Our second Market Blog for the year is no less crowded than the first. Familiar faces are beginning to re-issue, we welcome new kids to the block and green bonds go retail.

Latest Certified Bonds

Breaking news - Queensland Treasury Corp's first green bond - AUD750m (USD577m)

Just yesterday, Queensland Treasury Corp issued its first certified Climate Bond for AUD750m, becoming the second sub-sovereign in Australia to issue a green bond.

More information to come in a follow up blog.

More information about investors here.

Neerg Energy (ReNew Power) raises USD475m in secured green bond

This new 6-year tenor bond is the second green issuance from India based ReNew Power, following their Climate Bonds Certified August 2016 debut.

The Economic Times reported that the bond traded at about 38 basis points tighter than the initial guidance, allowing the firm to secure cheaper financing.

Proceeds will be used for refinancing solar and wind power projects of its subsidiaries, across 5 Indian States (Andhra Pradesh, Madhya Pradesh, Karnataka, Gujarat and Maharashtra).

The Verification was undertaken by Emergent Ventures.

Underwriters: Bank of America Merrill Lynch, Goldman Sachs, HSBC, JP Morgan and UBS

NY MTA’s USD313m green bond

New York’s Metropolitan Transportation Authority , the largest certified climate bond issuer of 2016, have kicked off their 2017 green bond year with their latest USD313m green bond.

They have again offered a retail investor component in this issuance, with ads up on screens at major stations, a follow up from their “Invest in the Planet Invest in the MTA” offer to New Yorkers in their inaugural certified green bond of February 2016.

MTA went a step further by becoming one of the first green bond issuers to take advantage of the Climate Bonds new Programmatic Certification option.

The programmatic approach allows issuers with large pools of eligible assets who aspire to be frequent issuers of Certified Climate Bonds - such as MTA - to issue multiple Certified bonds using a streamlined pre and post issuance reporting processes, while maintaining the environmental integrity that the Climate Bonds Standard ensures.

Sustainalytics has verified that from MTA’s 2010-2014 Capital Plan, a multi-billion pool exists of assets and projects that are eligible under the Low-carbon transport criteria of the Climate Bonds Standard.

This latest bond will refinance existing low carbon transport projects including stations and subway cars on the subway system in New York.

The transport authority has now raised nearly USD1.7bn in green bonds since February 2016.

Underwriter: Bank of America Merrill Lynch

PS: The sharp-eyed blog devotee will also note new retail offerings from Canada and via two new ETFs. Are green bonds breaking out into retail? We’ll have more to say on this in a future post.

Australia’s FlexiGroup returns to market for second green certified securitisation- AUD50m (USD38.3m)

Flexi broke new ground in Australia last year when it issued the first Climate Bonds Certified structured green ABS deal. This latest transaction is again certified and is part of a larger Asset Backed Securitisation sale totalling AUD265m. Debt raised will refinance residential rooftop solar PV systems and other equipment such as batteries and inverters.

Flexi’s April 2016 transaction obtained a 5bp green premium or “greenium” in the overall AUD260m securitisation and there is a Nasdaq report discussing a pricing benefit in this second offering.

The approved verifier was DNV GL.

Underwriters: Commonwealth Bank of Australia, National Australia Bank

National Australia Bank’s second certified green bond – EUR500m (USD528m)

The bank issued their second Climate Bonds Certified green bond after the order book was well oversubscribed.

Proceeds from the bond will refinance renewable energy and low carbon transport projects and assets in the UK, Europe, Australia and the Americas, including wind and solar energy generation, and electrified rail infrastructure including electric rolling stock.

NAB have committed to undertaking environmental financing activities of USD18bn by 2022.

According to their press release, the renewable energy assets earmarked for refinancing by this bond are expected to have an installed capacity of approximately 1.1GW – this is estimated to represent avoided GHG emissions of around 1.69 million tonnes annually.

NAB holds the distinction of being the first green bond issuer in Australia with a December 2014 transaction and has been involved in supporting several other Certified Climate Bonds, including the July 2016 Treasury Corporation of Victoria green bond.

