Green and other labelled bonds reach $417.8bn in the first half of 2022

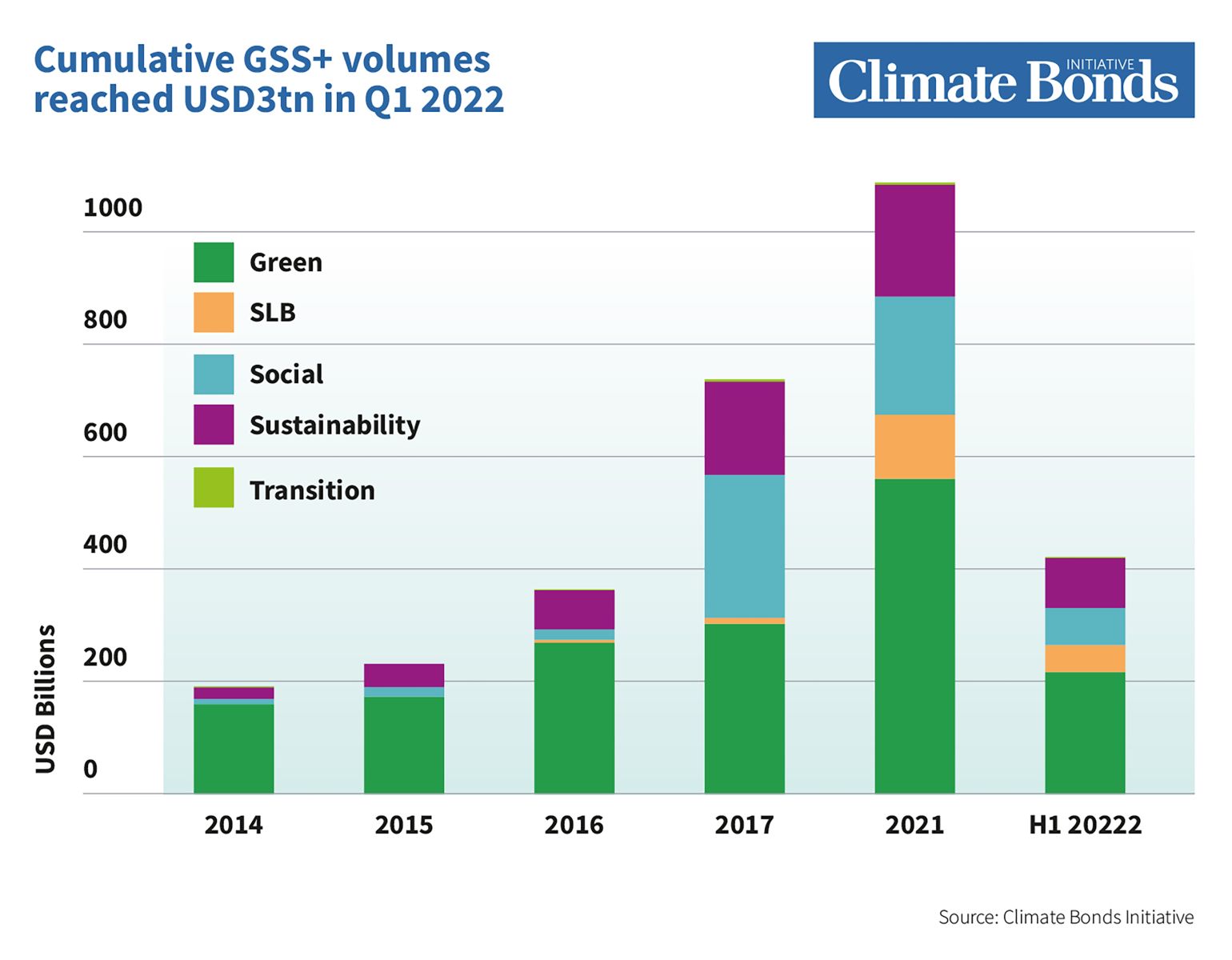

Green, social, sustainability, sustainability-linked, and transition (GSS+) labelled debt reached a combined volume of USD417.8bn in the first half of 2022 (H1 2022), representing a year-on-year (YoY) decrease of 27% against H1 2021. However, signs of a revival emerged as green issuance picked up in Q2, increasing by 25% on Q1 volumes with a total of USD121.3bn.

