Policymakers hold the keys to a rapid transition

12 policies to unlock deep decarbonisation - Read the new paper now!

In order to prevent catastrophic climate change, the world’s economies need to rapidly transition to net zero. This global transition will require every sector of the economy, including high-emitting sectors like critical raw materials (CRMs), cement and steel industries, to make immediate, dramatic cuts in their emissions. This transition will not be possible without strong policy support to enable finance to flow to credible, ambitious projects.

Unfortunately, current climate policies and government commitments are inadequate to meet the Paris Agreement objectives. Climate Bonds' new paper on hard-to-abate sector transition to net zero lays out 12 key policies to enable countries to develop new green industries, conserve natural resources, and drive sustainable growth.

The decarbonisation of hard-to-abate sectors requires targeted policy support

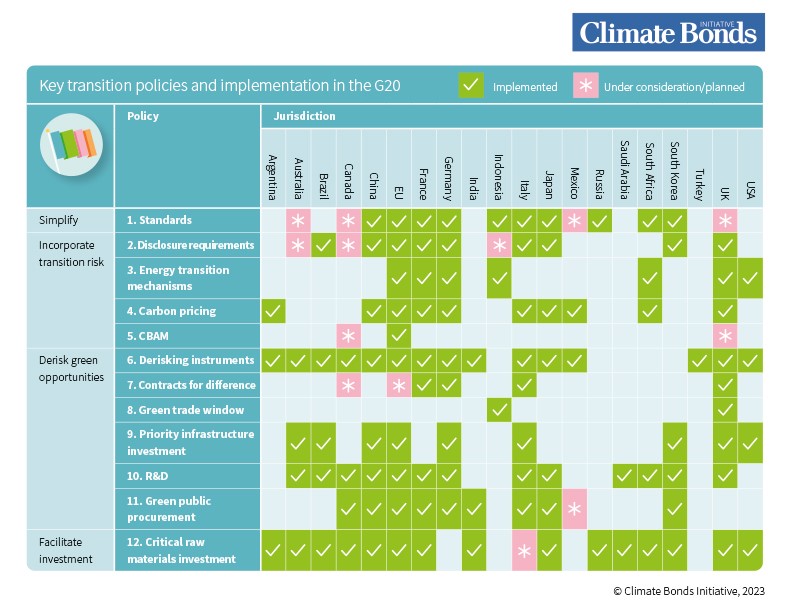

This publication builds on Climate Bonds’ policy recommendations and sector criteria for hard-to-abate sectors’ transition, such as steel and cement, and draws on the recent report, “101 Sustainable Finance Policies for 1.5°C”, proposing 12 of the 101 policies that are critical for facilitating this transition.

Policy support is essential to the successful transition of hard-to-abate sectors. Risk-opportunity assessments underpinning investment allocation usually favour fossil fuels and other carbon-intensive industries. Such backwards-looking and short-term assessments tend to overvalue fossil fuel investments. Ambitious climate policies before 2030 are urgently needed to achieve the long-term goals of the Paris Agreement.

While every sector and country will have a different decarbonisation pathway, requiring specific and targeted policies, there are certain key policies that can accelerate the hard-to-abate transition globally. These policies can ensure rapid emissions reduction, avoid stranded asset risks, and develop transition opportunities.

Redirecting and enabling sustainable investment in key decarbonisation technologies demand is sky-high. But this demand is very risk-averse, and many transition investments, in emerging markets or innovative technologies, are seen as too high-risk.

Lily Burge, Climate Bonds Senior Policy Research Analyst, says: “Current investment models severely underestimate climate risks and opportunities. Policy support is crucial to ensuring these are fully incorporated into decision making and safeguarding economic growth and stability.”

Increasing investments are being channelled into the transition in response to policy support

Policies can directly reduce risk of high-cost transition technologies. Tax credits in the US Inflation Reduction Act are expected to bring green steel into cost parity with conventional steel production – a gamechanger for the industry.

Contracts for Difference (CfD) cover the cost difference between green and conventional production, minimising the risks associated with high cost of production. Production costs are expected to fall as the technologies mature – CfD will reduce with this and so are a highly efficient way for governments to subsidise technologies.

There are many policies available to derisk green investment. Guarantees, subsidies, and blended finance solutions can help to reduce the risk associated with an investment and therefore reduce the cost of capital for the borrower/issuer. Policymakers can safeguard supply chains and prevent any bottlenecks in transition. Critical Raw Materials such as lithium, graphite, cobalt, and nickel will be needed to reach net zero and facilitating investment into this sector is critical to delivering this transition. The growth of decarbonisation technologies could increase demand for CRMs by 2040 by 4 to 6 times.

Policymakers have an essential role to play in ensuring a sustainable and resilient supply of critical raw materials. An increasing amount of investment is being channelled into mining, particularly in response to policies. For example, the European Investment Bank approved a EUR45bn package to finance the net-zero transition, with a specific reference to the REPowerEU plan and the EU Green Deal Industrial Plan. This funding is expected to mobilise around EUR150bn in investments and is particularly dedicated to supporting the industrial transition and scaling up CRM supply.

Fabio Passaro, Climate Bonds Senior Transition Policy analyst, says, “Policymakers are playing an important role in assuring a sustainable and resilient supply of crucial raw materials. Globally, over 100 new CRM-related policies have recently been adopted, clearly showing the importance of critical materials for the net-zero transition”.

The Last Word

There is a growing momentum of policy support for the transition and these policies are already being implemented across the world. The variety of policy options also demonstrate that it will not simply be met with increased government expenditure, there are opportunities for countries of all sizes and development levels to shift their economies to green.

This is a pivotal time for policymakers to seize the opportunity to develop the green industries of the future.

Check out the paper for details.

‘Til next time,

Climate Bonds