The biggest penalties will be paid for delaying climate action

Over recent months, the Intergovernmental Panel on Climate Change (IPCC) has continued to issue deafening warnings that the world is nowhere near on track to achieve the Paris targets of keeping warming below 1.5°C.

The last two reports - Working Groups I (The Physical Science Base) and II (Impacts, Adaptation and Vulnerability) Reports as precursors of the landmark 6th Assessment Report- forewarned of a devastating future for life on earth without significant action in this decisive decade. Global emissions must be halved by 2030 for humanity to stand a chance of avoiding catastrophic consequences of climate change.

On Monday the IPCC released its Working Group III (AR6 WGIII) report, offering the most comprehensive view of how we can mitigate climate change, calling for a vast global redress that involves a huge role for climate finance.

The grim state of play

Temperatures are soaring at a rate that hasn’t been witnessed in the last 2000 years. Scientists are certain of humanity’s influence on our changing climate and the message has been loud and clear throughout the IPCC’s reports. Despite this, greenhouse gas emissions have continued to climb since AR5,.

Current Nationally Determined Contributions (NDCs) will see a global temperature rise of at least 2.7°C this century, with other estimates being more morbid. If the rise in CO2 emissions continues at current pace our carbon budget will be spent in the early 2030s. The analysis in the latest report also hands greater recognition to the harm induced by methane and nitrous oxide.

Due to the severity of inaction, the world is likely to ‘overshoot’ average global temperatures of 1.5°C and 2°C. This entails the global average temperature exceeding the international targets before reducing again, necessitating a reduction in Greenhouse Gas concentrations through carbon dioxide removal (CDR).

But this is not a simple act of reparation; modelling suggests that between 100 and 1000 billion tonnes of CO2 removal will be needed by the end of the century. Academics and NGO’s have warned the scale of such an operation comes with adverse effects and will still lead to irreversible climate change such as extreme weather and biodiversity loss.

Climate finance must step up

The Paris Agreement acknowledged the important role finance needs to play in both mitigating climate impact and climate adaptation. Although climate finance is on the move, its progress seems incremental when considering that USD 6.3 trillion is estimated to be needed each year by 2030 to stay on course.

Climate Bonds is calling for an annual USD5trillion of labelled green bonds to be issued annually by 2025, as a significant contribution to the current investment gap. The green bond market has been soaring over recent years, with over half a trillion-volume recorded in 2021 and hopeful anticipation that the first annual trillion could land this year.

The IPCC’s latest report highlights the global shift to renewable energy generation and electrification as a central objective for climate finance. The renewable energy sector is developing with wind and solar generating 10% of global electricity for the first time in 2021.

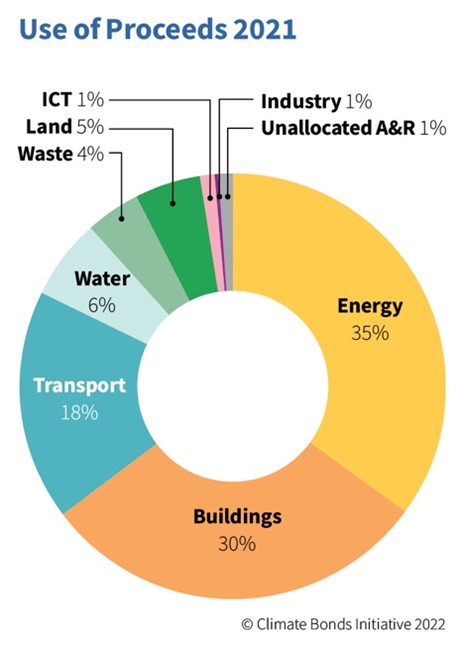

Climate Bonds Market Intel reported that Renewable Energy drew the largest share of green investment across sectors and issuer types in 2021, followed by investments into Low-Carbon Buildings and Transport. Market directions show a promising uplift over the past few years, but this acceleration must continue shifting capital to this sector at a faster pace with investors and policymakers prioritising these allocations.

Government subsidies to the fossil fuel sector should end in an effort to clear obstacles for the renewable energy sector. The fossil fuel industry benefits from USD11 million of subsidies every minute, according to estimates from the IMF.

Regulating climate finance responsibly

Government policy and its influence on the financial sector needs to show greater responsibility beyond just the reassessment of subsidies. In the green bond space, Climate Bonds are among several NGOs expressing concerns over an EU Complementary Delegated Act proposing unabated fossil gas as a transition fuel for future of sustainable investing in the continent.

Not only does fossil gas provide a further distraction from the need to invest in renewables, but handing it merits for sustainability in the world’s largest trading bloc is horrendously misguided as IPCC’s latest report recognises methane emissions to be considerably more harmful for global warming than CO2.

Methane is a powerful greenhouse gas— warming the Earth about 28 times more effectively than carbon dioxide. Moreover, the harm induced by fossil gas is immense and often fails to include the additional impact of significant methane leaks in production and transit.

The Last Word

Here at Climate Bonds, we are hopeful that the current progress in green and other labelled markets can provide a platform for Paris alignment in global economy.

Sean Kidney, CEO of Climate Bonds, calls for the shift to a climate conscious future to gather pace. “Don’t walk, run!”

Our forthcoming Sustainable Debt Global State of the Market 2021, due for release in late April, will provide insights on the scale and depth of the investment last year.

Stay tuned for that!

‘Til next time,

Climate Bonds.