The Russian invasion of Ukraine in February and the subsequent European energy crisis exacerbated post COVID-19 inflation, impacting bond market dynamics. Rising interest rates and high volatility resulted in decreased bond issuance, including GSS+ volumes that have been soaring in recent years. Cumulative volumes of labelled (GSS+) issuance stood at USD3.3tn at the end of H1 2022, with green cumulative volumes at USD1.9tn.

The data arrives as Climate Bonds Initiative (Climate Bonds) releases its Sustainable Debt Market Summary H1 2022. Climate Bonds screens self-labelled green bonds and only include those aligned with international climate targets as expressed in the Paris Agreement in the Green Bond Database (GBDB). Climate Bonds' rigorous screening process of the labelled debt markets has consolidated its position as a market authority and pioneer of market integrity.

Green Bond Issuance Highlights

The green label, historically the largest (with USD1.9tn cumulative volumes), has seen consecutive YoY growth over the last decade (since 2012) and boasts a YoY growth rate of over 50% since market inception in 2007. In 2022 however, a variety of challenges facing the global economy and the bond market have left this year’s progress slower than hoped as volumes are 21% behind H1 2021 volumes.

The first half of this year saw new green debt instruments recorded in the Climate Bonds GBDB totalling USD218.1bn, a 21% drop compared to the record H1 volumes of USD277.5bn in 2021. While Q1 2022 saw the lowest volumes since Q4 2020, green issuance picked up in Q2, with USD121.3bn, a 25% increase on the prior quarter. June was the busiest month of the year, closing the first half at almost USD47bn, or 22% of year-to-date issuance.

