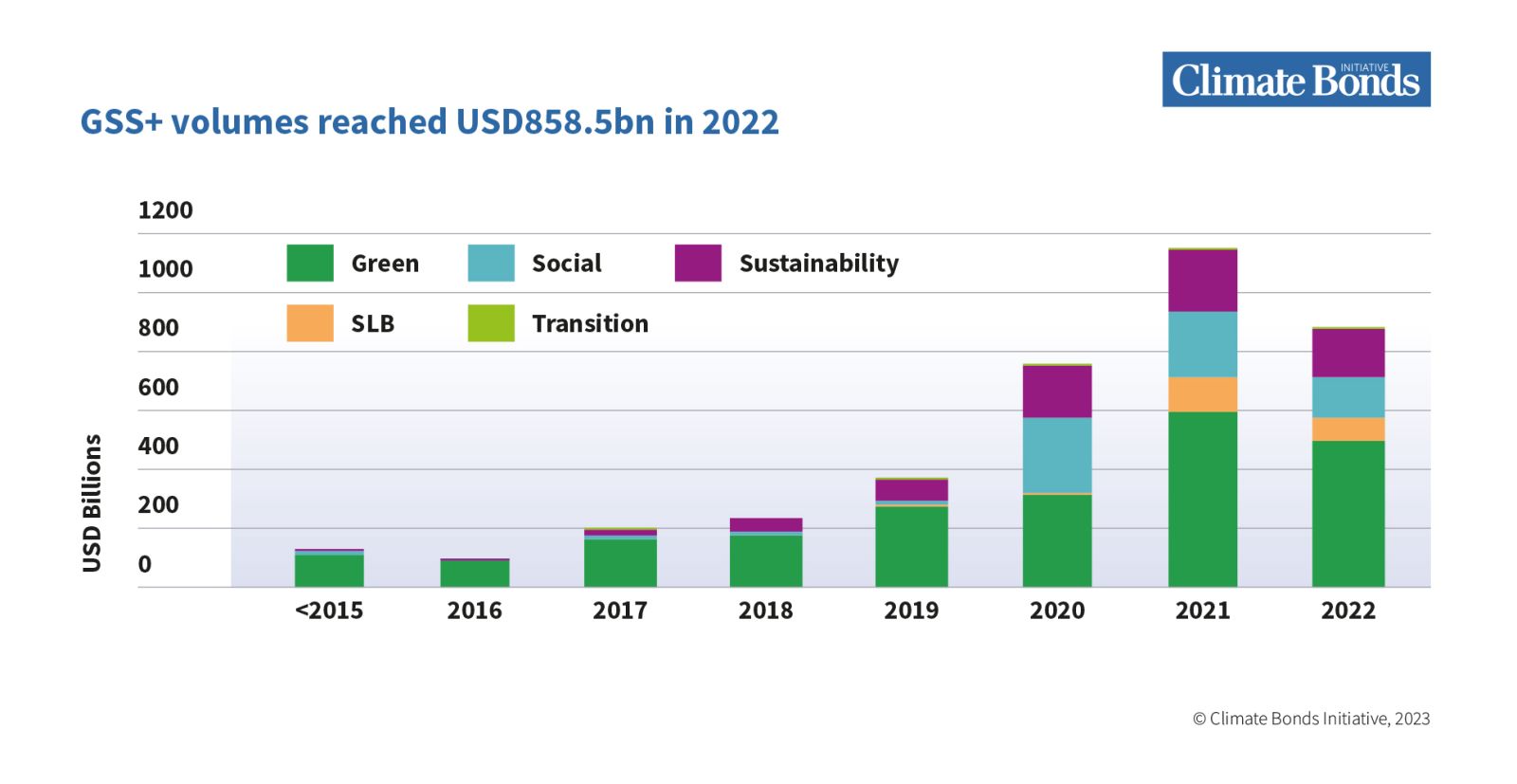

Climate Bonds captured USD858.5bn of new green, social, sustainability, sustainability-linked and transition (GSS+) volumes in 2022, 24% below the USD1.1tn recorded in 2021, marking the first time GSS+ volumes fell year-on-year in a decade. 2022 witnessed a contraction of the entire global bond market as soaring inflation caused fixed income markets to falter.

