Concrete transition policies to cement a green future

Climate Bonds' new policy paper on the cement sector’s transition to net zero lays out concrete policies to underpin the cement transition and here’s why you should read it:

Economy-wide rapid decarbonsation

The 2015 UNFCCC Paris Agreement is a testament to the global determination to limit increasing global temperatures to 1.5°C. To achieve this limit, all sectors of the economy must decarbonise rapidly, reducing emissions by nearly half by 2030 and to net zero by 2050. However, only a few economic activities currently operate at or near zero emissions.

Most sectors require substantial financing, clear guidance, and a framework of supportive policies to transition to net zero – and the cement sector is one of these. Cement is the second-largest industrial emitter, accounting for approximately 7% of global CO2 emissions, and demand for cement is predicted to increase.

Cement is a crucial input for many industries, including construction and infrastructure, and will inevitably need to be part of a low-carbon future. This new policy paper aims to support the EU in defining the necessary policy framework for financing the transition. While primarily focused on the EU context, many of the policy tools and recommendations apply globally.

Markets to bridge investment gap

The additional investments needed by 2030 to align with a Paris-aligned transition pathway are estimated to be relatively low. The investments needed for the EU cement sector to meet 2030 targets represent around 20% of annual maintenance CAPEX. At the system level, however, there are challenges in rapidly scaling up these investments across a huge number of locations.

The need to achieve deep emissions reductions by 2030 means that scale and speed are critical.

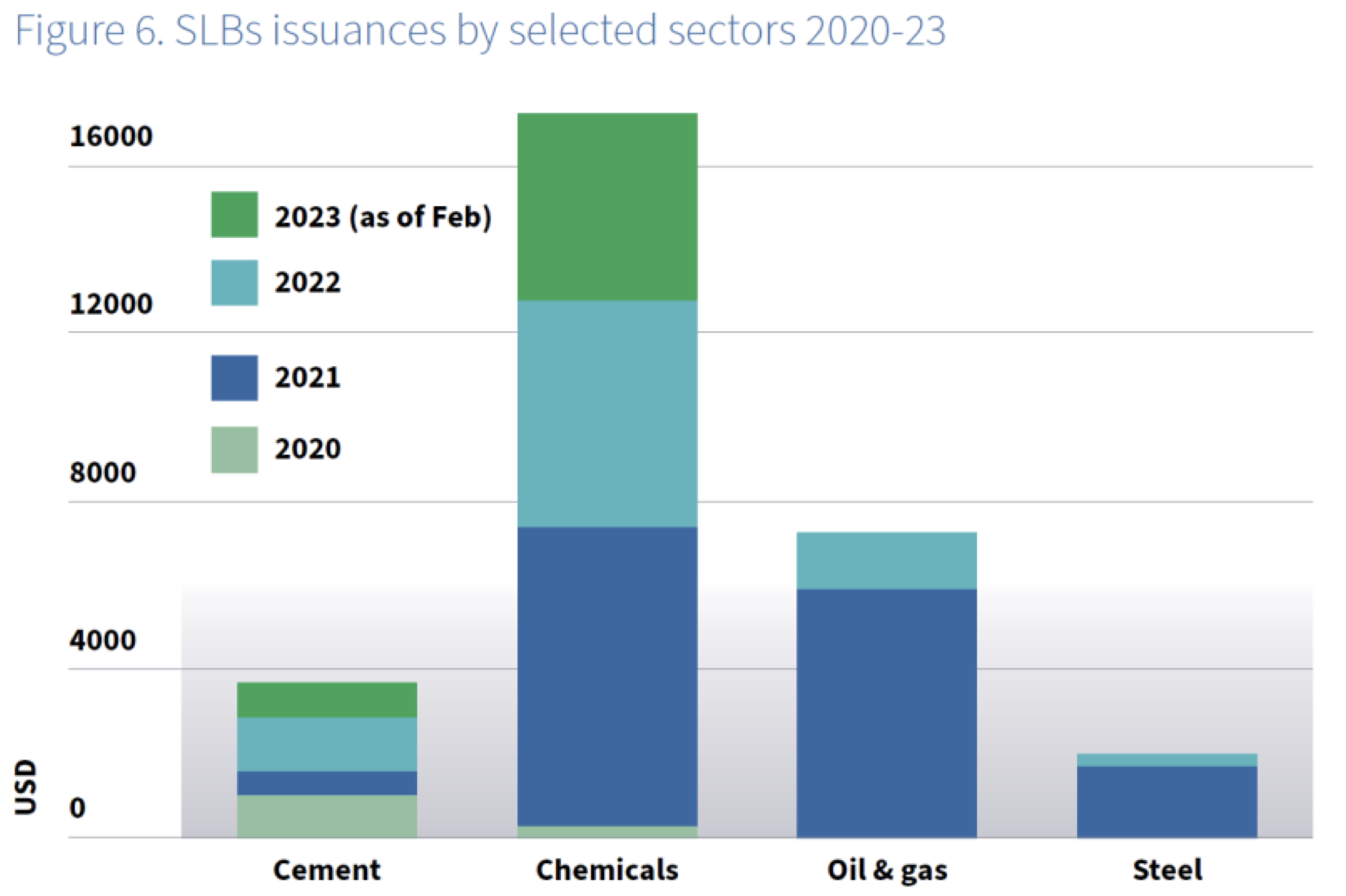

The global cement industry will need to invest USD16bn annually on top of business-as-usual investments to transition to net zero. Around USD3.7bn sustainability-linked bonds have been issued in the cement sector 2020-2023 (as of February 2023). The cement sector represents less than 2% of SLBs issued so far. Despite the growth of these financial instruments, their potential is not being fully exploited in this sector. Emerging standards and sector-specific criteria, such as those developed by Climate Bonds Initiative, can support the growth of these instruments in hard-to-abate sectors such as cement.

