32% of Green Bonds Achieved a Greenium in the First Half of 2023

Climate Bonds today releases a report showing that within a sample of 50 green bonds, 16 priced inside their own secondary market yield curves (32%). In the report, Climate Bonds built yield curves for 50 non-sovereign bonds out of a sample of 106. The findings arrive in the latest iteration of the Green Bonds Pricing in the Primary Market Series, sponsored by IFC, which assess bonds denominated in EUR or USD, across countries and issuer types.

The period saw particularly strong pricing metrics for USD deals. Average book cover for USD denominated green bonds was 5.4 times the deal size. This underscores the shortage of large USD deals with the required clarity and transparency over the Use of Proceeds (UoP). Domestic and international issuers can harness investor appetite by bringing USD deals to the market.

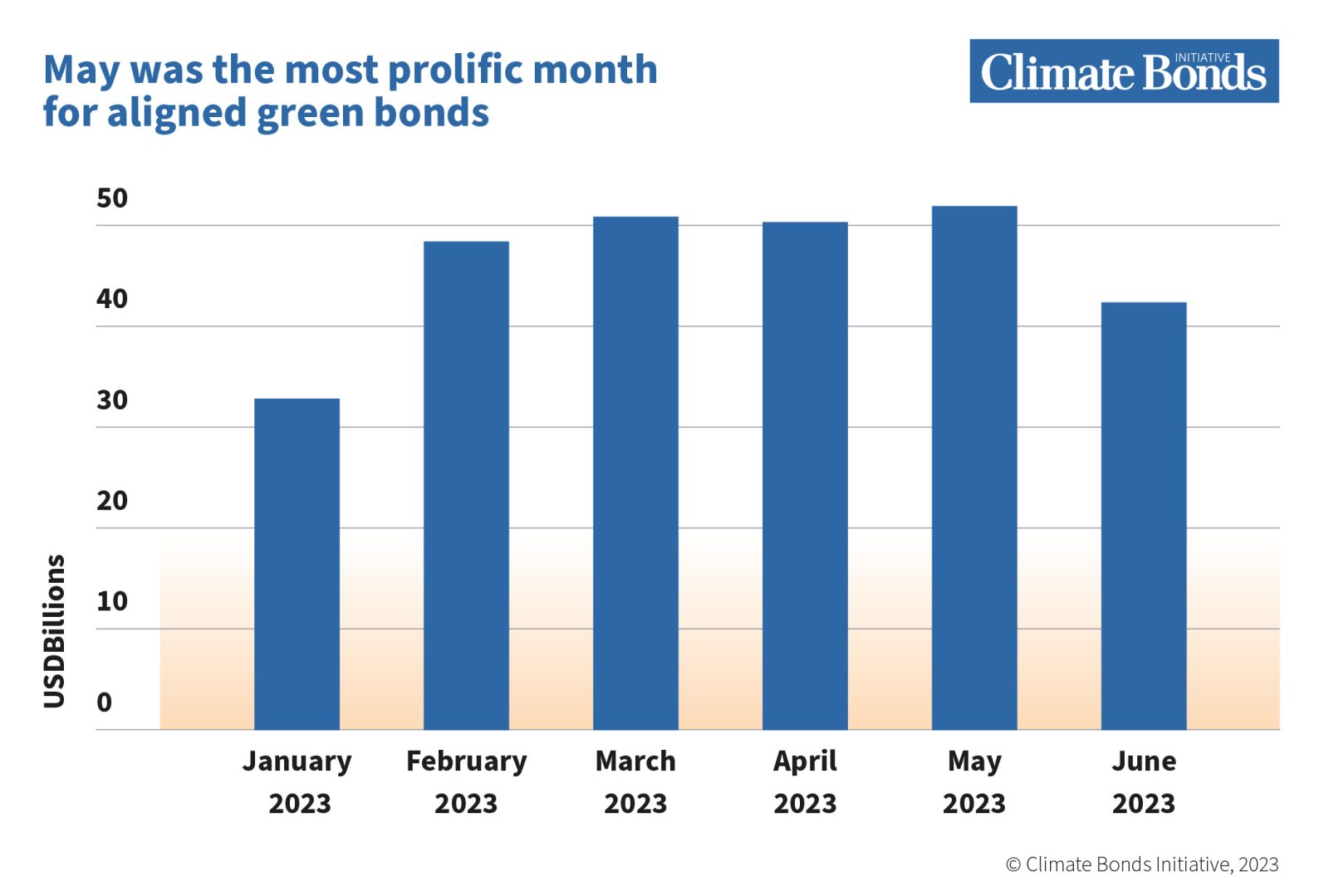

The H1 2023 iteration sees the largest semi-annual sample to date, assessing 111 green bonds with a combined volume of USD124.6bn The volume of aligned green bonds recorded in Climate Bonds GBDB in H1 2023 reached USD278.8bn, a 33% increase compared to the USD209bn logged in H2 2022. Aligned green bonds with volume of at least USD50bn were priced in March and April, peaking at USD52bn in May, bolstered by sovereign issuance.