In a year of volatility, GSS+ held its 5% share of bond market volumes as in 2021. The news comes in the latest iteration of Climate Bonds flagship report Sustainable Debt, Global State of the Market 2022, supported by Citi Bank, IFC, and JP Morgan.

The Climate Bonds Initiative screens self-labelled debt instruments to identify bonds and similar debt instruments as eligible for inclusion in Climate Bonds’ Green Bond Database. USD2.2trn of green bond issuance had been recorded at the end of 2022, with USD3.8trillion across all GSS+ labels combined.

Breakdown: Transition, the only label to exhibit growth

Green remains the dominant theme, taking 58% of the total with volumes of USD487.1bn, a 16% decline on 2021 volumes of USD582.4bn.

The social theme experienced the biggest drop of 41% from USD219.5 to 130.3bn. Issuers are no longer tapping the debt market to fund the COVID-19 recovery, favouring instead the combination of social and environmental proceeds under the sustainability label - though the sustainability label fell 21% from USD204.1bn in 2021 to USD161.3bn in 2022.

Volumes of sustainability-linked bonds (SLB) dropped 32% from USD112.1bn in 2021 to USD76.4bn in 2022. The Climate Bonds Standard has recently expanded to deliver long-awaited standards for SLBs. It’s hoped this will help spur the market onwards with greater confidence on the climate impact of these instruments.

Transition was the only theme to demonstrate growth, expanding 5% YOY from USD3.2bn to USD 3.5bn. This reflects the strong policy support the label has received in China and Japan. The number of deals rose 178% from nine in 2021 to 25 in 2022.

