環境金融(グリーンファイナンス)促進に向けてのネットワーク立ち上げ

Takada, Sueyoshi, & Tamaki establish Green Finance Network Japan (GFNJ):

High profile multi-stakeholder membership; Strong ambitions

重要関係者対象組織、グリーンファイナンスネットワーク・ジャパンの公式発表と活動における大望

On 3rd November 2018, Tokyo sees a green finance symposium which will mark the launch of the Green Finance Network Japan (GNFJ). The GFNJ will take on the role of putting Japan amongst the select group of nations who have undertaken green finance initiatives to review and examine options for reform of their financial systems.

This list includes the EU High-Level Expert Group on Sustainable Finance (EU HLEG), which has morphed into the Technical Expert Group (TEG) -with Sean Kidney amongs its members- the UK Green Finance Initiative (GFI), Hong Kong Green Finance Association (HKGFA), and the Canadian Expert Panel on Sustainable Finance, that has just released its Interim Report, and mulitlateral engagements like the Sustainable Banking Network (SBN) that just published the ‘Creating Green Bond Markets’ report, a joint Climate Bonds and IFC production.

Green Finance Network Japan

Mr. Hideki Takada Secretary General of GFNJ and a former Senior Policy Analyst, Green Finance and Investment, OECD (Ministry of Finance / Cabinet Secretariat, Government of Japan) shared the news of the pending launch with Climate Bonds:

“It was my great pleasure to work with Climate Bonds on the green finance and investment agenda during three years’ secondment to the OECD.”

“It was my great pleasure to work with Climate Bonds on the green finance and investment agenda during three years’ secondment to the OECD.”

“This agenda is gaining momentum in Japan as well as in the world and I have decided to keep my personal commitment to this theme. As part of my commitment, I have established the Green Finance Network Japan (GFNJ) together with founders Mr. Takejiro Sueyoshi, CEO, Green Finance Organisation Japan, and Mr. Rintaro Tamaki, President, Japan Centre for International Finance (also former Deputy Secretary-General of the OECD).”

The high-level taskforce has taken on the commitment to dynamize Japan’s finance market towards greater green focus. Some of the first green bonds sprouting from Japan were the environmentally-themed ‘Uridashi’ bonds (being very popular among secondary market and retail investors).

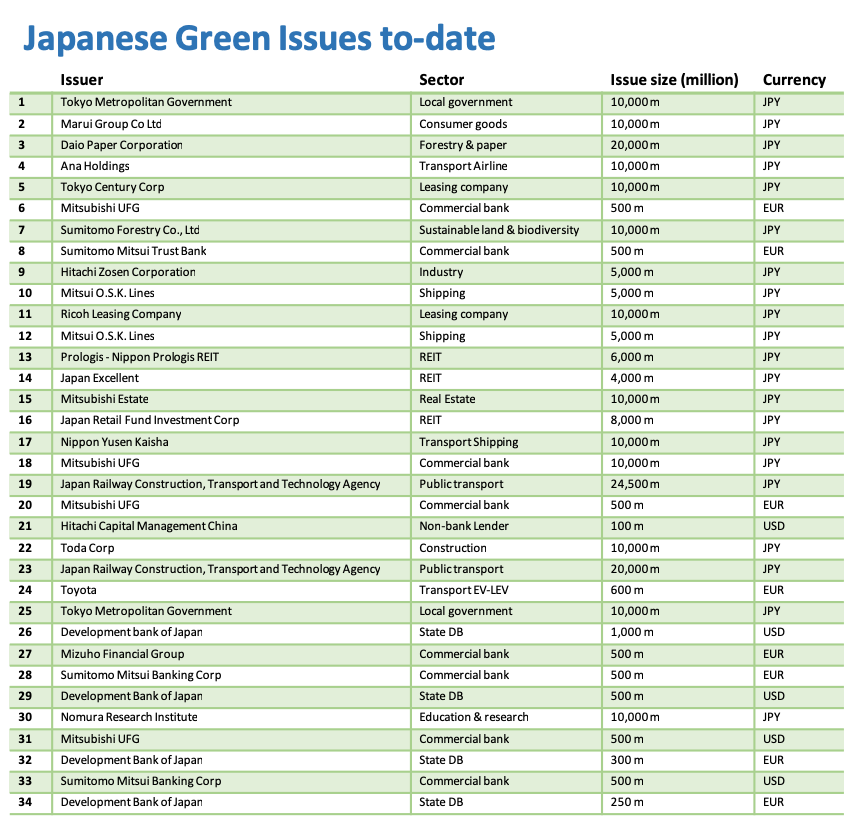

Japan is also a source of green issuance across a number of sectors with listings on foreign exchanges notably the German, Luxembourg and Singapore bourses.