Underwriter: CITI, HSBC, NAB

Sovereign & Sub-sovereign

First ever green bond from Argentina! La Rioja Province - USD200m

La Rioja Province issued Argentina’s first green bond in late February, USD200m. Deemed "historic" by its Lieutenant Governor, this is the first time the province has accessed international funding.

The issue will fund the expansion of the Parque Eólico Arauco SAPEM wind farm, increasing generation capacity by 300MW. Arauco SAPEM operates 24 turbines across the country.

This development is in line with Argentina's governmental renewable energy tender RenovAr, a policy kick-started in 2016 that has already initiated more than 1GW of renewable projects.

The Arauco wind farm is located in the North West part of Argentina where wind conditions help achieve a capacity factor of 40%. Operation started in 2012 and generates electricity for water pumping, which is used to increase the irrigation capacity of the region’s productive areas.

Maturing in 2025, the USD200m offering has a fixed yield rate of 9.75% per annum, with repayment in four years. More details in this press release in Spanish here.

Underwriter: UBS

Québec Province’s inaugural green bond – CAD500m (USD373.8m)

Canada’s Quebec Province became the second province in Canada to issue a green bond -with its CAD500m, 5-year inaugural green bond

Proceeds will finance 4 public transit projects identified and chosen by the ministerial-level Green Bond Advisory Committee:

- 52 new metro rail cars (60-100%)

- 258 hybrid buses (0-20%)

- Metro infrastructure upgrade, part of the Réno-Infrastructures project (0-10%);

- Metro network operational stationary equipment (0-10%)

The bond was well received, with an order book of over CAD1.1bn. Over 60 investors participated in the deal with 60% from Canada, 28% from the US, 8% from Europe and the rest from Asia. Fonds de solidarité (FTQ) took 4% of the allocation (FTQ is a development capital fund that channels the savings of Quebecers into investments)

The Québec green bond framework received a second opinion from CICERO.

The good news is that the Province plans to become a regular issuer in this market. Félicitations ami(e)s Québecois(es), l’affaire est ketchup!

Great to see more climate action and mobilisation from Canada’s provinces, a point notedby Banque Du Canada Deputy Governor Tim Lan’s address to the 2nd March Finance and Sustainability Initiative in Montréal.

Underwriters: HSBC, RBC, TD

Corporate

First green bond ever from Slovenia! Gen-I Sonce issued EUR14m (USD14.7m) for solar.

Another new kid on the block – this one from Eastern Europe.

Maturing in 2024, the green bond will be used solely for the purpose of financing green energy projects (exclusively solar) for Gen-I Sonce. A subsidiary of Gen-I, the firm provides electricity and solar power plants installation services to households and businesses across Slovenia.

The two bond investors were SID Banka and Nova KBM.

It’s a small green bond but it’s refreshing to see new entrants in the market, congratulations to Gen-I Sonce!

Fabege raises more green financing via SFF – 2 green bonds of SEK300m (USD67.5m) in less than 2 weeks!

Swedish property company Fabege has issued two green bonds in two weeks (early and mid-February 2017) for a total of SEK600m/USD67.5m via subsidiary SFF.

Fabege has a goal to increase green financing, which now represents 21% of Fabege's total funding. The company intends for its entire property portfolio to be environmentally certified by 2018.

The company also raised another SEK300m (USD34m) under its own name. This press release mentions a persistent high demand for the company’s green bonds, with oversubscription over 4x for this issuance.

Underwriters: Swedbank

Iberdrola’s whopping new EUR1bn (USD1.06bn) green bond – first of 2017

Spanish Iberdrola, the largest corporate green bond issuer of 2016, just kicked off 2017 with a big one - a EUR1bn 8-year green bond.

The bond received a second opinion from Vigeo Eiris.

Book orders reached EUR2.3bn from more than 100 big investors.

The money raised will refinance existing and on-going onshore and offshore wind projects in Spain, the UK and Germany and managed by Iberdrola’s subsidiaries.

The list of selected eligible projects includes:

- 6 onshore wind parks in Spain totalling 226MW;

- 5 onshore wind parks in the UK 365MW or 219,000 homes;

- 1 offshore windfarm in the German Baltic Sea,350MW, the first of 70 turbines was installed last month.