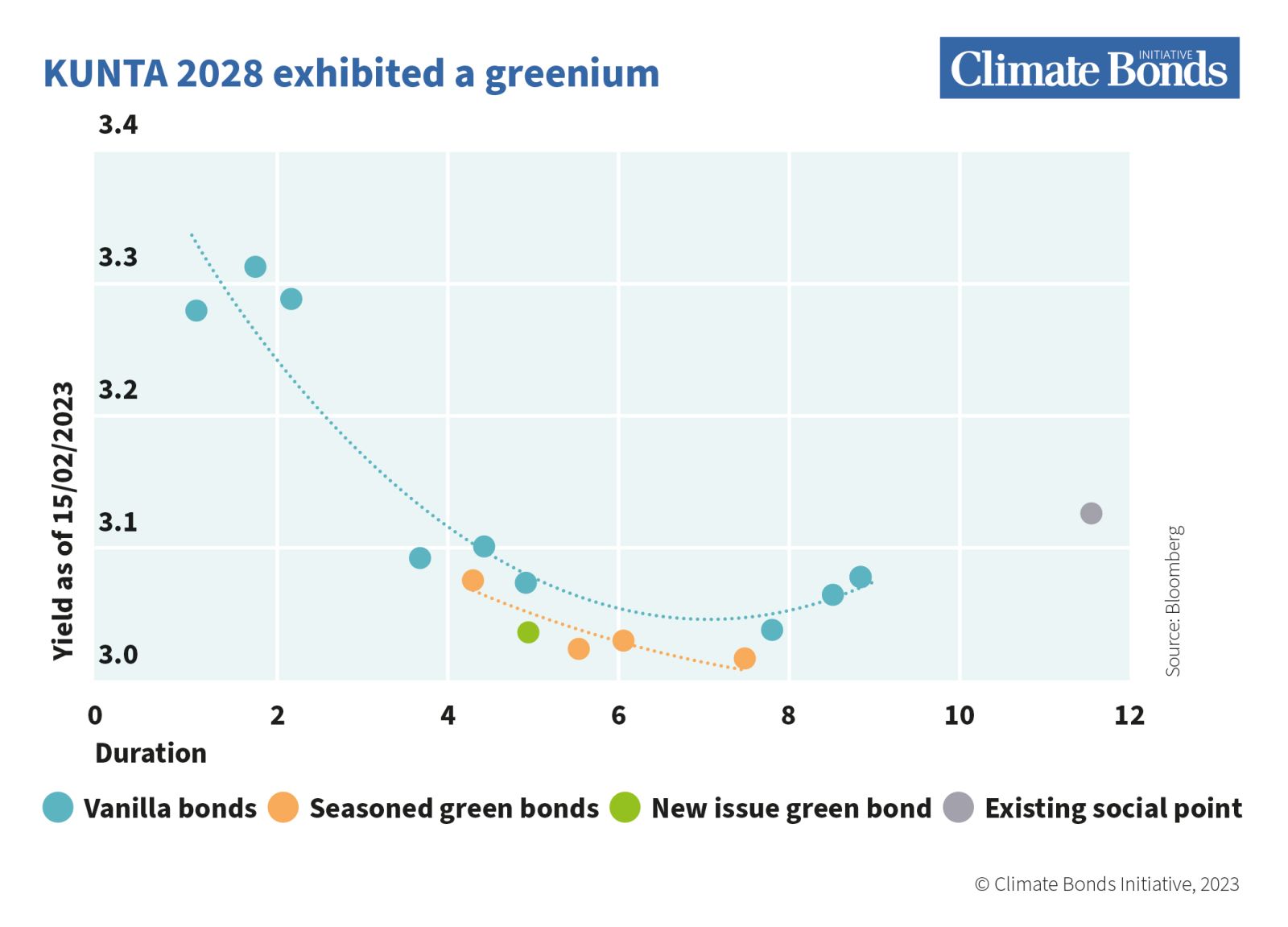

In H1 2023, Climate Bonds built yield curves for 50 non-sovereign bonds out of a sample of 106. Within our sample of 50 green bonds, 16 priced on or inside their own secondary market yield curves (32%). Twelve bonds obtaining a greenium were EUR denominated, while four were priced in USD. Among the EUR deals, five were covered bonds and seven were SSA.

