Policymakers hold the key to unlocking capital for transition

Climate Bonds’ new report demonstrates how countries can save trillions by financing climate action now

Meeting the IPCC’s ‘rapidly closing window of opportunity’ is still possible if we rapidly move investment to green. Climate Bonds' new flagship policy report "101 Sustainable Finance Policies for 1.5°C" outlines how policymakers around the world can facilitate the rapid, robust, and credible transition of global economies into a net zero future.

Policymakers at all development levels need to take immediate action to safeguard a liveable future. Rapid action will prevent increased costs, reduce stranded asset risks, and enable sustainable development.

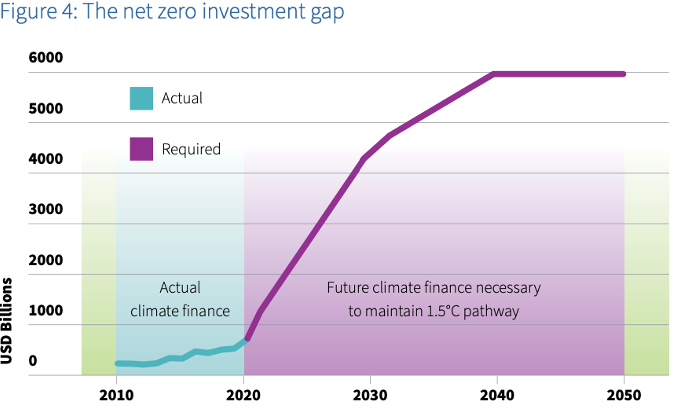

The IPCC’s recent sixth assessment report made clear that there is enough money globally to close the climate investment gap. Public investment cannot deliver transition alone. Policymakers can access private capital eager for sustainable investment opportunities and direct it to meet climate targets and deliver sustainable development.

Capital is not yet moving at scale because of a mismatch between investor appetite and green investment opportunities.

This is why policy is so important. Policymakers can tilt the playing field towards green in three crucial ways:

1. Speed: ensure rapid action by all decision makers,

2. Steer: tilt the whole economy to transition,

3. Simplify: clarify and streamline sustainable investment.

‘101 sustainable finance policies for 1.5°C’ demonstrates the breadth of action that policymakers at all development levels can take.

These policies are particularly crucial for emerging market economies. By aligning their economies with a net-zero trajectory, they can attract international investment flows to deliver environmental, social and economic goals.

In all areas of decisionmaking, policymakers can and must align with 1.5°C. The 101 recommendations cover all government departments, central banks, supervisors and regulators.

Webinar 26 April — Keeping 1.5°C Alive: 101 sustainable finance policies to mobilise capital and deliver net-zero

Join us on 26 April for a special webinar exploring how policymakers around the world can implement these policies to direct capital towards ambitious, credible net zero efforts. Registration is free and open now. Click here to register.

One of the most important roles of policymakers is to de-risk green investment opportunities and enable private investment to flow to both nascent technologies and developing markets. Backwards-looking risk assessments can overvalue high carbon assets with strong historical performance. Readjusting risk assessments, ensuring climate resilience is appropriately valued, is key.

Policymakers can ensure climate risks and opportunities are fully integrated in investment decisions through subsidy reform, climate disclosure requirements, adjustments to risk weightings etc. But this not enough to ensure urgent action.

Investor risk appetite is too low for many of the key sustainable investments that are essential to transition – those in innovative technologies or emerging markets.

Policies including green guarantees, blended finance facilities, preferential green trade windows will reduce the risk associated with an investment. This will enable mainstream investor participation and reduce the cost of capital for the borrower/issuer.

While investment will eventually flow to green, risk sharing and diversification will speed this up, maximising investment opportunities and ensuring climate targets are met.

One of the biggest risks to transition is that private investment appetite for green is not sufficiently exploited. Sustainable finance policy can overcome the barriers that are preventing capital redirection and enable largescale investment to deliver transition.

This report aims to equip policymakers at all development levels with a toolkit of policies that can drive capital to deliver system-wide rapid transition.

The 101 is an ongoing project . Climate Bonds will engage with governments globally on sustainable finance policy framework development. Contact policy@climatebonds.net to find out more.

'Til next time,

Climate Bonds