Curious about credibility? Tempted by transition plans? Interested in Paris alignment? Read on!

Over the past few years, the Climate Bonds Initiative has been spearheading work to support companies and financial institutions transition their activities to align with the needs of a net zero future. For many businesses, especially those in hard-to-abate industries like cement production or those where change takes time such as agriculture, the transition will be underpinned by the development of a transition plan.

Transition plans are tools that help a business think through what a Paris-aligned future looks like for them and how to get there. Essentially these are time-bound action plans that describe how an organisation will pivot existing assets, operations, and business models onto a decarbonization pathway that aligns with the latest climate science. To be credible, a transition plan needs to cover a few core elements – including a decarbonization goal, targets that demonstrate progress toward the goal (these should be set in relation to sector-specific guidance, more on that later), as well as the implementation and governance systems necessary to deliver on the goals.

Climate Bonds is working with other actors in the space to make sure the market guidance on transition planning is clear and aligned. As part of this, Climate Bonds is hosting a webinar series on transition which kicked off in March with representatives from Ceres, IIGCC, and CDP discussing how transition plans can be used to drive finance towards credible investments (you can find the recording online here).

During that discussion, Climate Bonds laid out the key hallmarks of a credible transition plan. First published in 2021, these hallmarks form the basis for evaluating a company’s plan, and are the bedrock of credible, ambitious transition efforts. They also underpin the Climate Bonds certification scheme for entities and sustainability linked debt (SLD) – all SLD instruments should be linked to an ambitious transition plan.

The five hallmarks of a credible company transition plan are:

- Performance Targets

These set the ambition of the company in terms of environmental sustainability. For greenhouse gas emissions the transition pathway needs to align with net zero by 2050 and nearly halving emissions by 2030. Companies can select the science based sector pathway from the work of organisations like Climate Bonds, SBTi, TPI, IEA and others which have laid out the necessary annual decrease in emissions, by sector, that will help the sector stay within the remaining global carbon budget.

- Foundation and Vision

Before a company can embark on a credible transition, it needs to establish a strategic vision of where the company is now, where it is going to go, and how it is going to get there. This involves identifying the overall approach and priorities for the company, what technologies will be key for the change, how to engage all the actors on the value chain and what are the key risks and opportunities for change. The plans and levers need to be coherent as well – i.e. decarbonization plans should be nature positive and not damage the wider environmental and social transition.

- Implementation Plans

This hallmark is about putting a company’s narrative and strategy into practice. In particular, we look to see if a company has an action plan, a financing plan, and internal policy alignment. The implementation plan provides the detail needed to deliver on the foundation outlined in Hallmark 2. What business streams the company is working towards, the technologies it plans to use, and other tools it will employ on its decarbonisation journey. The financing plan needs to demonstrate how the company is going to pay for the changes – both operating and capital expenditures.

- Governance

Transition plans needs to be owned and overseen by the board and senior executive team. Internal monitoring systems should be established to assess performance against the targets and goals outlined in Hallmark 1, these need to be flexible enough to allow for recalibration to reflect underperformance or emerging technologies and changing operating conditions.

- Disclosure

Disclosure is a key hallmark of a credible transition plan. Companies must disclose their progress against their own targets, as well as the methodologies used to measure performance. These disclosures should, ideally, be verified through a third party assurance provider.

Over the past year, Climate Bonds has looked at many transition plans, particularly in hard-to-abate sectors like the steel industry and cement industry. We have found that, while many plans do include some of these key hallmarks already, a lot of work remains to be done to be sure that transition efforts are credible and ambitious enough to meet the crisis we are facing.

We will be releasing more guidance for the market on how to assess transition plans soon as part of our ongoing work to make sure that investors, issuers, and asset owners have the tools they need to establish transition plans and invest in credible decarbonisation efforts. As mentioned earlier, the Climate Bonds Standard has been updated to enable certification for companies and transition plans linked to our criteria. We are currently able to offer entity and transition plan certification for 17 sectors, including for cement, steel, basic chemicals, and hydrogen production, helping hard-to-abate sectors bring their industries in line with the net zero future. We have also provided policy guidance to regulators and legislators around the world, who hold the keys to enabling the global transition. Our recent paper 101 Sustainable Finance Policies for 1.5° offers insights into how regulators at many levels of government can help facilitate the rapid, robust, and credible transition of world economies into a green future.

Transition is still an emerging field, and good work is being done by many organisations to ensure that industries and economies have the information they need to bring themselves in line with a net zero future. Thanks to the guidance coming from CDP, IIGCC, Ceres, and other organisations, we are reaching a place where we can assess transition plans as not just on their levels of ambition, but on whether or not they are credible, robust, and rapid enough to meet the climate crisis.

Climate Bonds Connect — Ready, Set, Transition

In 2023, Climate Bonds CONNECT will once again bring together key decision-makers and top-tier influencers at a series of world-class events in key financial capitals around the world, including London; Hong Kong; New York; and Bogotá. The first Regional Conference will be held in Hong Kong on 9 June. You can register your interest for the event here.

We will also be hosting a sustainable debt training, developed in partnership with ICMA, where participants can learn about sustainable debt instruments, Climate Bonds Standards, ICMA Principles, and more. Register now by clicking here!

To meet global climate targets, the world needs to rapidly transition its economies to a green future. For many sectors, especially high carbon emitting sectors, there may be need to fundamentally reshape and transform their strategy. With a focus on transition, and under the theme ‘Ready, Set, Transition’, discussion topics at this year’s Climate Bonds Connect series will centre around facilitating a credible brown to green global transition that is ambitious, inclusive, and aligned with the Paris Agreement.

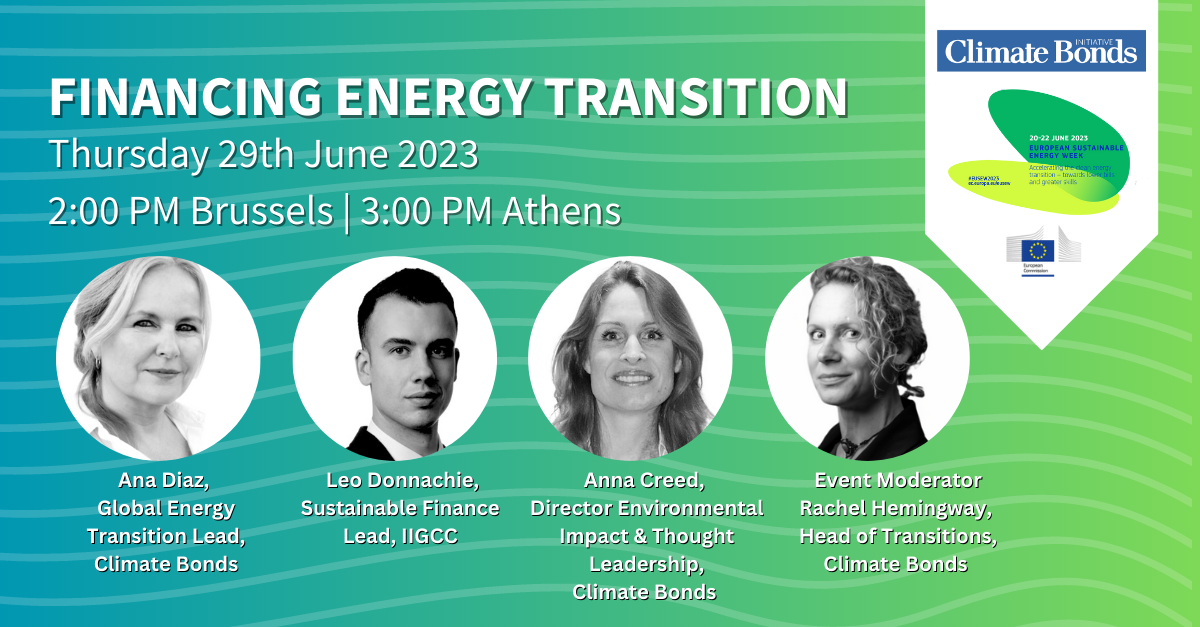

Join us for an exciting event on credible transition finance and clean energy projects during #EUSEW2023!

Thursday 29th June at 2:00PM CEST

Discover how to unlock green finance, ensure credible transitions, and mobilise capital for clean energy projects aligned with the 1.5°C pathway. Our event will feature discussions and expert insights on transition planning, science-based criteria, and financing mechanisms. Register now!

'Til next time!

Climate Bonds