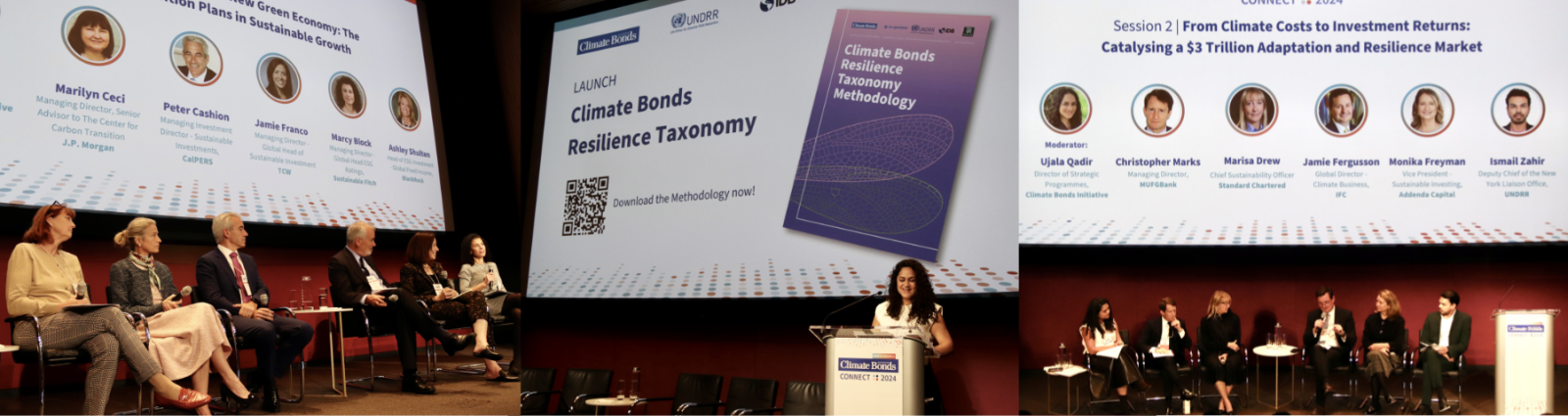

The North American edition of Climate Bonds CONNECT 2024, hosted by Sustainable Fitch at Hearst Tower, brought together senior leaders, investors, asset managers, and prominent representatives from the financial and intergovernmental sectors, energised by the NYC Climate Week atmosphere. This event offered a unique platform for impactful dialogue on sustainable finance and advancing climate action.

The discussion centred around accelerating the green transition and introducing a key new tool in sustainable finance — the Climate Bonds Resilience Taxonomy. This expansion of the Climate Bonds taxonomy is designed to guide investment in projects that address the dual challenges of climate mitigation and adaptation, focusing on sectors such as infrastructure, agriculture, and community resilience.

Driving the Green Transition

Participants explored the critical need to shift financing towards low-carbon technologies and sustainable infrastructure. Central to these discussions was the recognition that achieving climate goals will require rapid, large-scale investments across industries. Speakers highlighted that aligning capital flows with green transition goals is not just an environmental necessity but also a financial opportunity for investors, offering long-term stability and returns in a changing market.

One key takeaway was the importance of onboarding companies and investors at various stages of their green transition journey. By offering tailored financing solutions, financial institutions can support organisations as they implement incremental sustainability measures. This approach aims to transition entire sectors toward greener practices, providing clearer pathways for industries that are not yet fully aligned with net-zero targets but are willing to make progressive changes.

The Resilience Taxonomy Launch

The highlight of the event was the launch of the Climate Bonds Resilience Taxonomy, presented by Ujala Qadir. It sets out standardised criteria for classifying investments that build resilience to climate impacts. This framework addresses the growing demand for resilience-focused financial products and ensures that investment decisions are based on solid, measurable outcomes. The Resilience Taxonomy is expected to unlock trillions of dollars for critical infrastructure and adaptation projects, making it easier for investors to identify and support projects that offer long-term resilience in the face of climate risks.

The Future has been decided: it will be green and resilient!

The sessions made it clear that the green transition and resilience must go hand in hand. The CBRT bridges gaps in the market by creating a unified approach to both mitigation and adaptation, ensuring that future projects will be climate-proof and scalable.

"In our work to address climate, we must always be conscious of the broader challenges and opportunities — recognising that investments in resilience today aren’t just about reducing risk; they’re about creating stronger, healthier communities and economies. With a mix of solutions, from energy security to social resilience, we can turn the tide for future generations."

Sean Kidney, CEO, Climate Bonds Initiative

Acknowledging Our Sponsors

We extend our deepest gratitude to the sponsors who made this event possible. Special thanks to Sustainable Fitch, our venue sponsor, and Scotiabank, our gold sponsor, whose dedication to sustainability and resilience helped shape key discussions throughout the conference. We also thank MontRose Software and CUSIP Global Services for their support as sponsors, as well as our media partners, Climate & Capital Media and Green Central Banking, for amplifying the event's critical messages.

We're excited to see you next year at the Climate Bonds CONNECT 2025 edition!