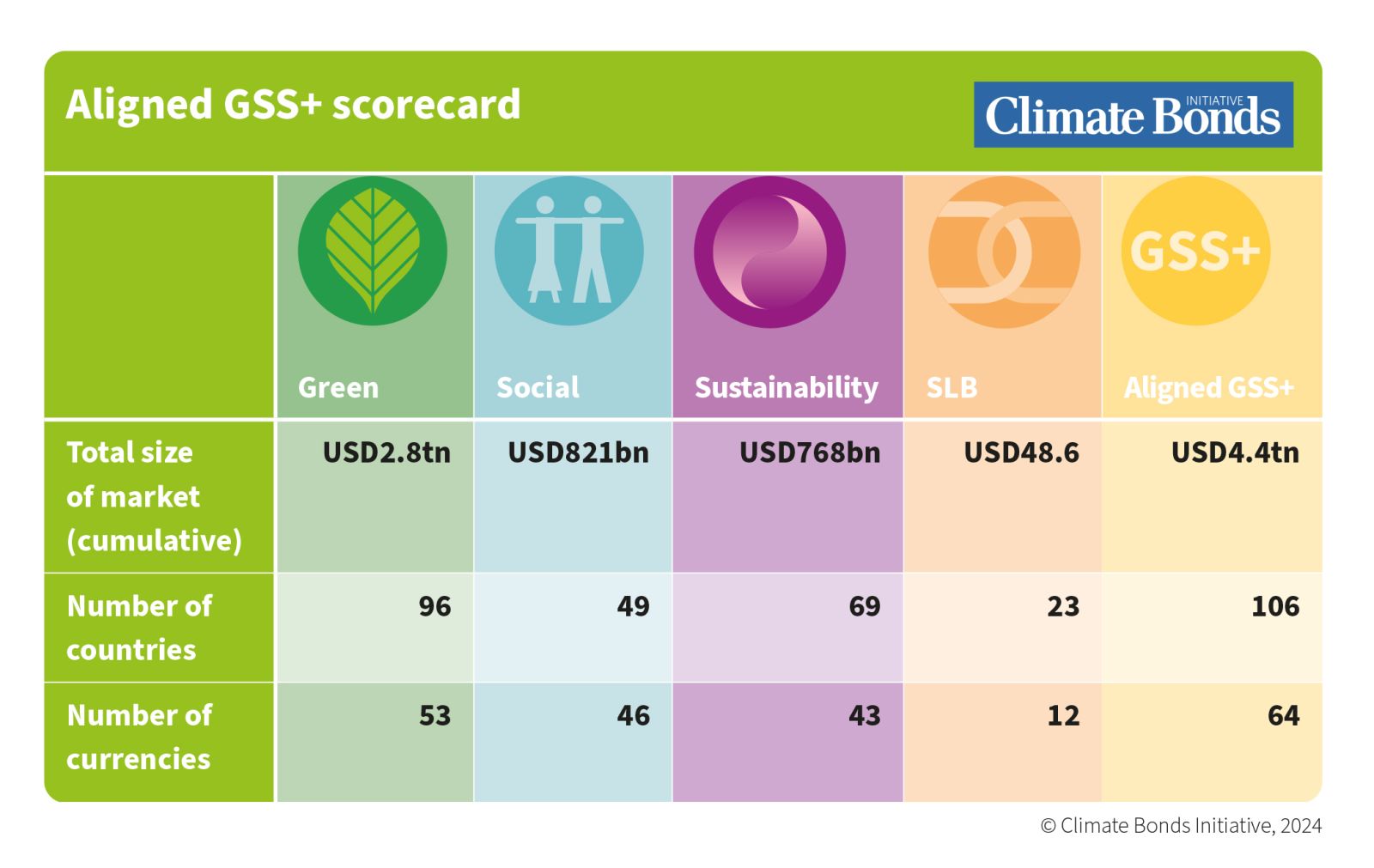

By the end of 2023, Climate Bonds had recorded USD5.5tn of cumulative GSS and SLB (collectively GSS+) volume, of which USD4.4tn (80%) was found to be aligned. This indicates strong appetite for thematic debt, with the difference between the two numbers highlighting the rigour of Climate Bonds curation.

The news arrives in the latest iteration of the Global State of the Market Report which also details that Climate Bonds captured aligned volume of USD870bn in 2023, 3% more than the 2022 figure of USD842.8bn. Two thirds of this (67.5%) were from the green theme which added USD6.3bn, reflecting a 15% YOY increase.

Conversely, there was a YOY decline in the volume of social and sustainability bonds by 7% and 30% respectively. The smallest segment, SLBs experienced a remarkable 83% increase in aligned volume, reaching USD21.4bn compared to USD11.7bn in 2022, and Climate Bonds expects the aligned SLB market to grow rapidly in 2024.

Europe was the largest source of aligned GSS+ debt instruments with volume of USD405bn representing 46% of the 2023 total. The LAC region delivered a 49% spike YOY. Conversely, anti-ESG sentiment affected aligned GSS+ volume in the USA resulting in a 38% decline.

