Climate Bonds Initiative & China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC, have launched the ChinaGreen Bond Market 2019 Research report in Beijing today.

The report analyses the key developments in the world’s largest source of labelled green bonds, focusing on green bond issuance, policy development & wider market growth.

At a glance

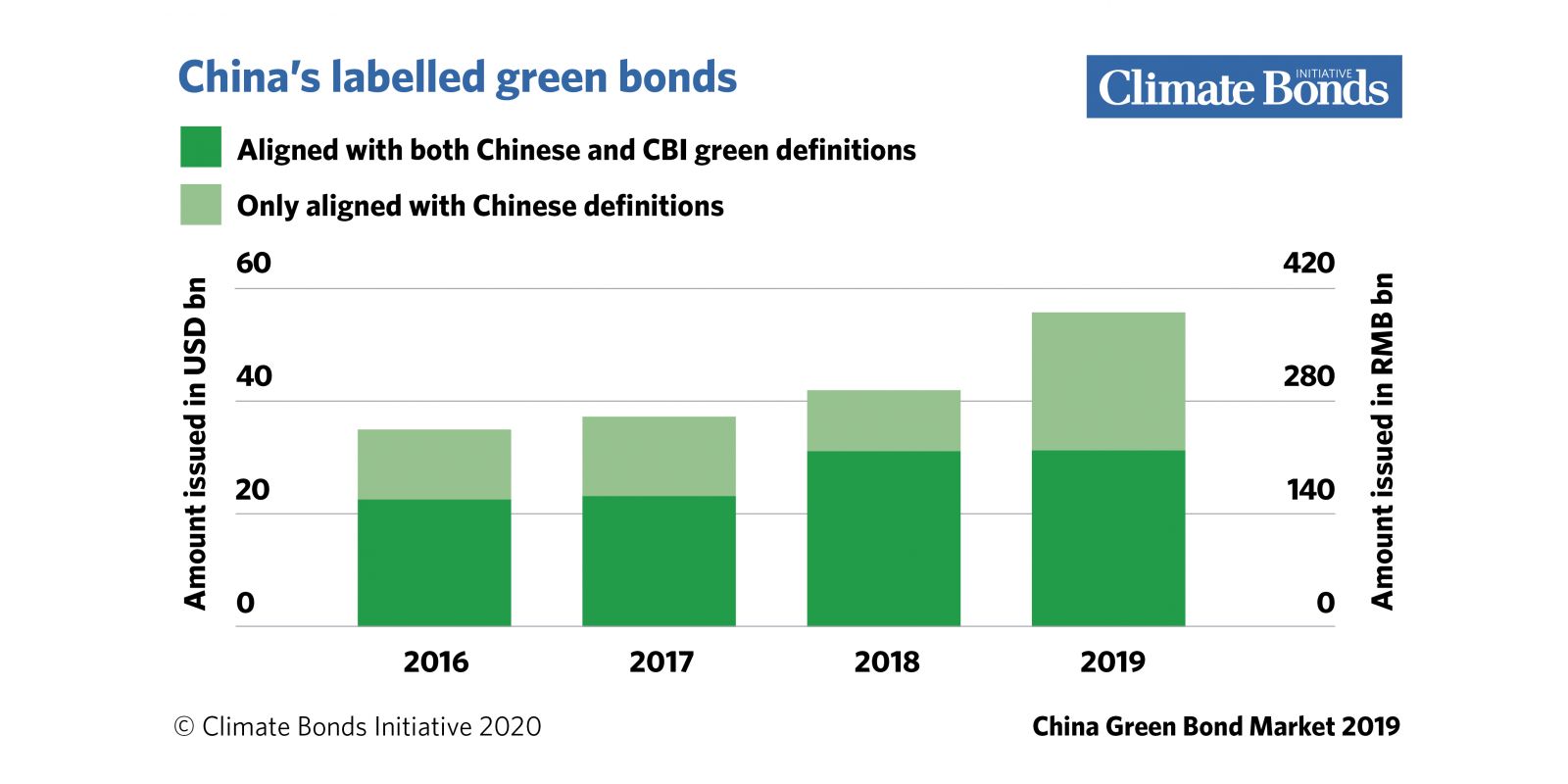

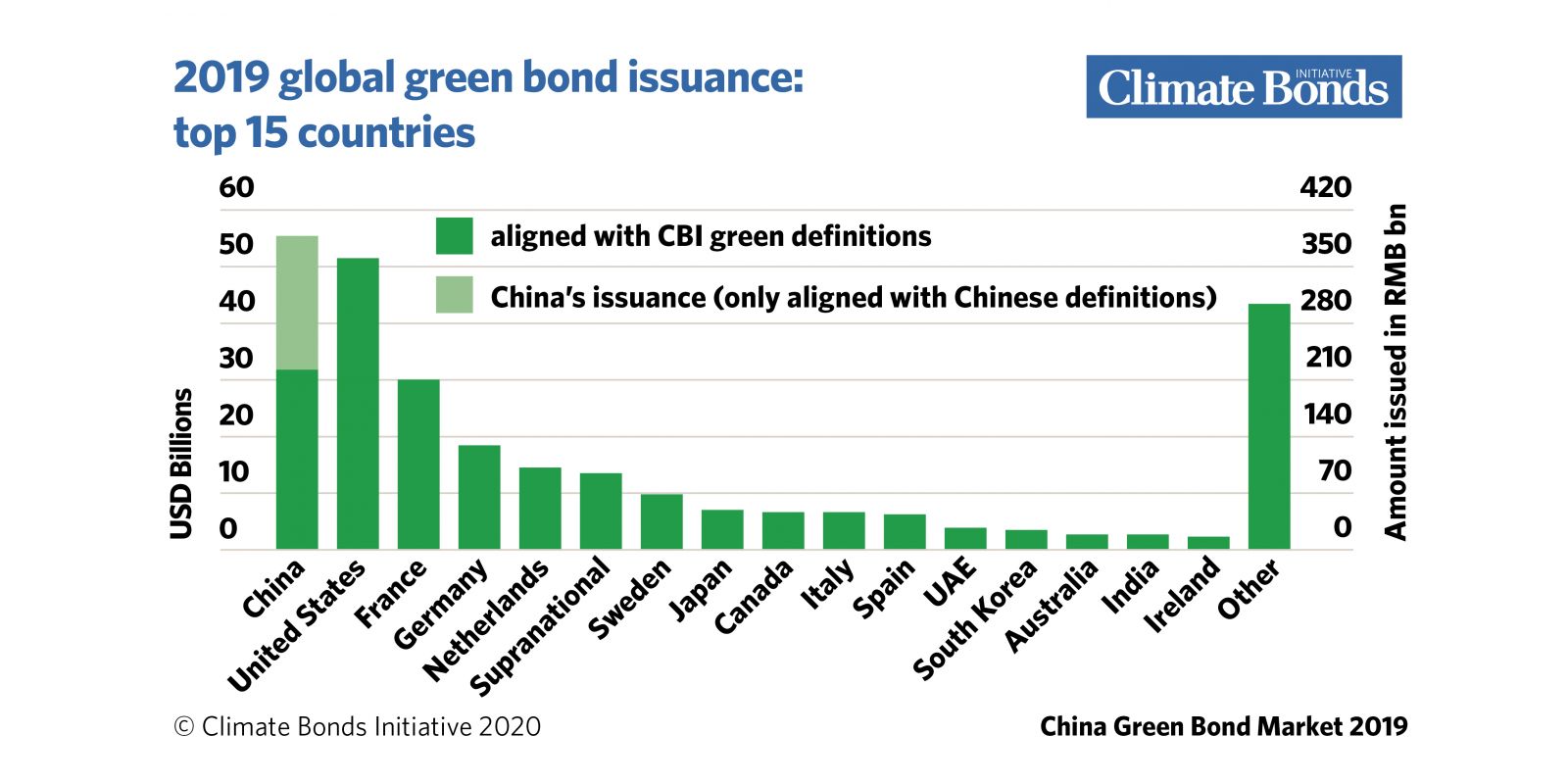

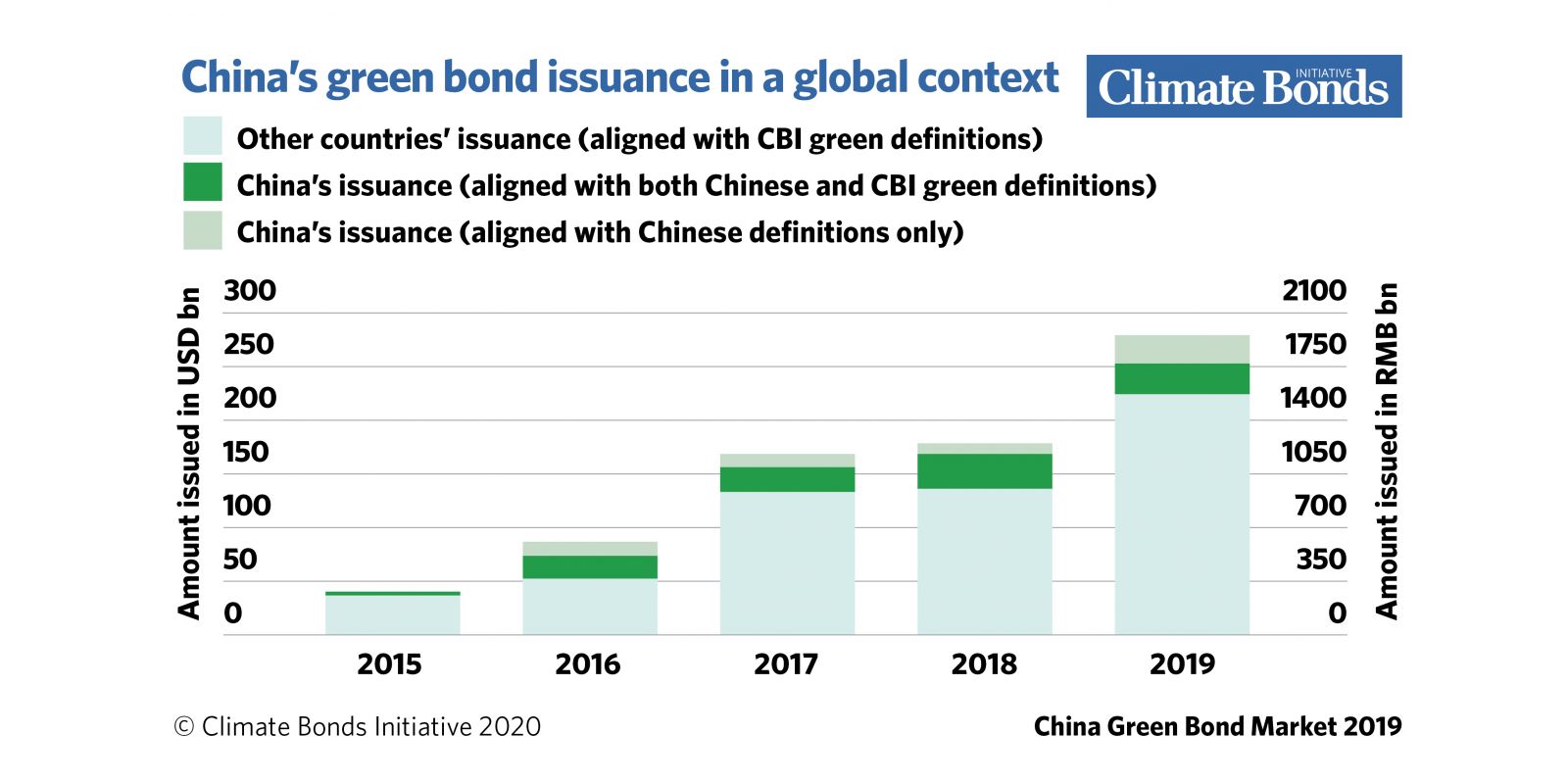

Total green bond issuance from China during 2019 reached USD55.8bn (RMB386.2bn), a 33% increase from the USD42bn (RMB282.6bn) in 2018. China, the USA & France led the annual country rankings once again by the total amount of labelled green bonds. (Figures 1,2)