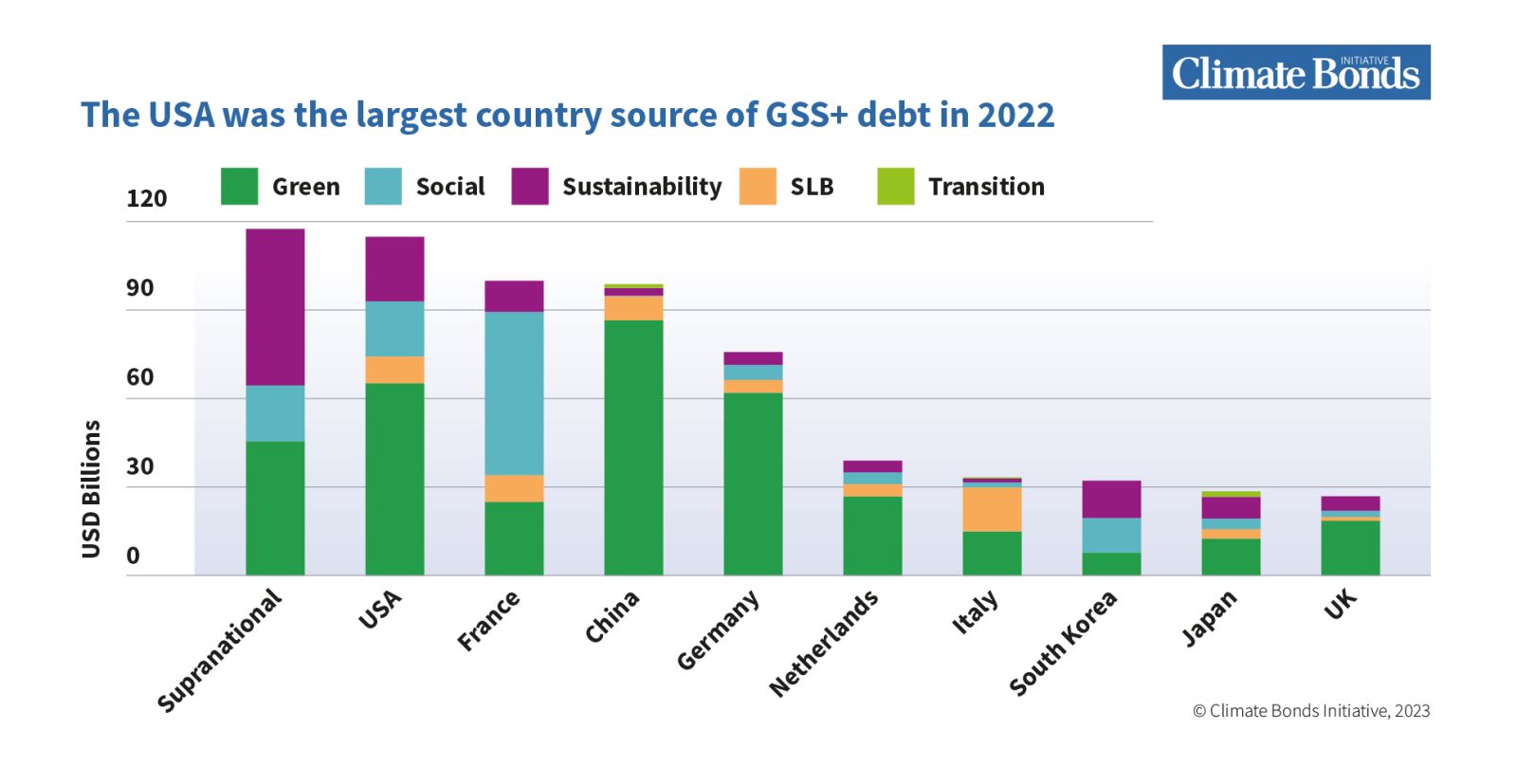

Breakdown by Nation

Supranational entities dominated the top ten sources of thematic debt in 2022, with USD115.9bn in volumes across all three GSS categories. The USA was the largest country source and priced the highest share of sustainability deals (USD21.5bn). China produced the largest volume of green bonds (USD85.4bn), France owned social bonds (USD54.5bn), Italy was top in SLBs (USD14.7bn), while USD1.9bn of transition debt originated from Japan.

GSS+ deals were priced in 40 currencies. The top three currencies were together responsible for 81% of the volumes, including 42% priced in EUR. Investors in the region have the immediate advantage of a broader investible opportunity set.

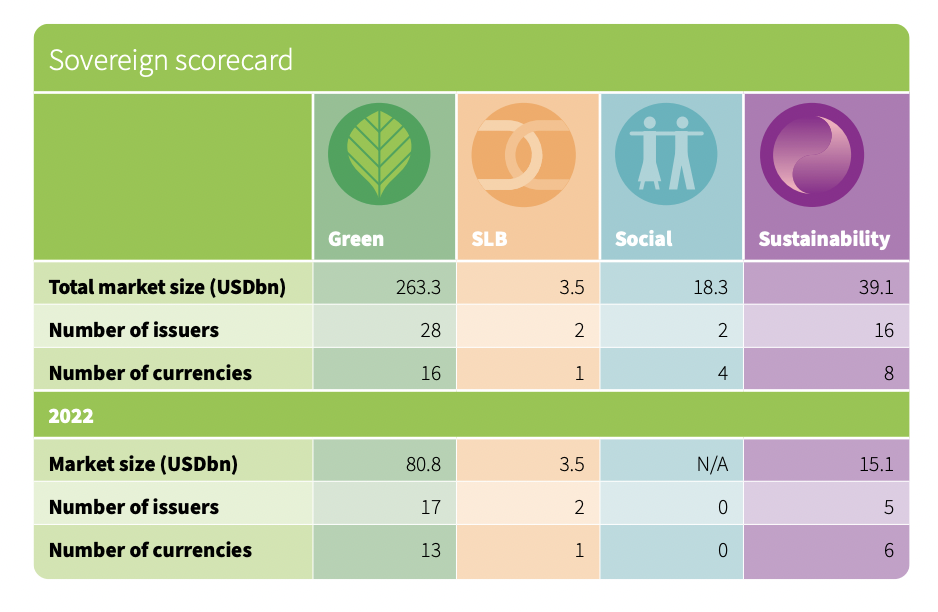

Sovereign Spotlight: Call for 50 issuer milestone to manifest in 2023

By the end of 2022, Climate Bonds had recorded sovereign GSS+ deals with cumulative volumes of USD320.4bn from 43 countries, 25 of which are repeat issuers, and some of which have leveraged multiple themes. Three-quarters of the volume (USD239.8bn) originated from 17 DM countries with the remainder (USD83.2bn) coming from 26 EM countries.

