Brazil Green Finance Initiative: Investors meet in São Paulo to discuss

the sustainable finance developments in the country

What’s it all about?

The Brazil Green Finance Initiative (BGFI) held a meeting on 31st August to gather investors and discuss the developments on sustainable finance in the country and share their views on the market demands and priorities.

The meeting was hosted at UBS Brasil and attended by representatives of Climate Bonds Initiative, Zurich-Santander Seguros e Previdencia S.A, Siemens Participações, Zurich Insurance Company Ltd, Itaú Asset Management, Natixis CIB and Sail Ventures.

The spotlight presentation on the scope of the Brazilian Taxonomy by Brazil’s Ministry of Finance's SDES (Sustainable Development, Environmental, and Social Secretariat) facilitated engagement with investors, a crucial step in shaping the regional sustainable finance landscape.

GSS+ market in Latin America

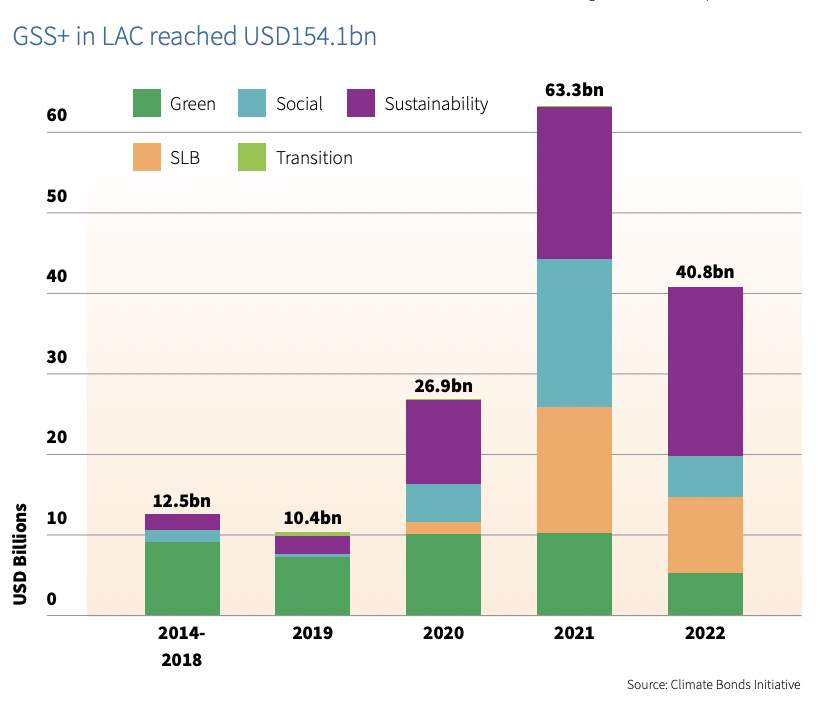

In Latin America, the GSS+ debt has a significant representation against the overall fixed-income market. This surge in Latin America reflects increased local market activity in recent years, and there is still substantial room for further growth. The growth potential can be harnessed by enhancing transparency and promoting the wider adoption of ESG disclosure practices among issuing companies.

As we look ahead, it is anticipated that with the advancement of taxonomy frameworks and trends that encourages green/sustainable finance regulations, organisations will have to disclose comprehensive information about the allocation of labelled capital towards specific assets and projects. This mandatory disclosure would aim to enhance data availability in a transparent and accessible manner for market participants.

Furthermore, there is a heightened expectation that the issuance of sovereign sustainable bonds by the Brazilian government in 2023 will inject more liquidity into the local GSS+ market.

Investors perspective

Investors worldwide are exerting strong pressure on companies to enhance their ESG (Environmental, Social, and Governance) transparency. This is further underscored by the recent developments in the creation of local taxonomies in various regions across the globe and the issuance of IFRS (International Financial Reporting Standards) S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and S2 (Climate-related Disclosures).

In the local market context, there is a pressing need to implement structural changes through innovative financial instruments and effective regulatory frameworks. These changes are essential to channel capital flows towards sectors like agriculture and to support smaller projects.

Find out more

Latin America and the Caribbean Sustainable Debt State of the Market 2022: The report describes the shape and size of labelled GSS+ debt issued by LAC domiciled entities to the end of December 2022. The market analysis is enhanced by an overview of key policy developments, trends, guidance, and growth opportunities for sustainable finance in LAC, and provides analysis and recommendations to support the growth of the sustainable finance market in the region.

Brazil Sustainable Securitisation State of the market Q3 2022: The report aims to provide an overview of the Brazilian sustainable asset-backed securities (ABS) market, its regulatory foundations and case studies, as well as highlighting opportunities to channel investment into sustainable activities, projects, and assets in the country.

12 Policies to Unlock Deep Decarbonisation: This report outlines 12 policies which will ensure sufficient levels of ambition, drive investment flows to deliver ambition, and facilitate rapid action: making the transition green, cheap, and easy.

The last word

Climate Bonds Initiative will continue to support the BGFI on the further development of the Brazilian sustainable bond market, engaging with key companies and parties interested in sustainable finance to achieve net-zero. In addition, we are committed to connecting the Brazilian investors with local and international requirements, as well as supporting the Brazilian Government on the implementation of the Taxonomy.

As Brazil works towards its climate goals, we look forward to seeing the continuous progress of its sustainable finance market. Though there is still much to accomplish, the journey ahead holds promise and potential.

‘Till next time,

Climate Bonds