The development of China’s sustainable debt market up to the first half of 2021 is the focus of a new report jointly produced by the Climate Bonds Initiative and CIB Research, with the support of UK PACT.

The Climate Bonds Initiative & CIB Economic Research and Consulting Co., Ltd. (CIB Research), with the support of UK PACT (Partnering for Accelerated Climate Transition), have today launched China’s Growing Sustainable Debt Market Report. The report analyses the development of China sustainable debt market up to the first half of 2021, focusing on the definitions, regulatory frameworks, and market development of existing sustainable labels, and takes an additional lens into the latest developments in market standards and policy incentives/constraints. The report is available for download in both Chinese and English.

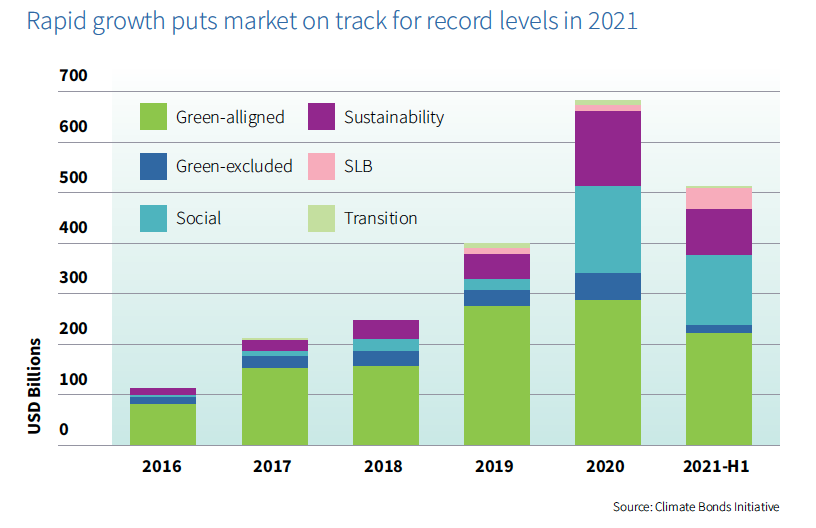

Alongside China’s public pledge to achieve carbon peaking by 2030 and carbon neutrality by 2060, the report underlines the rapid growth of global sustainable debt market over the past 6 years. This robust expansion in China’s green, social and sustainable debt market reflects the country’s ambition to rapidly decarbonize its economy and enhance resilience of its environment and society.

Over 2021, China has maintained the momentum by launching several innovative sustainable debt labels such as carbon neutral bonds and Sustainability-Linked Bonds (SLBs) into the domestic market. Other labels, including for social bond and sustainable development bonds, were also in pilot phase. As of the first half of 2021, the cumulative issuance of domestic labelled GSS debt was RMB3.3tn. The cumulative issuance of carbon neutral bonds reached RMB140.6bn by the end of June 2021, accounting for 57.3% of the total amount of green bonds issued in the H1 2021.

In April 2021, the Green Bond Endorsed Project Catalogue (2021 Edition) was launched, with the effective date 1 July 2021. Its application extends to all types of domestic green bonds, thus achieves the unification of disparate green bond standards in China. It also removes sectors relating to the clean use of fossil fuel and achieves alignment with international standards.

Report highlights:

RAPID GROWTH

● Between 2020 and H1 2021, overseas green bond deals totalled USD9.3bn, while Social and Sustainability bonds reached USD1.0bn and USD7.4bn respectively. Offshore issuance of SLBs was USD6.1bn.

● As of the first half of 2021, the cumulative issuance of domestic labelled GSS debt was RMB3.3tn, mainly comprising green bonds (including carbon neutral bonds and blue bonds) with total volumes of RMB1.4tn.

RAPID DIVERSIFICATION OF LABELS

● The cumulative issuance of carbon neutral bonds reached RMB140.6bn by the end of June 2021, accounting for 57.3% of the total amount of green bonds issued in the H1 2021.

● Blue bonds are still in the nascent stage. In 2020, the Bank of China and China Industrial Bank issued blue bond in the overseas market, Qingdao Water Group issued first domestic blue bond.

● In H1 2021, the scale of local government special-purpose bonds issued specifically for green projects reached RMB45.4bn.

● In May 2021, the first batch of seven SLBs were successfully issued in the China’s interbank market, with a combined amount of RMB7.3bn.

● As of June 2021, the cumulative issuance of China's special bonds for poverty alleviation was RMB282.6bn.