The list of deals achieving a greenium includes the issuance by Kuntarahoitus Oyj (Kunta), a Finnish public sector owned institution lending to municipals to finance sustainable development. This lending is financed in the capital markets. Kunta’s objectives are aligned with those of the Finnish government, aiming for both carbon neutrality by 2035 and the protection of biodiversity, and financed emissions are calculated and monitored.

SLBs achieve brilliant bookbuilding metrics regardless of quality.

SLBs achieve brilliant bookbuilding metrics regardless of quality. To ascertain whether investors were making any discernments based on the quality of the SLB targets, Climate Bonds gathered primary market pricing data for SLBs priced in H1 2023, which were selected according to the criteria described below. The sample included 18 bonds with a broad range of economic sectors represented (as shown in the table).

In H1, it appears that primary market pricing could be squeezed more on SLBs in the not aligned category compared to fully aligned because of strong investor interest. Both fully aligned and not aligned SLBs accumulated larger order books and achieved more aggressive spread compression in primary markets compared to bonds in the green and vanilla samples.

The results demonstrate that investors in EUR SLBs are not giving preference to aligned deals in favour of non-aligned deals. Given that there is no consensus on how to evaluate the quality of SLB targets, this indicates that EUR investors are prioritising exposure to a particular sector, issuer, or sustainability label, regardless of structure or decarbonisation plans.

For this reason, Climate Bonds SLB Database Methodology is based on the 5 Hallmarks for credible transition, in particular Hallmark 1: Paris-aligned targets. The purpose of this methodology is to support investors in discerning which bonds have credible and material targets.

Read the full report for other highlights including:

Read the full report for other highlights including:

• USD deals did well on pricing metrics: For instance, average book cover for USD green deals was 5.4 times the deal size. This underscores the shortage of large USD denominated deals with the required clarity and transparency of the use of proceeds. Domestic and international issuers can harness this investor appetite by bringing USD deals to the market.

• EUR green bonds from issuers of the highest credit quality attracted most interest: SSA and covered bond issuers tend to have the highest credit quality, investors turn to the safest assets when the market is volatile. The green label adds extra appeal.

• EUR utilities achieved good price tightening in the primary market: EUR bonds from utility issuers have consistently done well in the six years that Climate Bonds has been monitoring green bond pricing. This is important because electrification is the most critical process for the decarbonisation of the economy and evidently investors are ready and willing to support this transition. Demand is in place to scale up low-carbon electricity and improvements to the grid, which should see more utility issuers coming to the market with green bonds.

• 66% of green bonds were allocated to green investors: Emphasising the unique source of support from the dedicated green investment community, and that more green bonds could be absorbed.

• ETF total fund assets increased by 20% in H1: Investors are keen to commit money to funds investing in green bonds.

• Largest half year for sovereign issuance so far: USD40.3bn of sovereigns were included in the H1 analysis. The momentum behind this issuer type continues and has the potential to increase

The Last word

The Green Bond Pricing in the Primary Market H1 2023 report is the 16th iteration of a leading series analysing the pricing dynamics of green bonds. The series has revelealed how these instruments offer continued pricing advantages for issuers and investors.

The Green Bond Pricing in the Primary Market H1 2023 report is the 16th iteration of a leading series analysing the pricing dynamics of green bonds. The series has revelealed how these instruments offer continued pricing advantages for issuers and investors.

Caroline Harrison, Head of Market Research, Climate Bonds: “The glowing green bond pricing metrics continue to demonstrate the strong investor appetite for these instruments. Investors are keen to finance the decarbonisation of our economy, and issuers should leverage this by prioritising green investment.”

We’d like to thank IFC for sponsoring and supporting the launch of this report at our Climate Bonds CONNECT New York Conference on the 20th of September.

Next in the CONNECT series is the Global Conference in London on the 9th and 10th of November. If you'd like to join us follow this link

‘til next time

Climate Bonds