Agriculture is 2020's first new Criteria available for Certification under the Climate Bonds Standard

The new Agriculture Criteria of the Climate Bonds Standard has been formally launched today, marking a major turning point in best practice for climate-aligned and climate-resilient investments in agriculture.

Developed for potential green bond issuers and investors, the new Agriculture Criteria defines and evaluates agriculture projects by encompassing two broad components:

- Climate mitigation

- Climate adaptation and resilience

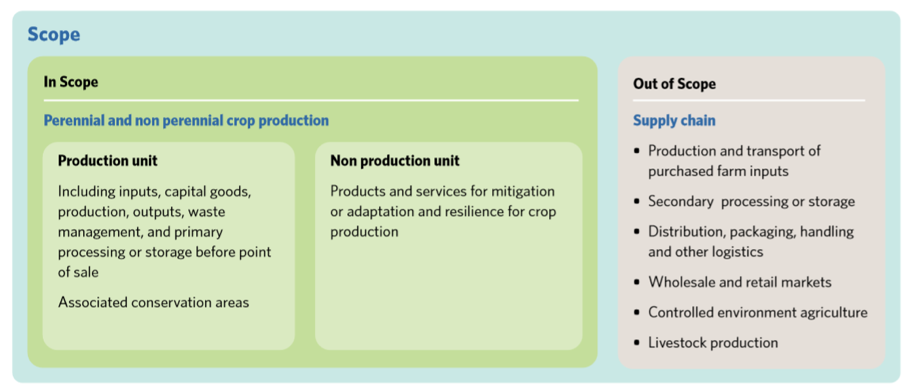

What’s in and out of scope?

Note - Livestock Not available for Certification at this time

Livestock production - including grazed and stall-fed cattle, buffalo, sheep, goats, dairy, pigs and poultry and their waste (manure) and related grassland or pasture are not within the scope of these Criteria and are not available for Certification at this time.

There may however be livestock specific Criteria released at a later date as there is potential to substantially reduce emissions in this activity relative to business as usual. This page will be updated should any Criteria change regarding Livestock take place and information will also be posted on our Blog.

What is the eligible use-of-proceeds?

Eligible use-of-proceeds relating to agriculture production systems might include capital and operating expenditure relating to:

- inputs (e.g. land, seeds, fertilizer, energy, information)

- capital goods (e.g. land, equipment, housing)

- crop-based transformation processes (e.g. crop cultivation and planted trees)

- agricultural outputs (e.g. grains, vegetables, fibre, meat, dairy products)

- waste management (composting, crop residue processing, recycling)

- primary processing and storage before point of sale

What is the framework of the Criteria?

The Criteria vary according to the bond’s use-of-proceeds as follows:

- use-of-proceeds relate to the whole agricultural production unit

- use-of-proceeds relate to a component of the agricultural production unit or a specific intervention in the agricultural production entity

- use-of-proceeds relate to activities outside of a production unit that enable production entities to reduce GHG emissions/ increase sequestration or enhance their climate adaptation and resilience

Bond issuers should determine which of these categories their use-of-proceeds fall into and use the appropriate Criteria accordingly.

For each of these categories, the Criteria encompass eligibility requirements relating to:

- GHG mitigation; and / or

- Climate adaptation and resilience.

Special provisions to demonstrate compliance are set out where the use-of-proceeds are allocated to a large number of separate producer units; specifically, where proceeds are allocated to over 50 producers, with single producers not being allowed to represent more than 20% of the portfolio and with the maximum concentration of the top five producers not exceeding 35%.

Why agriculture for green investment?

Agriculture can act as a source and sink for GHG emissions. Agricultural activities and assets are vulnerable to climate change, but also support adaptation and resilience due to their role in rural livelihoods and ecosystem services.

The land use sector receives only 2.5% of public mitigation finance yet is responsible for about 25% of global emissions. 86% of private investment in climate action from green bond issuances is invested in energy and transport, and only 0.9% in land use.

Trends in governmental interventions and business activity indicate that globally, governments and businesses recognise the economic and environmental value of better agricultural management. To transition to a climate-aligned and climate-resilient economy, these stakeholders require significant capital to invest in innovative, effective technologies, techniques and infrastructure that transform the agriculture sector.

The Climate Bonds Initiative sees a role for the $100 trillion bond market in addressing the huge funding needs of the global agriculture sector.

The Agriculture Criteria will assist in creating new capital flows into the sector with a new science-based framework that includes definitions and a screening mechanism for projects, assets, and activities against which both issuers and investors can assess green bonds. The qualifying projects and assets will be eligible for Climate Bonds certification.

Bonds seeking certification must also meet the reporting and transparency requirements of the overarching Climate Bonds Standard V3.0.

Why seek Certification for your agriculture green bond?

Climate Bonds Certification allows issuers to demonstrate to the market that their bond meets industry best practice for climate change mitigation and resilience, as well as for management of proceeds and transparency.

Agriculture has not yet become a significant share of the green bond market, and while best practice standards do exist in the sector, they do not necessarily focus on strong climate measures.

