The market’s first and only rankings to combine sustainable products & sustainable companies

Refinitiv has launched Sustainable Finance League Tables through its Deals Intelligence solution. Serving as a pivotal data-metric in the development of sustainable insights, it measures new capital raising, driving sustainable outcomes and ranks the investment banks underwriting such activity.

The rankings capture sustainability-related deals including green bonds through a Data Partnership with Climate Bonds Initiative to validate transactions consistent with ICMA green bond principles, social bonds and sustainability-linked bonds or loans, the use of sustainable proceeds, and companies operating in sustainable industries to provide a complete view of total capital raising in support of sustainable outcomes

With its combination of both sustainable products and sustainable companies, Refinitiv Deals Intelligence Sustainable Finance league tables are the first and only to join these two aspects of the market into one ranking.

League Tables capturing the full landscape

The Sustainable Finance League Tables aim to provide analysis on market trends and assessment of the ever-changing competitive landscape.

Refinitiv Deals Intelligence data is an extensive resource that provides insights and analytics on M&A and capital markets transactions.

- Green Bonds market analysis and league tables, in partnership with Climate Bonds.

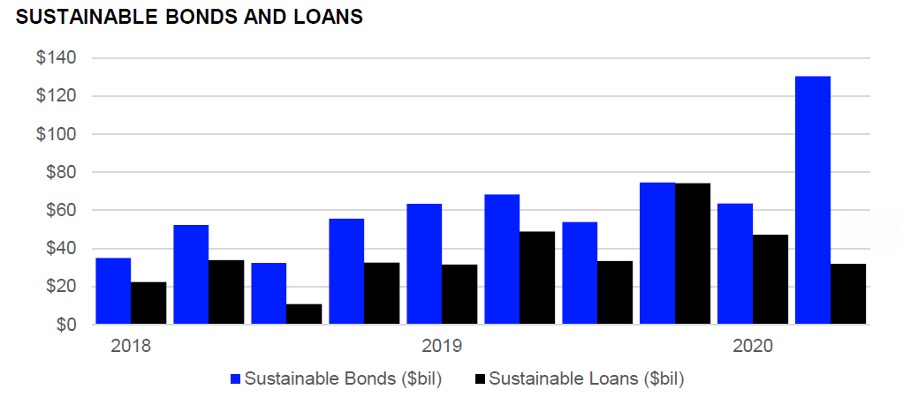

- Deals related to sustainability - including loans, social bonds and sustainability linked bonds.

- Use of proceeds/Sustainable proceeds - bonds where a proportion of proceeds are being used for sustainable outcomes.

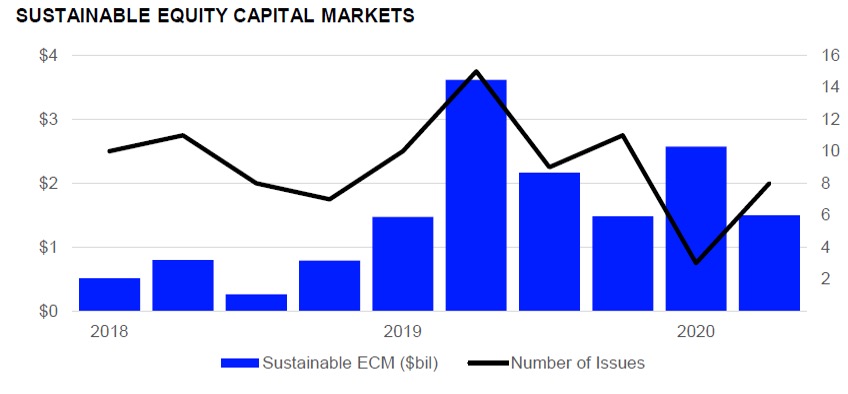

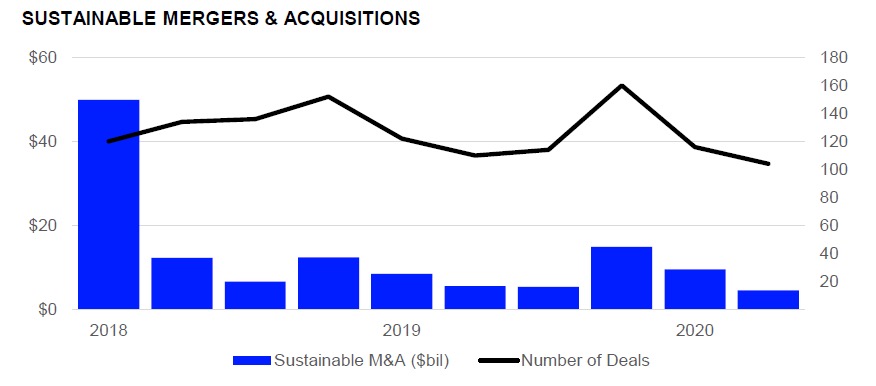

- Capital raising or deal making in sustainable industries - powered by our industry-leading business categories, companies or government bodies raising capital or making acquisitions in an industry where operations are classified as sustainable.

The last word - Climate Bonds Data

Climate Bonds has been collaborating with Refinitiv since 2016 around data supply and production of Quarterly green bond underwriter league tables.

Improving market intelligence and data provision in sustainable finance is undergoing constant expansion.

Climate Bonds plays an active role in data collection and market analysis, often in partnership with organisations like Refinitiv.

This Partnership is a further example of that active role we play in the market.

See more details in Refinitiv’s H1 2020 Sustainable Finance Review.

‘Till next time,

Climate Bonds.

For access to and more information on Refinitiv’s Deals Intelligence, send enquiries to: DealsIntelligence@refinitiv.com

For Data on Green Bonds/Loans/Sukuk contact Climate Bonds Data Team: dataenquiries@climatebonds.net