Market

The Guardian, Out on its own: Australia the only country to use climate funding to upgrade coal-fired plants, Adam Morton

“Coal is a dead duck” says Sean Kidney in an interview with The Guardian, commenting on Australia’s government using climate change funding to upgrade coal-fired power plants.

Sean Kidney, chief executive of the London-based Climate Bonds Initiative, says China’s shift leaves Australia out on its own. “If you were committed to meeting the goals of the Paris climate agreement, which the Australian government says it is committed to, this is just lunacy,” Kidney says.

China Times, 跨國買家青睞 全球瘋綠債 今年衝2千億美元

China Times quotes Climate Bonds’ and Moody’s green bond market forecast for 2019.

氣候債券倡議組織(The Climate Bonds Initiative)預估,綠色債券的全球發行量2019年將進入2千億美元大關,規模持續成長已是全球趨勢;全球信評機構穆迪也認為,將有更多元的發行人參與綠債市場,且綠債發行的標準和定義會更明確,成為法人機構和大富翁資產的「標準配置」之一。

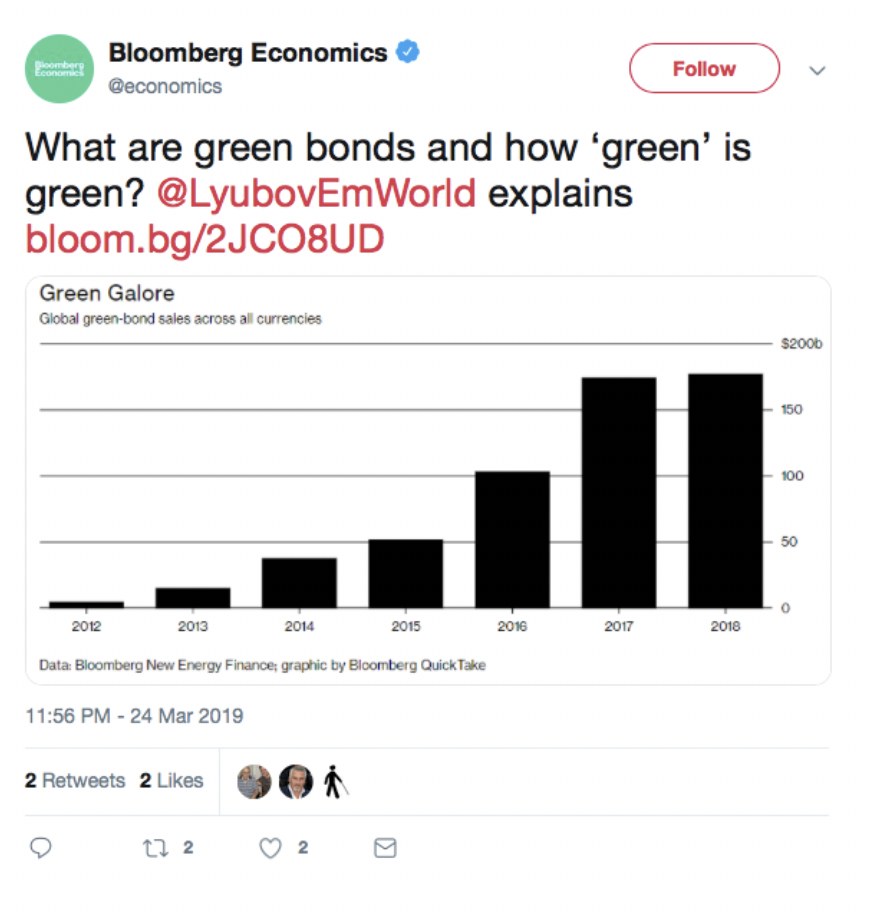

Bloomberg, What Are Green Bonds and How ‘Green’ Is Green?, Lyubov Pronina

Bloomberg, What Are Green Bonds and How ‘Green’ Is Green?, Lyubov Pronina

Green bonds for newbies: Bloomberg’s Q&A.