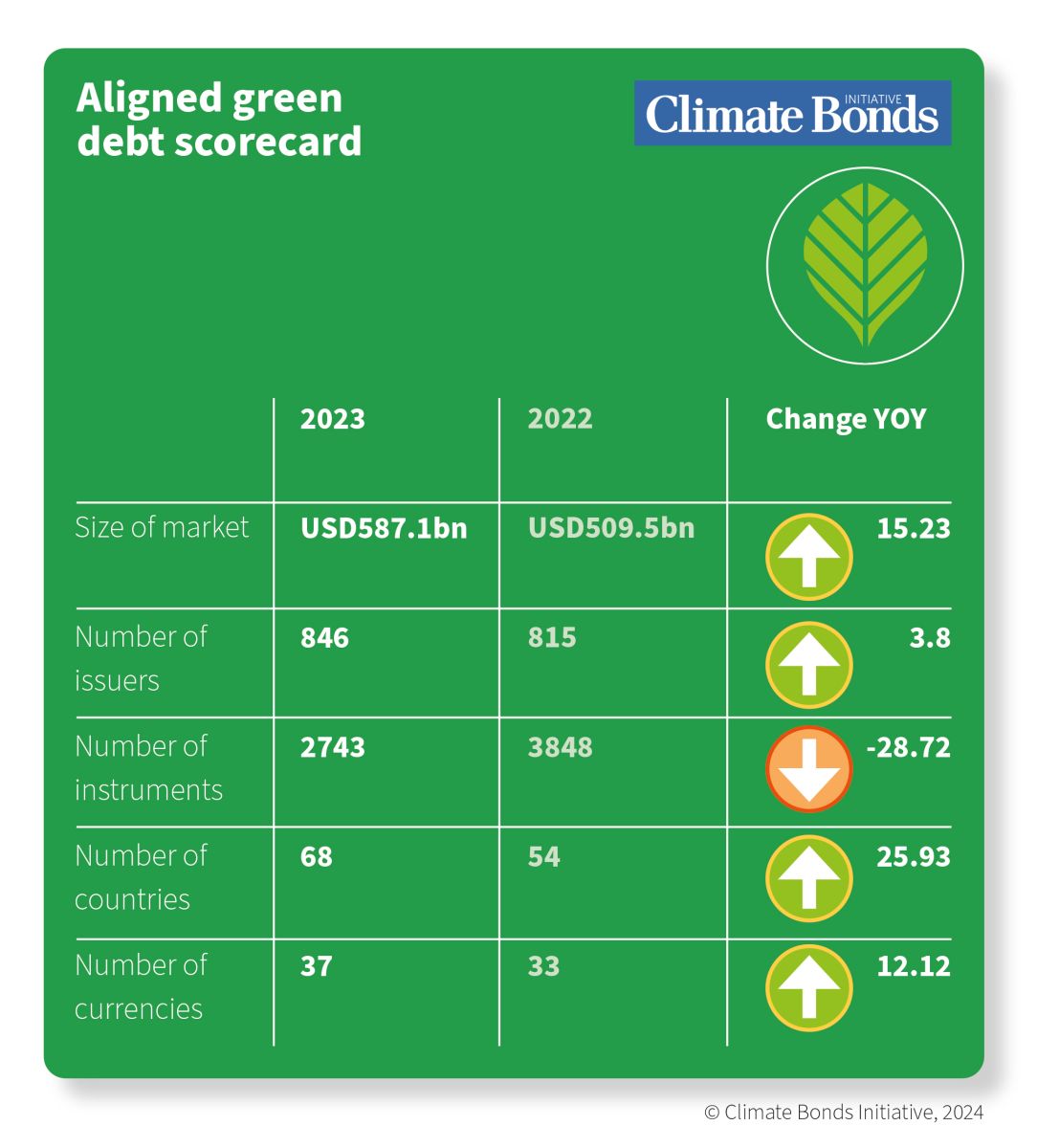

Green Bonds Break Half a Trillion for Third Year in a Row

In 2023, aligned annual volume reached USD587.6bn, breaking through the half trillion mark for the third consecutive year, and demonstrating an increase of 15% YOY. Furthermore, aligned sovereign green volume increased by 45% to USD120bn against USD83bn in 2022.

Europe dominated the aligned green bond market with over half of the total volume (USD309.6bn). The largest individual issuer was the United Kingdom (sovereign) with aligned issuance of GBP18.3bn (USD22.5bn) composed entirely of taps.

In 2023, private sector issuers returned to the green bond market in force, as aligned issuance from non-financial corporate issuers grew by 29% YOY. May was the most prolific month in 2023 with aligned green issuance of USD61.6bn.