Crucial Policy levers to decarbonise Cement

Public procurement can drive the market for green cement. The EU has set green public procurement criteria, but these are only voluntary. Introducing mandatory criteria in line with the Green Deal would enable preferential spending to be embedded in governmental budgets. Aligning green public procurement standards with the EU Taxonomy will ensure consistency of green public investment.

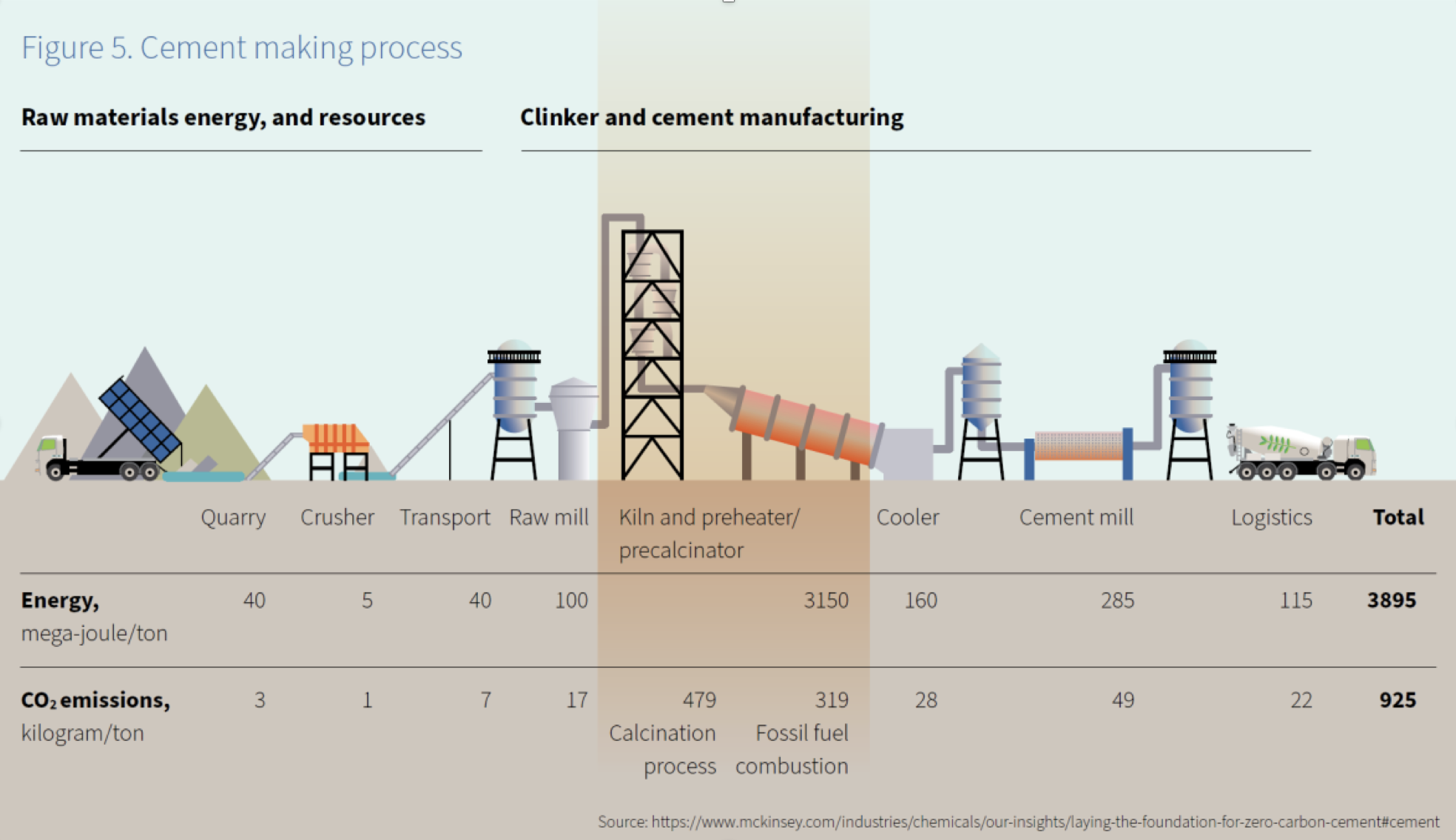

Carbon capture and storage (CCS) technologies will play a significant role in the cement sector transition, but it needs to meet specific criteria to be a credible decarbonisation option. CCS technologies are likely to play an important role in reducing CO2 emissions from the cement industry, notably, the emissions that occur because of the chemical reaction needed to make cement, irrespective of the energy source. Around 60% of the direct emissions in the production process do not result from fuel combustion but from chemical reactions in the clinker calcination process. CCS in cement should address these emissions that cannot otherwise be abated, rather than prolong fossil fuel combustion.

Cement tech solutions of today and tomorrow

30% of EU cement kilns are estimated to reach the end of life and need reinvestment by 2030. Cement assets’ lifetimes reach up to 60 years and the investment choices that cement companies make now will create long-lasting pathway dependencies, well beyond 2050. By investing in technologies that are consistent with a net-zero scenario they can avoid stranded assets and high economic losses.

Policymakers should act immediately to guide industry and investors onto a climate-aligned pathway for cement and support informed investment decisions consistent with a net-zero cement investment approach.

The last word

Want to learn more about Cement sector transition? Check out the recent Climate Bonds Cafe podcast episode.

'Til next time,

Climate Bonds.

Find out more about our transition policy work

Here are the latest developments: