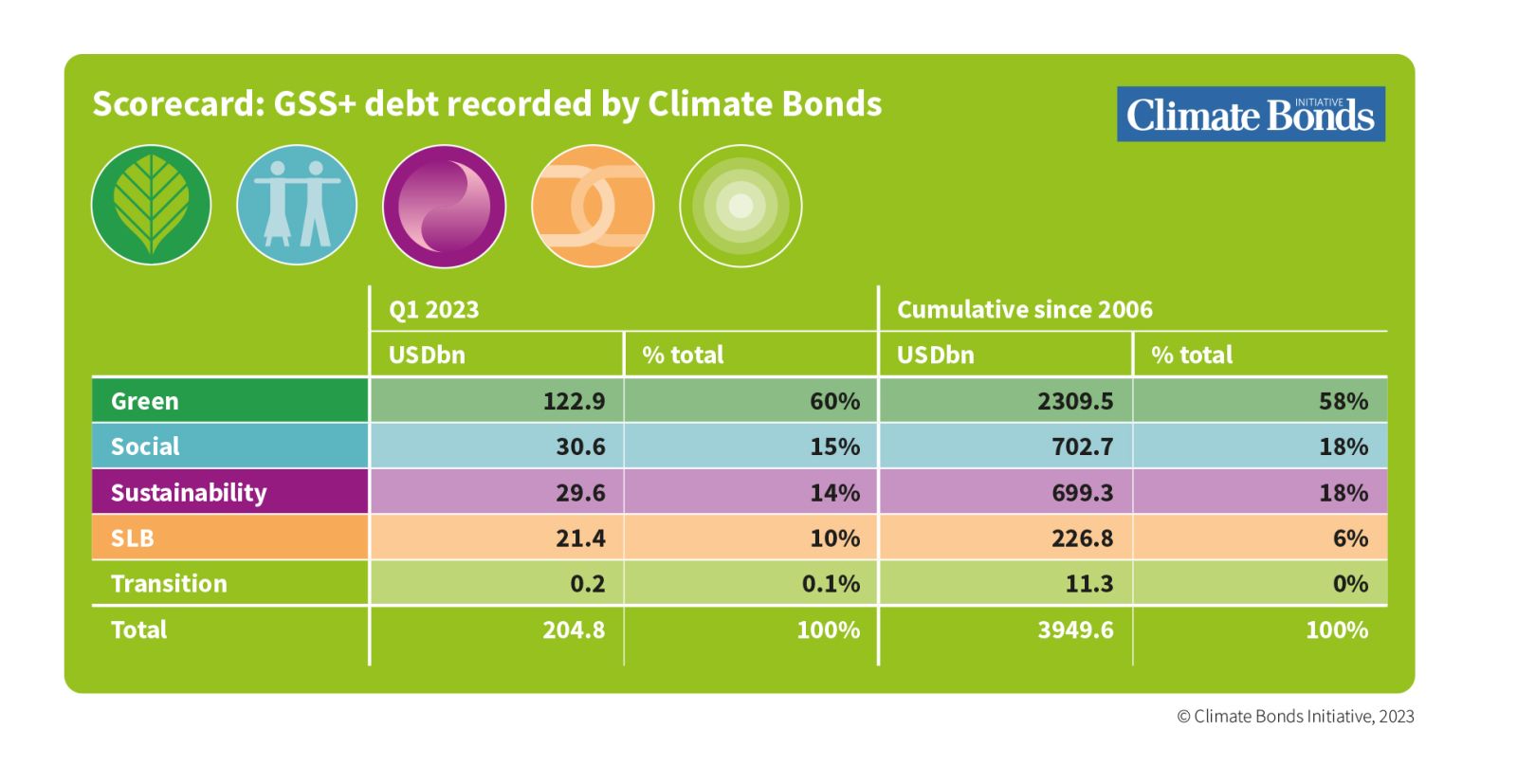

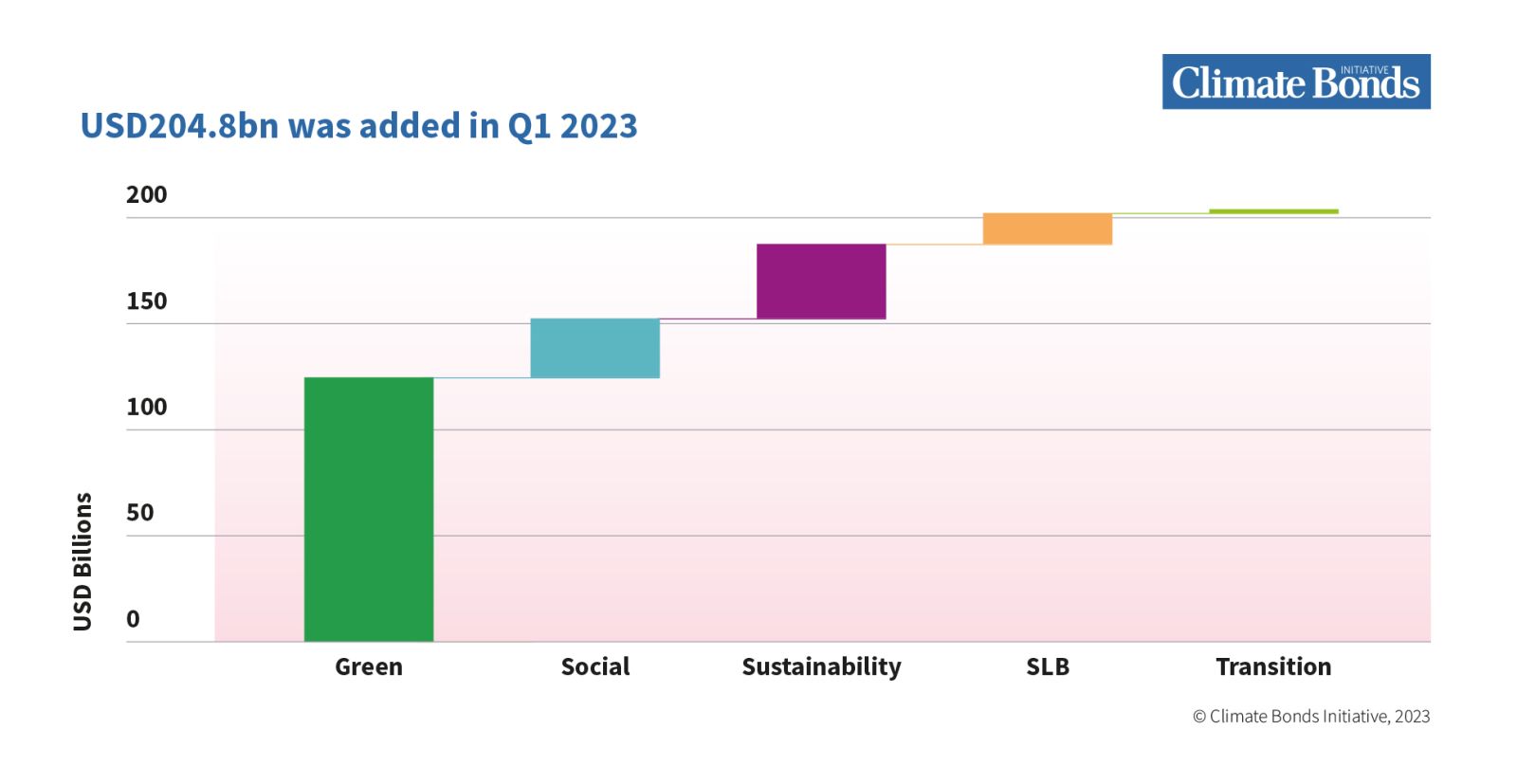

Climate Bonds’ latest market report shows recorded volumes of green, social sustainability, sustainability-linked, and transition (collectively GSS+) debt of USD204.8bn for Q1 2023, a 17% increase compared to the prior quarter, but a 21% YOY drop against Q1 2022. Our latest quarterly report shares the full details, read it here.

