On the 5th of July Thailand has officially adopted the Green Taxonomy[1]. This event marks a seminal moment for the country's climate policy. The Green Taxonomy hands the nation’s business community, government, and experts the blueprint for a green future.

Though the current version of the taxonomy (Phase 1) covers only two sectors (energy and transportation), collectively they are responsible for up to two-thirds of country’s total emissions[2] and is expected to expand to other key sectors within foreseeable years, covering up to 95% of the country's emission-relevant activities.

The document was developed by the Climate Bonds Initiative and the Bank of Thailand with support from the IFC to underpin the country’s efforts of decarbonization and fulfilling its global climate commitments. The taxonomy can be used to issue green bonds, green loans, label investment funds, calculate insurance ratios, collect statistics, implement special support measures, and much more. For all this, additional documents and political decisions are needed, but the core of the new system has already been created.

The system to guide the market

Thailand Green Taxonomy contains all components that could, if underpinned by a combination of government and market support, substantially change this situation for the better. This is a thresholds-based and traffic lights-based taxonomy, which is substantially interoperable with the taxonomies of the European Union, South Africa and Colombia, but with enhanced usability and efficiency. It is based on the following key principles:

- Science-guided. The criteria there are based on years of work done by experts and scientists under the auspices of the Climate Bonds Initiative and are consistent with the objectives of the Paris Agreement (net-zero by 2050). This applies to both "green" (zero or near-zero emitting activities like solar energy production) and "amber" category activities, which allows upgrading many already existing non-green facilities and activities, bringing them in line with the Paris-aligned climate change mitigation objective of the document.

- Thailand-specific. While the green thresholds are aligned with international standards for 1.5 degree, the thresholds for the amber category within the taxonomy were calculated based on the decarbonization trajectories adopted by the Thai government, subject to a sunset clause that helps ensure an ambitious 1.5 degree-aligned transition. This gives local businesses more maneuvering power in moving towards the goal of decarbonizing the country's economy by 2050 without compromising the goal itself.

- Experience-based. The results of numerous usability research of operational taxonomies were processed to avoid repeating their mistakes. A simplified Do-No-Significant-Harm section, streamlined criteria, and clear decarbonization trajectories to 2050 are intended to help Thailand's business community incorporate the Taxonomy into their business planning quickly and efficiently.

- Greenwash-proof. The clarity of criteria and procedures makes it nearly impossible to abuse the taxonomy and replace real decarbonization efforts with marketing.

Taxonomies on Track in Asia

Across the globe green taxonomies are catalyzing climate investment in a crucial moment for the world’s fight against climate catastrophe. Climate Bonds is backing governments to adopt these tools as part of efforts to hit climate targets, and as we approach the middle of 2023, Asia is seeing a spike of activity, with Thailand’s taxonomy set to be followed by Singapore and Hong Kong which have taxonomies under development.

