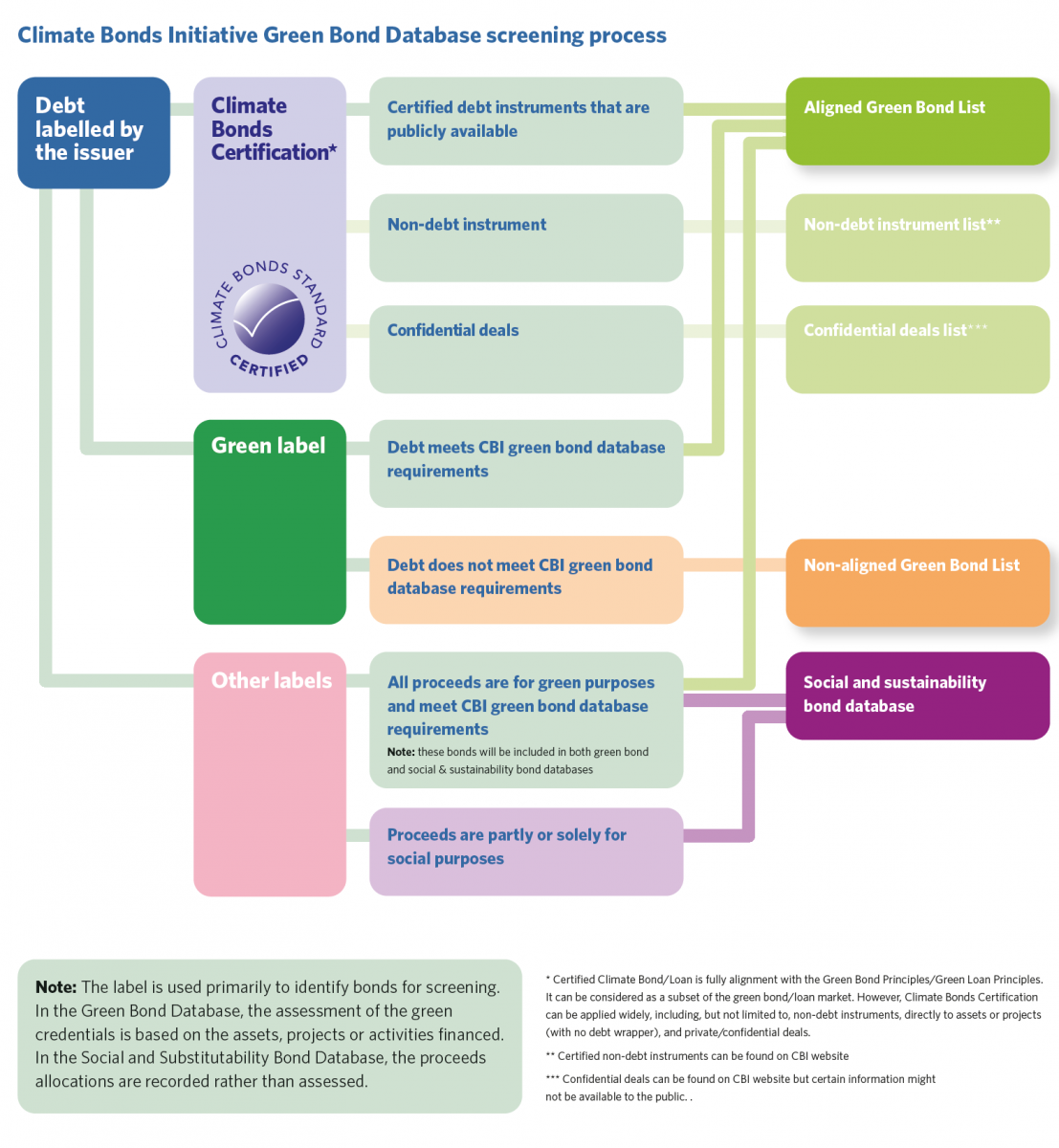

Updated Methodology to Climate Bonds Classification and screening process for green debt instruments

To reflect the green bond market evolution as well as changes made in the recently published the Climate Bonds Standard Version 3.0 and the new Climate Bonds Taxonomy, we have updated and released our Green Bond Database Methodology (2020 V1.1).

