新报告:香港绿色债券市场简报2018:与汇丰银行合作,由香港金融管理局和香港绿色金融协会支持

CBI's First HK Briefing Paper: Volumes up: Government and private sector support driving growth

Hong Kong moving on the ambition to become a major Asian green finance hub

Our first Briefing Paper focused on green finance in Hong Kong has been launched today!

Prepared in partnership with HSBC and supported by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Green Finance Association (HKGFA), the paper provides an overview of HK's market whose growth is being bolstered by policy support and incentives and increasing momentum from the private sector.

The Briefing Paper also analyses the market dynamics from a broader perspective including green bond deals arranged in Hong Kong, reflecting it’s increasing role as a financial centre for green bond issuance.

2018 highlights:

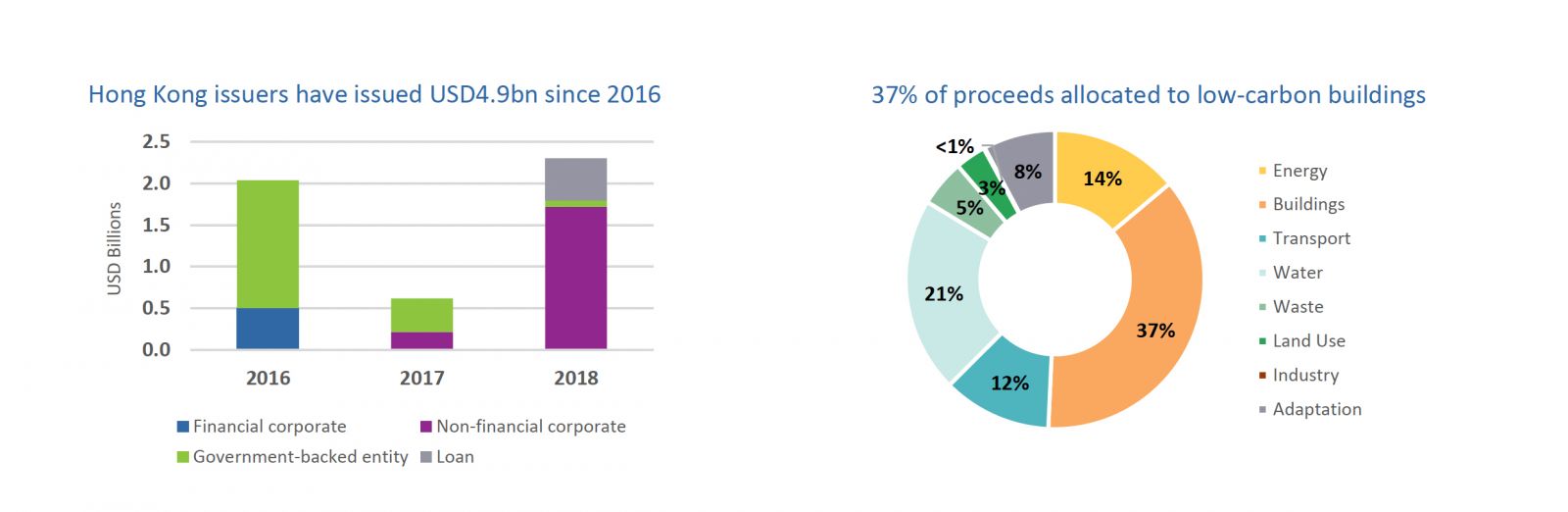

- Green bonds from Hong Kong issuers in 2018 totalled USD2.3bn from 9 issuers, 4.6x of 2017 volumes.

- Green loans became a strong feature in 2018, making up 22% of the total annual issuance

- Cumulative issuance has reached USD4.9bn overall

- MTR is the largest single cumulative issuer

- Low-carbon buildings dominated use of proceeds at 37% of cumulative green issuance

- Green bonds arranged and issued in HK as a financial centre comprised USD11bn in 2018* (*According to HKMA methodology)

The report identifies the following major drivers for strengthening Hong Kong’s position as an Asian green finance hub through:

- Labelling the unlabelled in bond issuance

- Facilitating international capital flows into mainland Chinese green bonds

- Greening of Bond Connect

- Demonstration issuance via sovereign green bonds

Who’s saying what?

Vincent Lee, Executive Director (External) of HKMA:

“We are delighted to see CBI launching a market briefing report on Hong Kong. It is a recognition of Hong Kong’s emergence as one of the world’s leading green finance markets. The report shows that the Hong Kong market has been growing from strength to strength and is attracting companies from around the region to raise green financing.”

“Hong Kong is also the designated green finance hub for the Greater Bay Area. We see strong potential in the Hong Kong market, and will continue to work with the Government and the industry to make Hong Kong a better place for green finance businesses."

Helen Wong, Chief Executive, Greater China, HSBC:

“China is emerging as a global leader in the transition to a lower carbon economy, supporting new sustainable technologies and accelerating the development of its green finance market. As the world’s second-biggest issuer of green bonds, China is making a positive contribution to the evolution of sustainable finance internationally."

“Sustainable financing in China will benefit from the continued liberalisation of its capital markets and its strategy to develop the Guangdong-Hong Kong-Macao Greater Bay Area. Chinese bonds’ inclusion in major global indices should attract more foreign investors to domestic green bonds, while the Government’s Outline Development Plan makes clear its ambition to support the development of Hong Kong as a global green finance centre in the Greater Bay Area.”

Sean Kidney, CEO of Climate Bonds Initiative:

“Hong Kong saw positive signs in green finance development in 2018 with both government and private sector looking to channel capital to assets or projects that produce positive climate impacts.”

“The HKD100bn sovereign green bond programme proposed by the Hong Kong government shows leadership and is expected to drive the market further upon implementation. Enhancing visibility of green debts, steering investment towards green projects and a green bond segment on the stock exchange are also crucial to the next stage of growth.”

“In combination, all of these steps will help propel Hong Kong towards its ambition to become Asia’s major hub of green finance.”

The last word

The HK government’s announcement of a long term Sovereign Green Bond programme and the formation of the Hong Kong Green Finance Association are indicators of the policy direction to grow both domestic issuance and green trading overall.

There’s no shortage of reports and studies examining the green finance hub prospects.

We await the first issuance in the sovereign program and the positive signal it will send to the private sector and into Asia overall of Hong Kong’s green directions.

Till next time,

Climate Bonds

Download the Hong Kong Green Bond Market 2018 Briefing Paper here

Media Release in English and Chinese

新闻稿:英文和中文

Hong Kong Monetary Authority Statement (English)

香港金融管理局声明(英文)