Is there hope for a global green bond standard? Yes. The EU is creating a Green Bond Standard, which will build on current market practices, such as the ICMA Green Bond Principles.

Republished in Washington Post.

Seeking Alpha, Green Bonds: The Future Of Infrastructure Investing

Seeking Alpha’s article cities Climate Bonds Initiative 2015 research and predicts that pressure from environmentally conscious workers or retirees, will push institutions such as pension funds and insurance companies into green bonds.

Weber and Saravade cite a study by the Climate Bonds Initiative in 2015 (Sonerud et al.) that said “there is a huge demand in both developed and developing countries” for the upgrade of infrastructure, even without taking environmental mitigation into account. Since the upgrades will happen, then, they should happen in ways that assist the sustainability of the economy on this planet.

Asia

Eco-Business, How China grew its US$30 billion green bond market, Feng Zengkun

Sean Kidney, speaking to Eco-Business, explained how China’s central bank’s, government’s and local authorities’ “pioneering practices” helped grow the Chinese green bond market. Kidney also spoke about potential of Belt & Road Initiative to influence urban environmental policy in Asia, standards and the upcoming Macao International Environmental Co-operation Forum and Exhibition (MIECF).

“The People’s Bank of China was the first central bank to accept green bonds as collateral when banks borrow from it. To encourage banks to use green finance, it also offers a discount price on its lending for that. These are very clear incentives for banks to hold green bonds,” explained Sean Kidney, chief executive of the Climate Bonds Initiative, an international non-government organisation that works to mobilise debt capital markets for climate solutions.

Reuters, China to cut coal from new green bond standards: sources, David Stanway, Andrew Galbraith

Reuters’ sources reveal that China’s PBOC will soon end the policy of financing coal with green bonds.

Chinese regulators are close to releasing new “green bond” standards that would exclude polluting fossil fuel projects from corporate financing channels designed to lift environmental standards, people familiar with the matter told Reuters.

South China Morning Post, China and EU seek common ground on environmentally friendly green bonds, Amanda Lee

More good news from China concerning standards’ harmonisation.

Allowing green bonds to finance coal-related projects was a major sticking point between the EU and China, with existing European standards prohibiting any coal financing while Chinese rules allow half of green-bond proceeds to be used for that purpose.

The Australian, Are green bonds about to boom?

Demand for green investment in ASEAN in growing. According to Sean Kidney, interviewed for the article, ASEAN Green Bond Standards were “catalyst for green bond issuance in 2018”.

Early trends have emerged among ASEAN green bond markets. In Climate Bonds Initiative’s first ASEAN Green Finance State of the Market report 2018, it found that USD denominations account for about 50 per cent of green bond deals, while sukuk, tied to Islamic financial instruments, represented 42 per cent of the region’s green bond market.

Global Capital, Slow and steady: Asia’s SRI market grows, Morgan Davis

An insightful article by Morgan Davis based on conversations with Asian bankers and investors. Davis touches on themes such as market growth predictions, resilience to volatility, government incentives, green bond pricing, secondary market performance and more.

These green investors also tend to be buy-and-hold investors giving green bonds more stability in the rocky markets. In the secondary markets, green bonds perform slightly better than non-non-green equivalents, to the tune of about 2bp, says Huang (Natixis).

Brink News, Can the Belt and Road Initiative Be Green?, Ruediger Geis

Author – Head of Trade Affairs at Commerzbank AG – wonders whether Belt & Road Initiative and China’s carbon reduction commitment are mutually exclusive.

So, what is being done? To better harmonize standards, the CBI has been looking to launch Green Bond Connect, in partnership with the Hong Kong Stock Exchange, which would allow investors to identify which bonds are certified green by the CBI and thus meet international standards.

CBI’s Annual Conference

Here is just a taste of an abundance of media coverage for 2019 CBI Conference & Awards. More coming soon in a separate blog post.

PV Tech, Top finance names warn of scale of global green infra challenge

PV Tech, Top finance names warn of scale of global green infra challenge

Structural hurdles are stopping investors from bankrolling clean energy, transport and buildings at the scale needed to limit catastrophic global warming, financiers have warned at the annual Climate Bonds Initiative (CBI) conference.

Investment & Pensions Europe, Investors called upon to support EU green bond standard, Susanna Rust

Speaking about the TEG’s work at the Climate Bonds Initiative conference in London yesterday, Olivier Guersent, director general in the Commission’s financial services department, highlighted the interim nature of the report, and encouraged delegates to fill out the online survey.

Markets Media, Green Bonds May Have Halo Effect

There is increasing evidence that the issue of a green bond could lead to lower long-term financing costs and have a positive impact on share prices according to a panel at the Climate Bonds Initiative annual conference.

China News, 兴业银行获2018年度新兴市场国家最大绿色债券发行奖

中新网3月7日电 近日,气候债券倡议组织(The Climate Bonds Initiative, CBI)在英国伦敦揭晓第四届“绿色债券先锋奖”(Green Bond Pioneer Awards),兴业银行凭借在绿色金融及绿色债券领域的突出表现和国际影响力,荣获“2018年度新兴市场国家最大绿色债券发行”(Largest Emerging Markets Green Bond of 2018)奖。

Xinhua, London branch of China's ICBC receives CBI Green Bond Pioneer Award, Mu Xuequan

The London branch of the Industrial and Commercial Bank of China (ICBC) received on Tuesday the Green Bond Pioneer Award for being the issuer of the "Largest Emerging Market Certified Climate Bond" in 2018.

Le Figaro, La Société du Grand Paris récompensée par le Climat Bonds Initiative

A l'occasion de la 4ème cérémonie des Green Bond Pioneer Awards (GBPA) le 5 mars, la Société du Grand Paris a reçu le " Largest new Certified Climate Bond issuer Award " décerné par le Climat Bonds Initiative pour ses émissions d'obligations vertes. Climate Bond Initiative est un organisme à but non lucratif qui encourage les investissements à grande échelle dans une économie bas-carbone. Les " Green Bond Pioneer Award " récompensent les acteurs de la finance climat.

EU green bond standard

In 2018 Technical Expert Group (TEG) on Sustainable Finance, composed of 35 experts from industry and civil society, has been tasked with developing proposal for the EU taxonomy for sustainable economic activities and the EU green bond standard. Earlier in March TEG published preliminary recommendations for an EU standard and invited stakeholders for feedback. Media reports below.

Investment & Pensions Europe, Investors called upon to support EU green bond standard, Susanna Rust

The standard, which should be voluntary, should be created by the European Commission by way of a “recommendation” rather than a mandatory legal framework, according to the technical experts group (TEG) advising the Commission on its sustainable finance action plan.

Environmental Finance, Draft EU green bond standard published

Proposals for an EU green bond standard (EU GBS) have been published, which endorse regulating second opinion providers and requiring post-issuance impact reporting.

EU Reporter, Commission expert group calls for feedback on EU Green Bond Standard

Feedback from stakeholders is especially requested on key barriers to the development of the green bond market, eligible use of proceeds raised, reporting and verification requirements, as well as on possible incentives to help the European green bond market grow.

Portfolio Adviser, EU outlines plans for higher sustainability standards, Joe McGrath

Speaking at the High Level Sustainable Finance Conference, in Brussels on Thursday (21 March), he [European Commission vice president Valdis Dombrovskis] told delegates that the Commission’s Technical Expert Group was preparing new guidance in the areas of green bonds, carbon benchmarking and on the EU climate change taxonomy.

The Malta Independent, Towards a global approach to sustainable finance

The EU adopted its Action Plan on Financing Sustainable Growth in March 2018. It's Technical Expert Group will publish a package of recommendations in June relating to the EU Climate Change taxonomy, finalise the report on the first ever EU green bond standard and advice on low-carbon benchmarks methodologies of low-carbon benchmarks, leading to a broad range of new legislative measures.