Since their green bond debut in 2014, Iberdrola have raised more than USD5.3bn in green debt!

Underwriters: Banca IMI, BBVA, Citi, HSBC, NatWest Markets, Santander, SMBC

Huarong Financial Leasing issued RMB2bn green bonds in two tranches (USD292m)

Another new entry from China, Huarong Financial provides various leasing services across manufacturing, transport, environmental sectors and energy.

Proceeds will be used for 3 direct leasing projects in energy saving and clean energy sectors and 6 leaseback projects in pollution prevention, ecological protection and adaptation and clean energy sectors.

Typical projects to be financed are also disclosed and include solar farms and sewage plants.

Underwriter: China Development Bank, Exim Bank of China, Donghai Securities, Agricultural Bank of China, Merchants Bank of China

External Review from EY here.

Canadian CoPower’s second retail green bond (CAD20m, USD15m)

CoPower, a Canadian clean energy investment platform, has closed its second retail green bond totalling CAD20m.

CoPower green bonds are backed by a diversified portfolio of solar, LED and geothermal projects across North America. The underlying portfolio of project loans will continue to grow as proceeds from the sale of bonds are used to lend to more projects.

Proceeds will be used to refinance loans previously made by the platform including rooftop solar projects in the Ontario cities of Windsor and Chesley, condominium LED retrofits and an energy efficiency project in Toronto.

The minimum investment required from retail investors is CAD5,000.

The USD20m offering was made to five impact investors financing a revolving credit facility that provides CoPower access to flexible capital. As explained by this infographic, the revolving structure of the Credit Facility means that investors leverage their capital repeatedly and multiply their impact.

The company is also a Certified B Corporation, meaning it meets high standards of social and environmental performance, accountability, and transparency.

We receive lots of enquiries about retail green bonds so it’s good to see some starting to appear!

Commercial Banks

SEB’s first green bond – EUR500m (USD531m)

After being a pioneer in the market since the very beginning and having facilitated the issuance of USD13.8bn in green bonds, SEB have finally issued their own green bond.

Proceeds will finance or refinance the following eligible projects:

-

Renewable energy including:

-

wind, solar, small scale hydro power, tidal, geothermal and bio-energy

-

-

Energy efficiency/green buildings

-

Projects/technology/processes leading to 25% energy efficiency gain

-

LEED Gold, BREEAM Very Good or equivalent,

-

Commercial/residential buildings with energy use per m2 at least 25% lower than Swedish codes

-

Major renovations leading to 35% energy per m2 energy use

-

-

Clean transport

-

transport systems based on non-fossil fuel based fuel or hybrid technology

-

-

Pollution prevention and control

-

waste management: waste-to-energy, methane capture, waste reduction

-

reduction of CO2, Sox, NOx particulates

-

wastewater management

-

-

Sustainable forestry: forestry projects with certification from FSC or equivalent

There is a good level of detail disclosed for project types with great ambition shown in the buildings space – e.g. LEED Gold equivalent is in line with the Climate Bonds low carbon buildings criteria. Within potentially controversial areas like hydro and forestry, additional parameters are given (<10MW limit for hydro, FSC certification for forestry).

CICERO provided the second opinion on SEB’s Green Bond Framework.

PwC was mandated to analyse SEB's processes and systems for separating green borrowing and lending.

The final pricing at MS+20bps was the tightest of any EUR senior unsecured benchmark issued by a bank, post financial crisis. This followed from a highly oversubscribed order book in excess of EUR 2.1bn.

The final order book had broad participation across Europe, including investors from Germany and Austria (26%), Benelux (20%), Nordics (19%), France (19%), UK/Ireland (10%), Switzerland (3%) and other regions (3%).

Underwriters: SEB, ABN Amro, HSBC

Wuhai Bank comes to market with its first RMB500m (USD73m) green bond

Proceeds of this bond will be used to finance a wide range of projects under the PBoC’s Guidelines, including energy saving, clean transport, clean energy, pollution prevention, resources conservation and recycling.