Certification indicates to investors that proper climate due diligence has been carried out on the assets that they are investing in – a robust and credible way for this new asset type to enter the green bond market.

Benefits of issuing a Certified Climate Bond include:

- investor diversification (waste management issuers should find they attract new investors by certifying)

- greater investor engagement

- investor stickiness (investors buying Certified Climate Bonds tend to buy and hold)

- strengthened reputation (certifying shows commitment to delivering low carbon infrastructure)

- freeing up of balance sheets.

A full list of Certifications against the Climate Bonds Standard can be found here.

Criteria development process:

To develop the criteria, the Climate Bonds Standards team assembled an Agriculture Technical Working Group (TWG) that consisted of 20 international experts across 20 organisations, including universities, NGOs and consultancies, led by Lini Wollenberg of CGIAR as Lead Technical Consultant.

Launched in February 2019, the Agriculture TWG met monthly throughout the year. The Agriculture TWG developed mitigation and adaptation criteria for agricultural activities, which incorporated feedback from an Industry Working Group (IWG).

The output of the TWG was reviewed by an Industry Working Group with representation from industry stakeholders, investors and issuers.

The Criteria underwent public consultation from January 2020 to March 2020 and the feedback from this period was incorporated into the final Agriculture Criteria that we have today.

Lini Wollenberg, CGIAR - Lead Technical Agriculture Consultant

“Climate change is expected to severely affect agriculture, with average crop yield losses of 10-50% by 2030. At the same time, agriculture needs to reduce emissions by at least 20% to help achieve the mitigation goals of the Paris Agreement. The CBI Criteria provide guidance for agricultural investment towards a more climate-aligned future."

Pedro Luiz Oliveira de Almeida Machado, Brazilian Agricultural Research Corporation (Embrapa) - Agriculture TWG Member

"I am very grateful and honoured to have joined the TWG in this task. There was a large group of experts in various agricultural systems from different regions. The criteria are a good example of putting science into practice to help finance climate policies."

Mareike Hussels, SAIL Ventures - Agriculture IWG Member

"While there is no doubt about the exposure of the agricultural sector to climate risk and its responsibility for substantial greenhouse gas emissions, the sector also holds important solutions for the climate challenge: reducing deforestation, carbon sequestration, and low-carbon production models.”

“The CBI criteria for agriculture are an important step forward and as an advisor to agricultural projects and investment vehicles, SAIL Ventures supports progress towards a shared understanding of what constitutes climate-friendly and resilient agricultural production."

The Last Word - Thank you and acknowledgments

The Climate Bonds Standards team extends its sincere thanks to the dedicated TWG and IWG members for their instrumental role in developing the Agriculture Criteria.

'Till Next Time

Climate Bonds

Further details on the Agriculture Criteria can be found in three supporting documents available on our website: A brochure, the criteria document itself and a background paper. These can all be found from the resources box on the Agriculture criteria page.

Agriculture Criteria Technical and Industry Working Group Members:

|

TWG Lead Technical Consultant Lini Wollenberg - CGIAR |

|

|

TWG |

IWG |

|

Amy Dickie - California Environmental Associates |

Aarti Ramachandran/Iman Effendi - FAIRR Initiative |

|

Anna Lorant - Institute for European Environmental Policy |

Andrew Gazal - ESG Tech |

|

Bob Scholes - Wits University Johannesburg |

Ankita Shukla - Sustainanalytics |

|

Brent Matthies - University of Helsinki |

Aurélie Choiral Gupta - Credit Suisse |

|

Christine Negra - Versant Vision |

Brian Kernohan - Hancock Natural Resource Group |

|

Clare Stirling - CIMMYT |

Chang He - CECEP |

|

Debbie Reed - Ecosystem Services Markets Consortium |

Dana Muir, Mike Faville - BNZ |

|

Gerard Rijk - Profundo |

Francisco Avendano - Climate Policy IFC |

|

Gillian Galford - Gund Institute for Environment |

Gustavo Pimentel/Débora Masullo de Goes - Sitawi |

|

Greg Fishbein - The Nature Conservancy |

Hamish McDonald - NaturesCoin |

|

Jonathan Hillier - University of Edinburgh |

Jacob Michaelsen - Nordea |

|

Kim Schumacher - University of Oxford |

John Kazer - Carbon Trust |

|

Ngonidzashe Chirinda - CGIAR |

Mareike Hussels - SAIL Ventures |

|

Pablo Fernandez de Mello e Souza - BVRio |

Maria De Filippo - Affirmative Investment Management |

|

Pedro Luiz Oliveira de Almeida Machado - Brazilian Agriculture Research Corporation (Embrapa) |

Pedro Moura Costa - SIM/Facility |

|

Raylene Watson - ebsadvisory |

Pip Best - E&Y |

|

Sam Schiller - Kellogg School of Management |

Robert Rosenberg/Mélanie Comble - ISS ESG |

|

Stephen Donofrio - Forest Trends |

Roberto Strumpf - Pangea Capital |

|

Tanja Havemann - Clarmondial AG |

Rosemarie Thijssens - Rabobank |

|

Timm Tennigkeit - UNIQUE |

Scot Bryson – Orbital Farm |