JD Supra, The European Commission’s Technical Expert Group requests feedback on proposed EU Green Bond Standard, Abdul Khan

The Technical Expert Group is proposing a voluntary standard building on existing market practices and designed to be compatible with them.

Private Banking Magazin, So wird der Green-Bond-Standard zum Goldstandard, Tobias Bürger

Eine Expertengruppe der EU hat ihren Zwischenbericht für die Einführung eines Green-Bond-Standards (GBS) veröffentlicht. Marktteilnehmer können sich noch bis Anfang April zu dem Vorhaben äußern.

IWR, Kommt ein EU-Standard für grüne Anleihen?

Im Rahmen des Aktionsplans der EU-Kommission zur Finanzierung eines nachhaltigen Wachstums hat die Expertengruppe am Mittwoch, den 06.03.2019 ihren vorläufigen Entwurf veröffentlicht, wie ein EU-Standard für grüne Anleihen (EU Green Bonds) aussehen könnte. Ziel ist es, erhebliche Investitionen für Klima- und Umweltschutz zu mobilisieren, indem ein EU-Kennzeichen entwickelt wird, das Hindernisse für die Entwicklung des Marktes für grüne Anleihen beseitigt.

Ius in itinere, Finanza sostenibile: verso i Green Bond Standards, Francesco Cimino

L’intento dei GBS è disciplinare le quattro componenti fondamentali dei Green Bond: Green Projects, Green Bond Framework, Reporting e Verification.

L’Agefi, Les obligations vertes auront bientôt leur standard, Valérie Riochet

En cours d’élaboration à la Commission européenne, il devrait inciter de nombreux industriels à se lancer.

SDG Knowledge Hub, Institutional Finance Update: Steering Capital Towards Global Investments in Climate-aligned Assets, Beate Antonich, Ph.d.

IISD briefing mentions the Climate Bonds Initiative briefing “Growing green bond markets: The development of taxonomies to identify green assets” that, among others, introduce readers to the development of the EU Taxonomy for Sustainable Finance.

A briefing by the Climate Bonds Initiative makes the case for a green bonds taxonomy to increase the capability of issuers and investors to identify eligible green and sustainable assets. The authors explore the role of green definitions in steering capital towards investments in climate-aligned assets, review green bond guidelines, and shine light on the development of the EU Taxonomy for Sustainable Finance.

South China Morning Post, China and EU seek common ground on environmentally friendly green bonds, Amanda Lee

The European Commission is expected to release a final report on a new European green bond certification standard in the second quarter of 2019.

Natural Capital Coalition, European Commission Technical Expert Group on Sustainable Finance Releases Report on Climate-related Disclosures

The TEG began work in July 2018 and has a one-year mandate, which it carries out through formal plenaries and sub group meetings for each work stream

CBI reports

“China Green Bond Market 2018 Report”

China Daily, China emerges as key player in green bonds market, Harvey Morris

At the launch of a 2018 China green bond market report in February, Sean Kidney, CEO of the non-government Climate Bonds Initiative, an international NGO, said: "China has been the global leader in regulatory measures to support green finance. The rest of the word has a lot to learn.”

Xinhua, China issues green bonds worth 31.2 bln USD in 2018

The issuance in 2018 saw a 33-percent increase from the previous year, according to an annual report on China's green bond market jointly released Tuesday by the China Central Depository & Clearing Co. and Climate Bonds Initiative.

Reuters, China to cut coal from new green bond standards, David Stanway, Andrew Galbraith

Of the $42.8 billion worth of green bonds issued in China last year, only $31.2 billion would have met global criteria, according to a report published at the end of February by the Climate Bonds Initiative (CBI), a non-profit group backing green bond standards.

Russia Today, China emerges as key player in green bonds market

“The rest of the world has a lot to learn,” he said [Sean Kidney], adding: “The nations that are leading on green finance now have an opportunity to work together to drive capital on a global basis to achieve Paris climate goals and other urgent environmental objectives.”

