The sandy shores of Rhode Island go even greener via RIIB: Meanwhile Q3 figures slow: Connecting cities' balance sheets with climate action

The Rhode Island Infrastructure Bank (RIIB) has become the latest signatory to the Green Bond Pledge, continuing an environmental commitment and green direction that includes the issuance of 6 green bonds to date and the appointment of a Director as Chief Resilience Officer to help facilitate projects addressing climate impacts.

Momentum from GCAS in October

RIIB joins the Rhode Island Treasurer’s Office, one of the foundation signatories announced during the September Global Climate Action Summit (GCAS) in San Francisco that saw a slew of international and sub-national commitments around climate action and green finance. Additional Pledge signatories from GCAS included the City of Mexico, California State Treasurer and City of Ashville.

There was also support for future Pledge signatories in developing their inaugural green bond issuance as one of the proposed activities of the Global Green Bond Partnership (GGBP), another major initiative launched during the Summit.

The RIIB View

Jeff Diehl, CEO Infrastructure Bank:

“As the state’s central hub for local infrastructure financing, we finance environmental projects and increasingly we are incorporating resilience into these projects, which already contain green elements."

"Since its inception almost 30 years ago, the Bank has been an issuer of what are now regarded as Green Bonds. We are supportive of the efforts outlined in the Green Bond Pledge and look forward to continuing our pursuit of a more sustainable and resilient future for Rhode Island.”

“Today’s pledge underscores our commitment to creating a sustainable Rhode Island economy and environment. As the sole Rhode Island issuer to-date of Green Bonds, the Infrastructure Bank prioritises the implementation and efficacy of green components across its programmes. As a signatory to the Pledge, the Bank is deeply excited to continue these practices and promote industry-wide adoption of green financing vehicles.”

The US Green Muni Market in 2018

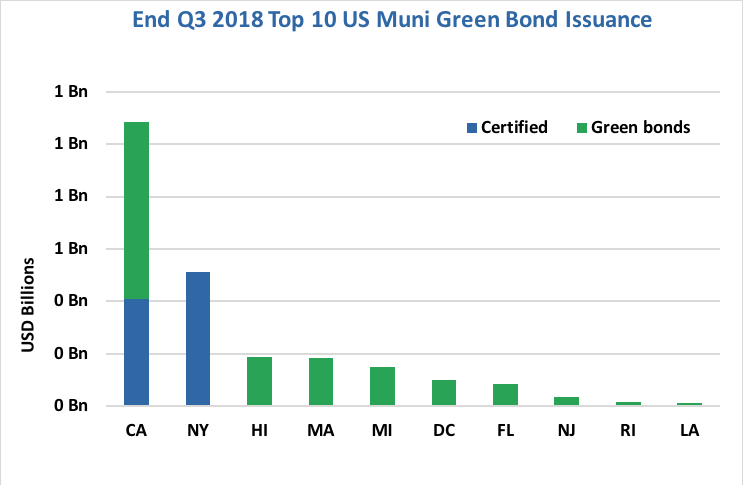

Climate Bonds' figures for 2018 issuance at end Q3 show the market has slowed and last year's record of USD11.4bn of municipal issuance may not be surpassed.

Annual issuance is at USD2.3bn compared to USD6.6bn at the end of Q3 in 2017. The Tax Cuts and Jobs Acts of 2017 have resulted in a drop in refunding issuance volume in 2018 and had an impact on new issuance, a point we noted in our half yearly municipal briefing paper from July and discussed in this recent Bloomberg interview.

Despite this shortfall we remain confident that the green muni market has significant growth prospects. Put simply, many of the climate and carbon commitments being made by US cities and states through various groups cannot be met without significant greening of balance sheets and public investment programs. We are not alone in a postive view of the green muni sector. In this 8:03 min radio interview, Sean McCarthy, CEO, and Bob Cochran, Chair from leading muni bond insurer Build America Mutual (BAM) give their encouraging insights.

California and New York still lead on annual issuance as at the end of Q3 2018, congratulations to Rhode Island for making the top 10.

The largest single issuance so far this year has been the California Infrastructure and Economic Development Bank (Ibank): USD449m, San Francisco Public Utilities: USD408m, New York State Housing Finance Agency: USD286m.

Both California and New York have strong political leadership on climate action and this has also been replicated in their respective state based pension funds, a point noted by Asset Owners Disclosure Project (AODP) in their 2018 Global Climate Index Pension Fund study.

On the performance side, new studies are emerging on green muni bond pricing, providing more background for the market and analysts looking at the green muni segment with demand for quality green product remaining strong.

For larger utilities, the offshore interest in SFPUC’s July USD408m Climate Bonds Certified green water bond is a pointer to investor attitudes outside the US.

The last word

Rhode Island signing the Green Bond Pledge ties into the values and mission of the Infrastructure Bank and how it has been operating for almost 30 years. RIIB has financed numerous green projects and has integrated green solutions into new financing programs.

We’ll finish with Sean Kidney’s perspective:

“Embedding climate adaptation and resilience into new infrastructure projects at a state and municipal level has never been more critical. Scaling up green muni bond issuance is vital to meeting this goal."

Aligning climate and carbon commitments and ambitions of cities with their longer-term infrastructure and investment plans has become the arena for change in the US.

By signing the Green Bond Pledge, RIIB is pointing to how this transition can be achieved. They are expanding the space for discussion around matching climate action with finance initiatives at the sub-national level.”

Who will be the next champions of green muni investment?

Stay tuned to this space for more!

‘Till next time,

Climate Bonds