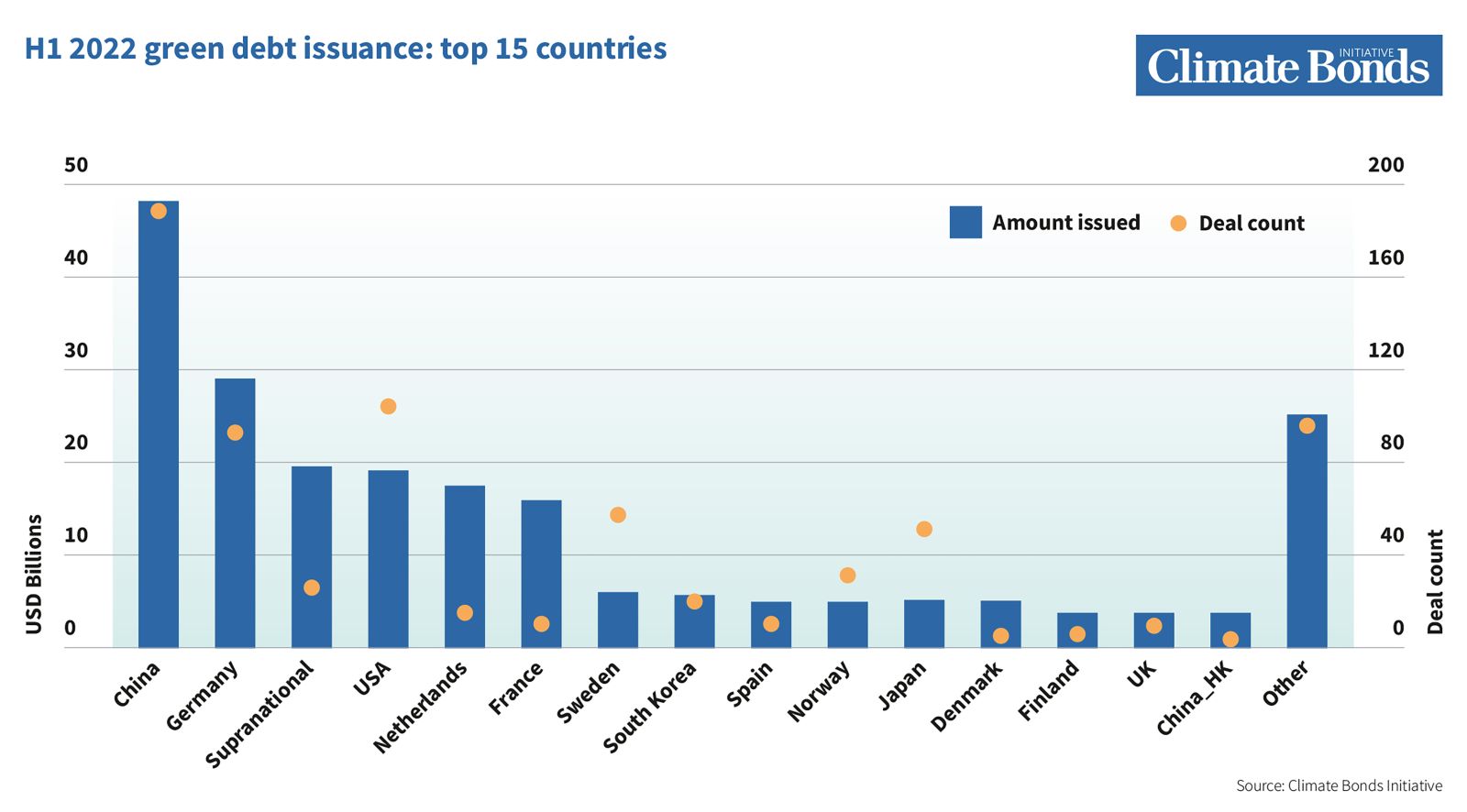

Issuers from 40 countries (excluding supranationals) priced green bonds in H1 2022. For the second consecutive quarter, China was the most prolific country by volume (USD48.2bn, or 22% of the total), issuance (190 deals) and number of issuers (116).

Sovereigns Maintain Green Momentum

In the first half of this year, volumes of USD27.4bn in new sovereign bonds or taps were added to the Climate Bonds GBDB. The majority of the largest green bonds issued in this period were from sovereign issuers and supranational bodies.

Social and Sustainability Bond Issuance

Social bonds comprised 15% (USD63.8bn) of the H1 2022 volumes, with social issuance down by 57% from H1 2021 (USD90.5n). Bonds issued to the end of H1 2022 brought cumulative social-themed volumes to USD583.9bn. The sharp rise of this theme was largely related to mitigating the most urgent impacts of COVID-19 and issuance has since subsided along with the crisis.

Sustainability bond issuance comprised 21% (USD87.2bn) of total labelled issuance in H1 2022, a decline of 13% against H1 2021 volumes. Bonds issued to the end of H1 2022 brought cumulative sustainability issuance to USD622.4bn. The proceeds of sustainability bond issuance are earmarked for a mixture of green and social causes and projects.

Transition and Sustainability Linked Bond Markets Grow

Transition and Sustainability Linked Bonds (SLBs) offer a way into sustainable financing for high-emitting issuers that are looking to become green. The proceeds of transition bonds are committed to emissions-reducing projects whereas SLB’s come with no restrictions on the Use of Proceeds (UoP), instead, issuers commit to improving their environmental performance against KPIs and link the achievement of these pledges to the coupon paid to investors.

The sustainability-linked bond (SLB) market continued to grow in H1 2022, with new issuers and repeat issuers using the format to define and signal to investors their transition pathways. The SLB segment saw rapid YoY growth in Q1 and a more muted Q2 bringing H1 2022 total issuance to USD46.6bn, which still marks an increase of 5.2% YoY.

H1 2022 also saw 23 transition bonds from 17 issuers totalling a volume of USD2.1bn, as transition volumes trebled in Q2 from Q1 2021. Other than EBRD’s SEK1.9bn (USD209m) deal in January, all 2022 transition bonds originated from Japan and China’s transition finance programmes, targeting hard-to-abate sectors like steel, chemicals, aviation, as well as some issuance from utilities.

The Last Word

It’s been a difficult year for the global bond market, and this hasn’t gone without consequences for labelled issuance. However, signs of a rebound did emerge in the second quarter of the year and we expect a steady revival to continue throughout 2022.

The impact of green finance is as important as ever, said Sean Kidney, CEO of Climate Bonds: “A climate catastrophe is underway and decisive action is needed. Green bonds are driving a global conversation about the opportunities within climate investments and the mobilisation of capital.”

The sheer significance of our planet’s plight has left an inevitability about the coming change, Sean continued: “Investors now know the future will need to be clean and green; it’s now a question of the speed in getting there and who will be winners in the transition. Issuing a green bond signals transition efforts that reduce the risk of being bowled over by the coming tidal wave of change.”

Stay tuned for more market updates as we follow the progress of sustainable finance throughout the year!