The Japan Exchange Group (JPX) has one sustainability-themed listed issue by Japan Investment Cooperation Agency (JICA), released earlier this year. The use of proceeds are dedicated to projects around the world promoting peace, stability and prosperity in the international community addressing JICA’s goals of promoting socio-economic development in the developing world to help achieve the SDGs.

In 2017 Japan ranked 11th in the world with USD3.3bn issued and at the end of Q3 2018 Japan ranked 13th in the world with USD2.2bn issued.

GFNJ objectives and stakeholders

Mr. Hideki Takada has shared the initial aims of the GFNJ and details of an impressive list of members from government, DFIs, financial heavyweights including Mitsubishi UFJ Financial Group (MUFG) and Mizuho Securities, academia and the OECD.

The aims of the GFNJ is to facilitate multi-level stakeholders:

- On information sharing on green finance activities of members, by organising events and workshops

- Gathering and sharing of information on global green finance activities

- Providing a platform for connecting Japanese and international stakeholders

The current provisional list of members for the GFNJ are:

Founders

- Takejiro Sueyoshi: CEO, Green Finance Organisation / Special Adviser to UNEP FI

- Rintaro Tamaki: President, Japan Centre for International Finance / Former Deputy Secretary-General, OECD

Secretary General

- Hideki Takada: Former Senior Policy Analyst, Green Finance and Investment, OECD (Ministry of Finance / Cabinet Secretariat, Government of Japan)

Government Ministries

- Tomoaki Ishigaki: Ministry of Foreign Affairs / Office of the Prime Minister

- Haruhiko Nishimura: Ministry of the Environment

- Aya Nagata: Ministry of the Environment

- Tadashi Shibakawa: Ministry of the Environment

- Naomi Sugo: Ministry of the Environment

- Makoto Yakushiji: Ministry of the Environment

- Satoshi Ikeda: Financial Services Agency

- Jun Takashina: Ministry of Economy, Trade and Industry

- Mayuko Hirai: Ministry of Economy, Trade and Industry

- Kiichi Tokuoka: Ministry of Finance

Private Financial institutions

- Teiko Kudo: Sumitomo Mitsui Banking Corporation

- Amane Yamasaki: MUFG Bank

- Koji Omachi: Citigroup

- Osamu Morishita: Mizuho Securities

- Sachie Ii: Mizuho Securities

- Mana Nakazora: BNP Paribas

Development Financial Institutions

- Megumi Muto: Japan International Cooperation Agency

- Tsutomu Sato: Japan Bank for International Cooperation

- Hiroyuki Kato: Development Bank of Japan

Insurance companies / Institutional investors / Corporates

- Mitsugu Sumiya: Axa Life Insurance

- Hiroshi Ozeki: Nippon Life Insurance

- Masaaki Nagamura: Tokio Marine and Nichido Fire Insurance

- Shizuko Omi: Amundi Japan

- Shigeki Miwa: SoftBank Group / SB Energy

Think tanks / Academics

- Mariko Kawaguchi: Daiwa Institute of Research

- Eiichiro Adachi: The Japan Research Institute

- Akane Enatsu: Nomura Institute of Capital Markets Research

- Akiko Shigemoto: Institute for Global Environmental Strategies

- Yoshihiro Fujii: Research Institute for Environmental Finance

- Tsuyoshi Mizuguchi: Takasaki City University of Economics

- Yukari Takamura: Nagoya University

International organisations

- Masamichi Kono: Deputy Secretary-General, OECD

- Tsuzuri Sakamaki: Senior Policy Analyst, Green Finance and Investment, OECD

The last word

The JPX has mainstreamed sustainability into their objectives and have setup initiatives to support listed companies in adopting ESG practices. Similarly, the Ministry of Environment, Japan (MOEJ) set up Green Bond Guidelines in March 2017 to facilitate issuance however, the on-shore market, like most of global finance, still has a long journey ahead.

Sean Kidney sums it up:

“I have been involved with many stakeholders in Japan for some time now. Japan has significant presence in the green sphere and the new commitment towards green and sustainable finance is commendable. The GFNJ is an exciting new initiative and will be a major driver of progress. Messrs Hideki Takada, Takejiro Sueyoshi and Rintaro Tamaki are to be congratulated for taking the lead.”

Follow this space for more developments on GFNJ.

‘Till next time,

Climate Bonds