You can still register to the ‘Global Forum for the expanding Green Bonds Market’ taking place in London on the 29th April (next Wednesday!).

You’ll qualify for a free pass if you’re:

You can still register to the ‘Global Forum for the expanding Green Bonds Market’ taking place in London on the 29th April (next Wednesday!).

You’ll qualify for a free pass if you’re:

By Tess Olsen-Rong, Climate Bonds Market Analyst

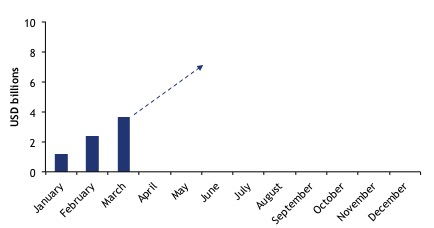

The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the works and we expect Q3 and Q4 in particular to be strong in the lead up to the UN COP.

From a slow Q1 2015 start green bond issuance is climbing

Last week the European Commission’s Directorate-General of Climate published report on mobilising private finance for climate, co-authored by the Climate Bonds Initiative.

Three weeks ago we released our Climate Bonds Bioenergy Standard for public consultation. Bioenergy is energy made available from materials derived from biological sources such as wood, manure or other agricultural byproducts. Using waste products is preferred due to reduced social and environmental risks. The focus of the proposed criteria is on liquid biofuels, biogas, and solid biomass used for heat and electricity.

We’ve had some interesting responses, including suggestions that climate change benefits from biofuels – one of the forms of bioenergy addressed – are “a fallacy”. Well, that’s not quite right.

Washington DC: A couple of blocks down from the White House, the World Bank and IMF buildings on Pennsylvania Avenue were buzzing last week with activity, as top policymakers, private sector actors, development banks, and civil society organizations descended on the city for the annual World Bank/IMF Spring Meetings this week.

Development Banks

EXIM Bank of India issues inaugural $500m green bond (5yr, 2.75%, BBB-/Baa3) to fund low-carbon transport, solar and wind projects

‘China – the game changer’ was a phrase that recurred in several articles in March that reported on the growing climate awareness of the political elite in China. They also reported on the key reform recommendations that Climate Bonds Initiative, IISD and the Chongyang Institute for Financial Studies at Renmin University of China put forward to the Chinese policy makers in the whitepaper released in March.

The emerging market flavour of the digest in March is amplified by the coverage of developments in India (2nd green bond issued) and potential bond issuance from UEA.

Update to the Green Bonds Principles and the standards for green bonds were high on the media agenda too.

Today, in Amsterdam, 110 attendees, including investors, rating agencies, supras, government reps and green bond consultants are getting together discuss the future of the green bonds market.

The event is hosted by Mr Berry Marttin, Member of the Executive Board of Rabobank and the keynote speech will be delivered by former Prime Minister of the Netherlands Prof. Jan Peter Balkenende. Sean Kidney, CEO of the Climate Bond Initiative is chairing the interactive discussion. Investor representatives present include Actiam, Delta Lloyd and KfW AM, APG Asset management, PGGM and Candriam.

Join us in Washington DC next week on 17 April 2015, 8.30-10.30am, for a briefing from Sean Kidney (plus surprise guests!) on what's happening and where we're going with the bubbling green & climate bonds market.

Topics:

- The changing landscape of the green bond market and where it's going next.

- How the US green muni market is taking off (and about out new Green City Bond campaign with C40, NRDC, Ceres, CDP and others).

- How Green Bond markets are stirring in China, India and other emerging economies.

- How assurance of green credentials (standards and second opinions) will help the corporate green bond market grow.

Development bank issuance

Massive demand for KfW’s third green bond offering, and first ever kanga bond, sees it upsize to A$600m ($456m) and its still oversubscribed! 5.25yrs, AAA, 2.4% coupon

After a blazing entry to the green bond market last summer German development bank KfW continued to lead with a Kanga (Australian dollar denominated) bond to the tune of A$600m ($456m). It’s KfW’s first ever Australian dollar bond.