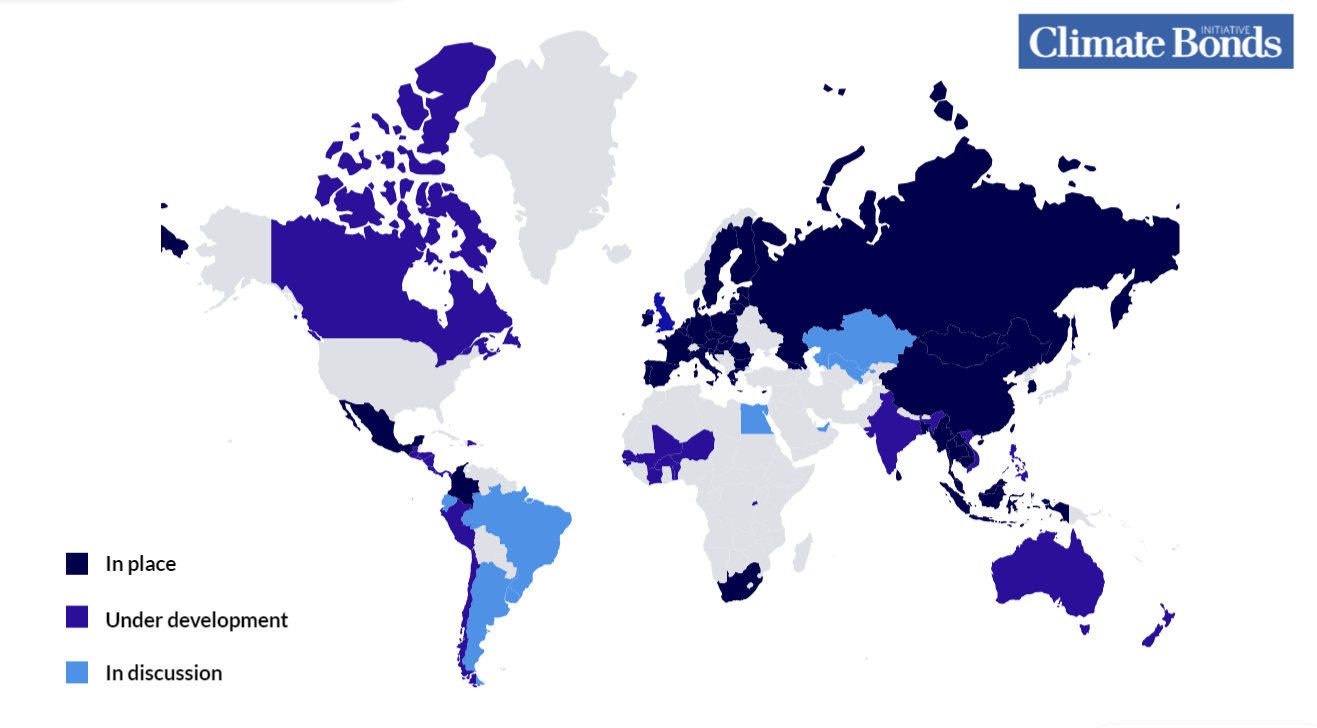

15 taxonomies have already released globally, 29 are under development and 8 are discussion. Most taxonomies are nationwide, but there are exceptions, such as regional taxonomies adopted by the European Union and the ASEAN region.

The work being done on taxonomies creates as a shopping list for a net-zero future. It is a landmark achievement in a country envisaging the sustainable path ahead and providing the tools to follow it. The recent developments in Thailand and beyond are a welcome development, but also the minimum countries should be doing to support the green finance movement and stamp out greenwash.

Thailand is very familiar with catastrophic consequences of climate change

Thailand is ninth most affected country in the world when it comes to climate change, says The Global Climate Risk Index[1]. Over 20 million people residing along the coastline face daily threats from coastal erosion, typhoons, and tsunamis, while the interior is susceptible to intensifying tropical storms that could cause devastating floods. In 2011, the country experienced massive floods that claimed the lives of 815 people and affected 13.6 million others, with scientists attributing the event to climate change[2].

The World Bank warns[3] that the number of people affected by extreme river floods in Thailand could increase by 2+ million by 2035-2044 and another 2.4 million by 2070-2100. Climate-vulnerable sectors include agriculture (30% of the labor force) and uses up to 47% of the country's land, as well as water resource management, public health, tourism, natural resource management, and public infrastructure[4].

Despite its low contribution to global greenhouse gas emissions, Thailand remains heavily reliant on fossil fuels, particularly natural gas. To achieve its international climate commitment on mitigation, the country must scale up investments in clean energy and low-carbon sectors like transport, manufacturing, and waste management. The transition to a low-carbon economy will be critical to protect the country's economy and people from the risks associated with climate change. The taxonomy will help Thailand to decarbonize quickly and efficiently.

The Last Word: It’s now or never

The IPPC’s latest report has signaled that it’s do or die for the environment as we know it. Climate Bonds has been rallying behind green finance to play its part and development’s such as Thailand’s taxonomy developments offer valuable contribution.

If they can be equipped with further policy pushes and private sector support, we can prevent the 2020’s from being another lost decade. Stay tuned to our blog for further updates on the latest green finance developments – there’s huge news on the horizon

‘Til Next Time

Climate Bonds