Climate Bonds has recorded a cumulative volume of USD5.1tn in green, social, sustainability, sustainability-linked bonds (SLBs), and transition bonds (collectively GSS+) as of 30 June this year. Aligned with Climate Bonds dataset methodologies and best practice, the findings are detailed in the Sustainable Debt Market Summary H1 2024 with a breakdown of labelled bond markets.

While global interest rates remained higher than had initially been expected going into 2024, global debt issuance climbed to USD13.2tn during this period compared to USD9.8tn in H1 2023, an increase of 35%. Nevertheless, the GSS+ market is thriving, with new issuers progressively entering the market and volumes set to surpass the annual record of $1trillion set in 2021.

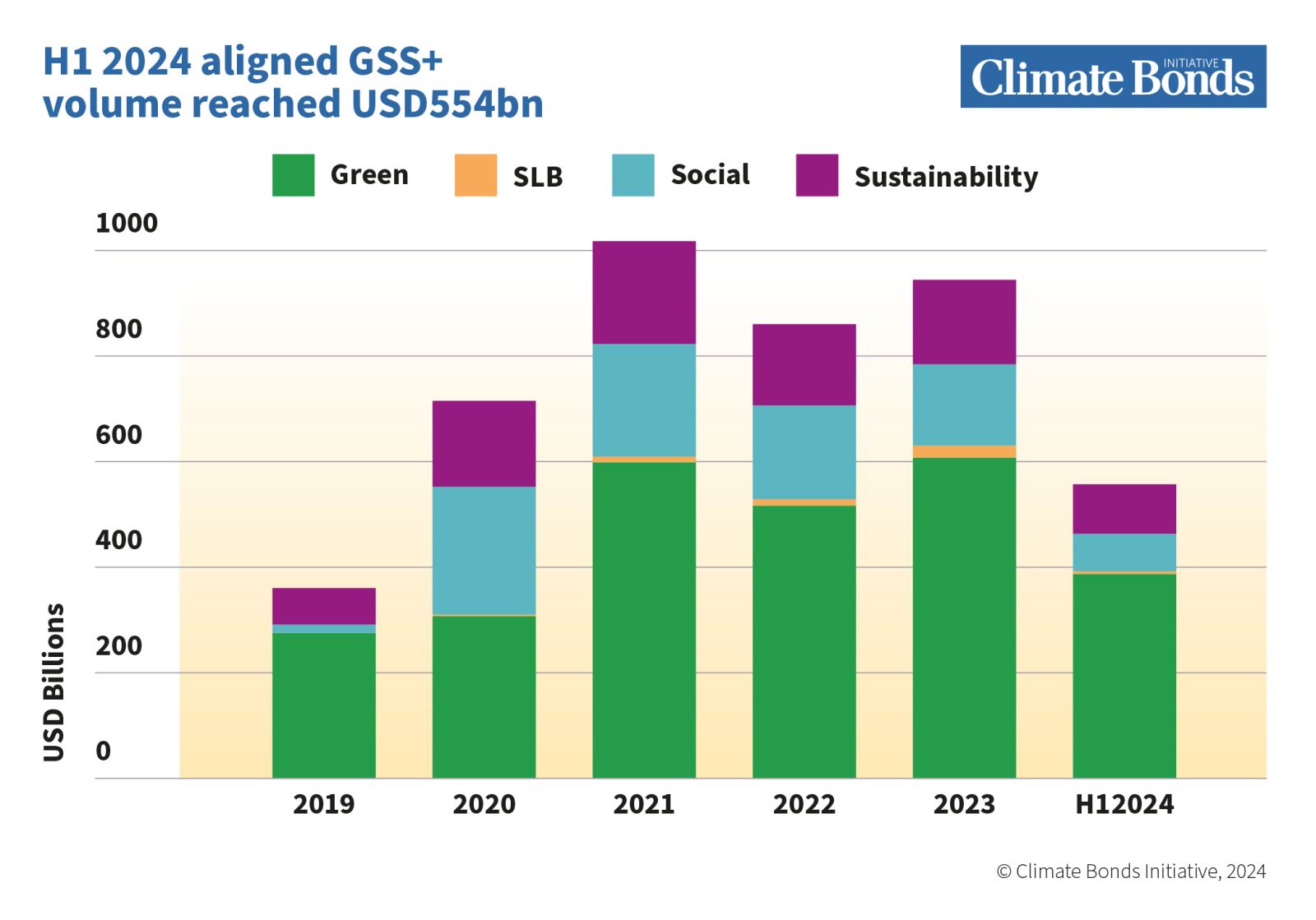

USD554bn of aligned GSS+ volume was captured in H1 2024 alone, a 7% year-on-year (YOY) increase compared to H1 2023. Green bonds accounted for 70% of H1 aligned volume, reaching USD385.1bn. This was followed by sustainability and social volumes contributing USD93.9bn (17%) and USD70.5bn (13%), respectively.

France attains sustainable finance podium position in its Olympic year.

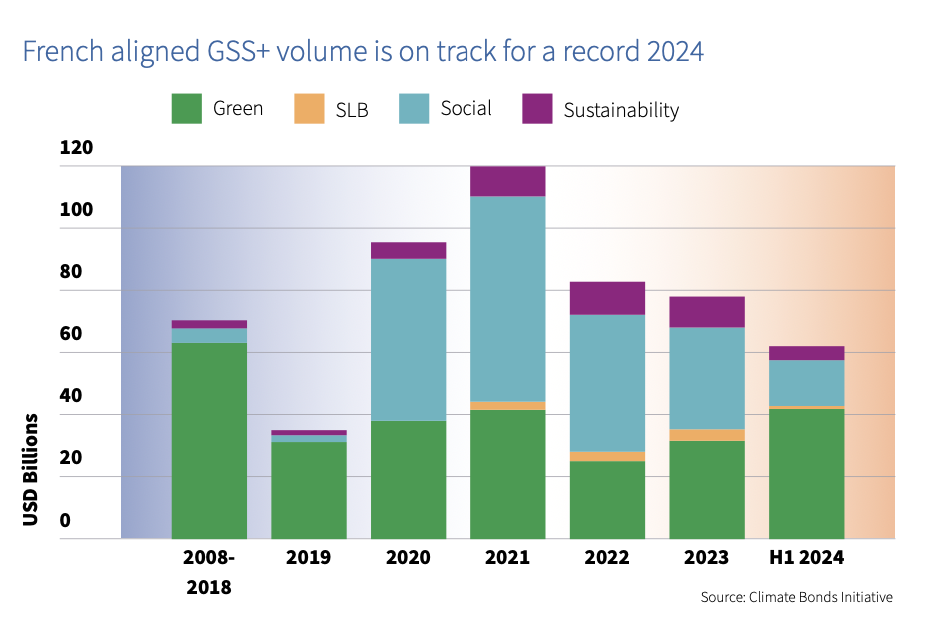

In its Olympic year, France stands on the sustainable finance podium as a clear winner. Since hosting the UN Climate Change Conference (COP21) in Paris on 12 December 2015, culminating in the ground-breaking Paris Agreement, France’s lead in sustainable finance policy has underpinned the immense growth of its GSS+ market. As at the end of H1 2024, the country was the third largest source of cumulative aligned GSS+ volume with USD542.9bn, following supranational issuance (USD763.2bn) and the USA (USD714.6bn).

France is also the largest source of aligned social deals with USD216.2bn by the end of H1. This has been championed by its social security agency Caisse d’amortissement de la Dette Sociale (CADES), which at the end of H1 had priced over USD143.3bn in aligned social bonds, making it the largest issuer in that category. France's momentum in labelled bond markets is setting the nation for a record year for GSS+ volumes.

A further 22 French issuers have priced aligned social deals. French GSS+ deals commenced in earnest in 2012 with three deals from local government entities: Île-de-France, Provence-Alpes-Côte d’Azur, and Hauts-de-France (which had previously issued a sustainability bond in 2008) and one from French corporate Air Liquide. In 2017, France became the first core sovereign borrower to issue a green bond.