Specific projects include solar, wind, hydro and geothermal energy, to replace the use of fossil fuel use. In the Clean Energy Category, there is no indication that clean coal projects will be financed.

Founded in 2010, Wuhai Bank is a regional commercial bank, operating in China’s northern autonomous region, Inner Mongolia. The bank is headquartered in Wuhai City, whose economy is heavily based on coal mining, electric power generation, metal-working and chemical industries.

Many Chinese coal cities are looking for a transition to low carbon economy through green bonds. Climate Bonds was invited to another big Chinese industrial city, Datong, to give suggestions on developing green city bonds last year.

Underwriter: Guotai

China Credit Rating provides a second opinion.

Development Banks

Agricultural Development Bank of China makes second tap of RMB4bn (USD 582m)

Following their first RMB 6bn issuance in last December, Agricultural Development Bank of China just issued the second RMB 4bn tap on 27th February.

Proceeds of this tap will be allocated to 42 forest projects. It is worthwhile noting that the bank’s initial issuance last year received was 4.5 times oversubscribed.

CECEP provided the second opinion.

KfW re-opening – GBP250m (USD311.5m)

German development bank KfW has just made a GBP250m second tap of its sterling issue in November 2016. This raises the total value of the bond to GBP500m. Proceeds will finance renewable energy projects as with previous KfW green bonds.

Underwriters: Citigroup, Deutsche Bank and TD Bank

KfW is one of the largest issuers in the green bond market, with over EUR9bn outstanding.

Government Agencies

Inaugural green bond from Caisse des Dépôts et Consignations (CDC) – EUR500m (USD531m)

French public sector financial institution, Caisse des Dépôts et Consignations, has just issued its inaugural green bond for EUR500m, continuing the French flavour of 2017.

Vigeo Eiris provided the second opinion on the bond. The green bond framework is available in French as well as the full list of eligible projects.

Net proceeds will be used to finance and refinance existing eligible assets in France or Europe included under the 3 categories:

Renewable energy, 24% of the use of proceeds:

-

construction and development of electricity production units with more than 85% of its production from solar, wind, geothermal, micro-hydropower, biomass, or wave and tidal

-

construction and development of heat production units with more than 85% of its production from solar, geothermal, or biomass. The units will have to emit less than 500g of CO2 per MWh and will have to obtain the ‘Ecoréseau de chaleur’ label

-

The eligibility list describes 4 biomass projects, and a large number of wind, geothermal and solar projects.

Real estate, 66%:

-

construction or renovation of buildings with at least a minimum level of LEED Gold, BREEAM Very Good and other equivalent French certifications

-

The list notably includes the constructions of 7 nursing homes.

Site rehabilitation, 10%:

-

remediation of polluted soils in urban zones

This inclusion of these renewable energy and real estate assets are in line with Climate Bonds criteria in these area e.g. Climate Bonds solar criteria state that solar thermal generation may use a maximum of 15% gas-fired power as a backup while our Low Carbon Buildings criteria also use LEED Gold and BREEAM Very Good as minimum hurdle rates.

While we do not have criteria in place for soil remediation yet, there will be clear environmental benefits and possibly climate benefits to such projects.

The issuer will track the net proceeds in two dedicated accounting sections of its treasury and the management of proceeds will be reviewed annually by an external auditor.

CDC expects to issue around EUR3bn of bonds by the end of this year.

Underwriters: BNP Paribas, Crédit Agricole, HSBC, JP Morgan, Natixis and SocGen

Municipal

DC Water and Sewer Authority’s new USD100m green muni bond

The District of Columbia Water and Sewer Authority (D.C. Water) has issued a USD100m green bond financing a 25-year municipal sewage clean-up project as part of the DC Clean Rivers Project. This is part of a larger USD300m transaction.

The project is scheduled to be fully implemented by 2030. It will help to reduce flooding in certain districts and is also expected to reduce sewer overflows by 96%. D.C. Water will make annual green bond issuances to fund the project through to its scheduled completion in 2030.

Flood protection is essential to ensure the resilience of cities and municipalities.

Green bonds now account for 20% of DCW’s outstanding debt.

The bond received a Moody's green bond assessment (GBA) of GB1 (Excellent).