The revised Methodology is a substantial revision of the 2018 Methodology and seeks to provide significantly greater transparency and clarity on the process, considerations and distinctions between different segments of the Climate Bonds Green Bond Database.

About Climate Bonds Green Bond Database & Methodology

The Methodology V1.1 outline processes and criteria to define green bonds, green loans, green sukuk and other similar labelled debt instruments as eligible for inclusion in the Green Bond Database.

The green definitions contained in the Methodology are in line with the Climate Bonds Taxonomy, which a science-based classification system for green asset and project categories eligible for green financing. The Taxonomy is an important reference point for common green definitions across global markets and supports the growth of a cohesive thematic bond market that supports transition and development towards a net zero economy.

The Climate Bonds Green Bond Database contains green bonds and similar labelled debt instruments analysed using the Methodology. The Database is used by investors & index providers, including JP Morgan, BlackRock, State Street Global Advisors, Invesco & Amundi Asset Management, governments and a range of other debt market participants such as stock exchanges (e.g. Hong Kong Exchange) and index providers (e.g. S&P) to identify low carbon investments.

Three-step screening process

The Methodology contains a three-step process to classify a green bond (or other debt instrument) as eligible:

- Identification of climate-themed, self-labelled debt;

- Screening eligible project and asset categories and green credentials to determine if the proceeds will finance eligible expenses, assets, projects or activities that are in line with the Green Definitions in the Methodology,

- Evaluating the use of proceeds threshold. Only bonds which are expected to allocate all net proceeds to aligned green assets, projects or activities are included in the Green Bond Database.

What’s new?

• 100% of net proceeds need to be aligned. Only bonds which are expected to allocate all net proceeds to aligned green assets, projects and activities will be included in the Climate Bonds Green Bond Database. Climate Bonds Initiative previously required at least 95% of gross proceeds to be aligned as a Database inclusion criterion and allowed issuers use up to 5% of proceeds to cover issuing costs or other expenses.

The change from 95% to 100% primarily reflects the current market practice where most issuers tend to disclose the use of net proceeds, which is the amount received after all costs and expenses are deducted. The new requirement will better reflect the green credentials of a bond in the database.

• Eligible expenses are a new aspect. Historically, the focus has been on direct financing of physical assets and projects and indebtedness incurred to finance physical assets. This has been expanded to other related and supporting expenditures for physical assets that conform to the eligibility criteria. For example, Climate Bonds Initiative is supportive of Research & Development (R&D) aimed at improving our collective ability to address climate change for example by helping to commercialise new low-carbon technologies. We encourage late stage R&D spending that is likely to provide an immediate to near-term investment in capital assets that can deliver positive climate benefits.

• The EU taxonomy may be used as a point of reference or proxy for sector-specific criteria for which there are no relevant Sector Criteria yet under the Climate Bonds Standard. This will be re-assessed as Climate Bonds Initiative develops and releases new Sector Criteria.

• Clearer rules on Adaptation and Resilience (A&R) measures. Most green bond financing to date has been allocated to climate change mitigation. Climate change adaptation and resilience (A&R) measures are also eligible. Climate Bonds Initiative published new Climate Resilience Principles in late 2019 year which shaped our views around database inclusion.

Financing of A&R will be included in the Climate Bonds Initiative Green Bond Database if the issuer can demonstrate that the A&R use of proceeds do not finance assets or activities that undermine emissions reductions goals. For example, adaptation and resilience projects that lock in fossil fuel technology will not be eligible and may lead to the bond not being included.

Coming Up - A Social & Sustainability Bond Database

Climate Bonds will launch a new Social and Sustainability Bond database this quarter.

It is intended that bonds and other debt instruments with other labels whose proceeds allocation is not in line with our green definitions will be included in the separate Social and Sustainability Bond Database.

Bonds or similar debt instruments with other labels such as Sustainability and ESG could be included in the Green Bond Database as long as the use of proceeds comply with Climate Bonds’ green definitions, irrespective of their original labels.

We have more to say on this expansion of our data and analysis capability in the coming weeks.

Meantime don't miss our next Webinar! Thursday, October 22nd 13:00 PM Paris / 12:00 PM London / 07:00 AM New York.

Report launch, policy developments, market outlook & rise of social & sustainability bonds discussed by market experts.

More information & Registration is here.

‘Till next time,

Climate Bonds