China.org.cn, China emerges as key player in green bonds market

Sean Kidney said said: "China, with its green finance leadership, has created an enormous opportunity for investment both domestically and along the Belt and Road.”

People.cn, 俄媒:中国成为全球绿色债券市场主要参与者

据今日俄罗斯网报道,2018年,符合国际绿色债券定义的中国发行额突破300亿美元,中国领先于法国,成为仅次于美国的全球第二大绿色债券发行国。

Oversea.huanqiu.com, 俄媒:中国成全球绿色债券市场主要参与者

据报道,中国兴业银行是2018年全球第二大绿色债券发行机构。而中国建设银行则成为首家在卢森堡绿色证券交易所发行绿色债券的中国机构,据悉,该绿色债券发行额达5亿欧元。

Euractiv, Top-Meldungen der Woche aus dem Bereich Energie und Umwelt

Euractiv, Top-Meldungen der Woche aus dem Bereich Energie und Umwelt

Im laufenden Jahr verbesserte sich die Qualität grüner Anleihen sowie die Transparenz chinesischer grüner Anleihen, heißt es in der Studie. Es wird erwartet, dass das Wachstum auf dem chinesischen, grünen Finanzmarkt durch die politische Unterstützung und die weitere regulatorische Entwicklung beschleunigen wird.

Agenzia Nova, Cina: emessi 31,2 miliardi di dollari in obbligazioni verdi nel 2018

Secondo i dati contenuti nel rapporto, l'emissione nel 2018 ha visto un aumento del 33 per cento rispetto all'anno precedente. Le istituzioni finanziarie hanno emesso il maggior numero di obbligazioni versi, con la Banca Industriale che rappresenta il 23 per cento dell'emissione totale dello scorso anno, il più grande emittente in Cina e il secondo più grande al mondo, secondo il rapporto.

Akurat.co, China Masih Menjadi Penerbit Greenbond Terbesar Kedua di Dunia, Anggi Dwifiani

Menurut Sean Kidney, CEO dari Climate Bonds Initiative non-pemerintah, China telah menjadi pemimpin global dalam langkah-langkah mendukung keuangan hijau.

News Front, China emerge como un jugador clave en el mercado de los »bonos verdes»

El Banco Industrial de China fue el segundo mayor emisor de bonos verdes en 2018. El Banco de Construcción de China se convirtió en la primera institución china en incluir un bono verde en el recién formado Luxemburgo Green Exchange, una garantía de ingresos fijos de € 500 millones (US $ 561 millones).

“Global Corporate Green Investment And The Un Sustainable Development Goals”

In March CBI & Corporate Knights jointly released a report: Global Corporate Green Investment And The Un Sustainable Development Goals.

Corporate Knights, Global corporate green investment and the UN sustainable development goals

Corporate Knights and Climate Bonds Initiative assessed 7,000 of the world’s largest companies, representing all publicly traded companies with US$1 billion+ in revenues. (…) This yielded a figure of $611 billion in green investments by non-financial sector corporations in 2017.

The Asset, Urgent need to ramp up corporate green investment

While 17% of current investment by large public corporations is already green, and while less than 5% of 2017 corporate green investments were financed via certified green bonds, they have the potential to play a much larger role.

Benzinga, Corporate green investment already vast, but needs to be accelerated

Today's report also evaluates the green bond issuance potential of a representative cross-section of 21 of the 2019 Global 100 Most Sustainable Corporations in the World. (…) These companies alone have incremental green capital requirements of approximately $43 billion annually in order to move to full SGD alignment, a significant portion of which could be covered by green bond offerings.

“Post-issuance reporting in the green bond market”

Another report published by CBI in March. Read more.

Boursorama, Icade : distingué pour son reporting Green Bond

Icade indique arriver en tête du classement du Top 10 mondial pour la qualité de son reporting Green Bond selon le rapport 'Post-issuance Reporting in the Green Bond Market' du Climate Bonds Initiative (CBI).