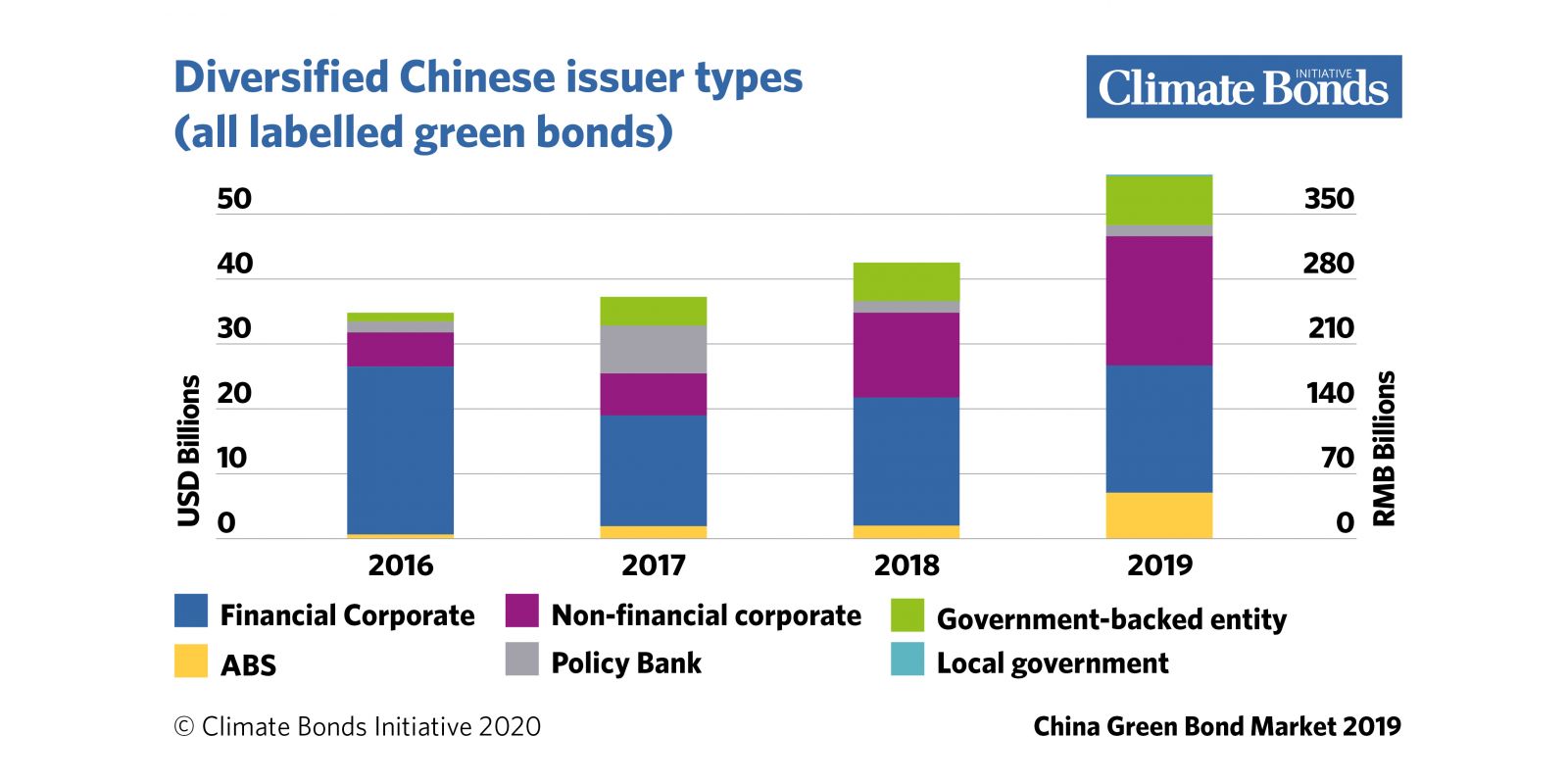

2019 was marked by new developments in the profile of China issuers, notably the strong growth in issuance by non-financial corporates, which increased 54% year-on-year, & accounted for 37% of total issuance for the year. (Figure 3)

2019 report highlights:

- Of USD55.8bn (RMB386.2bn) worth of green bonds issued in 2019, USD31.3bn (RMB216.8bn) worth was of aligned with both Chinese & CBI green definitions. (Figure 4)

- Industrial & Commercial Bank of China (ICBC) was the largest Chinese issuer in 2019

- 72% of green bonds benefited from at least one external review.