Underwriters: Goldman Sachs, Ramirez & Co.

It is good to see such buoyant green bond market activity in the US space, considering the recent US muni bond outlook for 2017.

Martha's Vineyard Land Bank’s second green muni bond (USD20m)

This is the second green bond issued by Martha’s Vineyard since 2014.

The prospectus states that proceeds will be used to refinance environmentally beneficial projects located on the 93km2 Martha’s Vineyard island, located off the coast of Cape Cod, Massachusetts.

Projects include the 8.5ha Ocean View Farm Preserve and the 1.1km2Three Ponds Reservation. Both parks are used for activities including nature study, hiking, picnicking, biking, horseback riding, mountain-biking, dog-walking, fishing, kayaking, farming or hunting.

From both a climate and a broader environmental point of view - parks and recreation bonds like these are pale green - a ‘nice to have’ rather than a ‘have to have’ as they are unlikely to have a strong environmental or climate impact.

It’s nice for local citizens and there’s value in that but they won’t get us to the USD1tr in green bonds by 2020 objective needed to help reach global climate goals.

Underwriter: RBC

ABS and MBS

Solar Mosaic's USD139m green securitisation ABS

California-based Mosaic closed its first green labelled securitization of consumer loans for solar rooftop. Mosaic provides solar loan financing solutions for homeowners.

The offering will enable Mosaic to continue to provide loans for residential renewable energy projects by providing financing to homeowners for loans that enable the sale and installation of residential solar energy systems.

The deal generated overwhelming investor demand and achieved an oversubscription level of 5.6x the offering size.

Mosaic has originated over USD1bn in solar loans since inception, and expects to be a frequent issuer in the securitization markets.

The ABS received a second opinion from Sustainalytics.

Underwriters: BNP Paribas, Guggenheim Securities

Fannie Mae’s inaugural Green REMIC (USD611m)

US Fannie May priced its first green REMIC (Real Estate Mortgage Investment Conduit) tranches maturing in 2027, backed by exclusively green collateral.

The USD611m green tranches were part of a larger USD1bn bond.

The collateral in this deal consists of mortgage loans backed by multifamily properties that meet one of two criteria:

-

Possess a recognised green building certification (e.g. LEED or ENERGY STAR)

-

Use a portion of the loan to ensure that the property achieves at least 20% annual reduction in either energy or water consumption.

Fannie Mae's Multifamily Green Financing Business provides financing through several different green product offerings. The aim is to incentivise borrowers to undertake energy- and water-savings improvements to their properties via preferential borrowing rates.

We’re very enthusiastic about mortgage giant Fannie Mae joining the green bond market and especially in their preferential borrowing rates for green.

We do, however, think that for the first criteria, more ambitious hurdle rates should be pursued for next time.

Our view, based on the research of our Technical Working Group for the low carbon buildings criteria is that to achieve significant climate impact, buildings should be certified to at least LEED Gold or equivalent rather than just any level of certification (as in the first criteria).

The second criteria is aligned with Climate Bonds criteria in that it specifically targets energy/water consumption improvements – but at 20%, the hurdle isn’t as ambitious as the 30% - 50% we ask for in our Low Carbon Buildings Criteria.

While this is Fannie Mae’s first labelled green product, it states that in 2016 it delivered USD3.6bn in mortgage backed securities to the market for multifamily properties with a Green Building Certification such as LEED and ENERGY STAR or properties committing to reducing their energy or water consumption by 20%.

Prospectus available here.

Underwriters: Citi, Nomura, KGS-Alpha Capital Markets, CastleOak Securities

Other green debt instruments

Green loan from BBVA - EUR500m (USD534m)

Spanish bank, BBVA provided a EUR500m green loan to the multinational electric utility Iberdrola earlier in February.

The purpose of this loan is to fund several projects related to energy efficiency and renewable energy.

Access Iberdrola’s press release in Spanish here. The loan received a second opinion from Vigeo Eiris.

Bonds not yet aligned with international definitions and best practice

Longfor Properties’ RMB 1billion (USD150m) Green Bond

Longfor is a Chinese property developer listed on Hong Kong Stock Exchange. This RMB 1bn green bond will be mainly used for green buildings development.

