Milestone arrives in the first quarter of a tough year for global bond markets

The green, social, sustainable and other labelled (GSS+) bond charge was threatened by market volatility in Q1, as the Ukraine war and rising interest rates sprung upon the opening months of the year.

Despite this, the labelled debt market demonstrated resilience and amassed a strong volume which is expected to rise in the second quarter. In Q1 of 2022, a respectable USD202bn was raised across the different GSS+ labels, according to our Q1 Market Update.

The Q1 volume pushes cumulative GSS+ volumes past the USD3tn mark, a solid milestone for a well-established market that is innovating the future of capital flows.

Green market expected to gain momentum throughout the year

Green bonds added to the Climate Bonds Green Bond Database (GBDB) in the first quarter of 2022 totalled USD83.5bn. The effects of rising interest rates and concerns over energy security as war struck Europe were felt; green bond issuance in the opening quarter was down 38% compared to Q1 2021.

The 27% increase YoY registered in the month of January was offset by declining volumes in the two following months (-18% and -69%, respectively) which is as one may expect in a turbulent market environment.

The decrease in green volume for this period compared to last year is also attributable to fewer bonds being recognised as green under the Climate Bonds Standard. Disclosure standards must be upheld to safeguard market integrity and Climate Bonds is a gatekeeper of this integrity.

Despite a slow start, which is typical of opening quarters, there remains some hope that the market can deliver another successive year of growth.

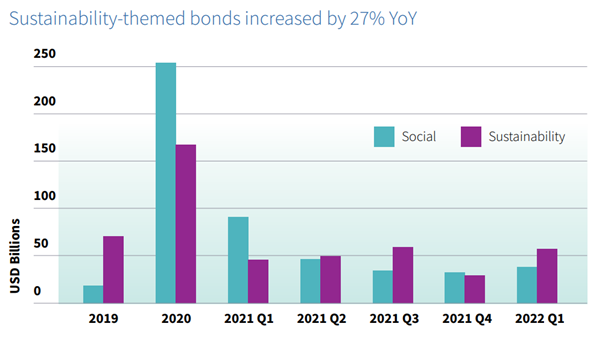

Sustainability bonds boom, while social bonds slow

Social and sustainability (S&S) bonds comprised 18% (USD37.2bn) and 28% (USD56.5bn), respectively, of total labelled issuance captured by Climate Bonds in Q1 2022. Sustainability bond volumes increased 27% YoY (from USD44.5bn in Q1 2021), with prolific issuance in January 2022 (+111% vs Q1 2021).

The growth of the sustainability theme was spurred by strong issuance from supranational organisations, which contributed 41% of the label’s Q1 total. Notably, The World Bank (IBRD) issued USD18.6bn of sustainability deals earmarked to support gender equality and education; clean energy; biodiversity conservation; and conflict mitigation among others.

Social issuance was down by 59% from Q1 2021 (USD90.5n). While January 2022 saw 66% growth YoY, February and March recorded an 82% drop. The 2020 and 2021 spikes in this theme were largely related to mitigating the most urgent impacts of COVID-19 and issuance has subsided along with the crisis.

Bonds issued in this quarter brought cumulative social-themed volumes to USD551.4bn, while sustainability issuance stood at USD563.9bn over the lifetime of its market.

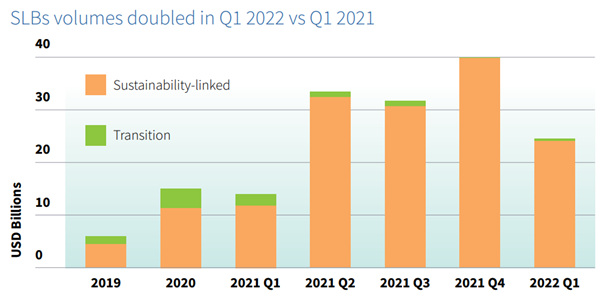

Sustainability-linked bonds continue to grow, transition bonds led by Japanese issuers

The Sustainability-linked bond (SLB) segment has seen rapid growth as more entities, especially corporates, look to access sustainable finance that is not tied to specific projects or assets, but can help them define and signal to investors their overarching transition pathways.

The first quarter of 2022 saw continued growth in SLB-themed volumes, which represented 11.9% (USD24.bn) of total sustainable debt issuance in Q1 (+103.3% YoY).

The first quarter of 2022 saw two new issuers enter the transition bond market: Japan Airlines and Tokyo Gas. Their bonds, coupled with deals from experienced transition bond issuer EBRD, brought the transition-themed volumes to USD470m in Q1 2022, a cumulative USD9.7bn since market inception.

The Last Word – Learning curve for labelled markets

Rising interest rates make for unfriendly conditions for fixed income securities and the whole bond market is suffering. The green (and other labelled bond) markets have yet to be faced with such an environment since market inception.

These new conditions offer analysts an opportunity to learn more about the characteristics of labelled debt instruments. Sean Kidney, Climate Bonds’ CEO, is optimistic about the resilience of green bonds:

“We have witnessed the immense durability of green bonds during the global Covid-crisis of the last two years. Whilst the recent impact of rising rates and geopolitics have been felt, we are hopeful the market will endure, revealing further protections offered by the green label in tough times.”

Climate Bonds will return with further analysis over the coming weeks when our Market Intelligence team reviews the first half (H1) of 2022. Stay tuned for that!

‘Til next time!

Climate Bonds