Market performance in2023’s opening quarter showed that bond volumes were recovering from market trauma of late 2022. However, in this period a greater number of bonds were excluded from our best practice Green Bond Database or pending under further assessment, including some large sovereign deals.

Label breakdown: USD204.8bn GSS+

Green: In the first three months of 2023, USD122.9bn was added, comfortably above the Q4 2022 number of USD97.5bn, and almost matching the Q1 2022 volume of USD129.7bn. By the end of Q1 2023, Climate Bonds had recognised lifetime volumes of USD2.3tn of green bonds.

Social: In Q1 2023, Climate Bonds captured social bond volumes of USD30.6bn in Q1 2023, which represented a 38% decline YOY. The social theme also delivered a 23% lower volume compared to its Q4 figure of USD39.8bn. By the end of Q1 2023, Climate Bonds had recorded cumulative social bond volumes of USD702.7bn.

Sustainability: USD29.6bn was added in Q1 2023, a 43% drop compared to USD52.3bn recorded a year earlier, and the largest YOY decline among the themes. Nevertheless, deal volumes had picked up by 40% since the USD21.2bn added in Q4 2022. At the end of Q1 2023, sustainability deals with lifetime volume of USD699.3bn had been captured by Climate Bonds.

Transition: Transition bonds constitute the smallest theme and in Q1 contributed just USD236m, spread over three deals. This was a decline of 9% compared to Q1 2022 and 61% lower than issuance recorded in Q4 2022. The transition theme had accumulated total volumes of USD11.3bn at the end of Q1 2023.

Sustainability-Linked Bonds: In the first quarter, USD21.4bn was added, which was a huge rebound of 46% compared to Q4 2022 but a 17% decline on Q1 2022. Climate Bonds had registered total SLB volumes of USD226.6bn at the close of Q1 2023.

Pending and excluded bonds

On top of the USD122.9bn volume of green bonds recognised in our Q1 figure, a further USD57.7bn of green deals were either excluded from the Climate Bonds Green Bond Database (GBDB) or are classified as pending, awaiting further clarification from the issuer.

USD31bn of green bonds priced in Q1 2023 remained on the pending list, awaiting further assessment to determine inclusion in the Climate Bonds GBDB. Sovereigns constituted the largest issuer category, with USD12.9bn worth of debt across four deals making up 42% of the total pending amount. Climate Bonds is in dialogue with issuers to obtain further clarity on their stated Use of Proceeds. See the report for more detail.

Strong quarter for sovereigns

Sovereign GSS+ liabilities received a huge boost in Q1, as countries began addressing their annual sustainable financing needs straight off the block. Climate Bonds recorded sovereign GSS+ debt from 11 countries amounting to USD21.8bn, split between new deals from six countries worth a combined USD8bn, and taps from another six (including India which brought its first deal, and reopened it in the same quarter) to the tune of USD13.8bn.

The Q1 sovereign total represented an increase of 44% on the prior quarter, but a decline of 15% YOY. The largest single issuer was the UK, which extended its green liabilities by GBP5bn (USD6.1bn), tapping its 2033 for GBP3bn (USD3.7bn) and its 2053 for USD2bn (USD2.4bn). The UK is the third largest issuer of sovereign GSS+ debt with GBP31.3bn (USD39.8bn), behind Germany (USD46bn), and France (USD58.8bn), which retained its crown.

By the end of March, Climate Bond's databases reflected cumulative sovereign GSS+ volumes of USD345.8bn.

The Last Word

Climate Bonds, CEO, Sean Kidney predicts market conditions where global bond issuance is in greater scarcity will reveal the favorability of labelled debt. Sean remarked:

“As fixed-income markets recover, a more selective approach to bond buying is likely to favour sustainable bonds, which offer investors vision on where their capital is heading and assurance the issuer is moving with the times on the critical issue of climate impact.”

“Stabilising the road ahead means getting tough on climate action and all market actors need to step up and shoulder this responsibility. Climate commitments, credible pathways and sustainable finance should be the pillars of good governance in public and private sector alike.”

We at Climate Bonds are looking forward to what Q2 reveals about the market. Stay tuned for more comment and reaction.

‘til next time

Climate Bonds