With such robust sustainable finance credentials, it is no surprise that France’s environmental objectives for the 2024 Paris Olympics were ground-breaking. Paris 2024 has set new sustainability standards for global sporting events with the aim of reducing the environmental impact while maximising social and economic benefits.

The organisers’ intention was to deliver an event that was more ‘responsible, sustainable, and inclusive’. Hence, in February 2024, the Société des Grands Projets (formerly Société du Grand Paris) priced a EUR1bn, 25-year green bond dedicated to financing the Grand Paris Express; a 200-km rapid passenger transport project built within the Paris region (Île-de-France) that comprises an extension to the existing lines and construction of new lines for the Paris Metro. The extension of Line 14, one many metro lines, was finished by June 2024 ahead of the Paris Olympics.

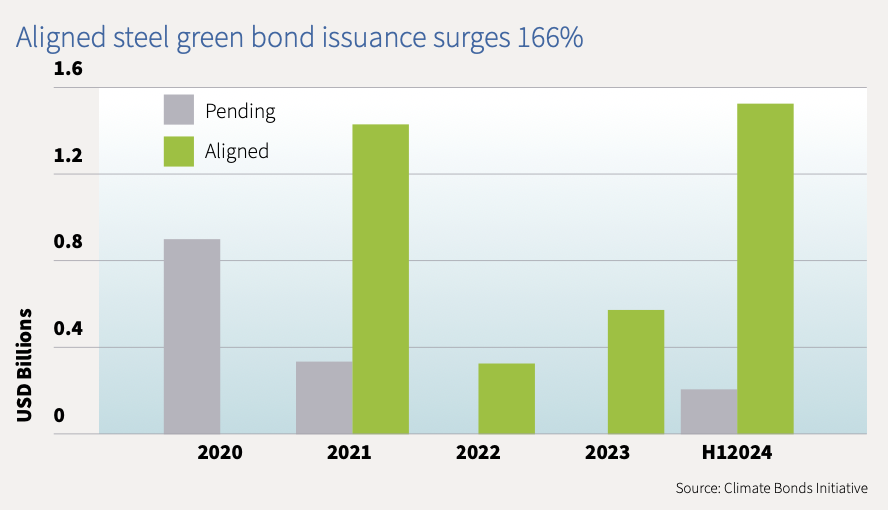

Spotlight: aligned steel green bond issuance surges by 166%

Climate Bonds review of the steel and cement sectors has revealed two encouraging developments. Firstly, there has been an increase in aligned green bond volumes from steel and cement issuers and, secondly, most (57%) of the 21 companies assessed had credible transition plans in place.'

To support the flow of investment towards decarbonising the hard-to-abate sectors, Climate Bonds has developed tools and guidance, including hard-to-abate sector criteria, transition plan guidance, and the inclusion of these activities as part of its Certification programme, as well as GSS, and SLB dataset assessment methodologies.

Climate Bonds is building a Transition Plan Monitor (TPM), which is an assessment of the quality of entity-level transition plans. Steel and cement were chosen as the first sectors to undergo analysis via the TPM.

The Last word – new era in data analysis

Data analysis is at the heart of the Climate Bonds Initiative’s State of the Market Report series. To strengthen this future in data analysis, Climate Bonds has established a working partnership with Montrose Software to explore ways to optimize our data management.

Montrose Software is a dynamic software development firm that partners with global market leaders and SMEs to deliver high-quality, tailored solutions. They are known for strong client relationships and exceptional service as they integrate seamlessly into clients' business structures, driving projects to successful completion, outcomes oriented, always focused on the ultimate business value.

This project started months ago with detailed business analysis and product management engagement that produced a proposed set of product features so that Climate Bonds could scale their data offerings more efficiently.

We are already working together on delivering a new Market Information Portal (MIP) which will streamline processes and workflows, improve the quality and fidelity of our data, and allow us to be more responsive to feature requests.

These actions will not only support our data delivery objectives but will also enable us to leverage future value that can be extracted from our specialized data. More consistent and well-formed data will help us to benefit from AI without compromising on workflow quality.

Stay tuned for more on our future data offerings and more market research!

‘Til next time,

Climate Bonds