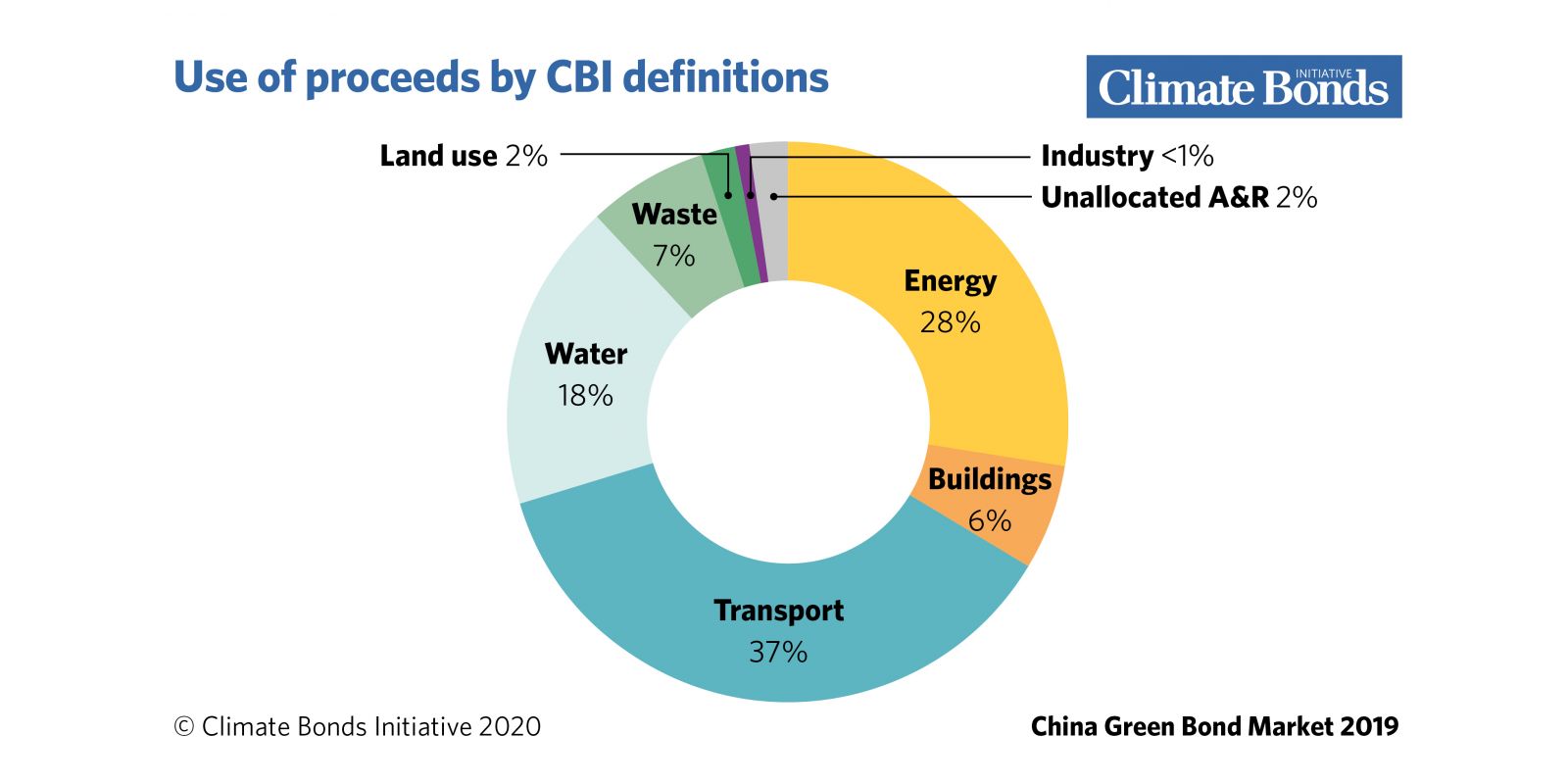

- Low-carbon transport (37%) was the single largest theme, followed by energy (28%) & water (18%). (Figure 5)