Boursier, Icade obtient la meilleure note du Climate Bonds Initiative pour son reporting Green Bond

Pour mémoire, Icade a procédé le 4 septembre 2017 à l'émission de sa première obligation verte "Green Bond" d'un montant de 600 ME à 10 ans avec un coupon de 1,50%. Sursouscrite près de 3 fois, cette émission a remporté un grand succès auprès des investisseurs ISR tant français qu'internationaux.

Business Immo, Icade obtient la meilleure note du Climate Bonds Initiative pour son reporting Green Bond

Immo Week, Icade obtient la meilleure note du CBI pour son « reporting Green Bond »

“Hong Kong Green Bond Market Briefing 2018”

EJ Insight, Promoting green finance in Hong Kong, Kenneth Leung Kai-cheong

According to a market briefing by Climate Bonds Initiative (CBI), a total of US$11 billion (HK$85.8 billion) of green bonds were arranged and issued in the city in 2018, 83 percent of the total, or US$9 billion, were by non-Hong Kong-based entities, suggesting that Hong Kong is an attractive platform accessible to overseas issuers.

The Asset, Time to shift to a sustainable model is now, Herry Cho

“Green Bonds. The State of the Market 2018”

Markets Media, Green Bonds May Have Halo Effect, Shanny Basar

Climate Bonds issued its ‘Green Bonds: The state of the market 2018’ report on the first day of the conference. In 2018 global labelled green bond issuance was $167.6bn (€148bn), a 1% increase on $162.1bn in 2017. The USA had the largest share of issuance, followed by China and then France.

South China Morning Post, China and EU seek common ground on environmentally friendly green bonds, Amanda Lee

Last year, Fuzhou-based Industrial Bank was the second-biggest issuer of green bonds after the US’ Fannie Mae, according to the CBI, which collected a combined US$29.7 billion of proceeds from selling green bonds to international investors.

Duurzaam Financieel, Climate Bonds launches Green Bonds – State of the Market 2018 report

Produced with the support of HSBC and Amundi, this is the first publication in a new annual series of reports, focusing primarily on labelled green bonds and the latest developments on a global scale.

Investinfra, Совокупный объем эмиссии зеленых облигаций в мире с 2007 года превысил $500 млрд

Ранее на ежегодной конференции CBI в Лондоне организация представила доклад «Зеленые облигации: состояние рынка в 2018 году» — Green Bonds: the State of the Market 2018.

“Green Bonds – a key tool for financial centre competitiveness: Lessons from Europe”

Etica News, Italia sesta in Europa per emissioni di green bond

Climate Bonds Initiative ha presentato a Londra un rapporto sul mercato europeo dei “green bond”. Lo riporta la newsletter di Febaf. A livello mondiale, il mercato dei green bond è cresciuto esponenzialmente a partire dal 2012, con circa 500 miliardi di emissioni registrate sinora.

Professione Finanza, Green bond, Italia sesta in Europa: in vetta la Francia

L’Italia con oltre 184 miliardi di dollari è il sesto Paese in Europa per emissioni di green bond. In testa c’è la Francia, con Germania e Olanda a completare il podio. La classifica è stata stilata nell’ambito del lavoro di ricerca della no profit Climate Bonds Initiative, che ha presentato a Londra un rapporto sul mercato europeo dei “green bond”.

Climate Bond Standard certified bonds

UBank

Australian Financial Review, NAB's UBank launches 'green' deposits to chase Millennials' savings, James Eyers

UBank will match the deposits to loans made by NAB group to renewable energy and low-carbon transport and buildings certified by the Climate Bonds Initiative, and will offer the same interest rates as its term deposits.

Finder, UBank launches world’s first green term deposit

UBank has today launched the UBank Green Term Deposit, which is the world's first green term deposit and certified by the Climate Bonds Initiative.

