Special Report Launch Webinar: Green ABS in India - Wednesday, 20th May at 4:00pm India (11:30 am London) Registration.

Small scale projects can build large scale resilience

India, like so many countries is still in a state of lockdown and only just beginning the first steps in a phased exit. Though it is hard to imagine at the moment, but the Coronavirus pandemic will one day be behind us leaving the world to deal with the impacts.

Afterwards emerging market governments will have fiscally weakened, with limited capacity to fund small-scale projects that urban and rural communities so desperately need to build resilience against climate change and future health challenges.

The small, targeted investments in solar home devices, crop loans, micro-irrigation, solar roofs and batteries that are crucial to urban and rural development, providing much needed light at night, water and food, security and connectivity.

Private capital to provide urban and rural communities resilience

If governments are less able to fund this where will this finance come from?

Over the next year or two, bank balance sheets will be stretched extending loans to existing customers to finance temporary shortfalls in business revenue and weakened through increased losses from non-performing loans. Low-income households lacking collateral and credit histories have always been underserved by conventional banks.

The pandemic can potentially exacerbate this situation.

Though in India, Priority Sector Lending regulations mean banks have specific targets to lend to some disadvantaged groups including farmers. This pressure on bank balance sheets could be alleviated if banks refinance their loan portfolio from the debt capital market.

Challenges of Green Securitisation

Last year, Climate Bonds Initiative concluded research looking at the opportunities and challenges of Indian financial institutions using green securitisation to refinance their climate-friendly lending portfolios. Securities as an enabler of green asset finance in India analysed the structural, financial and policy issues around securitisation and the potential role of green finance as an enabler to market growth.

Securitisation using instruments like Asset Backed Securities (ABS) allows small, illiquid loans like mortgages to be pooled and then structured into tranches with different risk characteristics, which can be sold into the debt capital markets to investors with various risk appetites, such as insurance companies, pension funds or mutual funds.

At the macro level, these transactions contribute to the dissemination of risks across a larger pool of investors, helping to strengthen the financial market making it more resilient.

DFIs and Philanthropies have a role

Development agencies and philanthropies with a mission to help finance climate mitigation or development can increase their impact by investing in the riskier part of these transactions (also called “first loss”), allowing other investors to crowd in. In so doing, they can achieve scale and supply green or socially-minded projects with credit-enhancement making the securities more attractive to private capital.

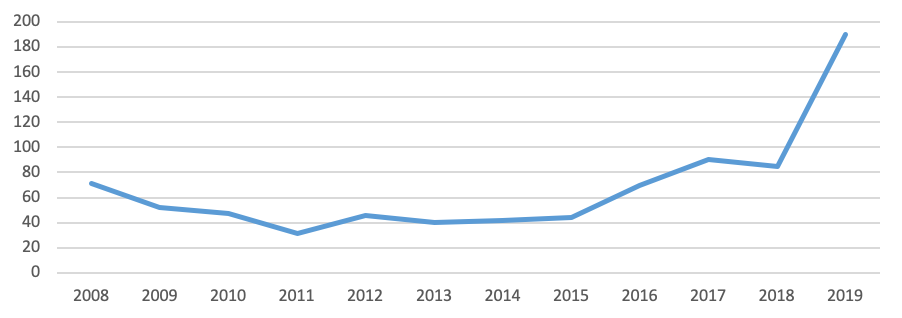

Globally, securitisation using green ABS accounted for USD20bn of issuance in 2019. This was used for refinancing green mortgages, loans for electric vehicles and other micro-finance loans. But none of India’s USD 10.3 bn green bond issuance has been in green securitised products. Indeed, the use of securitisation changed little 2015. The lack of growth of issuances arose because of worries about the treatment of the income by tax authorities. Once this was clarified there has been significant growth especially in fiscal year 2019 with a doubling of activity.

However, in 2020, the moratorium granted by RBI because of the virus outbreak on loan repayment is again likely to decrease volumes.

Retail transactions of securitisations for fiscal years (INR ‘000 Cr)

Source: CRISIL estimates

Previous barriers to growth

In our report, we note a number of factors impeding the market: uncertainty about the tax treatment of earnings held by mutual funds, regulations capping the credit rating or type of issuer that pension and insurance funds can invest in and hurdles on foreign investors involved in the ABS.

Financial disputes have been notoriously slow to be resolved in Indian courts, this potentially makes it difficult for investors to recoup money from the Special Purpose Vehicle set-up to ensure securitised assets are held remotely from the bank that originated the loans.

Progressively many of these restrictions have been lifted and India has passed a Commercial Courts Act in 2015 to speed up financial disputes.

The opportunities of green ABS

Asset-backed securities work best for pools of investments that are homogenous in their risk characteristics, tenor and the regulatory framework.

We identify several opportunities for greater use of green ABS including loans including

- Mortgages for low-carbon buildings – in India there are INR 300 billion of mortgage-backed securities issued annually. India already has building certification schemes that could be assessed to ensure their data collection is rigorous;

- Hybrid and electric vehicles like cars, rickshaws – starting from a narrow base the demand for these vehicles grew seven-fold between 2015 and 2017.

- Agricultural loans – Indian banks, Rural Regional Banks and rural co-ops lend to farmers for crop loans and to cover capital projects like micro-irrigation, solar pumps.

- Solar home systems/ appliances – India has a target for installing 175 GW of renewable energy by 2022 and a sub-target of 40 GW for solar rooftops.

- Green Infrastructure – loans to various types of green infrastructure can be pooled together, sometimes across multiple lenders, in order to free up some capital for these lenders to provide additional financing.

Using securitisation to increase investment in small scale projects

Providing small-scale borrowers for green projects cheap and abundant finance is a huge challenge for India’s development. Where projects are relatively homogenous and the risks and rewards well understood by investors and the regulatory framework conducive green, ABS can be a good financial tool.

But additional reforms are needed to increase its use in India and Securities as an enabler of green asset finance in India makes some recommendations.

- Increasing the origination of green loans: A number of reforms could be made to increase the underlying amount of green lending taking place. This could include extending the scope of Priority Sector Lending to embrace all green assets identified in the green taxonomy, and Indian states creating warehousing facilities to pool together projects like the solar-roof top programme

- Improving returns on green loans: Government institutions like IREDA or NABARD could provide partial credit guarantees.

- Attract multilateral agencies to provide “first-loss” concessionary capital: philanthropies and development institutions can offer guarantees at the first-loss level in order to facilitate the formation of portfolios that can be offered, for their mezzanine and senior risk layers, to institutional investors

- Increasing the demand for green ABS: One simple reform would be to standardise loan documents to make it easier to pool loans. Some of the remaining restrictions on Indian pension and insurance funds on credit quality could be relaxed and just as importantly training provided to staff to help them assess asset classes they might be unfamiliar with.

The Last Word

India has the opportunity to invest in hundreds of thousands of small, dispersed projects: roof-top solar and other renewables, energy-efficient buildings, sustainable agricultural practices and mass transportation systems to allow the country’s enviable rates of economic growth reach deep into its masses.

Tackling policies for recovery that lean towards transition and sustainable development.

The nation has the opportunity as an emerging market to create financial mobility towards green investing. Increasing both demand for and supply of green ABS is one of the areas deserving further support.

Register for our Webinar: Unlocking Millions of Small-scale Investment Opportunities – Green ABS in India on Wednesday, 20th May at 4:00 pm India (11:30 am London) as expert speakers discuss how ABS can help finance green investment projects, build resilience and support sustainable development.

'Till next time,

Climate Bonds

More information on all Climate Bonds Webinars and links to recordings of previous events can be found here.