They have disclosed that 70% proceeds will finance projects including office buildings, a hotel, and a commercial centre. All of them are located in a newly developed business district in Shanghai City.

The projects received at least a 2-Star Certificate from the Evaluation Standard for Green Buildings, which is equivalent to LEED Silver. This is a widely-used Chinese domestic green building standard and was developed by the Ministry of Housing and Urban-Rural Development.

This bond will not be included in our data as 30% of proceeds will be used for the corporate’s general operations.

Although NDRC regulations allow issuers to use up to 50% of bond proceeds to repay bank loans and invest in general working capital, this bond is not in line with international expectations that at least 95% of proceeds must be linked to green assets or projects.

Dongjiang Environment issues first green bond for RMB 1bn (USD 144m)

Another new entrant to the market, Dongjiang Environment is an environmental service provider in China. It is focused on resource recovery, industrial and municipal waste treatment as well as environmental engineering.

They have disclosed that the RMB540m proceeds will be used to finance 4 projects including waste-to-energy facilities, recycling facilities and recycled products, which are in line with Climate Bonds definitions.

However, the remaining RMB460m will be used to refinance 7 other projects, including at least RMB 70 million that will go to landfill projects without gas capture process.

Although this is permissible under NDRC’s guidelines, we excluded this bond as it’s not in line with our taxonomy, however it it is included in our China domestic listing and our annual China based green bonds reporting.

This is the first green bond to be listed on the Shenzhen Stock Exchange.

No second opinion was provided.

Underwriter: GF Securities

China Development Bank’s RMB5bn (USD728m)

Following the green bonds issuance by Exim Bank of China and the Agricultural Development Bank late in 2016, the third of the policy banks, China Development Bank (CDB), issued its inaugural green bond on 21st February.

The bond is themed as “Air Pollution Prevention”, proceeds will be used for 9 projects under Energy Saving, Clean Transport and Clean Energy categories, etc. The expected environmental impact includes: reductions of 137K tons of CO2, 591 tons of PM, 1584 tons of SO2, 351 tons of NOx, etc.

CDB is primarily responsible for raising funding for large infrastructure projects. Debts issued by CDB are usually treated as risk free assets and it is also exempt from providing bond ratings on the China Interbank Bond Market. Of note, the bond was issued on a tender basis, which means the coupon rate is determined by auctions from investors.

However, among the project examples given by CDB, we found a project titled “Replacing Small Units with Large Ones (RSWL)”.

Although replacing small coal-fired power stations with larger ones can improve efficiency and ‘clean coal’ projects are included in the PBoC’s green Catalogue, any projects relating to coal are excluded from our database.

External review was provided by PwC.

Gossip

This section is growing a life all its own, so again we’ve arranged it into some categories for you.

On the green horizon:

Nigeria plans a USD64m green bond issue by April; list of preliminary eligible projects here.

IBank (California Infrastructure and Economic Development Bank) approved USD450 Million of Green Bonds issuance For State Water Resources Control Board.

India’s Rural Electrification Corporation (REC) to raise green bonds?

Swedish real estate company Atrium Ljungberg has developed a green framework aimed at issuing green bonds.

Lawrence City (Kansas) commissioners approved USD11.3 million in energy-efficient improvements to lighting, heating and cooling systems financed by green bonds.

Norwegian real estate Entra contemplates green bond issuance

Sovereign and policy news:

Poland considers another green bond issuance according to Polish newspaper Puls Biznesu.

In comments reported by Radio Poland, following their 2017 Green Bond Pioneer Award, Deputy Finance Minister Piotr Nowak signalled another bond later this year. If your Polish is good, the original Polska Agencja Prasowa story is here.

Nigeria - Amina J Mohammed Chairs Green Bond Program Administrative Team Meeting before inaugural sovereign green bond to be launched next month.

Federal Government of Nigeria meets investors on issuance of Sovereign Green Bonds.

Climate Bonds is providing technical advice to Nigeria on this project.