RateCity, Online lender releases green term deposit, Nick Bendel

Mozo, Tackle climate change with the new Green Term Deposit from UBank

Finextra, UBank unveils green term deposit for retail segment

Investor Daily, UBank launches sustainable investments to capture Millennials

The Asset, Aussie lender breaks new green ground

Société du Grand Paris

Le Figaro, La Société du Grand Paris récompensée par le Climat Bonds Initiative

Le Figaro, La Société du Grand Paris récompensée par le Climat Bonds Initiative

A l'occasion de la 4ème cérémonie des Green Bond Pioneer Awards (GBPA) le 5 mars, la Société du Grand Paris a reçu le " Largest new Certified Climate Bond issuer Award " décerné par le Climat Bonds Initiative pour ses émissions d'obligations vertes. Climate Bond Initiative est un organisme à but non lucratif qui encourage les investissements à grande échelle dans une économie bas-carbone. Les " Green Bond Pioneer Award " récompensent les acteurs de la finance climat.

Tribune Assurance, La Société du Grand Paris récompensée par le Climat Bonds Initiative

Zonebourse, La Société du Grand Paris récompensée par le Climat Bonds Initiative

IDmediacannes, MIPIM 2019 – Inauguration Du Pavillon United Grand Paris

Grand Paris Express, La Société du Grand Paris récompensée pour ses émissions d’obligations vertes

Access Bank

The Guardian Nigeria, Access Bank seals N15 billion green bond issuance deal, Helen Oji

Access Bank Plc has announced the issuance of a five-year fixed rate senior unsecured N15billion green bond the first ever climate bonds standard fully certified corporate Green Bond to be issued in Africa.

Punch, Access Bank issues N15bn green bond

The green bond, which has been awarded an Aa- rating by Agusto & Co and certified by the Climate Bonds Initiative having met the global climate bonds standard, saw its offer by way of a book build fully subscribed.

Commod Africa, Access Bank au Nigéria émet avec succès les premières obligations vertes d’Afrique

Sundiata Post, Access Bank’s N15bn Green Bond Fully Subscribed

Nairametrics, Access Bank Plc holds Signing Ceremony for N15 Billion Green Bond Issuance

The Nation, Access Bank raises N15b in Africa’s first corporate green bond, Taofik Salako

The Eagle Online, Access Bank’s N15b Green Bond fully subscribed

This Day, Access Bank Plc Raises N15bn to Finance Green Projects

YNaija, Access Bank reaffirms its commitment to sustainability with groundbreaking Green Bond

More coverage in February’s media digest.

The Clean Energy Finance Corporation (Flexi Group)

The Fifth Estate, CEFC invests in bond for rooftop solar and storage

The Clean Energy Finance Corporation has contributed $10 million towards the latest FlexiGroup green bond issuance for rooftop solar and small scale storage. The $90.9 million-in-total climate bond has been certified by the global Climate Bonds Initiative as being aligned to the Paris Agreement goals.

PV-Magazine, Australian first climate bond gives investors new access to solar and storage market, Marija Maisch

The FlexiGroup green notes have been certified by the global Climate Bonds Initiative (CBI) as being aligned to the Paris Agreement goals and the bond proceeds will be managed accordingly.

Energy Storage, ‘Important market development’: Energy storage included in Australian climate bonds

AC Energy

International Financial Law Review, DEAL: ASEAN’s debut CBI’s certified bond

AC Energy has listed the first ever green bond from an ASEAN issuer to receive the Climate Bonds Initiative’s stamp of approval.

Vantage Asia, Milbank in first US-backed climate bond issue in SE Asia

Under the terms of the CBI certification, AC Energy must use the funds for assets and projects that have low carbon impact and further climate resiliency within the economy.

More coverage in February’s media digest.

Foreign Coverage

German

Finanz und Wirtschaft, Könnten „Grüne Bundesanleihen“ ein Mittel gegen die wirtschaftliche Unruhe in Europa sein?