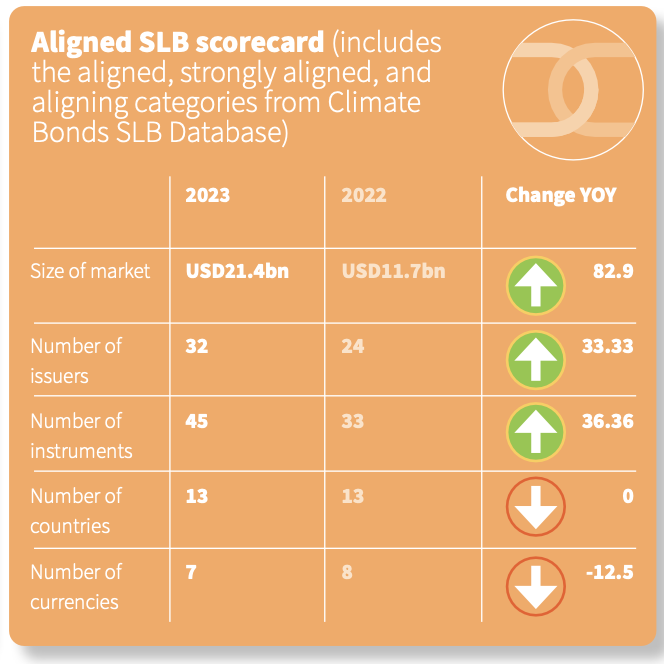

Sustainability-Linked Bonds Soaring

Aligned SLB issuance exhibited an 83% increase in 2023, with deals from 32 issuers. Climate Bonds published its Sustainability- Linked Bond Database Methodology in 2023, and a corresponding data product was launched in early 2024. These developments have helped define and measure climate standards, encouraging greater market credibility.

The quality of SLBs is improving overall; 35% of the amount issued was aligned in 2023 versus 14% in 2022 and 10% in 2021. This points to potential for the aligned SLB market to expand.

Despite the lack of growth since the big SLB boom of 2021, the market is maturing. A greater number of currencies, issuer domiciles, and issuer types are being added each year, contributing to the market’s diversification.

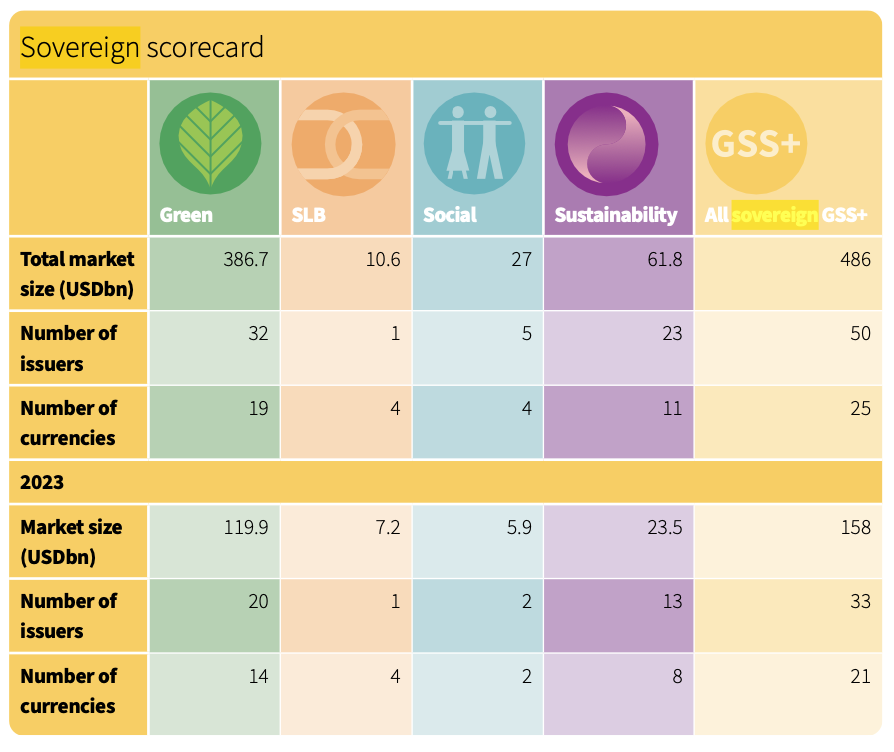

50th Sovereign Issuer

The sovereign GSS+ market reached a critical milestone in 2023 as Brazil became the 50th aligned issuer with its November sustainability deal. Cumulative sovereign GSS+ volume had reached USD485.6bn by the end of the year.

In 2023 alone, 33 countries priced GSS+ bonds amounting to USD158bn, representing an increase of 54% compared to the USD102.5bn priced by 25 countries in 2022. In 2023, 76% of the volume came from the green theme, which was used by 20 nations in total. Eleven countries priced new deals for a combined total of USD61.5bn, and 14 nations tapped into existing deals amounting to USD58.1bn.

The Last Word: Full breakdown in the Report

The State of the Market series represents the most extensive assessment of the labelled bond market. Read the full report for a breakdown of every label by climate alignment, country, currency, sector and more.

Sean Kidney, CEO, of Climate Bonds: “The green bond market has overcome a tumultuous economic terrain to land three consecutive years of over half a trillion in global issuance. The story is strengthened by the rise of other labelled markets emerging to support sustainability. Nevertheless, these totals must explode in the latter half of the decade if we are to raise enough to avert catastrophic climate consequence.”

The analysis for the opening months of the year is to arrive in our Q1 Report in the coming weeks, stay tuned for that.