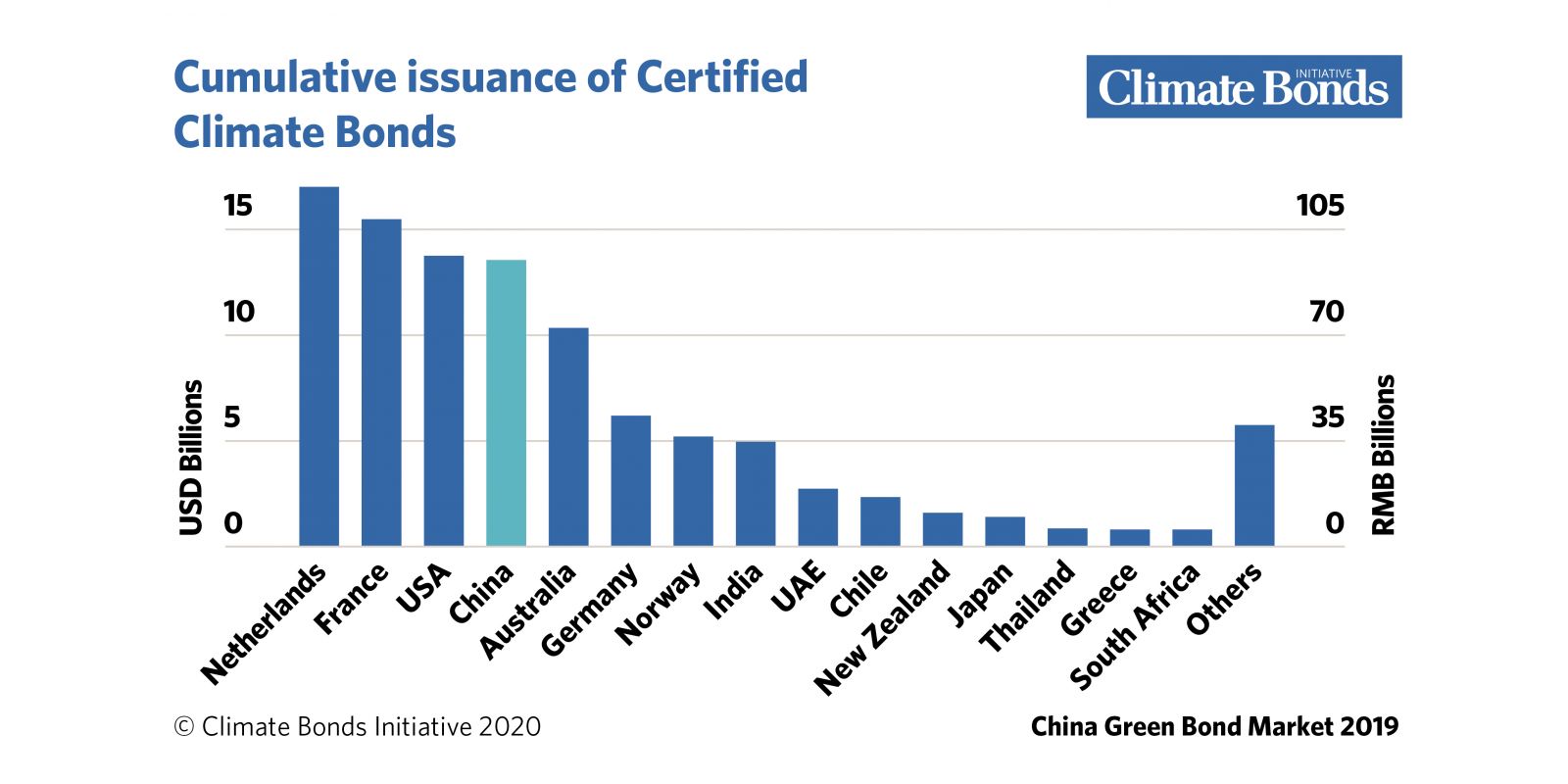

- China remains one of the largest global sources of bonds certified under the Climate Bonds Standard (Certified Climate Bonds). In 2019, Chinese issuers brought four Certified deals to market, totalling USD3bn.

- By the end of 2019, the total outstanding amount of China’s domestic green bond market stood at USD140bn (RMB977.2bn).

- A total of USD124bn (RMB865.5bn) worth of green bonds in China reach maturity in the next 5 years, representing 88% of the total outstanding.

In detail:

Largest Issuer

- ICBC was the largest issuer in 2019 with USD5.3bn (RMB36.7bn) & an additional USD600m green bond issued on the Hong Kong Stock Exchange (HKEX) through subsidiary ICBC Financial Leasing.

- Non-Financial Corporates became the largest issuer type in 2019, with an increase of 54% year-on-year, representing 37% of the total volume of issuance in 2019, rising above financial corporates, which have dominated issuance since 2015.