● By the end of June 2021, China had issued seven green rural revitalization bonds with a combined amount of RMB3.4bn.

● As of June 2021, the cumulative issuance of China's pandemic bonds reached RMB1.54tn.

INCENTIVES ARE BECOMING PREVALENT

- Supporting policies for green bonds have been launched across China, including substantial incentives such as discounted interest rates, guarantees and subsidies for green bonds.

GREEN DEFINITIONS UNIFIED PLUS CHINA-EU COLLABORATION ON TAXONOMY

● Latest version of the Green Bond Endorsed Project Catalogue (2021 Edition) was launched with an effective date 1 July 2021. It achieves the unification of disparate domestic green bond standards and further alignment with international standards.

● Progress has been made in COP26. The report Common Ground Taxonomy – Climate Change Mitigation launched during COP26, in which Climate Bonds participated as an expert advisor, adds clarity to the common ground on the definition of green between China and EU, and will facilitate cross-border flows of green capital.

Market Outlook

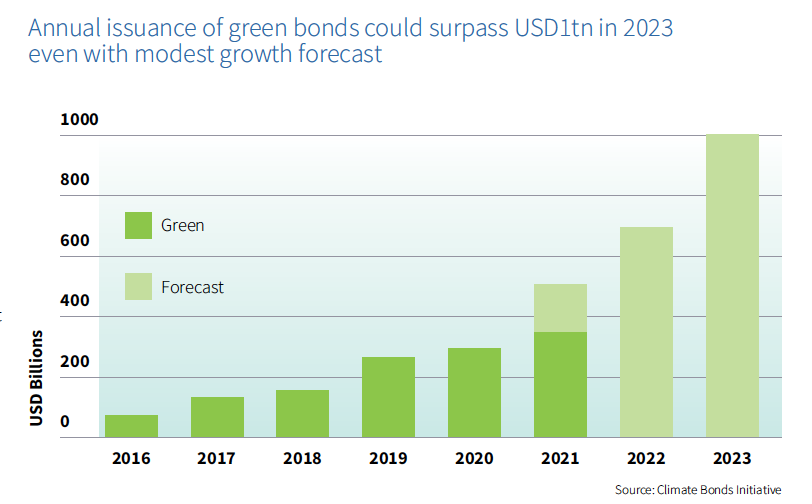

Projections see the long-awaited milestone of USD1tn in annual green investment now in sight for 2023. We also expect the global GSS market on track to reach record highs this year after a 2020 total of nearly USD700bn.

Projections see the long-awaited milestone of USD1tn in annual green investment now in sight for 2023. We also expect the global GSS market on track to reach record highs this year after a 2020 total of nearly USD700bn.

We are positive on the future of China’s sustainable debt market: Carbon neutral bonds have broad scope for growth, green local government bond issuance may accelerate, and transition finance have potential to accelerate rapid portfolio decarbonisation.

Sean Kidney, CEO, Climate Bonds Initiative:

“Green bonds are a critical part of China’s efforts to drive its financial markets to better serve environmental objectives. They also enhance financial stability: a notable feature of the market is its clear longer-tenor nature, in contrast to broader bond market’s shorter tenor profile.

“Longer-tenor bonds dampen debt market volatility and reduce the risks of instability. As credit transparency increases to improve capital allocation efficiency in debt markets, the enhanced predictability of green debt allows orderly change.”

“Strong regulatory directions and international cooperation will allow demand to grow and more capital to flow towards net zero investments. This market will see continued rapid growth in 2022.”

Dr. LU Zhengwei, Chief Economist of China Industrial Bank:

“Achieving China’s carbon target entails a broad and profound economic and social change. China's green and low-carbon development strategy is in full swing, just as China's sustainable bond market will continue to grow rapidly in 2022 with the introduction of innovative products such as carbon neutral bonds and sustainability-linked bonds. In addition, China's bond market will continue to provide support for a broader range of sustainable-related themes, from poverty alleviation to rural revitalisation, from pandemic to biodiversity conservation. With green bonds as a starting point, there is huge scope for the future development of China's sustainable debt market.”

The final word

China’s green development has entered a new phase with achieving carbon peaking and carbon neutrality as the key strategic direction. In this context, green bonds with proceeds used for projects with emission reduction benefits, such as carbon neutral bonds, may receive more policy support in the future, and are expected to increase in scope. We are looking forward to seeing more issuances coming from China in 2022.

‘Til Next Time!

Climate Bonds