The Kenya Bankers Association and the Nairobi Security Exchange are working on publishing their Green Bond Guidelines. Climate Bonds is one of the coordinators in the Kenyan sovereign green bond program.

Central Bank of Russia conducts "Review of financial market regulation: green bonds", available in Russian only.

India targets green bond development. Indian Green Bonds Market Development Council Meets in Mumbai.

Asean Green Bond Standards are being developed by the Asean Capital Markets Forum (ACMF) in collaboration with the International Capital Market Association (ICMA).

Reading, reports, moving pictures:

Nigeria Green Bonds Summit: Nigeria targets 30% Renewable Energy by 2030. (2m51s)

Find a short and sweet interview from our CEO Sean Kidney on Bloomberg TV Canada about the Quebec green bond, global growth trends and 2017 predictions. (6m22s)

Joint Climate Bonds & CCCEP-LSE Report: How to grow green securitisation in Europe: Building a USD80bn+ market. Download here .

Cambridge Institute for Sustainability Leadership (CISL) and ClimateWise published the report “Investing for Resilience”, which explores how the insurance industry can contribute to redirecting substantial flows of capital into resilience enhancing investments.

Share Action's new investor guide for engaging with banks on climate change is out.

Climate change could threaten the entire financial system, Australian financial services regulator APRA warns.

Green bonds made it to the Daily Mail!

LBBW’s (Landesbank Baden-Württemberg) new piece of research on Green Bonds is out (German only).

French current affairs clip from BFM Business about green bond funds. Explores recent retail ETF offerings from Lyxor and Van Eck. (3m29secs)

Green Bond reporting:

Apple published their first Annual Green Bond Impact Report.

NIB’s Environmental Bond Report 2016 out.

Bancolombia is ready to lend around USD55m to clean-energy projects with money raised via its inaugural green bond.

Green bond Funds and investors:

Solactive and Lyxor launch USD & EUR green bond index with the help of the Climate Bonds Initiative.

Lyxor launches green bond ETF;

VanEck launches green bond ETF;

Natixis launches green bond fund.

S&P Dow Jones Indices launches S&P Green Bond Select Index.

NN Investment Partners includes green bonds in recently launched sustainable multi-asset fund.

AP3 (Sweden’s third national pension fund) is reported to have doubled its green bond holdings (rising to SEK9.5bn in 2016 from SEK4.5bn in 2015).

Second AP Fund Publishes 2016 Sustainability & Corporate Governance Report and return figures on its green bond portfolio.

Deutsche AM enters ESG corporate bond ETF market.

Canadian Montrusco Bolton Investments announces the introduction of green bonds to its portfolio.

Huxford Group has pledged to invest a minimum of USD100m into green bonds by the end of this year.

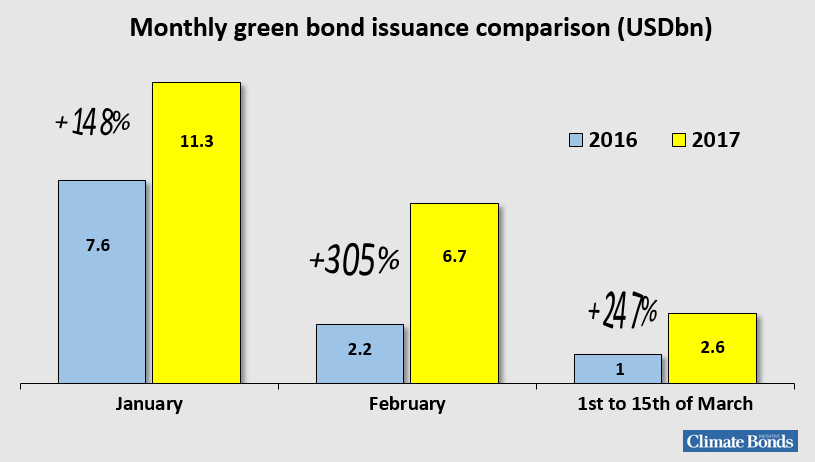

Graph of the month (as of 15 March 2017)

Monthly green bond issuance comparison indicates 2017 is well on its way to overtake 2016:

VanEck is a partner of the Climate Bonds Initiative.

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.