Offshore Activity

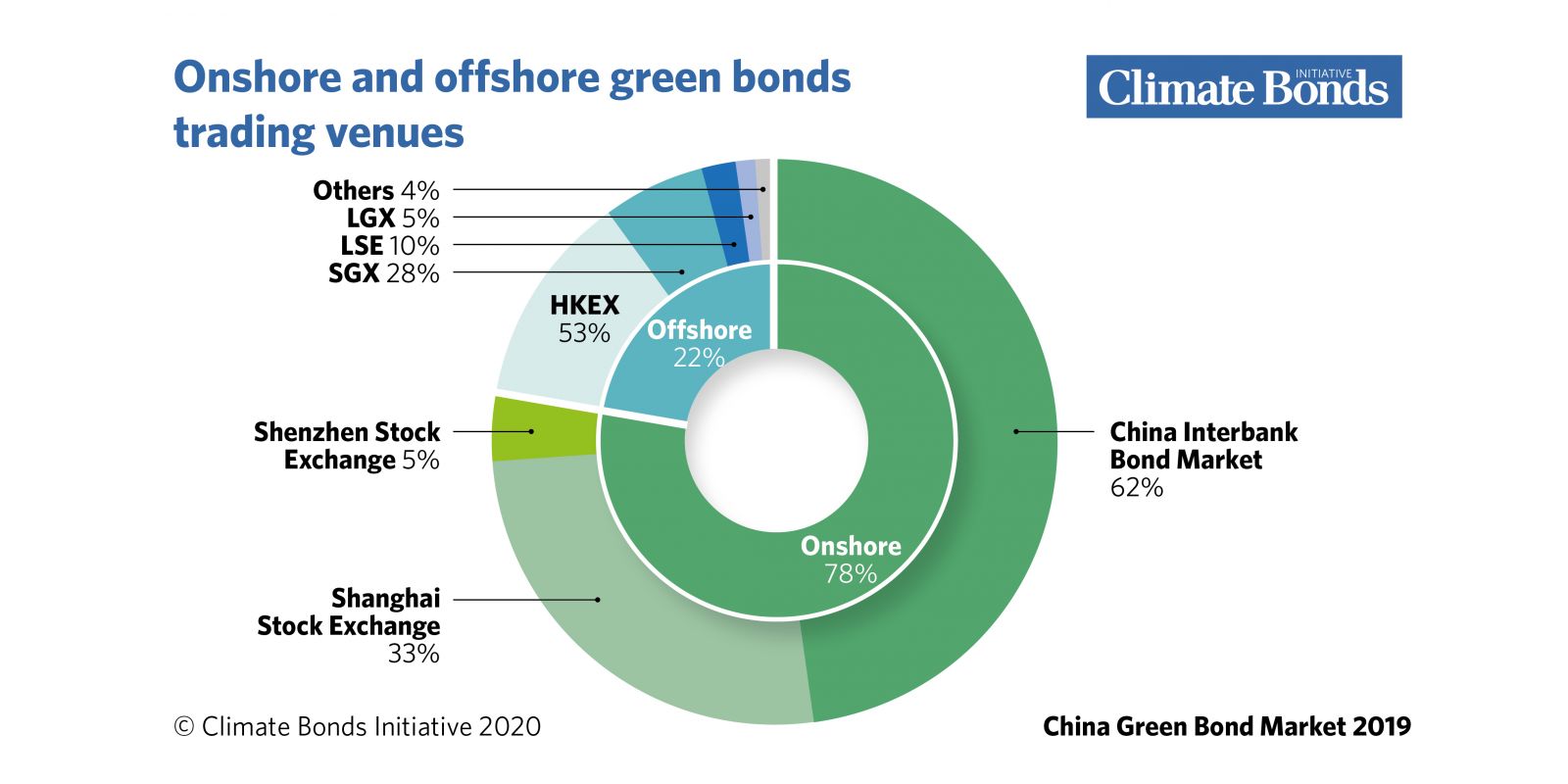

- 22% of green bonds were issued in the offshore market with 15 issuers raising a total of USD12.5bn (RMB87.2bn), an increase of 30% year-on-year.

- New offshore issuers included ICBC Financial Leasing, Jiangxi Provincial Water Conservancy Investment, Rongshi International Finance, Zhuhai Dahengqin Investment, China Jinmao Holdings, GSP Renewables, Shanghai Pudong Development Bank, & Shui On Development.

- HKEX remained the largest listing venue for Chinese offshore green bonds, accounting for 53% of total offshore volume. Singapore was second with 28%, LSE 10%, LGX 4% & others 4%. (Figure 6)

- Transport was the most funded sector (35%) by offshore green bonds, closely followed by low carbon buildings at 32%. More than three quarters of the deals were denominated in USD (76%). EUR ranked second (12%), followed by RMB (8%) & HKD (4%).