Aber wenn die deutsche Geringschätzung einer Schuldenfinanzierung zumindest teilweise von ethischen Bedenken und der Sorge um langfristige Nachhaltigkeit herrührt, dann könnten grüne Anleihen – oder besser gesagt „Grüne Bundesanleihen“ – die Antwort sein.

Börse Frankfurt, Aus dem ETF Magazin: "Green Bonds”, Thorben Lippert

Einen weiteren Standard bietet die Organisation Climate Bonds Initiative an. Das Ziel: eine Mobilisierung des Anleihenmarkts für den Umweltschutz. Ein standardisiertes Zertifikat soll dabei helfen. Dafür müssen die Emittenten transparent agieren, geförderte Projekte werden bewertet.

Focus Money Online, Rendite und Umweltschutz: Das steckt hinter Grünen Anleihen

Die „Climate Bonds Initiative" kann hier jedoch Unterstützung bieten: Sie hat ein Zertifizierungsverfahren entwickelt, das Anlegern dabei hilft Anleihen ausfindig zu machen, die zur Kohlenstoffreduktion beitragen.

e-fundresearch.com, “Green Bunds" | Grüne deutsche Staatsanleihen als logischer Schritt?

Grüne Anleihen sind natürlich nicht auf den Unternehmenssektor beschränkt. In den letzten Jahren haben mehrere europäische Länder nennenswerte Volumina an Green Bonds emittiert.

boerse.ARD.de, Grüne Anleihen: (Mini-)Zinsen mit gutem Gewissen

Das Emissionsvolumen hat sich seit 2013 mehr als versechsfacht: von zehn Milliarden auf 65 Milliarden Euro. In diesem Jahr rechnet die Climate Bonds Initiative mit einem Volumen von über 120 Milliarden Euro.

French

Marianne, Finance verte: bientôt la fin des entourloupes de greenwashing?

Ce marché des green bonds, qui pèse près de 167 milliards de dollars en 2018 selon Climate Bonds Initiative, pourrait-il vraiment faire de la finance un allié de la lutte contre le réchauffement climatique?

Spanish

Reuters, España estudia emitir bonos verdes para financiar transición ecológica, Belén Carreño

La ministra de Economía de España, Nadia Calviño, está estudiando emitir “bonos verdes” como método para que las empresas financien la transición ecológica impulsada por el Gobierno, según explicó en una entrevista con Reuters.

El Economista, El Gobierno podría emitir bonos verdes para que las empresas financien la transición ecológica

"España tiene una posición muy ambiciosa en torno al cambio climático, queremos estar a la vanguardia en la transición ecológica y energética y esto requiere un volumen de inversión muy importante, por lo que vamos a estudiar la posibilidad de emitir bonos verdes", explicó Calviño.

Noticias Bancarias, El Gobierno podría emitir ‘bonos verdes’

A principios del pasado mes de febrero, el Gobierno de España dio a conocer un plan de inversión pública de 47.000 millones de euros en los próximos diez años, con el propósito de lograr que el país sea neutral en emisiones de CO2 cuando llegue el año 2050.

Portugese

Terra, Mercado exige medidas sustentáveis de empresas e paga por isso

A demanda de investidores por projetos ecologicamente corretos ganha destaque, envolvendo projetos de infraestrutura verde, desenvolvimento imobiliário e iniciativas de eficiência energética. De acordo com a Climate Bonds Initiative , foram emitidos US$ 160,8 bilhões em títulos verdes no ano de 2017 e valor superior em 2018.

Polish

Forsal, Biznes idzie na wojnę ze skutkami zmian klimatu. Oby nie było za późno, Magdalena Krukowska

Według szacunków Climate Bonds Initiative w tym roku wartość emisji dojdzie do poziomu 100 mld dolarów, choć na dzień dzisiejszy pewna jest kwota 75,3 mld dolarów. Najwięcej środków z emisji „zielonych obligacji” inwestuje się obecnie w transport określany jako niskoemisyjny, czyli przede wszystkim w koleje, ale również w odnawialne źródła energii (OZE).