The green theme was responsible for 81% of this (USD263.3bn), with social and sustainability taking 5% (USD16.3bn) and 12% (USD40.3bn) respectively and the final 1% (USD3.5bn) coming from SLBs, a new sovereign theme in 2022. During 2022 the sovereign GSS+ bonds captured by Climate Bonds declined by 20% YOY. Climate Bonds hopes to see the total number of sovereign GSS+ issuers top 50 before the end of 2023

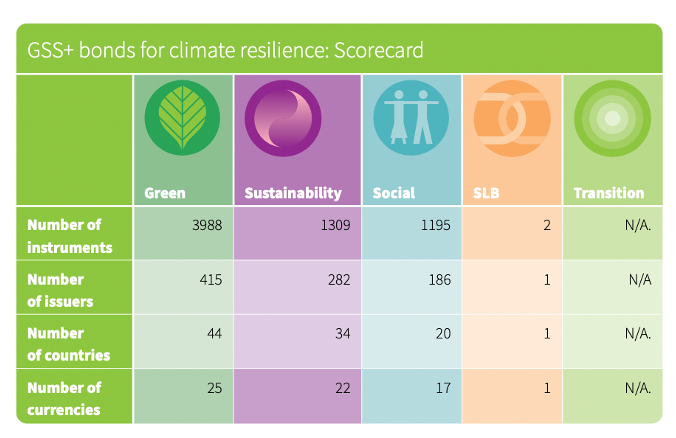

Resilience can help Reach $5Trillion by 2025

Cumulative green bond issuance reached USD2.2tn by the end of 2022, but Climate Bonds is pushing for at least USD5tn annual issuance by 2025. The persistent lack of supply has been a key obstacle to reaching this target.

There is a tremendous opportunity to tap unmet demand by scaling-up capital flows towards investments in resilience. By providing the market with clear rules and definitions, the current universe of green investment can be expanded to include those that build resilience.

This expansion will move beyond investments that reduce direct physical impacts of extreme weather and include investments that address the underlying vulnerability of people and ecosystems to climate change. Climate Bonds is committed to developing this market as described in section 8 of this report.

Of the 33,849 GSS+ debt instruments recorded by Climate Bonds at the end of 2022, 6,494 (19%) were identified as having some degree of resilience related UoP. In 2022, the share was 13% (949). Across the global thematic debt market, 845 issuers priced instruments with a resilience component (23%). The number of issuers in 2022 was 277.

Government Support for Green Industry Grows

Subsidies, credit guarantees, tax offsets or other financial incentives will finance discoveries that will enable the rapid scaling up of climate change solutions, through the large, transparent deals that investors in the GSS+ market are so keen to see more of.

Climate forecasting group, Inevitable Policy Response (IPR) calculates the combined total of public money now available in the US for clean energy and climate investment via the Inflation Reduction Act (IRA), Infrastructure and Investment Jobs Act (IIJA) and the CHIPS & Science Act is almost USD1tn.

This is being supplemented by the Bipartisan Infrastructure Laws (BILs), which will provide tax cuts and grants for clean energy. The BILs represent a government enabled but private sector led tool to facilitate a new raft of investment to green projects.

Across the Atlantic, Europe is responding with EU Commission President Ursula von der Leyen announcing the Green Deal Industrial Plan at Davos, which includes the Net Zero Industry Act. The aim is to increase the funding of clean energy technologies.

The Last Word

We at Climate Bonds hope to see green and other labelled bonds rally in 2023, though economic conditions remain challenging. The green finance movement has demonstrated its enduring appeal and brought to light so many advantages of climate-considerations in global finance.

Sean Kidney CEO of Climate Bonds, highlighted that tough inflationary environment, will become much more prevalent should the climate challenge be ignored.

Sean said, “The green bond market offers a crucial opportunity to finance a climate-conscious future and prevent the decline of our planet. 2022 saw a change in the macroeconomic landscape in which rising inflation rates caused fixed income to falter and put stress on global finance. Unfortunately, Spikes in inflation will only become more common as global production and geography is obstructed by climate chaos.”

We’d like to thank all the market actors who helped the labelled debt march on in 2022. Be sure to check out the full report for more information.

‘Til next time

Climate Bonds