Local Government

- Local Government Financing Vehicles (LGFVs) contributed USD6.2bn (RMB42.5bn) to total issuance in 2019. Low carbon transport & water infrastructure are the most funded project types.

- On a cumulative basis, Guangdong, Anhui, Hubei, Jiangsu & Shandong are the top five provinces for green issuance.

Green ABS

- Green Asset Backed Securities (ABS) collateral types more than tripled in volume in 2019, rising by 3.5 times to USD7.2bn (RMB50.3bn) while their share of total issuance grew from 5% to 13%.

Climate Bonds Certification

- In 2019, Chinese issuers brought four Certified Climate Bonds deals to the market, totalling USD3bn (RMB21bn). China remains one of the largest global sources of Certified Climate Bonds, with previous issuance from ICBC, Jiangsu Financial Leasing, China Construction Bank, Bank of China & Shanghai Pudong Development Bank (SPDB).

- Cumulative global Certified issuance at the end of 2019 reached a record USD101.5bn (RMB700bn) with China ranking fourth internationally with USD13.5bn (RMB87.9bn) of Certified Climate Bonds. (Figure 7)

Policy recommendations

Looking ahead, the government’s role in providing consistent & credible policy signals will continue to be paramount for the sustained & orderly growth of China’s domestic green bond market.

The report identifies thirteen policy recommendations (See P17) to support development of China’s Green Bond Market including:

- Bring China’s green definitions closer to international definitions

- Provide smart, tailor-made, & practical policy incentives at both national & local level

- Encourage more transparency around allocation to working capital

- Harmonisation of post-issuance reporting

- Further guidance on the green bond verification

- Further diversify the types of green instrument, including ABS, municipal bonds & sovereign bond

- Foster green bond investors in China

- Mobilising the financial sector to support ‘brown-to-green’ transition measures

Fan Liu, Deputy General Manager, China Central Depository & Clearing Company:

"Developing a green bond market can help us mobilize more social capital to cope with climate change and environmental challenges and help China's green development transformation. China's green bond market has achieved great development in 2019, and the total labeled green bonds from China ranks first in the world.

As a member of China's Green Finance Committee, the China Central Depository & Clearing Co., Ltd. has done a lot of fundamental and pioneering work in supporting the development of Chinese green bonds.

Commissioned by the Green Finance Committee, we jointly conducted research on the "Environmental Information Disclosure System for Green Bonds" with CECEP Consulting Co., Ltd., to provide policy support for the development of the green bond market. ChinaBond Pricing Center Co., Ltd. and CECEP Hundred Technical Service (Beijing) Co. Ltd identify green bonds and issue green bond labels every month.

We developed green bond-related products, such as green bond indices, and provided services throughout the bond life cycle for domestic and overseas green bonds including issuance, registration and custody, transaction settlement, interest payment, valuation, collateral management, and information disclosure. We will continue to help promote the innovative development of China's green bond market."

Eddie Ching, Executive Vice President & Co-Head of Global Banking, HSBC Bank (China) Company Limited:

“As the world’s largest issuer of green bonds, China is leading the world in using sustainable finance to support its transition to a low-carbon economy. Last year we saw China’s first municipal green bond issued & strong growth in green bonds issued by non-financial corporates – all these show that green bonds are playing an increasingly important role in more diverse sectors.

According to Climate Bonds Initiative, USD124 billion (RMB865.5 billion) worth of green bonds in China will reach maturity in the next five years. This represents a significant opportunity for green bond refinancing. With various green finance policies & measures, coupled with further capital market opening, China’s green bond market is set to grow further, powering the country’s low-carbon transition.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The tremendous potential for China to become the global engine room in the 2020s for green finance is reflected throughout this report. Increased offshore issuance, harmonisation & alignment is making the domestic market increasingly attractive to international investors.

Continued, rapid expansion will have a ripple effect, supporting transition & providing global momentum to policy, regulatory & financial sector measures to address climate adaptation & resilience.”

Download the English version of the report here.

Download the Chinese version of the report 点击下载中文报告.

A Launch Webinar will be held on Monday 29th June

17:00 / Hong Kong / Beijing / Singapore / 11:00 Paris / 10:00 London

‘Til next time,

Climate Bonds

Acknowledgements: Climate Bonds would like to thank China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research) & HSBC for their partnership & support in this project.